Previous Session Recap

Trading volume at PSX floor increased by 41.67 million shares or 37.00% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 45,426.10, posted a day high of 45,911.61 and a day low of 45,413.86 during last trading session. The session suspended at 45,876.70 with net change of 112.61 and net trading volume of 84.50 million shares. Daily trading volume of KSE100 listed companies increased by 22.71 million shares or 36.75% on DoD basis.

Foreign Investors remained in net buying position of 1.51 million shares but net value of Foreign Inflow increased by 0.53 million US Dollars. Categorically, Foreign Corporate remained in net buying position of 2.18 million shares but Foreign Individuals and Overseas Pakistanis Investors remained in net selling position of 0.13 and 0.54 million shares. While on the other side NBFCs and Mutual Fund remained in net buying positions of 0.49 and 0.78 million shares but Local Individuals, Local Companies, Banks, Brokers and Insurance Companies remained in net selling positions of 3.23, 1.63, 2.10, 0.72 and 0.49 million shares respectively.

Analytical Review

Asian shares spooked by rising U.S. yields, cost worries

Asian shares fell on Wednesday as a rise in U.S. bond yields to 3 percent and warnings from bellwether U.S. companies of higher costs drove fears that corporate earnings growth may peak soon.MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS dropped 0.7 percent to its lowest in almost three weeks, with tech-heavy Taiwan shares .TWII hitting two-month lows on worries about slowing semi-conductor demand. Japan's Nikkei .N225 also dropped 0.7 percent. S&P E-mini futures ESc1 slipped 0.2 percent. Wall Street shares skidded overnight, with the S&P 500 .SPX falling 1.34 percent, the most in two-and-a-half weeks. Industrial heavyweight Caterpillar (CAT.N) beat earnings estimates due to strong global demand but its shares tumbled 6.2 percent after management said first-quarter earnings would be the “high water mark” for the year and warned of increasing steel prices.

Budget outlay set to rise to Rs5.7tr

With addition of Rs180 billion in project aid and Rs100bn allocation for public-private partnership (PPP) investments, the total development programme for 2018-19 is being pitched at Rs2.043 trillion and overall federal budgetary outlay at Rs5.7tr. Last week’s Budget Strategy Paper (BSP) had pegged total outlays at Rs5.237tr. Prime Minister Shahid Khaqan Abbasi will preside over a meeting of the National Economic Council (NEC) on Tuesday to clear an estimated development programme of Rs2.043tr including a federal Public Sector Development Programme (PSDP) of Rs1.03tr and provincial annual development plans worth Rs1.013tr. The BSP had put the PSDP at Rs800bn.

Chinese ambassador invites Pakistanis to take advantage of CPEC and Chinese expertise

Chinese Ambassador Yao Jing on Tuesday invited Pakistani citizens to take advantage of the China-Pakistan Economic Corridor (CPEC) as well as Chinese expertise. He was addressing the CPEC Summit, being hosted by the Dawn Media Group in collaboration with the Ministry of Planning and Development, which kicked off at Karachi’s Bagh-i-Jinnah on Monday. Various speakers — including Prime Minister Shahid Khaqan Abbasi, Planning Minister Ahsan Iqbal, Punjab and Sindh chief ministers, and several prominent researchers and analysts — had addressed the conference on the first day of the event.

Textile exports increase to $9.9bn

Exports of textile and clothing products recorded a 7.7 per cent growth year-on-year to $9.99 billion in the first nine months of 2017-18, the Pakistan Bureau of Statistics (PBS) reported on Monday. The revival in the export proceeds from these sectors is due to the cash subsidy offered under the prime minister’s exports enhancement package with maximum refunds/rebate of exporters being cleared in FY18. However, there are still outstanding amount which was yet to be released. The main driver of growth was the value-added textile sector as exports of ready-made garments went up 12.56pc during the period in value and 12.85pc in quantity while those of knitwear edged up 14.12pc in value and 3.52pc in quantity during these nine months. Exports of bedwear went up 4.99pc in value and 3.16pc in quantity.

