Previous Session Recap

Trading volume at PSX floor dropped by 55.74 million shares or 42.75% on DOD basis whereas the Benchmark KSE100 index opened at 38,240.70, posted a day high of 38,347.25 and day low of 37.934.01 during last trading session while session suspended at 38,308.92 points with net change of 57.88 points and net trading volume of 57.69 million shares. Daily trading volume of KSE100 listed companies dropped by 40.87 million shares or 41.47% on DOD basis.

Foreign Investors remained in net buying positions of 0.91 million shares and net value of Foreign Inflow dropped by 0.17 million US Dollars. Categorically, Foreign Corporate remained in net buying positions of 1.03 million shares but and Overseas Pakistanis investors remained in net selling positions of 0.11 million shares. While on the other side Local Individuals, Banks, NBFCs and Brokers remained in net buying positions of 2.73, 1.21, 0.043 and 10.83 million shares respectively but Local Companies, Mutual Fund and Insurance Companies remained in net selling positions of 1.59, 1.63 and 12.39 million shares.

Analytical Review

Stocks under a cloud as U.S. political tumult adds to growth anxiety

Global stock markets headed into the year-end under a heavy cloud after another rout this week as U.S. political uncertainty added to heightened concerns over slowing global economic growth. Asian equities were shaky on Wednesday following a Christmas eve Wall Street plunge, as investors were unnerved by U.S. political developments including a U.S. federal government shutdown and President Donald Trump’s hostile stance toward the Federal Reserve chairman.

Major chambers announce support to UBG for FPCCI polls

Country’s all major chambers and trade bodies have announced to support the United Business Group (UBG) candidates in the upcoming elections of the apex chamber for 2019 being held at the end of December 2018. The Chairman Iftikhar Malik, addressing the meeting, said that it would sweep the annual election of Federation of Pakistan Chamber of Commerce and Industry (FPCCI) which is to be held on December 30.

First-ever dedicated freight train launched

First ever dedicated freight train loaded with 75 cargo containers commenced its journey from Karachi’s Cantonment Railway Station to Lahore. The freight train is being launched under public-private partnership with the expected journey time of 48 hours. The Federal Minister for Railways Sheikh Rasheed Ahmed while inaugurating the service said he was optimistic about the dedicated and regular freight train service for cargo transport.

Govt adopts tight cash release policy for development projects

The government has adopted tight cash release policy for the development projects of the country due to the tight fiscal position and revenue shortfall during six months of the ongoing fiscal year. The government has released only Rs184.5 billion for the Public Sector Development Programme (PSDP) during almost six months (July to December 21) of the year 2018-19. The government has released only 27 percent of the annual development budget in six months period, according to the data released by the Planning Commission.

Japan's MUFG to promote bank unit chief Mike to president

Mitsubishi UFJ Financial Group (8306.T) is set to name Kanetsugu Mike, the head of its banking unit, as president, a source with direct knowledge of the matter said on Tuesday. Current President Nobuyuki Hirano will become chairman while Mike will also continue to serve as CEO of the banking unit, said the source, who requested anonymity because he was not authorised to discuss the matter. An spokeswoman for MUFG, Japan’s largest lender, said nothing had been decided. Joining what is today’s MUFG in 1979, Mike spent about half of his four-decade career outside Japan and became CEO of the core unit MUFG Bank last year following his predecessor’s sudden resignation for health reasons. Mike is taking over the helm of the financial conglomerate with over 300 trillion yen ($2.7 trillion) in assets. Hirano, who led the banking group since 2013, has been pushing the expansion of its overseas operations, as its western peers shrank their businesses in the wake of the global financial crisis a decade ago.

Global stock markets headed into the year-end under a heavy cloud after another rout this week as U.S. political uncertainty added to heightened concerns over slowing global economic growth. Asian equities were shaky on Wednesday following a Christmas eve Wall Street plunge, as investors were unnerved by U.S. political developments including a U.S. federal government shutdown and President Donald Trump’s hostile stance toward the Federal Reserve chairman.

Country’s all major chambers and trade bodies have announced to support the United Business Group (UBG) candidates in the upcoming elections of the apex chamber for 2019 being held at the end of December 2018. The Chairman Iftikhar Malik, addressing the meeting, said that it would sweep the annual election of Federation of Pakistan Chamber of Commerce and Industry (FPCCI) which is to be held on December 30.

First ever dedicated freight train loaded with 75 cargo containers commenced its journey from Karachi’s Cantonment Railway Station to Lahore. The freight train is being launched under public-private partnership with the expected journey time of 48 hours. The Federal Minister for Railways Sheikh Rasheed Ahmed while inaugurating the service said he was optimistic about the dedicated and regular freight train service for cargo transport.

The government has adopted tight cash release policy for the development projects of the country due to the tight fiscal position and revenue shortfall during six months of the ongoing fiscal year. The government has released only Rs184.5 billion for the Public Sector Development Programme (PSDP) during almost six months (July to December 21) of the year 2018-19. The government has released only 27 percent of the annual development budget in six months period, according to the data released by the Planning Commission.

Mitsubishi UFJ Financial Group (8306.T) is set to name Kanetsugu Mike, the head of its banking unit, as president, a source with direct knowledge of the matter said on Tuesday. Current President Nobuyuki Hirano will become chairman while Mike will also continue to serve as CEO of the banking unit, said the source, who requested anonymity because he was not authorised to discuss the matter. An spokeswoman for MUFG, Japan’s largest lender, said nothing had been decided. Joining what is today’s MUFG in 1979, Mike spent about half of his four-decade career outside Japan and became CEO of the core unit MUFG Bank last year following his predecessor’s sudden resignation for health reasons. Mike is taking over the helm of the financial conglomerate with over 300 trillion yen ($2.7 trillion) in assets. Hirano, who led the banking group since 2013, has been pushing the expansion of its overseas operations, as its western peers shrank their businesses in the wake of the global financial crisis a decade ago.

