Previous Session Recap

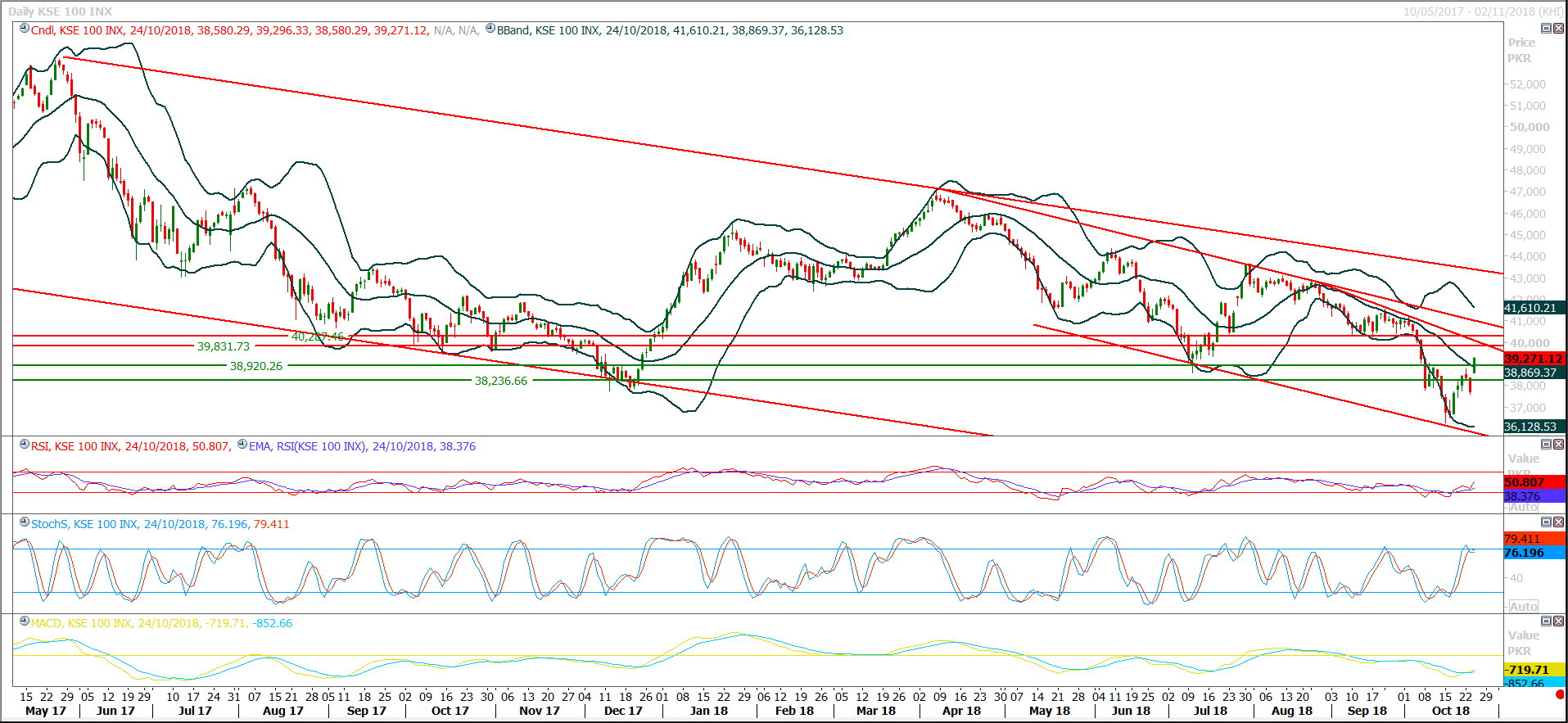

Trading volume at PSX floor increased by 109.70 million shares or 48.99% on DoD basis, whereas the Benchmark KSE100 index opened at 38,580.29 posted a day high of 39,296.33 and day low of 38,580.29 points while the session suspended at 39,271.12 with net change of 1556.22 points and net trading volume of 167.68 million shares. Daily trading volume of KSE100 listed companies increased by 49.84 million shares or 42.29% on DoD basis.

Foreign Investors remained in net selling position of 8.77 million shares and net value of Foreign Inflow dropped by 9.68 million US Dollars. Categorically, Foreign Corporate remained in net selling positions of 11.70 million shares but Foreign Individuals and Overseas Pakistanis investors remained in net buying positions of 0.13 and 2.80 million shares. While on the other side Local Individuals, Local Companies and Mutual Fund remained in net buying positions of 27.87, 2.04 and 7.74 million shares but Banks, NBFCs, Brokers and Insurance Companies remained in net selling positions of 6.97, 7.89, 3.22 and 9.25 million shares respectively.

Analytical Review

Nasdaq confirms correction while S&P 500 and Dow erase 2018 gains

U.S. stocks plunged again on Wednesday, confirming a correction for the Nasdaq and erasing the Dow and the S&P 500’s gains for the year, as disappointing forecasts from chipmakers and weak home sales data fueled jitters about economic and profit growth. The Nasdaq closed down 12.4 percent from its Aug. 29 record closing high, falling 4.4 percent for the day in its biggest one-day percentage decline since Aug. 18, 2011. Chipmakers Texas Instruments and STMicroelectronics (STM.PA) (STM.N) warned of slowing demand. They followed disappointing forecasts on Tuesday from Caterpillar (CAT.N) and 3M (MMM.N). The forecasts gave investors further reason to pause and helped fuel the selling momentum, said Peter Tuz, president of Chase Investment Counsel in Charlottesville, Virginia.