Neelum Jhelum’s 2nd unit starts generation on trial basis

In yet another development, the second unit of Neelum Jhelum Hydropower Project, which went into trial generation two days ago, achieved full generation capacity of 242 MW Tuesday after having been tested successfully with 100 percent load rejection. Earlier, the first unit of Neelum Jhelum Hydropower Project started electricity generation on trial basis on April 9, while the project was formally inaugurated on April 13, 2018. The project has so far injected over one million units of hydel electricity into the National Grid. The first and second units of the project are expected to start their commercial operation soon. Neelum Jhelum Hydropower Project is considered to be an engineering marvel, with 90percent of the project being underground in the high mountainous areas. The project will provide about five billion units of electricity annually to the National Grid. The benefits of the project have been estimated at Rs.55 billion per annum.

Asian shares fell on Wednesday as a rise in U.S. bond yields to 3 percent and warnings from bellwether U.S. companies of higher costs drove fears that corporate earnings growth may peak soon.MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS dropped 0.7 percent to its lowest in almost three weeks, with tech-heavy Taiwan shares .TWII hitting two-month lows on worries about slowing semi-conductor demand. Japan's Nikkei .N225 also dropped 0.7 percent. S&P E-mini futures ESc1 slipped 0.2 percent. Wall Street shares skidded overnight, with the S&P 500 .SPX falling 1.34 percent, the most in two-and-a-half weeks. Industrial heavyweight Caterpillar (CAT.N) beat earnings estimates due to strong global demand but its shares tumbled 6.2 percent after management said first-quarter earnings would be the “high water mark” for the year and warned of increasing steel prices.

With addition of Rs180 billion in project aid and Rs100bn allocation for public-private partnership (PPP) investments, the total development programme for 2018-19 is being pitched at Rs2.043 trillion and overall federal budgetary outlay at Rs5.7tr. Last week’s Budget Strategy Paper (BSP) had pegged total outlays at Rs5.237tr. Prime Minister Shahid Khaqan Abbasi will preside over a meeting of the National Economic Council (NEC) on Tuesday to clear an estimated development programme of Rs2.043tr including a federal Public Sector Development Programme (PSDP) of Rs1.03tr and provincial annual development plans worth Rs1.013tr. The BSP had put the PSDP at Rs800bn.

Chinese Ambassador Yao Jing on Tuesday invited Pakistani citizens to take advantage of the China-Pakistan Economic Corridor (CPEC) as well as Chinese expertise. He was addressing the CPEC Summit, being hosted by the Dawn Media Group in collaboration with the Ministry of Planning and Development, which kicked off at Karachi’s Bagh-i-Jinnah on Monday. Various speakers — including Prime Minister Shahid Khaqan Abbasi, Planning Minister Ahsan Iqbal, Punjab and Sindh chief ministers, and several prominent researchers and analysts — had addressed the conference on the first day of the event.

Exports of textile and clothing products recorded a 7.7 per cent growth year-on-year to $9.99 billion in the first nine months of 2017-18, the Pakistan Bureau of Statistics (PBS) reported on Monday. The revival in the export proceeds from these sectors is due to the cash subsidy offered under the prime minister’s exports enhancement package with maximum refunds/rebate of exporters being cleared in FY18. However, there are still outstanding amount which was yet to be released. The main driver of growth was the value-added textile sector as exports of ready-made garments went up 12.56pc during the period in value and 12.85pc in quantity while those of knitwear edged up 14.12pc in value and 3.52pc in quantity during these nine months. Exports of bedwear went up 4.99pc in value and 3.16pc in quantity.

In yet another development, the second unit of Neelum Jhelum Hydropower Project, which went into trial generation two days ago, achieved full generation capacity of 242 MW Tuesday after having been tested successfully with 100 percent load rejection. Earlier, the first unit of Neelum Jhelum Hydropower Project started electricity generation on trial basis on April 9, while the project was formally inaugurated on April 13, 2018. The project has so far injected over one million units of hydel electricity into the National Grid. The first and second units of the project are expected to start their commercial operation soon. Neelum Jhelum Hydropower Project is considered to be an engineering marvel, with 90percent of the project being underground in the high mountainous areas. The project will provide about five billion units of electricity annually to the National Grid. The benefits of the project have been estimated at Rs.55 billion per annum.

PSO,ATRL,PPL and PAEL may lead the index in positive direction.

