Previous Session Recap

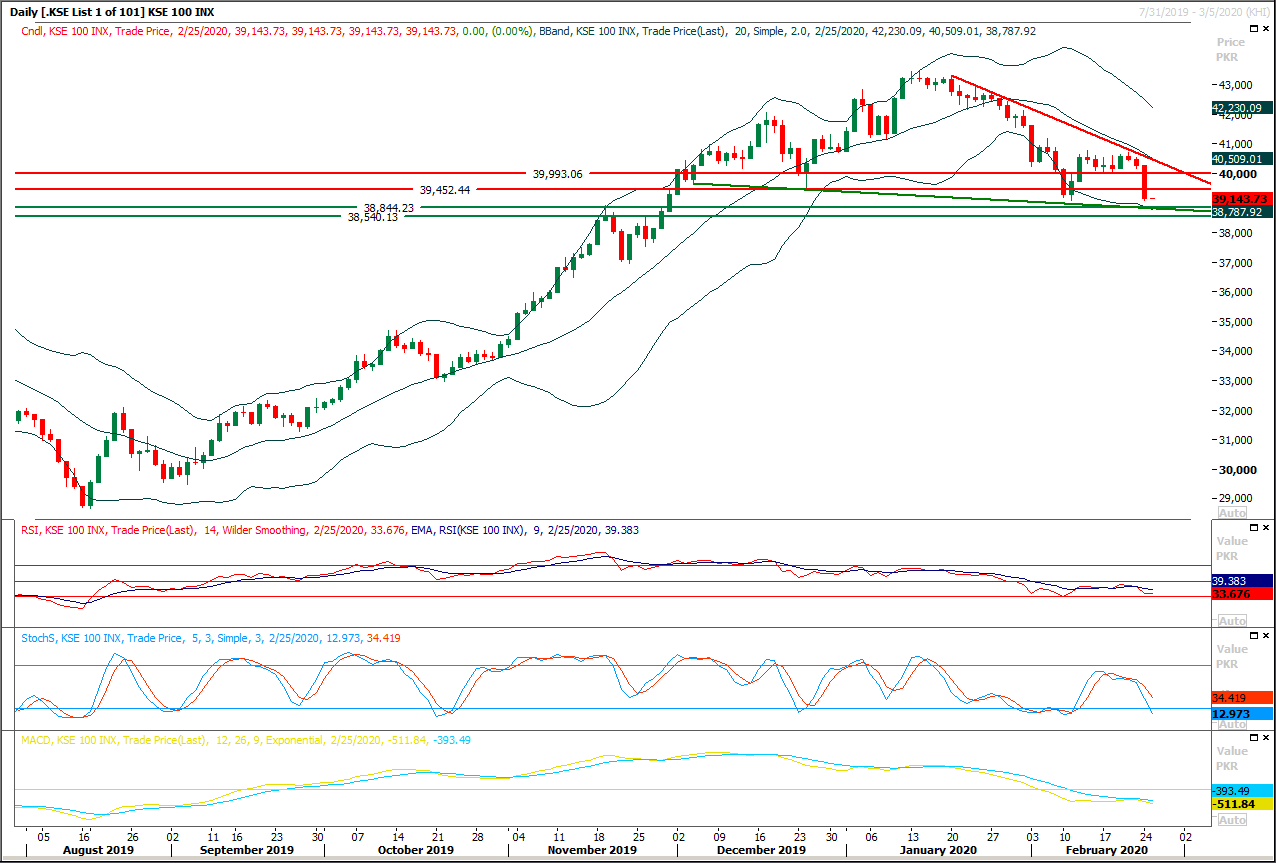

Trading volume at PSX floor increased by 58.68 million shares or 68.57% on DoD basis, whereas the benchmark KSE100 index opened at 40,238.25, posted a day high of 40,238.25 and a day low of 39,079.78 points during last trading session while session suspended at 39,143.73 points with net change of -1105.49 points and net trading volume of 103.98 million shares. Daily trading volume of KSE100 listed companies also increased by 45.50 million shares or 77.82% on DoD basis.

Foreign Investors remained in net selling positions of 6.99 million shares and value of Foreign Inflow dropped by 3.03 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistani remained in net long positions of 0.28 and 1.16 million shares but Foreign Corporate remained in net selling positions of 8.44 million shares respectively. While on the other side Local Companies, Mutual Fund and Brokers remained in net selling positions of 6.17, 0.84 and 1.46 million shares but Local Individuals, Banks, NBFCs and Insurance Companies remained in net Long positions of 8.94, 1.41, 0.35 and 4.14 million shares respectively.

Analytical Review

Wall Street plunges on fears of coronavirus pandemic

The S&P 500 and the Dow Jones Industrial Average on Monday suffered their biggest one-day percentage losses in two years after a surge in coronavirus cases outside China fanned worries about the global economic impact of a potential pandemic. Investors sold riskier assets and rushed to traditionally safer bets such as gold and U.S. Treasuries after countries including Iran, Italy and South Korea reported a rise in virus cases over the weekend even as China eased curbs with no new cases reported in Beijing and other cities. The benchmark S&P 500, which represents over 44% of the market capitalization of all global equities, lost $927 billion of its value on Monday alone and $1.33 trillion since its closing high on Wednesday last week, according to S&P Dow Jones Indices senior analyst Howard Silverblatt.

$700m WB loan sought for Dasu project expansion

The World Bank has started appraising the government’s request for a $700 million credit for expansion of electricity supply from Dasu Hydropower Project (DHP). According to project information document released by the World Bank, the loan is expected to be approved by the bank’s executive board next month. The proposed loan from the International Development Association will be utilised as additional financing for first phase of Dasu project, and will cover cost of construction of a 255km long, 765kV high-voltage alternating current transmission line from the DHP-I to the Islamabad West and Mansehra substations, that would not only have capacity to carry power generation from Dasu project but also for future expansions of lines to other parts of the country.