Market is expected to remain volatile during current trading session therefore it's recommended to stay cautious while trading

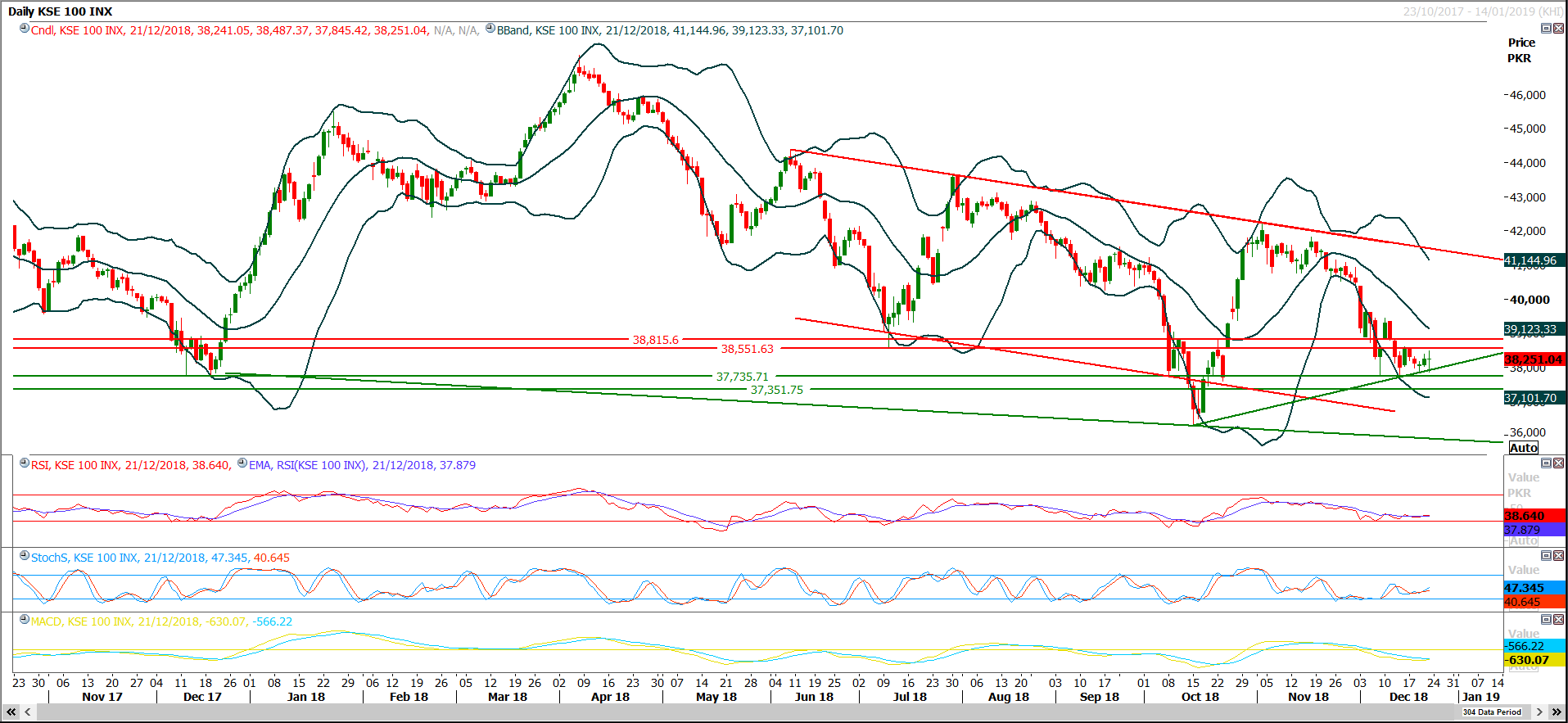

Technical Analysis

The Benchmark KSE100 index have tried to bounce back after getting support from a rising trend line on daily chart during last trading session and could not succeed in penetration of 37,700 on weekly basis in downward direction. With last trading session’s closing above 38,800 index have formatted a weekly triple bottom above 37,760 points which is indicating that index would try to take a spike during this week which may lead index towards 38,830 and 39,200 points initially, but index would not considered bullish until it close above 39,500 points on weekly basis therefore its recommended to start profit taking in chunks from buying on dips while selling on strength.

PSO have resistant region ahead at 245 till 248 therefore it’s recommended to stay cautious with buying positions while reaching these prices levels. TRG have started its pull back after getting support from a descending trend line and have succeed in closing above 25.60 during last trading session now it would try to target 27.30 in coming days. DGKC have supportive region ahead at 85 Rs and it can be bought between 87-86 with strict stop loss of 85 and target at 89 and 91.60.

PSO have resistant region ahead at 245 till 248 therefore it’s recommended to stay cautious with buying positions while reaching these prices levels. TRG have started its pull back after getting support from a descending trend line and have succeed in closing above 25.60 during last trading session now it would try to target 27.30 in coming days. DGKC have supportive region ahead at 85 Rs and it can be bought between 87-86 with strict stop loss of 85 and target at 89 and 91.60.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.