Technical Analysis

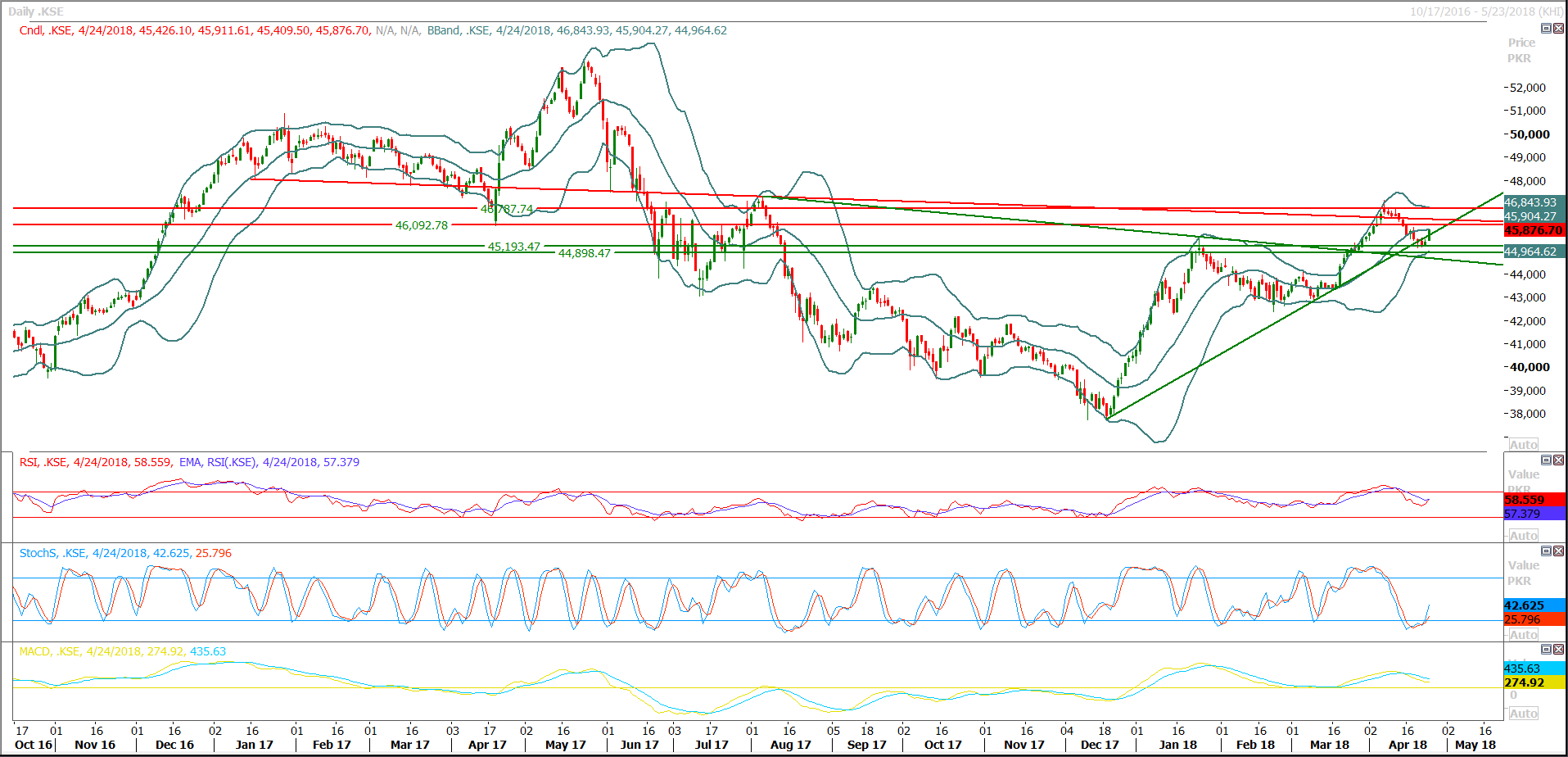

The Benchmark KSE100 Index have bounced back after posting a double bottom on a horizontal supportive region on daily chart and have succeeded in closing above its supportive trend line again during last trading session. But trend is still not changed to bullish because index still need to close above its two major resistance levels of 46,096 and 46,370 points for a complete shift in its trend. Daily momentum is trying to convert itself to bullish but hourly and weekly momentum indicators are not supporting bullish stance till now. It’s expected that index may take a spike towards 46,096 and 46,370 points today but it needs to close above these regions to maintain its bullish momentum. For current trading session index have supportive regions around 45,200 and 44,900 points while resistant regions are standing at 46,096 and 46,370 points because these both regions are falling at 50 and 61.8 percent correction levels of last bearish rally.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.