Previous Session Recap

Trading volume at PSX floor dropped by 19.93 million shares or 13.82% on DoD basis, whereas the benchmark KSE100 index opened at 39,143.73, posted a day high of 39,247.75 and a day low of 38,693.02 points during last trading session while session suspended at 38,858.45 points with net change of -285.28 points and net trading volume of 94.48 million shares. Daily trading volume of KSE100 listed companies also dropped by 9.51 million shares or 9.14% on DoD basis.

Foreign Investors remained in net selling positions of 11.34 million shares and value of Foreign Inflow dropped by 5.50 million US Dollars. Categorically, Foreign Individuals, Corporate and Overseas Pakistani remained in net selling positions of 0.25, 9.42 and 1.67 million shares respectively. While on the other side Local Individuals, Banks, NBFCs, Brokers Insurance Companies remained in net long positions of 5.03, 2.50, 0.08, 0.99 and 4.26 million shares but Local Companies and Mutual Fund remained in net selling positions of 0.67 and 1.21 million shares respectively.

Analytical Review

Asian shares slump, bonds rally as virus fears grow

Asian shares fell on Wednesday as a U.S. warning to Americans to prepare for the possibility of a coronavirus pandemic drove another Wall Street tumble and pushed yields on safe-haven Treasuries to record lows. The S&P 500 .SPX and the Dow Jones Industrial Average .DJI both shed more than 3% on Tuesday in their fourth straight session of losses. That led MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS down 1.28%. Japan was among the worst-performing market in the region, weighed by growing concerns the virus could cancel the Tokyo Olympics. Yields on 10-year and 30-year U.S. Treasuries teetered near record lows and gold rose as worries about the economic impact of the virus outbreak boosted safe-haven assets. The World Health Organization says the epidemic has peaked in China, but concern that its spread is accelerating in other countries is likely to keep investors on edge.

Pakistani importers exploring new raw material sources amid coronavirus fears

Businessmen and industrialists are not placing fresh orders for imports amid fears around the coronavirus which has claimed lives of over 2,500 people. This has impacted the clearance of goods at Chinese ports while no issues are being encountered at the local ports. Industrialists are also trying to manage raw materials from other countries following suspension and delay in supply of raw materials from China. Besides, foreign buyers have also started nominating raw material sources other than China to local exporters in order to avoid any delay in export shipments.

FBR to watch real estate, jewellery trades for FATF compliance

The Federal Board of Revenue (FBR) will implement rules in three areas in the next few days as part of compliance with recommendations of the Financial Action Task Force (FATF) regarding anti-money laundering and combating financing of terrorism (AML/CFT) in Pakistan. The rules will cover real estate, gems and jewellery sectors to minimise chances of parking of terror financing there. The FBR will also work as a focal organisation for monitoring services of income tax practitioners. The services of lawyers and chartered accountants will be monitored through the law division and the Securities and Exchange Commission of Pakistan (SECP). “We have sent these rules to the law division for vetting,” FBR spokesperson and Member Policy Dr Hamid Ateeq confirmed to Dawn. After vetting, he said, the rules would be notified for implementation.

PFIA calls for discouraging smuggling

Pakistan FMCG Importers Association (PFIA) has urged the government to bring the import and customs duties down to discourage the smuggling, which was also hurting the genuine commercial importers. These views were expressed at a meeting of the PFIA here on Tuesday, which was chaired by its Chairman Anjum Nisar and attended by Vice-Chairman Muhammad Ejaz Tanveer, Secretary-General Ali Tariq Mattoo, Zeeshan Bukhshi and others. The members of the Association expressed pleasure that the government realizing the hardships of the commercial importers had decided to launch a crackdown against smugglers.

Govt links Rs4.88/unit hike in K-Electric tariff to ECC’s approval

The government will seek the approval of Economic Coordination Committee (ECC) of the cabinet for the approval of Rs4.88 increase in power tariff for K-Electric consumers under 11 quarterly adjustments, it is learnt reliably here. The government has decided that instead of transferring the burden of 11 quarterly adjustments to the power consumers of K-Electric in a single go and will seek ECC approval for the phase wise hike in power tariff, official sources said. The matter of tariff increase for K-electric on the agenda of ECC meeting, scheduled for today (Wednesday), sources told The Nation.

Asian shares fell on Wednesday as a U.S. warning to Americans to prepare for the possibility of a coronavirus pandemic drove another Wall Street tumble and pushed yields on safe-haven Treasuries to record lows. The S&P 500 .SPX and the Dow Jones Industrial Average .DJI both shed more than 3% on Tuesday in their fourth straight session of losses. That led MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS down 1.28%. Japan was among the worst-performing market in the region, weighed by growing concerns the virus could cancel the Tokyo Olympics. Yields on 10-year and 30-year U.S. Treasuries teetered near record lows and gold rose as worries about the economic impact of the virus outbreak boosted safe-haven assets. The World Health Organization says the epidemic has peaked in China, but concern that its spread is accelerating in other countries is likely to keep investors on edge.

Businessmen and industrialists are not placing fresh orders for imports amid fears around the coronavirus which has claimed lives of over 2,500 people. This has impacted the clearance of goods at Chinese ports while no issues are being encountered at the local ports. Industrialists are also trying to manage raw materials from other countries following suspension and delay in supply of raw materials from China. Besides, foreign buyers have also started nominating raw material sources other than China to local exporters in order to avoid any delay in export shipments.