Pakistan offers $100bn investment opportunities in energy sector: Ayub

Pakistan and China on Monday pledged to keep the China-Pakistan Economic Corridor (CPEC) unaffected by the temporary challenge of coronavirus outbreak as Energy Minister Omar Ayub Khan pitched for about $100 billion worth of investment opportunities in the country’s power sector. Speaking at a ceremony — Energy Week — organised by National Electric Power Regulatory Authority (Nepra), Mr Ayub said the country’s energy sector offered investment opportunities of $100bn. This included about $45bn in power generation, $20bn in transmission and $15-20bn in distribution. He said the government was planning to provide sustainable, affordable and reliable power to the consumers by producing 75 to 80pc of electricity from indigenous resources. He said Pakistan was a large and open market for all the industries of the world to come and invest and enjoy high rates of return.

Substantial decline in vegetable prices, says PM

Prime Minister Imran Khan claimed on Monday that the prices of vegetables in the country had declined significantly and warned that those involved in the artificial price hike would be dealt with an iron hand. In a tweet, the prime minister said: “As a result of the government’s focus on price control, substantial decrease in prices, especially in vegetable prices, can now be seen. I assure our people that I will not relent until all involved in artificially-created price hike are identified and punished.”

Rs84bn tax potential in Sindh’s mineral sector: FBR

The Federal Board of Revenue (FBR) Intelligence and Investigation (I&I) Department in Karachi has identified potential of Rs84 billion sales tax collection from the mines and minerals sector in Sindh, it emerged on Monday. The detection came to surface, when the Directorate of I&I Karachi was examining records regarding income tax and sales tax payments to be made by the mines licence holders in Sindh on the extraction and supply of minerals including silica sand, gravel, morum, reti, bajri, crushed stone, bauxite, laterite and marble. It was revealed in the report that most of the mine lease holders are non-filers and not registered for the purpose of income tax and sales tax. This exercise will bring unregistered mine holders into the tax net.

The S&P 500 and the Dow Jones Industrial Average on Monday suffered their biggest one-day percentage losses in two years after a surge in coronavirus cases outside China fanned worries about the global economic impact of a potential pandemic. Investors sold riskier assets and rushed to traditionally safer bets such as gold and U.S. Treasuries after countries including Iran, Italy and South Korea reported a rise in virus cases over the weekend even as China eased curbs with no new cases reported in Beijing and other cities. The benchmark S&P 500, which represents over 44% of the market capitalization of all global equities, lost $927 billion of its value on Monday alone and $1.33 trillion since its closing high on Wednesday last week, according to S&P Dow Jones Indices senior analyst Howard Silverblatt.

The World Bank has started appraising the government’s request for a $700 million credit for expansion of electricity supply from Dasu Hydropower Project (DHP). According to project information document released by the World Bank, the loan is expected to be approved by the bank’s executive board next month. The proposed loan from the International Development Association will be utilised as additional financing for first phase of Dasu project, and will cover cost of construction of a 255km long, 765kV high-voltage alternating current transmission line from the DHP-I to the Islamabad West and Mansehra substations, that would not only have capacity to carry power generation from Dasu project but also for future expansions of lines to other parts of the country.

Pakistan and China on Monday pledged to keep the China-Pakistan Economic Corridor (CPEC) unaffected by the temporary challenge of coronavirus outbreak as Energy Minister Omar Ayub Khan pitched for about $100 billion worth of investment opportunities in the country’s power sector. Speaking at a ceremony — Energy Week — organised by National Electric Power Regulatory Authority (Nepra), Mr Ayub said the country’s energy sector offered investment opportunities of $100bn. This included about $45bn in power generation, $20bn in transmission and $15-20bn in distribution. He said the government was planning to provide sustainable, affordable and reliable power to the consumers by producing 75 to 80pc of electricity from indigenous resources. He said Pakistan was a large and open market for all the industries of the world to come and invest and enjoy high rates of return.

Prime Minister Imran Khan claimed on Monday that the prices of vegetables in the country had declined significantly and warned that those involved in the artificial price hike would be dealt with an iron hand. In a tweet, the prime minister said: “As a result of the government’s focus on price control, substantial decrease in prices, especially in vegetable prices, can now be seen. I assure our people that I will not relent until all involved in artificially-created price hike are identified and punished.”

The Federal Board of Revenue (FBR) Intelligence and Investigation (I&I) Department in Karachi has identified potential of Rs84 billion sales tax collection from the mines and minerals sector in Sindh, it emerged on Monday. The detection came to surface, when the Directorate of I&I Karachi was examining records regarding income tax and sales tax payments to be made by the mines licence holders in Sindh on the extraction and supply of minerals including silica sand, gravel, morum, reti, bajri, crushed stone, bauxite, laterite and marble. It was revealed in the report that most of the mine lease holders are non-filers and not registered for the purpose of income tax and sales tax. This exercise will bring unregistered mine holders into the tax net.

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 index have moved toward supportive trend line of its descending wedge after getting resistance from resistant trend line and a double bottom formation have been created on daily chart. As of now it's expected that index would try to find support at 38,800 points and if it would succeed in maintaining above this region then an intraday pull back towards 39,450 points and 39,600 points could be witnessed. But it's recommended to stay cautious and post trailing stop loss on existing positions because if index would succeed in breakout below 38,800 points then it could slide towards 38,500 and 38,000 points. Daily momentum indicators have entered into bearish zone therefore it's recommended to stay cautious.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.