Previous Session Recap

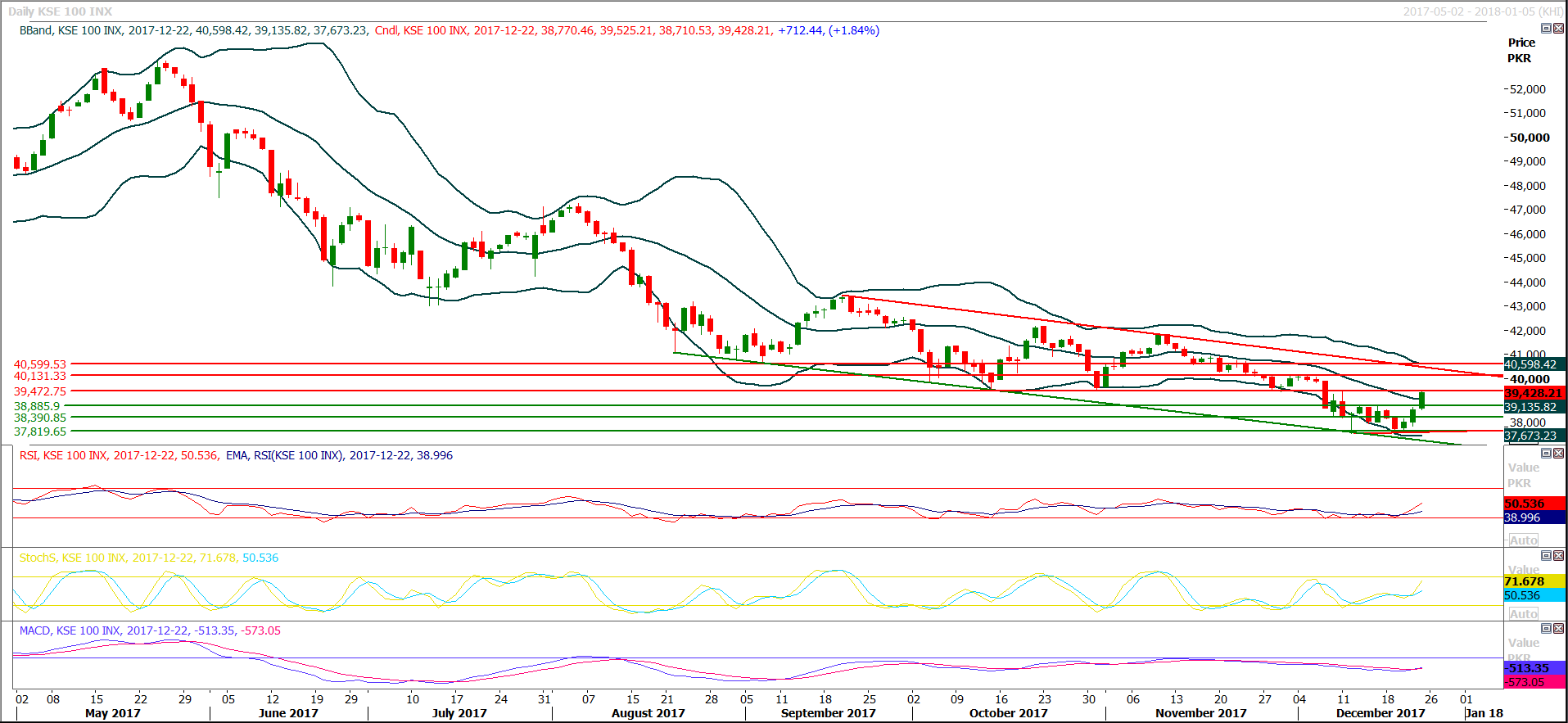

Trading volume at PSX floor increased by 43.23 million shares or 24.06% on DoD basis, whereas, the benchmark KSE100 Index opened at 38770.46, posted a day high of 39525.21 and a day low of 38710.53 during last trading session. The session suspended at 39428.21 with net change of 712.44 and net trading volume of 98.5 million shares. Daily trading volume of KSE100 listed companies increased by 17.2 million shares or 21.16% on DoD basis.

