Previous Session Recap

Trading volume at PSX floor increased by 81.85 million shares or 75.09% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 40,494.45, posted a day high of 41,461.83 and a day low of 40,487.07 during last trading session. The session suspended at 40,339.22 with net change of 875.24 and net trading volume of 107.58 million shares. Daily trading volume of KSE100 listed companies increased by 46.41 million shares or 75.88% on DoD basis.

Foreign Investors remained in net selling position of 9.84 million shares but net value of Foreign Inflow dropped by 2.73 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistanis remained in net buying positions of 0.02 and 1.88 million shares but Foreign Corporate investors remained in net selling positions of 11.74 million shares. While on the other side Local Individuals and Local Companies remained in net buying positions of17.14 and 3.35 million shares but Banks, NBFCs, Mutual Fund, Brokers and Insurance Companies remained in net selling positions of 5.35, 0.06, 1.48, 0.3 and 3.61 million shares respectively.

Analytical Review

Asian stocks inch up after Trump, Juncker pledge cuts to trade barriers

Asian stocks edged higher on Thursday, taking comfort from gains on Wall Street after U.S. President Donald Trump and European Commission President Jean-Claude Juncker agreed to work toward eliminating trade barriers on industrial goods. In a news conference following a meeting between the two leaders on Wednesday, Trump said he and Juncker had agreed to work to lower industrial tariffs on both sides and to increase European imports of liquefied natural gas and soybeans from the United States, among other measures. The meeting helped to extend a rally in global stocks into its fourth day, as investors took heart from a rare piece of good news amid global concerns over trade.

Nepra approves 50 paisa per unit hike for June

The National Electric Power Regulatory Authority (Nepra) on Tuesday allowed the Ex-WAPDA power distribution companies (Discos) to increase the power tariff by Rs 0.50 per unit on account of fuel adjustment for the month of June 2018. The decision was taken in public hearing conducted by Nepra on the petition filed by the Central Power Purchasing Agency (CPPA). In its petition the Central Power Purchasing Agency (CPPA) had sought an increase of Rs0.70 per unit in tariff for the month of June, however NEPRA allowed an increase Rs0.50 per unit. The increase of Rs 0.50 per unit will put the burden of Rs6.5 billion to power consumers. This is second time consumers is facing increase in electricity rates. It is pertinent to mention here that the power regulator had increased power tariff by Rs1.25 per unit for fuel cost adjustment for May 2018 due to use of furnace oil which is expensive than LNG. For the month of June the consumers were going to face increase in power tariff by Rs 0.50 per unit for month of June 2018.

Copper clings to gains as dollar dips

Copper held at two-week highs on Wednesday as the dollar weakened and the market awaited a resolution to wage talks at the world’s largest miner of the industrial metal. BHP’s Escondida mine in Chile said on Tuesday it had made a final offer to the union representing its rank-and-file workers that includes a beefed up contract signing bonus and a 1.5 percent increase in wages. There was no immediate response from the union, which had asked for a 5 percent pay rise. LME copper was bid 0.2 percent lower at $6,280 per tonne after failing to trade in official rings. The metal used in power and construction jumped the most since January on Tuesday. “It’s not a done deal yet,” said Aneeka Gupta, associate director at ETF Securities, referring to the Escondida wage talks.

LG slashes investment plans

South Korea's LG Display Co Ltd, a key Apple supplier, slashed its investment plans by $2.7 billion to 2020 citing concern for the global smartphone market, as it posted a second consecutive quarterly loss on sagging panel prices. The cut underscores the bleak outlook for electronics makers and comes a week after another Apple Inc supplier, Taiwan Semiconductor Manufacturing Co Ltd, also scaled back its revenue and investment estimates. "It is a conservative approach resulting from uncertainty around the mobile market," Don Kim, LG's chief finance officer, told an earnings conference call, referring to the capex reduction.–Reuters LG shares tumbled 7 percent versus the broader market's .KS11 0.3 percent fall after it flagged faster-than-expected panel price declines and an uncertain outlook. "Market conditions are turning favorable, but still the unpredictability is high," Kim added. "Oversupply and asymmetrical competition are unavoidable."

