Previous Session Recap

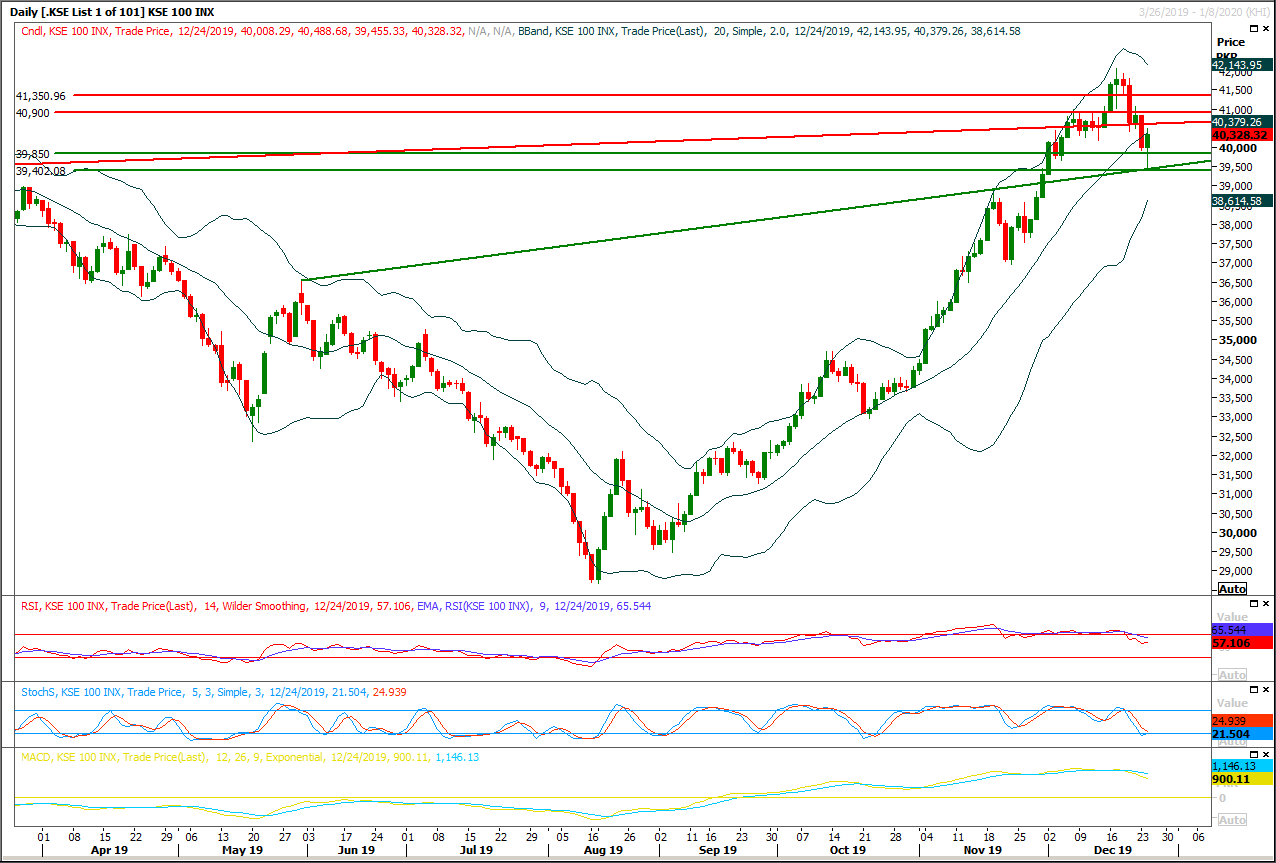

Trading volume at PSX floor Increased by 57.13 million shares or 31.90% on DoD basis, whereas the benchmark KSE100 index opened at 40,008.29, posted a day high of 40,488.68 and a day low of 39,455.33 points during last trading session while session suspended at 40,328.32 points with net change of 320.03 points and net trading volume of 135.30 million shares. Daily trading volume of KSE100 listed companies dropped by 31.01 million shares or 29.74% on DoD basis.

