Previous Session Recap

The Benchmark KSE100 index opened at 50111.67, posted a day high of 50304.65 and a day low of 49532.02 during the last trading session. Whereas, the session suspended at 49785.17 with a net change of -326.50 points and net trading volume of 130.39 million shares. Daily trading volume of KSE100 listed companies dropped by 5.28 million shares or 3.89%, DoD basis.

Foreign Investors remained in a net selling position of 21.42 million shares and the net value of Foreign Inflow dropped by 6.2 million US Dollars. Categorically, Foreign Individuals, Corporate and Overseas Pakistani investors remained in net selling positions of 0.085, 19.4 and 1.94 million shares, respectively. On the other side, Local Individuals and Mutual Funds remained in net buying positions of 20.81 and 7.82 million shares but Local Companies, Banks and Brokers remained in net selling positions of 2.31, 0.63 and 0.95 million shares respectively.

Analytical Review

Asian stocks extended gains for a fifth straight day on Wednesday as Wall Street hit new peaks while the euro consolidated recent gains as immediate concerns of political uncertainty in the euro zone receded. Broadest index of MSCI in Asia-Pacific shares outside Japan MIAPJ0000PUS rose 0.1 percent, hovering near their highest since June 2015. Early Asian stock markets such as New Zealand .NZ50 and South Korea .KS11 were key gainers. A strong finish to U.S. markets was the main driver. The Nasdaq Composite hit a record high on Tuesday, while the Dow and S&P 500 brushed against recent peaks as strong earnings underscored the health of corporate America. Fanning the market rally were reports that President Donald Trump tax reform proposals, due to be announced on Wednesday, would include a slashing of the corporate tax rate and lower taxes on offshore earnings stockpiled by U.S. companies overseas.

Finance Minister Ishaq Dar has said that he has discussed a proposal with the World Bank to illuminate entire Balochistan province with solar energy and response of the bank was positive. Speaking at the economic forum of Pakistan Embassy on Monday night, the minister also acknowledged that the Chinese companies investing in the China-Pakistan Economic Corridor (CPEC) would get huge tax breaks but claimed that “this calculated decision” would not hurt economy of the country. “I discussed (the proposal) to illuminate entire Balochistan with World Bank President Jim Yong Kim and his response had been positive,” said Mr Dar, who attended spring meetings of the World Bank Group in Washington this week.

The government has notified a relaxation of the moratorium on new gas connections for industrial, commercial and captive consumers and directed the gas utilities to implement it with immediate effect. In an order issued recently, the Ministry of Petroleum and Natural Resources informed the managing directors of the Sui Southern Gas Company Limited (SSGCL) and Sui Northern Gas Pipelines Limited (SNGPL) about decision of the cabinet of April 12.

The government is likely to fix GDP growth of the country at 6.2 percent and budget deficit at 4 percent for the next financial year 2017-18. “The broad contours of the budget are almost ready, which will be presented to the federal cabinet for approval after the return of Finance Minister Ishaq Dar from the United States,” said an official of the Ministry of Finance. The government had already decided to announce the budget for financial year 2017-18 on May 26. The announcement of the budget had been pulled earlier because Ramazan was expected to begin on May 28.

The exports of basmati rice from the country during the month of March 2017 increased by 154.28 percent as compared the exports of the corresponding month of last year. During month of March, about 45,745 metric tons of basmati rice worth $43.976m were exported as compared the exports of 17,412 metric tons valuing of $17.294m of same month last year. According the data of PBS during the month of March, sugar exports from the country grew by 1.60pc and about 107,558 metric tons of sugar worth $57.742m were exported as compared the exports of 127,009 metric tons valuing of $56.883 million of same month last year.

MARI, PSMC, SMBL and TRG can lead the market in the positive direction.

Technical Analysis

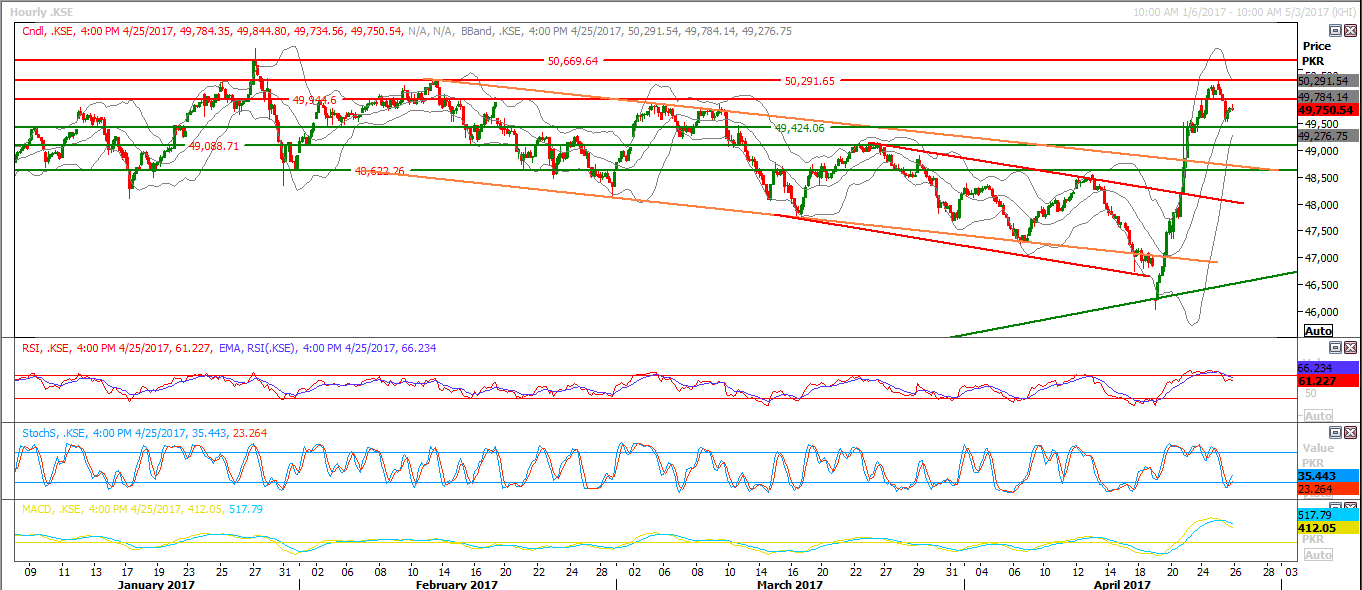

The Benchmark KSE100 Index bounced back after resisting from a horizontal trend line, indicating towards a corrective mode. During the last trading session, it has closed below 49960 which confirmed a false breakout of its horizontal resistance. This level is likely to react as a strong resistance and may push the index towards 49440. Breakout of this region will call for 49275 and 49088. For the current session, trading with strict stop loss of 49440 is recommended as closing below this level will confirm its reversal from bullish trend to bearish trend.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.