Previous Session Recap

The Benchmark KSE100 Index Opened with a positive gap of 170 points, posted day high of 50267.24 and day low of 49721.46 during last trading session. The session suspended at 49756.77 with net change of -212.15 points and net trading volume of 172.66 million shares. Daily trading volume of KSE100 listed companies dropped by 53.73 million shares or 23.73% on DOD bases.

Analytical Review

Asian stocks gained early on Thursday, cheered by the Dow Jones Industrial Average breaching past the 20,000-level threshold for the first time though concerns about U.S. President Donald Trump protectionist stance kept the dollar on the defensive. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS tacked on 0.3 percent. Australian stocks added 0.4 percent and Japanese Nikkei .N225 brushed aside a stronger yen to rise 1.1 percent. The Dow .DJI closed atop the 20,000 mark for the first time overnight as solid earnings and optimism over Trump pro-growth initiatives revitalized a post-election rally. Safe-haven U.S. Treasuries were duly sold as risk aversion ebbed and the benchmark 10-year note yield US10YT=RR rose to a four-week high on Wednesday. Subdued investor demand at a five-year auction also hurt Treasuries. The dollar, which often draws support from higher Treasury yields, failed to follow suit, with an index tracking the greenback against a basket of major currencies .DXY sliding to a seven-week low of 99.335 on Wednesday.

A joint venture of Hub Power Company (Hubco) and a Chinese company on Wednesday announced that they would set up two coal-fired power plants of 1650MW in Hub, (Balochistan) and Thar, Sindh under China-Pakistan Economic Corridor (CPEC). Documents relating to Power Purchase Agreement (PPA) and Implementation Agreement (IA) were signed in Islamabad in the Ministry of Water and Power between China Power Hub Generation Company, Hubco, Private Power Infrastructure Board (PPIB) and Central Power Purchasing Agency (CPPA).

Punjab Chief Minister Shahbaz Sharif and Chief Executive Officer of the renowned German company Lahmeyer, Bernd Metzger, discussed the expansion of co-operation in the energy sector in a meeting held here Wednesday. Speaking on the occasion, Chief Minister Shahbaz Sharif said that Pakistan is working on the several energy projects with diligence and many of them are in the final phase of the completion.

The Abraaj Group, a Dubai based investment group, announced it had bought a majority stake in a 50MW wind power project in Sindh, it has been learnt. The project — which is part of the Jhimpir wind corridor — achieved financial close in August 2016 and is expected to commence operations in the first quarter of 2018, read a statement issued by Abraaj Group on Wednesday. The Jhimpir wind corridor is an established area for wind projects with 550MW of capacity already operational and a further 1GW under the construction and development phase, it stated.

The third Pakistan Mega Leather Show is being held from January 27-29 at Lahore Expo Centre with a special focus on enhancing the investors confidence in Pakistan business market and to attract investors, national and international, towards the tremendous potential that exists in the leather sector of Pakistan.

TRG, ANL, HUBC and SEARL can lead market in positive direction.

Technical Analysis

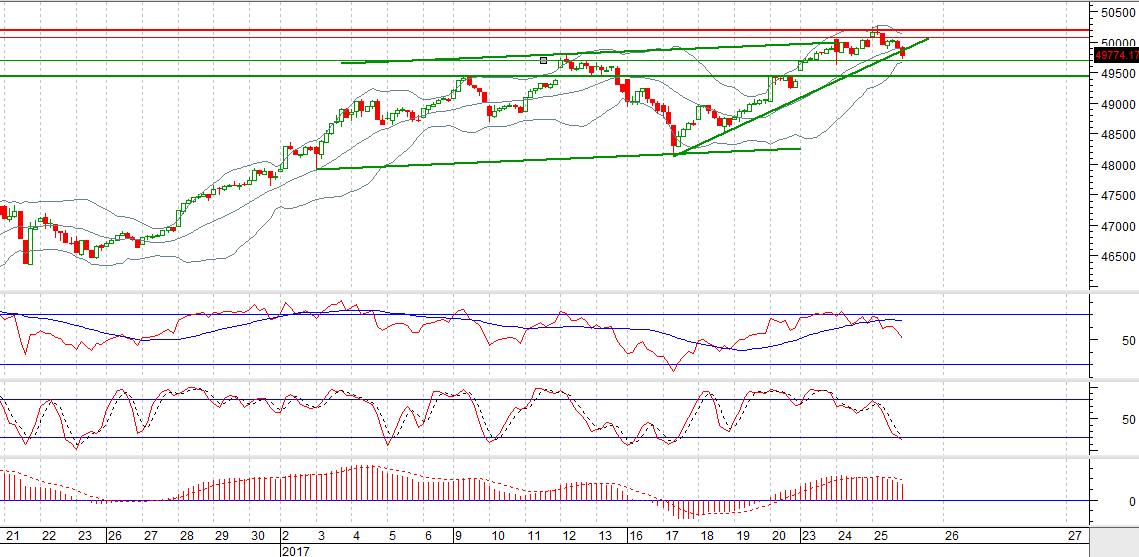

The Benchmark KSE100 Index has penetrated a major barrier of 50000 during last trading session by posting day high of 50267, but it did not close above its expansion levels of 49995 and 50203. Its short term bullish trend channel is completed at 49995 and right now it is in correction mode on hourly chart. It has penetrated its supportive trend line in downward direction but it is being supported by a horizontal support which will provide a supportive breath around 49640 which will try to push index back in positive zone around 49660. Trading with strict stop loss is recommended for current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.