Foreign Investors remained in net buying positions of 0.015 million shares but value of Foreign Inflow dropped by 1.82 million US Dollars. Categorically, Foreign Individuals and Corporate remained in net selling positions of 0.06 and 3.61 million shares but Overseas Pakistanis remained in net buying positions of 3.69 million shares. While on the other side Local Companies, Banks, NBFCs, Mutual Fund and Brokers and remained in net selling positions of 13.89, 1.57, 0.07and 1.60 million shares but Local Individuals and Insurance Companies remained in net buying positions of 16.77 and 3.55 million shares respectively.

Analytical Review

Oil rises, supported by trade deal, OPEC cuts

Oil prices rose on Thursday, buoyed by a potential breakthrough in the Sino-U.S. trade war and OPEC-led efforts to constrain supply, although trading was quiet as many markets were in holiday mode. Brent crude was up 16 cents, or 0.2%, at $67.36 a barrel by 0155 GMT. West Texas Intermediate was up 20 cents, or 0.3%, at $61.31 a barrel. “Oil prices continue to show year-end strength supported by a combination of definitive progress on the U.S.-China trade deal, the Dec OPEC/OPEC+ agreement, and slowing shale activity,” said Stephen Innes, chief Asia market strategist at AxiTrader. “All of which is pointing to a stronger performance for oil prices in Q1 than anyone had thought only two months ago.” U.S. President Donald Trump said on Tuesday he and Chinese President Xi Jinping will have a signing ceremony for the so-called Phase 1 agreement to end their trade dispute that was put together earlier this month.

Govt wants quick NEVP implementation despite resistance from auto industry

Despite auto assemblers’ reservations regarding the National Electric Vehicle Policy (NEVP), the government has aimed at making it operational by January 2020. The federal cabinet approved NEVP on Nov 5 and the Ministry for Climate Change (MoCC) has summoned an inter-ministerial meeting on Thursday in Islamabad to discuss the same. The MoCC has informed relevant ministries and government departments that the “NEVP needs to be operational by January 2020 by validation of incentive packages through the Economic Coordination Committee (ECC).” Prime Minister Imran Khan has already announced early implementation of NEVP, especially for two- and three-wheelers as well as buses for public transport in order to prevent smog.

Saudi Arabia, Kuwait end dispute over shared oil fields

Saudi Arabia and Kuwait have ended a nearly five-year-long dispute over shared oil fields and have agreed to resume oil production from the divided Neutral Zone, but stressed this would not change their OPEC commitments to crude oil production cuts. The allied Gulf Arab nations signed the agreement in Kuwait City on Tuesday. Local media reported that about 300,000 barrels per day were being pumped from the area before the dispute halted production in early 2015. The divided zone, located between the two neighboring countries’ land borders, can produce up to half-a-million barrels per day.

Facing US trade uncertainty, China seeks closer ties with neighbours

China made overtures on trade to Japan and South Korea and offered support for an infrastructure initiative as it hosted the leaders of its two neighbours this week amid strained ties with the US. Chinese Premier Li Keqiang said on Wednesday at a meeting with Japanese Prime Minister Shinzo Abe that Beijing was willing to strengthen economic cooperation with Japan in third-country markets. At the meeting on the sidelines of a trilateral summit in the southwestern city of Chengdu, Li added that China would “further open up its services industry” to Japan. During a separate meeting on Monday with South Korean President Moon Jae-in, Li said China was willing to work on a rail network linking Korea with China and Europe, Yonhap news agency reported.

LCCI for uninterrupted gas supply to industries

The Lahore Chamber of Commerce & Industry on Tuesday called for continuous gas supply with full pressure to the industries. In a statement issued on Tuesday, LCCI President Irfan Iqbal Sheikh said that most of the industrial units use gas as a major source of energy for their production. He said that unavailability of gas or low pressure would result in low production, unemployment of daily wagers and delay in export consignments. He said that low gas pressure is like non provision of gas as it fails to run heavy industrial machinery. It hurts industry badly therefore the authorities should take all steps to keep the industrial wheel moving. He said that at a time when country is struggling to boost its exports, unavailability of gas to the industrial sector would play a devastating role. He said that how the government would be able to collect revenues to run its day-to-day affairs when the industrial wheel is coming to a halt. He said that concerned authorities should understand that economic well being is a must and it is only possible when business community would be able to play its due role.

