Previous Session Recap

Trading volume at PSX floor dropped by 93.95 million shares or 27.66% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 45063.21, posted a day high of 45179.00 and a day low of 44729.81 during last trading session. The session suspended at 44816.71 with net change of -246.5 and net trading volume of 101.41 million shares. Daily trading volume of KSE100 listed companies dropped by 71.94 million shares or 41.5% on DoD basis.

Foreign Investors remained in net selling position of 10.67 million shares and net value of Foreign Inflow dropped by 3.79 million US Dollars. Categorically, Foreign Corporate and Overseas Pakistani Investors remained in net selling postions of 8.63 and 2.06 million shares. While on the other side Local Individuals, Banks, NBFCs, Mutual Funds, Brokers and Insurance Companies remained in net buying positions of 7.07, 0.36, 0.84, 0.28, 0.26 and 0.1 million shares respectively but Local Companies remained in net selling postions of 0.8 million shares.

Analytical Review

Asian stocks came off record highs on Friday but were still poised to end the week with strong gains, while the battered dollar won back some ground after President Donald Trump said he wanted a strong U.S. currency. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was effectively flat at 609.50 after reaching a record intraday high of 611 on Thursday, capped after Wall Street shares lost momentum overnight. MSCI’s Asia-Pacific index was still poised to rise about 1.8 percent on the week and headed for its seventh straight week of gains. World equity markets have rallied over the past year, buoyed by a synchronized uptick in global economic growth in a boon to corporate profits and stock valuations.

Imports of used cars and minivans surged to 65,723 units in 2017, up almost 70 per cent from 38,676 units a year ago, latest data released by the auto industry shows. The arrival of sport utility vehicles (SUVs) also increased 59pc to 7,758 units. Imports of pickups and vans registered a 9pc rise to 3,154 units. The local industry maintains a record of each imported vehicle, whether new or old, through the Import General Manifest (IGM). Every imported car is logged in the customs’ IGM.

UAE 's newly appointed Ambassador to Pakistan, Hamad Obaid Ibrahim Salim Al-Zaabi visited Punjab Board of Investment & Trade on Thursday. On the occasion, different matters of mutual interest including the promotion of bilateral economic ties between Pakistan and UAE and further expansion in mutual cooperation in different sectors were discussed. PBIT CEO Jahanzeb Burana congratulated the ambassador over his posting in Pakistan. He said that bilateral relations exist between both brotherly countries but there is a need to further promote trade and economic relations between the two countries. UAE has always extended full support to Pakistan and its cooperation in the development of the country is praiseworthy. At the meeting, a short documentary was presented to the delegates highlighting the benefits and advantages of investing in Punjab.

Adviser to prime minister on finance Miftah Ismail has said that Pakistan has resolved the problem of energy shortage and is now looking for more investment in infrastructure development. He said that Pakistan would welcome World Bank’s support in this regard. He made these remarks in a meeting with visiting World Bank delegation along with minister for water resources and minister of state for finance. The delegation, led by Ms Annette Dixon, vice president for South Asia Region, also included Ms Snezana Stoiijkovic, IFC regional vice president (Asia-Pacific) and country director World Bank in Pakistan, Patchamuthu Illangovan. Adviser Miftah Ismail apprised the visiting delegation of the current state of economy and said that the policies pursued during the last four years had stabilized the economy and helped it to grow at a steady pace. He said Pakistan achieved a decade high growth rate of 5.3% last fiscal year and was targeting 6% growth in 2017-18

The National Electric Power Regulatory Authority (NEPRA) Thursday approved Rs 2.99 per unit reduction in power tariff for ex-Wapda distribution companies for the month of December under a monthly fuel adjustment formula. The decision was taken by NEPRA , in a public hearing, on a petition filed by Central Power Purchasing Agency (CPPA). However the CPPA request of previous adjustment of Rs 969.88 million or Rs 0.124 per unit on account of supplemental charges was turned down by the NEPRA . On the basis of data, the CPPA has proposed a reduction of Rs 2.77 per unit for December 2017. Against the actual cost of generation, in the period under review, of Rs 5.32 per unit the consumer were charges at the reference price of Rs 8.1037 per unit. The power distribution companies have charged an extra Rs 21.7 billion through electricity bills from its consumers for December, so it was decided by NEPRA that the amount will be returned to the consumers.

Its recommended to practice caution as market is expected to remain volatile.