Nepra raises power tariff by Re0.20 per unit

The National Electric Power Regulatory Authority on Wednesday allowed tariff increase of Rs0.20 per unit for ex-WAPDA distribution companies on account of fuel price adjustment for September. The decision was taken by NEPRA in a public hearing on the petition filed by the Central Power Purchasing Agency (CPPA) and will have a cumulative burden of around Rs2.4 billion on consumers.

FPCCI dubs D8 as future economic powerhouse

President of the Federation of Pakistan Chambers of Commerce and Industry (FPCCI) Ghazanfar Bilour has said that the Developing Eight Organization for Economic Cooperation (D-8) is the economic powerhouse of the future. He said that this group of developing eight countries including Pakistan, Turkey, Bangladesh, Egypt, Iran, Malaysia, Indonesia, and Nigeria was formed in 1997 with an aim to enhance economic cooperation in the global economy and generate new opportunities.

TDAP to collaborate with Bank of China to hold B2B sessions

Bank of China - Pakistan Operations held a pre-departure briefing for 1st China International Import Expo (CIIE) at a local hotel. Qamar Zaman, Director General of Trade Development Authority of Pakistan (TDAP), Liu Zhan, Counselor of Chinese Consulate-General in Lahore, and Wang Jian, Economic and Commercial Counsel of China in Lahore, were the guests of honor in the briefing. The briefing was attended by top exporters of Pakistan based in Lahore.

Govt urged to ensure safe working conditions

The federal and provincial governments should take immediate steps to ensure safe working conditions in transport, mines, chemical, construction, textile industries etc to save the innocent citizens and workers from fatal and non fatal accidents and occupational diseases occurring very now and then. This demand was raised in a large meeting of All Pakistan Workers Confederation (Regd.) held at Lahore at National Bank of Pakistan Employees Union Hall, Lahore.

U.S. stocks plunged again on Wednesday, confirming a correction for the Nasdaq and erasing the Dow and the S&P 500’s gains for the year, as disappointing forecasts from chipmakers and weak home sales data fueled jitters about economic and profit growth. The Nasdaq closed down 12.4 percent from its Aug. 29 record closing high, falling 4.4 percent for the day in its biggest one-day percentage decline since Aug. 18, 2011. Chipmakers Texas Instruments and STMicroelectronics (STM.PA) (STM.N) warned of slowing demand. They followed disappointing forecasts on Tuesday from Caterpillar (CAT.N) and 3M (MMM.N). The forecasts gave investors further reason to pause and helped fuel the selling momentum, said Peter Tuz, president of Chase Investment Counsel in Charlottesville, Virginia.

The National Electric Power Regulatory Authority on Wednesday allowed tariff increase of Rs0.20 per unit for ex-WAPDA distribution companies on account of fuel price adjustment for September. The decision was taken by NEPRA in a public hearing on the petition filed by the Central Power Purchasing Agency (CPPA) and will have a cumulative burden of around Rs2.4 billion on consumers.

President of the Federation of Pakistan Chambers of Commerce and Industry (FPCCI) Ghazanfar Bilour has said that the Developing Eight Organization for Economic Cooperation (D-8) is the economic powerhouse of the future. He said that this group of developing eight countries including Pakistan, Turkey, Bangladesh, Egypt, Iran, Malaysia, Indonesia, and Nigeria was formed in 1997 with an aim to enhance economic cooperation in the global economy and generate new opportunities.

Bank of China - Pakistan Operations held a pre-departure briefing for 1st China International Import Expo (CIIE) at a local hotel. Qamar Zaman, Director General of Trade Development Authority of Pakistan (TDAP), Liu Zhan, Counselor of Chinese Consulate-General in Lahore, and Wang Jian, Economic and Commercial Counsel of China in Lahore, were the guests of honor in the briefing. The briefing was attended by top exporters of Pakistan based in Lahore.

The federal and provincial governments should take immediate steps to ensure safe working conditions in transport, mines, chemical, construction, textile industries etc to save the innocent citizens and workers from fatal and non fatal accidents and occupational diseases occurring very now and then. This demand was raised in a large meeting of All Pakistan Workers Confederation (Regd.) held at Lahore at National Bank of Pakistan Employees Union Hall, Lahore.

Market is expected to remain volatile therefore its recommended to stay cautious while trading during current trading session.

Technical Analysis

The Benchmark KSE100 Index has penetrated above 50% correction of its latest bearish rally during last trading session and right now it have resistant regions ahead at 39,830 and 40,010 points from two strong horizontal resistant regions. As of now 40,010 would try to react as a major resistance because it falls on a crossover of a strong horizontal resistant region with a descending trend line. Daily and weekly momentum indicators are in bullish mode and they would try to lead index towards 39,830 and 40,010 points but the gap on daily chart which occurred during last trading session would remain open and would create panic between investors and traders and this panic would increase day by day until index reversed to fill it. It’s recommended to start profit taking around 39,800 points and stay side line until index close above 40,280 points on daily chart because if it would not succeed in penetration of this region then a short term reversal could be witnessed in coming week.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.