Foreign Investors remained in net selling position of illion shares and net value of Foreign Inflow dropped by 7.39 million US Dollars. Categorically, Foreign Individual, Corporate and Overseas Pakistani Investors remained in net selling positions of 0.16, 6.51 and 3.76 million shares respectively. While on the other side Local Individuals remained in net selling position of 5.82 million shares but Local Companies, Banks, Mutual Funds, Brokers and Insurance Companies remained in net buying positions of 2.07, 1.41, 4.05, 0.87 and 2.31 million shares respectively.

Analytical Review

The dollar was steady in holiday-thinned trading on Tuesday, shrugging off upbeat Japanese economic data as most market participants have already closed their books for the year. Markets in Australia and Hong Kong remained closed after Monday’s Christmas holiday, and many financial centers in Europe will also be shut on Tuesday. The euro was steady at $1.1871 EUR=. The single currency gave up some ground last week after Catalan separatists won a regional election, deepening Spain's political crisis in a sharp rebuke to Prime Minister Mariano Rajoy and European Union leaders who backed him. Against the yen, the dollar was almost flat on the day at 113.29 JPY=.

Under the recently launched policy for the promotion of financing for small and medium enterprises (SMEs), Rs6 billion will be available at a subsidised rate of six per cent for renewable energy projects of up to 50 megawatts in hydro, solar, wind and biogas categories. According to the document issued by the State Bank of Pakistan (SBP) on Friday, the subsidised loan will be available for up to 12 years. The scheme also incentivises the establishment of small-scale renewable energy solutions of less than 1MW to promote solar usage among consumers.

PRICES of food items have started rising in the wake of a recent fall in the rupee’s value, though the price hike has somewhat remained subdued as the depreciation is not accompanied by supply constraints. However, a sharper rise has been noticed in prices of imported food items. From tea, coffee, milk powder, chocolates and cheese to pulses, spices and pickles, a large number of imported food items have become costlier by five to 10 per cent, wholesale traders at Jodia Bazaar say. Locally produced foodstuff has also depicted a rising trend in retail markets after the rupee lost about 5pc value against the US dollar in the second week of December, according to some media reports based on market surveys.

Pakistan Hosiery Manufacturers and Exporters Association (PHMA) Chairman Dr Khurram Anwar Khawaja has appealed to the government to withdraw duty on cotton yarn import in line with the proposed withdrawal of custom duties on raw cotton import from India. “PHMA appreciates the move to withdraw duties and taxes on the import of cotton to encourage the value-addition and also demanded the same relaxation for the import of cotton yarn, which is a raw material for value-added knitwear sector,” he demanded. Dr Khurram said that prime minister’s package for exporters was announced on January 10, 2017, wherein textile apparel sector was to be provided a number of facilitations, including withdrawal of customs duty and sales tax on the import of cotton yarn from January 16, 2017, but no such measure was taken so far.

The Union of Small and Medium Enterprises (UNISAME) has urged Pervaiz Malik, the federal commerce minister, to grant the status of industry to the rice sector, on the basis of its merits. UNISAME President Zulfikar Thaver said the rice growers, millers, processors and exporters all contributed towards the economic growth of the country collectively and hence the sector deserved the status of industry for its recognition and promotion on fast track basis. Thaver said all rice sector stakeholders, who had formed a rice syndicate and were on the same page, demanded and urged the ministry to oblige the sector with industry status due to its contribution to the GDP and economic growth which was substantial.

NML, ENGRO, NRL and DGKC may lead the index in positive direction

Technical Analysis

The Benchmark KSE100 Index have bounced back after posting a double botton on weekly chart during last trading week and have closed above its first resistance of 39100 points while the second and third major resistant regions are ahead at 39500 and 40150 points. Its expected that index would open with a positive gap above 39500 which would lead index towards 40150 during this week where inidex would face a major resistance. Index have created a weekly bullish engulfing pattern and weekly stochastic and MAORSI have generated bullish crossover which would push index in bullish direction. Its recommended to buy on dip and sell on strength during current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.