The Federal Board of Revenue (FBR) will implement rules in three areas in the next few days as part of compliance with recommendations of the Financial Action Task Force (FATF) regarding anti-money laundering and combating financing of terrorism (AML/CFT) in Pakistan. The rules will cover real estate, gems and jewellery sectors to minimise chances of parking of terror financing there. The FBR will also work as a focal organisation for monitoring services of income tax practitioners. The services of lawyers and chartered accountants will be monitored through the law division and the Securities and Exchange Commission of Pakistan (SECP). “We have sent these rules to the law division for vetting,” FBR spokesperson and Member Policy Dr Hamid Ateeq confirmed to Dawn. After vetting, he said, the rules would be notified for implementation.

Pakistan FMCG Importers Association (PFIA) has urged the government to bring the import and customs duties down to discourage the smuggling, which was also hurting the genuine commercial importers. These views were expressed at a meeting of the PFIA here on Tuesday, which was chaired by its Chairman Anjum Nisar and attended by Vice-Chairman Muhammad Ejaz Tanveer, Secretary-General Ali Tariq Mattoo, Zeeshan Bukhshi and others. The members of the Association expressed pleasure that the government realizing the hardships of the commercial importers had decided to launch a crackdown against smugglers.

The government will seek the approval of Economic Coordination Committee (ECC) of the cabinet for the approval of Rs4.88 increase in power tariff for K-Electric consumers under 11 quarterly adjustments, it is learnt reliably here. The government has decided that instead of transferring the burden of 11 quarterly adjustments to the power consumers of K-Electric in a single go and will seek ECC approval for the phase wise hike in power tariff, official sources said. The matter of tariff increase for K-electric on the agenda of ECC meeting, scheduled for today (Wednesday), sources told The Nation.

Market is expected to remain volatile during current trading session.

Technical Analysis

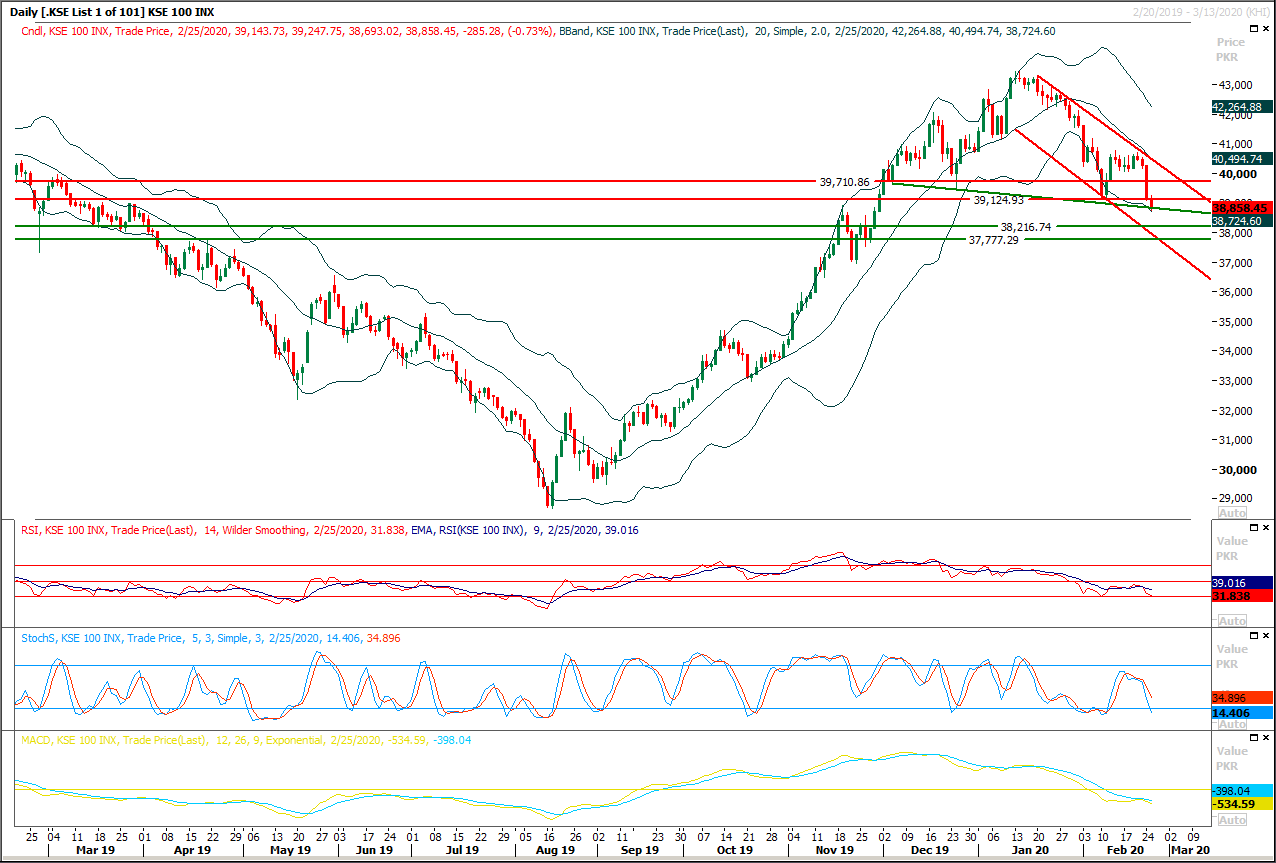

The Benchmark KSE100 index have given a breakout blow its daily double bottom during last trading session and it also have closed at supportive trend line of its descending wedge therefore it's expected that index would slide below said line during current trading session to target 38,500 points. For current trading session a strong supportive region is standing at 38,220 points where index would try to find some ground against bearish pressure. It's recommended to stay on selling side with strict stop loss of 39,150 points and target at 38,500 and 38,200 points. Daily closing below 38,000 points will call for 37,500 and 37,000 points in coming days. While on flip side in case of an intraday recovery index would face strong resistances at 39,150 points and 39,500 points. Index would remain bearish until it would not succeed in closing above 39,700 or 40,000 points on daily chart.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.