Previous Session Recap

Trading volume at PSX floor dropped by 33.65 million shares or 20.31%, DoD basis, whereas, the benchmark KSE100 Index opened at 42771.66, posted a day high of 42921.13 and a day low of 42572.04 during the last trading session.The session suspended at 42750.19 with a net change of -24.85 points and a net trading volume of 52.08 million shares. Daily trading volume of KSE100 listed companies dropped by 30.2 million shares or 36.71%,DoD basis.

Foreign Investors remained in net selling position of 0.71 million shares and net value of Foreign Inflow dropped by 1.02 million US Dollars. Categorically, Foreign Corporate Investors remained in net selling position of 1.23 million shares but Overseas Pakistanis remained in net buying position of 0.52 million shares.On the other side Local Individuals and Brokers remained in net buying positions of 7.77 and 5.35 million shares but Local Companies, Banks, NBFCs, Mutual Funds and Insurance Companies remained in net selling position of 1.75, 7.49, 0.48, 2.26 and 0.74 million shares respectively.

Analytical Review

The euro slipped on Monday after German Chancellor Angela Merkel won a fourth term in a weekend election, but faced leading a much less stable coalition in a fractured parliament as support for the far-right party surged. “The market reacted by selling the euro on the possibility of Merkel running into difficulties in forging a coalition. The euro, however, was already losing support from the European Central Bank’s monetary policy theme and appeared to be on its way lower,” said Daisuke Karakama, chief market economist at Mizuho Bank in Tokyo. “The election outcome in Germany showed the country was no longer a special presence in Europe amid growing support for populism and the far right.” MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was 0.2 percent higher. Japan's Nikkei .N225 rose 0.6 percent, Australian shares climbed 0.4 percent and South Korea's KOSPI .KS11 was flat.

IN the local currency market, the rupee/dollar parity last week displayed almost a stable trend amid minor variations. No new development was observed in the market where trading activity remained sluggish as leading currency players preferred to remain in sidelines. Last week on the interbank market, the rupee/dollar parity traded almost stable amid minor variations in dull trading.

ACCORDING to the weekly statement of position of all scheduled banks for the week ended September 08, 2017 deposits and other accounts of all scheduled banks stood at Rs11,593.328 billion after a 0.60 per cent decrease over the preceding week’s figure of Rs11,661.904bn. Compared with last year’s corresponding figure of Rs10,144.515bn, the current week’s figure was higher by 14.28pc. Deposits and other accounts of all commercial banks stood at Rs11,519.695bn against preceding week’s deposits of Rs11,588.601bn, showing a fall of 0.60pc.

Fish and fish preparations exports from the country during first two months of current financial year increased by 19.83 percent as compared the exports of the corresponding period of last year. About 13,648 metric tons of fish and fish preparations worth $35.273 million exported during the period from July-August, 2017 as compared the exports of 10,107 metric tons valuing $29.488 million of same period last year. On month on month basis, the exports of fish and fish products also grew by 24.13 percent in month of August as compared to the same month of last year, according the data of Pakistan Bureau of Statistics. In last month about 8,827 metric tons of fish and fish products worth of $22.800 million exported as compared the exports of 6,410 metric tons valuing of $18 million of same period last year.

The weekly inflation for the week ended on September 21 for the combined income groups increased by 0.61 percent as compared to the previous week. According to data released by Pakistan Bureau of Statistics (PBS), the Sensitive Price Indicator (SPI)for the week under review in the above mentioned group was recorded at 223.47 points against 222.11 points last week. As compared to the corresponding week of last year, the SPI for the combined group in the week under review witnessed increase of 2.16 percent. The weekly SPI has been computed with base 2007, 2008=100, covering 17 urban centres and 53 essential items for all income groups. Meanwhile, the SPI for the lowest income group up to Rs8,000 increased by 0.70 percent as it went up from 213.01 points in the previous week to 214.51 points in the week under review. As compared to the last week, the SPI for the income groups from Rs8001 to 12,000, Rs12,001 to 18,000, Rs18,001 to 35,000 and above Rs35,000, also increased by 0.66 percent, 0.67 percent, 0.62 percent and 0.65 percent, respectively.

The market is expected to remain volatile today. We advise traders to exercise caution. Buying on dips and booking gains on strength is recommended.

