Previous Session Recap

Trading volume at PSX floor increased by 282.77 million shares or 87.3%, DoD basis, whereas KSE100 Index opened at 52178.58, posted a day high of 53103.21 and a day low of 52178.58 during the last trading session. The session suspended at 52876.46 with a net change of 729.49 points and a net trading volume of 147.15 million shares. Daily trading volume of KSE100 listed companies increased by 35.11 million shares or 31.33%, DoD basis.

Foreign Investors remained in a net selling position of 1.7 million shares but a net value of Foreign Inflow increased by 5.22 million US Dollars. Categorically, Foreign Individual, Corporate and Overseas Pakistani investors remained in a net selling position of 0.006, 0.21 and 1.48 million shares respectively. On the other side Local Individuals, Companies, NBFCs and Mutual Funds remained in a net buying position of 33.34, 10.16, 0.58 and 7.15 million shares respectively but Local Brokers remained in a net selling position of 15.85 million shares.

Analytical Review

Asian shares scaled two-year highs on Thursday while the dollar and U.S. bond yields slipped after the U.S. Federal Reserve signaled a cautious approach to future rate hikes and the reduction of its $4.5 trillion of bond holdings. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS advanced 0.7 percent, hitting its highest level since June 2015, and bringing its gains so far this year to about 17 percent. The gains were led by South Korean shares .KS11, which rose 1.0 percent to record highs. Hang Seng .HSI gained 0.8 percent to its highest level since July 2015 while Taiwanese shares hit 17-year highs .TWII. In Japan, Nikkei .N225 gained 0.4 percent. Mainland Chinese shares .SSEC, which were briefly unsettled by Moody downgrade of its rating on China on Wednesday, bounced back 0.3 percent.

The top intelligence department of the Federal Board of Revenue (FBR) is investigating cases where investors trade digital currencies probably to evade taxes or launder money. The State Bank of Pakistan (SBP) does not recognise cryptocurrencies, such as bitcoin. These digital currencies are also traded as commodities. A senior tax official said people evade tax and launder money using cryptocurrencies. They buy bitcoin to launder their tax-evaded money, he said, adding that they park their black money out of Pakistan in many cases.

Amid warnings about the oversupply of generation capacity, the federal and provincial governments on Wednesday agreed to the immediate purchase of up to 450 megawatts of electricity from sugar mills. The meeting, presided over by Minister for Water and Power Khawaja Muhammad Asif, also finalised a load management plan that entailed closing down the key industrial sector for an eight-hour shift in Ramazan to divert electricity to the domestic sector for uninterrupted supplies at Sehr and Iftar.

The government on Wednesday raised Rs338 billion through auction of treasury bills against the target of Rs400bn. The government has reduced dependence on commercial banks as it has been borrowing more from the State Bank of Pakistan throughout this fiscal year for budgetary support. The fiscal deficit is expected to cross the projected target of 3.8 per cent for the current fiscal year. During the May-July period, the government announced to borrow Rs2.65 trillion. The maturing amount is about Rs2.443tr during the three-month period indicating higher than required borrowing.

Pakistan Railways and the Ministry of Petroleum signed a fuel transportation agreement under which the Pakistan State Oil (PSO) will transport at least 2 million tonnes of fuel every year based on the demand placed by the Ministry of Water and Power. The agreement was signed on Wednesday by PSO General Manager (Logistics) Syed Rashid Kamal and Pakistan Railways Additional General Manager (Traffic) Abdul Hameed Razi in the presence of Railways Minister Saad Rafiq. The agreement will increase fuel transportation activity of the railways.

The Ministry of Water and Power on Monday briefed the Public Accounts Committee (PAC) regarding the status of power generation in the country. The PAC was informed that Pakistan circular debt currently stands at Rs402.14 billion, of which outstanding payments for electricity stand at Rs237bn. It is worth mentioning here that the incumbent government had paid off Rs480 billion in outstanding dues when it assumed power in a bid to control the spiralling circular debt issue. Other major heads in the circular debt include outstanding payments for gas, which stand at Rs11bn, and oil arrears, which stand at Rs99bn.

Today BPL, NBP, PSO and STPL may lead the market in the positive direction.

Technical Analysis

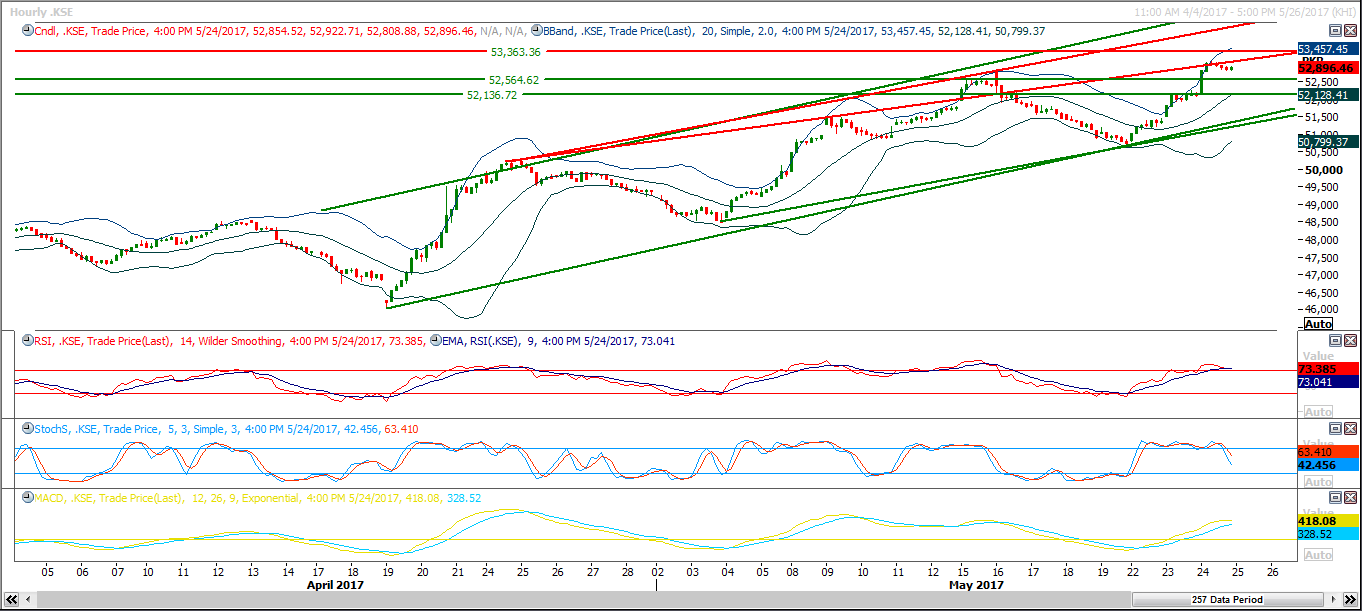

The Benchmark KSE100 Index is moving in an upward price channel and right now it is heading for 61.8% expansion of its last 50% correction which would be completed at 53363, but right now it is capped by a resistant trend line inside that channel which would try to push it back towards 54560 on intraday basis, if it closes above that trend line at 53080 then next target would be 53360 and more on. Trading with strict stop loss of 52530 is recommended for current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.