Technical Analysis

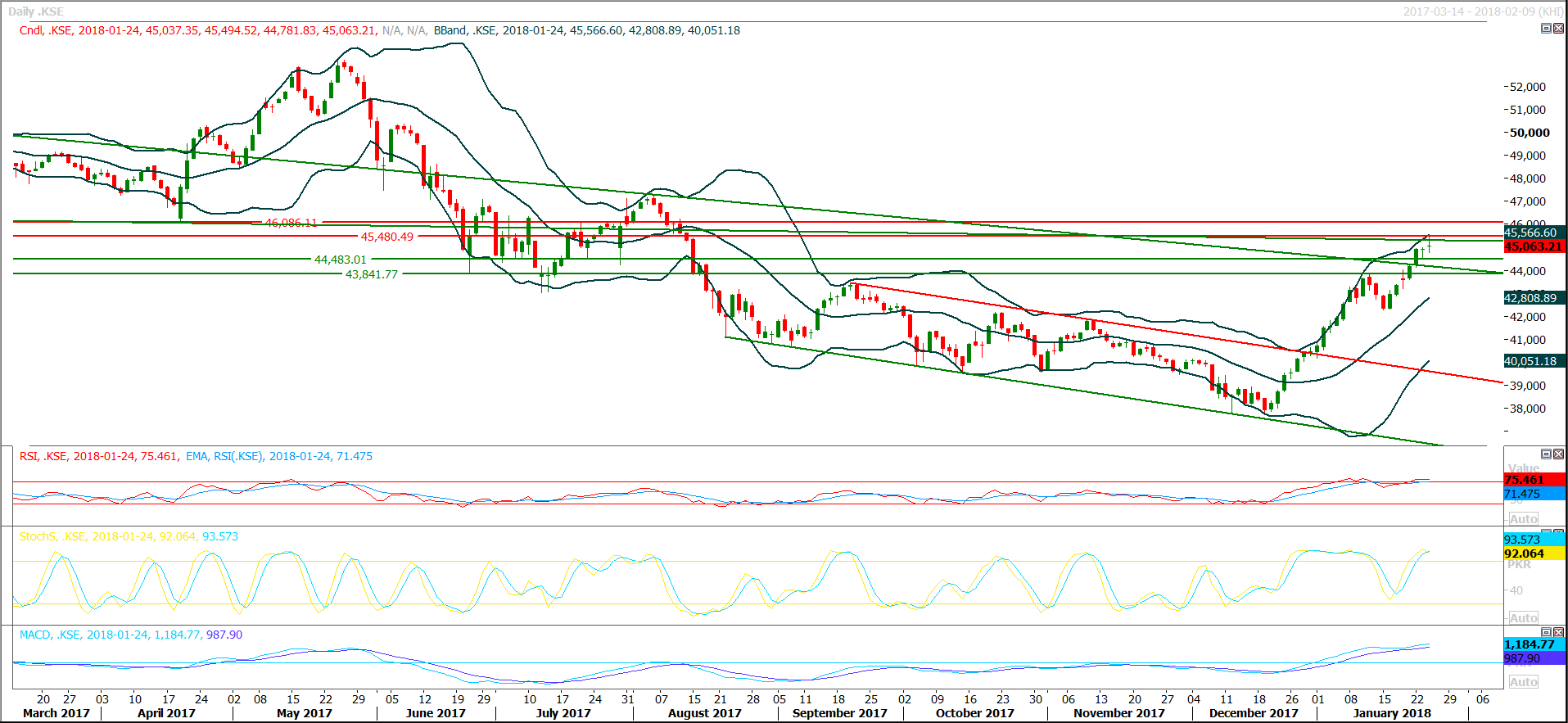

The Benchmark KSE100 Index have slipped below its supportive trend line and as of right now its also capped by a resistant trend line along with a horizontal resistant region at 45330 and 45465 and these both levels would try to react as strong resistnaces. Daily Stochastic have generated a bearish crossover while weekly stochastic is ready for that and if index would become able to slip below 44483 during current trading session then an evening star would be created which would push index in negative zone in coming days. Its recommended to stay sideline until index gives a clear breakout of either 45465 or 44483 as breakout in either direction would add 1000-1500 in index. On intraday basis maybe index would take a spike as hourly stochastic is reflecting some positive momentum but its not recommended to buy until index close above 45465.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.