Technical Analysis

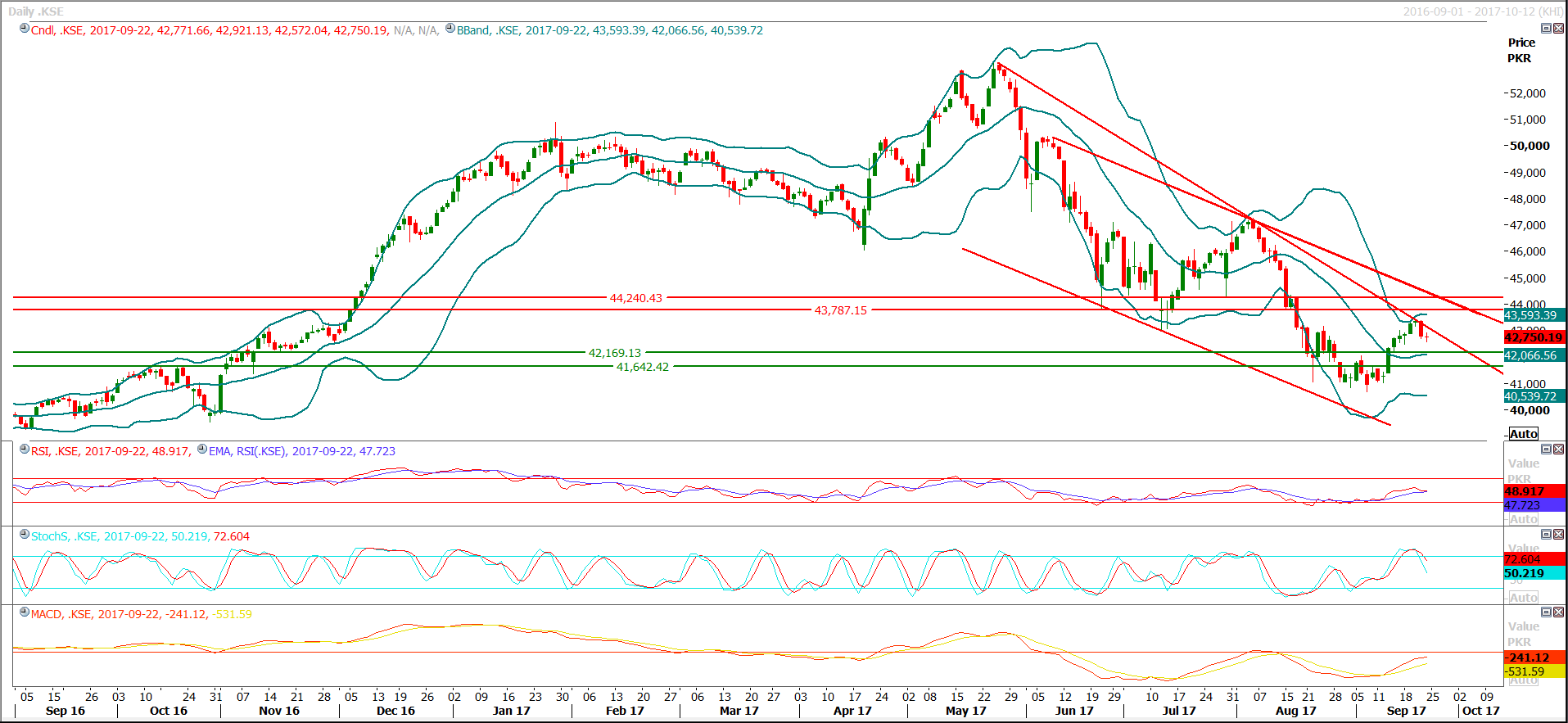

The Benchmark KSE100 Index has bounced back after getting resistance from a resistant trend line and has formatted an evening start on the daily chart, whereas, Daily stochastic and MAORSI have generated a bearish crossover which is also an indication of the start of a bearish rally and these crossovers might add further pressure to bearish momentum if index breaks 42450, next supports for index might be around 42160 and 41700, after breakout of 42450. Weekly bullish momentum was also capped by the last week's closing with a doji formation therefore a cautious trading strategy is recommended for the coming days and selling on strength is recommended for current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.