Oil prices rose on Thursday, buoyed by a potential breakthrough in the Sino-U.S. trade war and OPEC-led efforts to constrain supply, although trading was quiet as many markets were in holiday mode. Brent crude was up 16 cents, or 0.2%, at $67.36 a barrel by 0155 GMT. West Texas Intermediate was up 20 cents, or 0.3%, at $61.31 a barrel. “Oil prices continue to show year-end strength supported by a combination of definitive progress on the U.S.-China trade deal, the Dec OPEC/OPEC+ agreement, and slowing shale activity,” said Stephen Innes, chief Asia market strategist at AxiTrader. “All of which is pointing to a stronger performance for oil prices in Q1 than anyone had thought only two months ago.” U.S. President Donald Trump said on Tuesday he and Chinese President Xi Jinping will have a signing ceremony for the so-called Phase 1 agreement to end their trade dispute that was put together earlier this month.

Despite auto assemblers’ reservations regarding the National Electric Vehicle Policy (NEVP), the government has aimed at making it operational by January 2020. The federal cabinet approved NEVP on Nov 5 and the Ministry for Climate Change (MoCC) has summoned an inter-ministerial meeting on Thursday in Islamabad to discuss the same. The MoCC has informed relevant ministries and government departments that the “NEVP needs to be operational by January 2020 by validation of incentive packages through the Economic Coordination Committee (ECC).” Prime Minister Imran Khan has already announced early implementation of NEVP, especially for two- and three-wheelers as well as buses for public transport in order to prevent smog.

Saudi Arabia and Kuwait have ended a nearly five-year-long dispute over shared oil fields and have agreed to resume oil production from the divided Neutral Zone, but stressed this would not change their OPEC commitments to crude oil production cuts. The allied Gulf Arab nations signed the agreement in Kuwait City on Tuesday. Local media reported that about 300,000 barrels per day were being pumped from the area before the dispute halted production in early 2015. The divided zone, located between the two neighboring countries’ land borders, can produce up to half-a-million barrels per day.

China made overtures on trade to Japan and South Korea and offered support for an infrastructure initiative as it hosted the leaders of its two neighbours this week amid strained ties with the US. Chinese Premier Li Keqiang said on Wednesday at a meeting with Japanese Prime Minister Shinzo Abe that Beijing was willing to strengthen economic cooperation with Japan in third-country markets. At the meeting on the sidelines of a trilateral summit in the southwestern city of Chengdu, Li added that China would “further open up its services industry” to Japan. During a separate meeting on Monday with South Korean President Moon Jae-in, Li said China was willing to work on a rail network linking Korea with China and Europe, Yonhap news agency reported.

The Lahore Chamber of Commerce & Industry on Tuesday called for continuous gas supply with full pressure to the industries. In a statement issued on Tuesday, LCCI President Irfan Iqbal Sheikh said that most of the industrial units use gas as a major source of energy for their production. He said that unavailability of gas or low pressure would result in low production, unemployment of daily wagers and delay in export consignments. He said that low gas pressure is like non provision of gas as it fails to run heavy industrial machinery. It hurts industry badly therefore the authorities should take all steps to keep the industrial wheel moving. He said that at a time when country is struggling to boost its exports, unavailability of gas to the industrial sector would play a devastating role. He said that how the government would be able to collect revenues to run its day-to-day affairs when the industrial wheel is coming to a halt. He said that concerned authorities should understand that economic well being is a must and it is only possible when business community would be able to play its due role.

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 index have bounced back after getting support from a rising trend line on daily chart during last trading session and now it's trying to complete its correction of last bearish rally. As of now it's expected that index would face strong resistances at 40,600 and 40,900 points from a resistant trend line along with a horizontal resistant region. if index would not succeed in penetration above its resistant regions then it would got a push towards 39,850 and 39,400 points and chances of a weekly evening shooting star would become evident therefore it's recommended to stay cautious and post trailing stop loss on existing long positions. While its recommended to avoid initiating new long positions until a clear reversal sign on daily chart.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.