Previous Session Recap

The Benchmark KSE100 Index Opened at 49876.18, posted day high of 50055.36 and day low of 49621.84 during last trading session. The session suspended at 49968.92 with net change of 92.74 points and net trading volume of 226.39 million shares. Daily trading volume of KSE100 listed companies dropped by 122.74 million shares or 35.16% on DOD bases.

Foreign Investors remained in net selling position of 30.73 million shares and net value of Foreign Inflow dropped by 4.71 million US Dollars. Categorically Foreign Individuals, Corporate and Overseas Pakistani Investors remained in net selling position of 1.31, 22.92 and 6.5 million shares respectively. While on the other side, Local Individuals, Companies, Banks, NBFCs and Mutual Funds remained in net buying position of 2.6, 8.26, 5.21, 5.2 and 18.14 million shares respectively but Brokers remained in net selling position of 4.54 million shares.

Analytical Review

Asian stocks are set to climb to fresh three-month highs on Wednesday following a stronger Wall Street as investors welcomed U.S. President Donald Trump eagerness to deliver on his campaign promises. Trump shift back to growth initiatives including promising corporate tax breaks to fuel investment at home after focusing on protectionism in the first few days snapped the U.S. dollar losing streak and pushed Treasury yields higher. In Asia, MSCI broadest index of Asia-Pacific shares outside Japan rose 0.16 percent. Early Asian markets such as Japan and Australia led the region higher. After a bumpy start in the first few days where Trump focused on protectionist measures, the markets reacted positively overnight with U.S. equity benchmarks boosted to fresh all-time highs, said James Woods, global investment strategist at Rivkin Securities in Sydney. The S&P 500 and Nasdaq set records on Tuesday in a broad rally led by financial and technology stocks. [.N]

In a bid to achieve self-sufficiency in the energy sector, the government has started extensive oil and gas exploration activities in different parts of the Federally Administered Tribal Areas (Fata). MOL Pakistan, an oil and gas exploration company, has commenced the Gravity Survey in Tal block of North Waziristan Agency, besides it is planning to conduct drilling in the Biland Khel area under the same block, according to official data revealed on Tuesday.

Millions of dollars stashed away in lockers by Pakistanis face the risk of devaluation as banks have stopped accepting old-design notes. Meanwhile, moneychangers are charging up to a 4 per cent fee to exchange the old-design bills. Pakistanis who do not know the difference between old- and new-design notes are going to be unsuspecting victims of devaluation and unacceptability of the dollars. Banks and moneychangers confirmed on Tuesday that the former are not accepting the old-design notes while the latter are charging a fee to exchange them. The old-design $100 notes are not banned anywhere in the world, except Pakistan where the strange situation seems to have emerged mainly due to the banks refused to accept old-design banknotes.

Ministry of Textile Industry has allowed duty drawback of taxes collected from garments, home textiles, processed fabric, greige fabric and yarn manufacturing-cum-exporters units under the prime minister package of incentives for exporters. The duty drawbacks under this order shall be allowed for exports GDs, filed on or after Jan 16, 2017 to June 30, 2017. Further, duty drawback of taxes under this order shall be allowed for exports GSs, filed on or after July 1, 2017 to June 30, 2018, if the exporter would achieve an increase of 10 per cent or more in exports over 2016-17 exports.

The Pakistan Muslim League-Nawaz (PML-N) government has proposed an amnesty scheme to encourage Pakistani citizens with assets and companies abroad to legalise their earnings and siphon profit back to the country, DawnNews reported on Tuesday. Though details of the amnesty scheme are yet to be released, initial reports suggest that the scheme will enable Pakistanis to whiten their money without having to reveal the source of their acquisitions or earnings, even if it was earned illegally from within Pakistan. However, the scheme is yet to be finalised and approved. The Securities and Exchange Commission of Pakistan (SECP) also supports the proposed amnesty scheme, DawnNews reported.

DGKC, TRG, APL and Overall Textile Sector (specifically NML, NCL) can lead market in positive direction. However, EFOODS can lead market in negative direction.

Technical Analysis

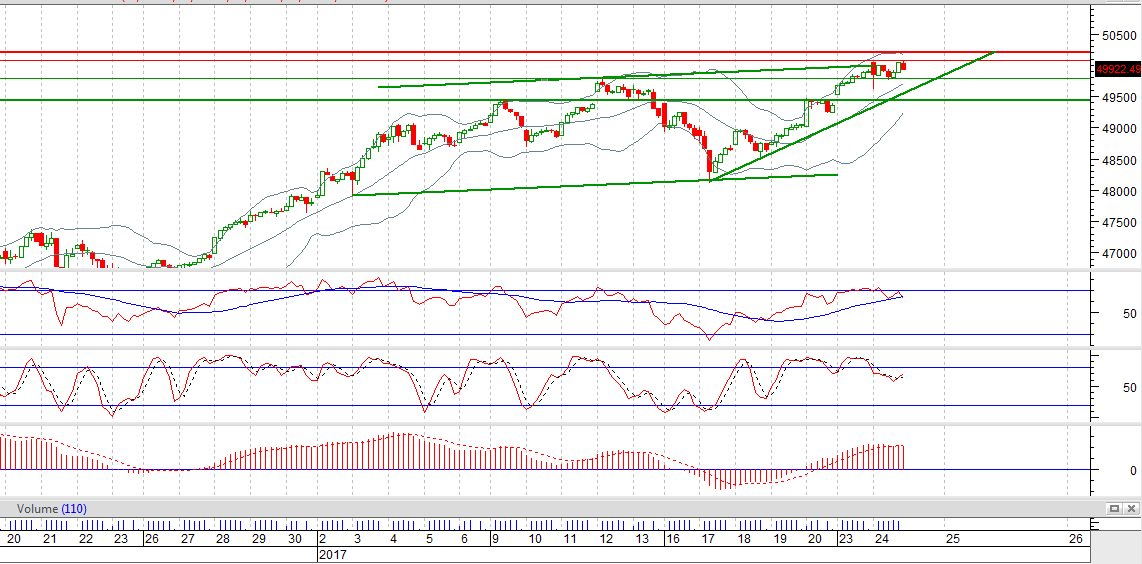

The Benchmark KSE100 Index has penetrated a major barrier of 50000 during last trading session by posting day high of 50055, but it did not close above its expansion levels of 49995 and 50203. Its short term bullish trend channel is completed at 49995 and it has tried to take an intraday correction during last trading session but succeeded in recovering from that correction after a dip of 250 points. It is being supported by a rising trend line inside that channel which will provide a supportive breath around 49517 but before that a horizontal supportive region will try to push index back in positive zone around 49660. Trading with strict stop loss is recommended for current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.