Previous Session Recap

Trading volume at PSX floor increased by 17.88 million shares or 10.72%, DoD basis, whereas the benchmark KSE100 Index opened at 42910.79, posted a day high of 43173.22 and day low of 42136.17 during the last trading session while the session suspended at 42268.62 with a net change of -642.17 points and a net trading volume of 82.59 million shares. Daily trading volume of KSE100 listed companies increased by 0.57 million shares or 0.7%, DoD basis.

Foreign Investors remained in a net buying position of 0.81 million shares and the net value of Foreign Inflow increased by 0.13 million US Dollars. Categorically, Foreign Corporate investors remained in a net selling position of 1.17 million shares but Overseas Pakistanis remained in a net buying position of 1.91 million shares. While on the other side, Local Individuals and Brokers remained in net selling positions of 2.42 and 8.37 million shares but Local Companies, Banks and Mutual Funds remained in net buying positions of 2.19, 1.45 and 4.15 million shares, respectively.

Analytical Review

Asian stocks traded tentatively on Friday as U.S. political turmoil continued to erode risk sentiment, but the dollar strengthened as attention shifted to the central bankers' symposium in Jackson Hole, Wyoming, that began on Thursday. Overnight, Wall Street indexes closed between 0.1 percent .IXIC .DJI and 0.2 percent .SPX lower as a rift between U.S. President Donald Trump and Congress appeared to widen. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS, was about 0.1 percent lower in early trade, set to end the week 1.25 percent higher. The MSCI World index .MIWD00000PUS was steady, heading for a 0.65 percent weekly gain. Japan's Nikkei .N225 climbed 0.25 percent, on track for a loss of 0.4 percent for the week. South Korea's KOSPI .KS11 was little changed and Australia's S&P/ASX 200 index slipped 0.3 percent.

The first meeting of the Punjab-dominated Council of Common Interests (CCI) will meet on Friday amid Khyber Pakhtunkhwa’s fresh demand for Rs55 billion additional annual funds, Sindh’s protests over national energy initiatives and the centre’s quest for approval of census results and provincial contributions to limit fiscal deficit. To be presided over by Prime Minister Shahid Khaqan Abbasi, the CCI will take up a total of 15 items and likely to also have discussions on the re-composition of CCI which has reduced representation of Balochistan and KP and increased that of Punjab.

National Bank of Pakistan (NBP) posted a profit of Rs8.51 billion for January-June, depicting a 15 per cent decline year-on-year. “Profitability of the bank remained under pressure during the period on account of lower interest rates and maturity of high-yielding Pakistan Investment Bonds,” said a press release issued by the bank on Thursday. Operating income for the half year amounted to Rs41.7bn, almost flat on an annual basis. The bank’s markup income for the period remained Rs26.4bn, slightly down from last year, due to a lower yield on government securities.

Sellers disappeared from the currency market on Thursday and the dollar inched up by 10 to 20 paisa, heads of exchange companies told Dawn. Some of them claimed this was a reaction to President Donald Trump’s recent statement on Pakistan. “The dollar was in surplus on the first day following the threat from the United States. We deposited additional $3 million in the interbank market,” said Malik Bostan, President of the Forex Association of Pakistan.

President Donald Trump said on Thursday congressional leaders could have avoided a legislative “mess” if they had heeded his advice on raising the US debt ceiling, renewing criticism of fellow Republicans whose support he needs to advance his policy agenda. Trump said he had advised Senate Majority Leader Mitch McConnell and House of Representatives Speaker Paul Ryan to link passage of legislation raising the debt ceiling to a measure on veterans affairs that he signed on Aug 12.

Today ATRL, DSL, GATM and ISL may lead the market in positive direction.

Technical Analysis

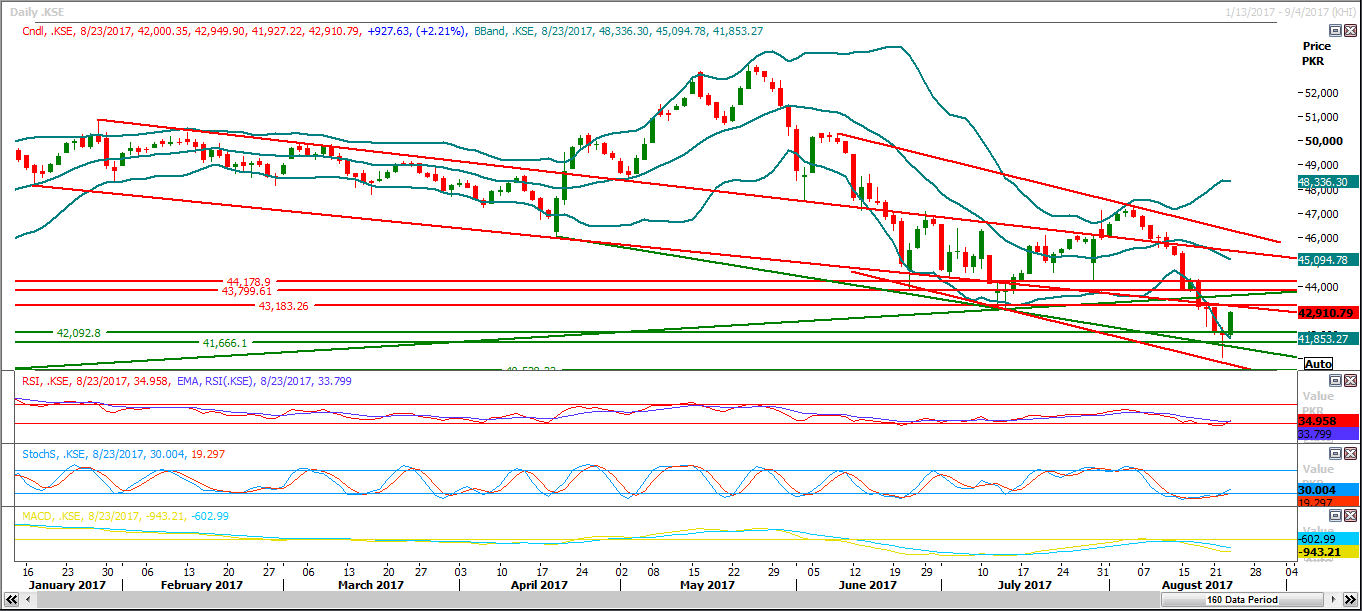

The Benchmark KSE100 Index moved back in bearish direction after retesting its resistant region at 43180 and expired the bullish momentum generated by the morning star pattern. As of now, the Index has supportive regions around 41560, 41000 and 40500 for the coming days. While, the resistant regions are standing around 43000, 43200 and 43800. The Index generated a bearish harami pattern on daily chart which may lead it towards the previous bottom once again, if closes below 41900 during the current trading session. Staying side line is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.