Previous Session Recap

The Bench Mark KSE100 Index Opened with a gap of 31 points at 46730.56, posted day high of 46826.71 and day low of 46443.22 points during last trading session.The session suspended at 46633.99 with net change of -65.79 points and net trading volume of 105.41 million shares. Daily trading volume of KSE100 Index dropped by 28.29 million shares or 21.16% on DOD bases.

Foreign Investors remained in net selling position of 8.45 million shares and net value of Foreign Inflow dropped by 9.72 million US Dollars. Categorically Foreign Individuals, Corporate and Overseas Pakistani Investors remained in net selling position of 0.02, 5.36 and 3.07 million shares respectively. While on the other side, Local Individuals, Mutual Funds and Brokers remained in net buying position of 13.92, 1.76 and 27.13 million shares respectively but Local Companies Banks and NBFCs remained in net selling position of 13.31, 15.76 and 4.2 million shares respectively.

Analytical Review

Asian stocks stepped back in subdued trade on Friday as Wall Street took a breather from its relentless rise since the U.S. election, while the dollar hovered below its 14-year high set earlier this week. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS, which touched a five-month low on Thursday, eased 0.1 percent, and is headed for a weekly drop of 1.4 percent. Japanese Nikkei .N225 also lost 0.1 percent, but is set to end the week with a small 0.1 percent gain. Overnight, U.S. equities posted their first back-to-back daily declines of the month in light trading as investors took time out ahead of the Christmas weekend. U.S. indices fell as much as 0.4 percent on Thursday. Wall Street stocks have been on a tear since the U.S. election on expectations that President-elect Donald Trump promised fiscal stimulus will boost economic growth and company profits. The Dow Jones Industrial Average .DJI has surged 8.7 percent since before the election.

The receivables of Pakistan State Oil are said to have increased by Rs 34 billion just in one year period due to measured payments by the public sector entities, especially out of crisis power sector and Pakistan International Airlines (PIA).

K-Electric (company) has approached Federal Board of Revenue (FBR) seeking customs duty concessions on the same pattern as available to Independent Power Producers (IPPs) to allow all power generation projects/IPPs connecting/supplying power to K-Electric to enjoy duty concessions.

The textile exports from the country on year-on-year basis increased by 9.71 percent during the November 2016 compared to the same month so the last year.According to the latest data released by the Pakistan Bureau of Statistics (PBS), the textile exports during November 2016 were recorded at $1,048.708 million compared to the exports of $955.859 million during November 2015.

Security arrangements as well as depreciation of rupee against the dollars apart from other factors have contributed to cost escalation to Rs 15.7 billion of three hydel power projects constructed in Khyber Pakhtunkhwa under renewable energy development sector investment programme (REDSIP).

Technical Analysis

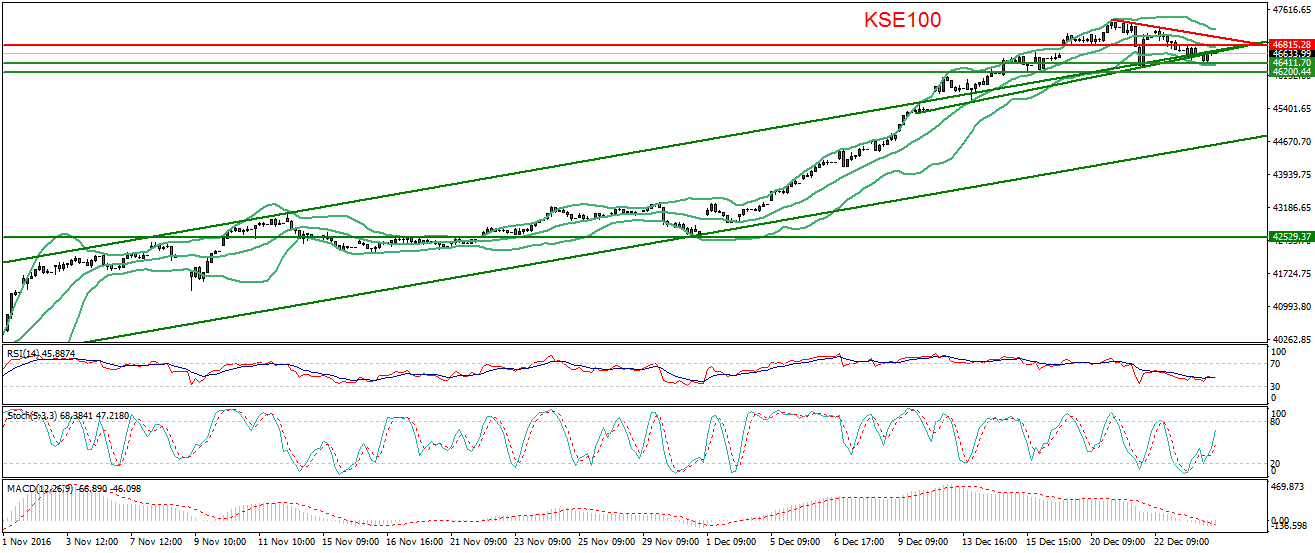

The Bench Mark KSE100 Index is closing with a bullish reversal pattern on hourly chart since last three trading sessions. It is also not being able to close below 61.8% intra-day correction which it already has fulfilled on 21st Dec. 2016. On hourly chart, it is being supported by a rising trend line but thin volumes are creating an alarming situation on psx. Therefore, right now trading with strict stop loss of 46259.96 points could be beneficial. During current trading session market will try to break its two major resistances at 46815 and 46959 points as it already has tried to break its supportive region during last two trading session but could not succeed.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.