Govt plans duty increase to control imports

The Ministry of Commerce is making a plan to control increasing imports of the country, which had touched all time high $60 billion during last fiscal year (FY2018). "The government is planning to increase Regulatory Duty (RD) on more than one thousand imported items," said an official of the ministry of commerce while talking to The Nation. He said that ministry would present its plan to the next government for approval. Pakistan's trade deficit had surged to all-time high $37.67 billion during FY2018 as imports increased faster than exports. Pakistan's imports have recorded at $60.9 billion during FY2018 as against $52.9 billion of the previous year showing an increase of 15.1 percent.

Asian stocks edged higher on Thursday, taking comfort from gains on Wall Street after U.S. President Donald Trump and European Commission President Jean-Claude Juncker agreed to work toward eliminating trade barriers on industrial goods. In a news conference following a meeting between the two leaders on Wednesday, Trump said he and Juncker had agreed to work to lower industrial tariffs on both sides and to increase European imports of liquefied natural gas and soybeans from the United States, among other measures. The meeting helped to extend a rally in global stocks into its fourth day, as investors took heart from a rare piece of good news amid global concerns over trade.

The National Electric Power Regulatory Authority (Nepra) on Tuesday allowed the Ex-WAPDA power distribution companies (Discos) to increase the power tariff by Rs 0.50 per unit on account of fuel adjustment for the month of June 2018. The decision was taken in public hearing conducted by Nepra on the petition filed by the Central Power Purchasing Agency (CPPA). In its petition the Central Power Purchasing Agency (CPPA) had sought an increase of Rs0.70 per unit in tariff for the month of June, however NEPRA allowed an increase Rs0.50 per unit. The increase of Rs 0.50 per unit will put the burden of Rs6.5 billion to power consumers. This is second time consumers is facing increase in electricity rates. It is pertinent to mention here that the power regulator had increased power tariff by Rs1.25 per unit for fuel cost adjustment for May 2018 due to use of furnace oil which is expensive than LNG. For the month of June the consumers were going to face increase in power tariff by Rs 0.50 per unit for month of June 2018.

Copper held at two-week highs on Wednesday as the dollar weakened and the market awaited a resolution to wage talks at the world’s largest miner of the industrial metal. BHP’s Escondida mine in Chile said on Tuesday it had made a final offer to the union representing its rank-and-file workers that includes a beefed up contract signing bonus and a 1.5 percent increase in wages. There was no immediate response from the union, which had asked for a 5 percent pay rise. LME copper was bid 0.2 percent lower at $6,280 per tonne after failing to trade in official rings. The metal used in power and construction jumped the most since January on Tuesday. “It’s not a done deal yet,” said Aneeka Gupta, associate director at ETF Securities, referring to the Escondida wage talks.

South Korea's LG Display Co Ltd, a key Apple supplier, slashed its investment plans by $2.7 billion to 2020 citing concern for the global smartphone market, as it posted a second consecutive quarterly loss on sagging panel prices. The cut underscores the bleak outlook for electronics makers and comes a week after another Apple Inc supplier, Taiwan Semiconductor Manufacturing Co Ltd, also scaled back its revenue and investment estimates. "It is a conservative approach resulting from uncertainty around the mobile market," Don Kim, LG's chief finance officer, told an earnings conference call, referring to the capex reduction.–Reuters LG shares tumbled 7 percent versus the broader market's .KS11 0.3 percent fall after it flagged faster-than-expected panel price declines and an uncertain outlook. "Market conditions are turning favorable, but still the unpredictability is high," Kim added. "Oversupply and asymmetrical competition are unavoidable."

The Ministry of Commerce is making a plan to control increasing imports of the country, which had touched all time high $60 billion during last fiscal year (FY2018). "The government is planning to increase Regulatory Duty (RD) on more than one thousand imported items," said an official of the ministry of commerce while talking to The Nation. He said that ministry would present its plan to the next government for approval. Pakistan's trade deficit had surged to all-time high $37.67 billion during FY2018 as imports increased faster than exports. Pakistan's imports have recorded at $60.9 billion during FY2018 as against $52.9 billion of the previous year showing an increase of 15.1 percent.

Market is expected to remain volatile therefore its recommended to stay cautious during current trading session.

Technical Analysis

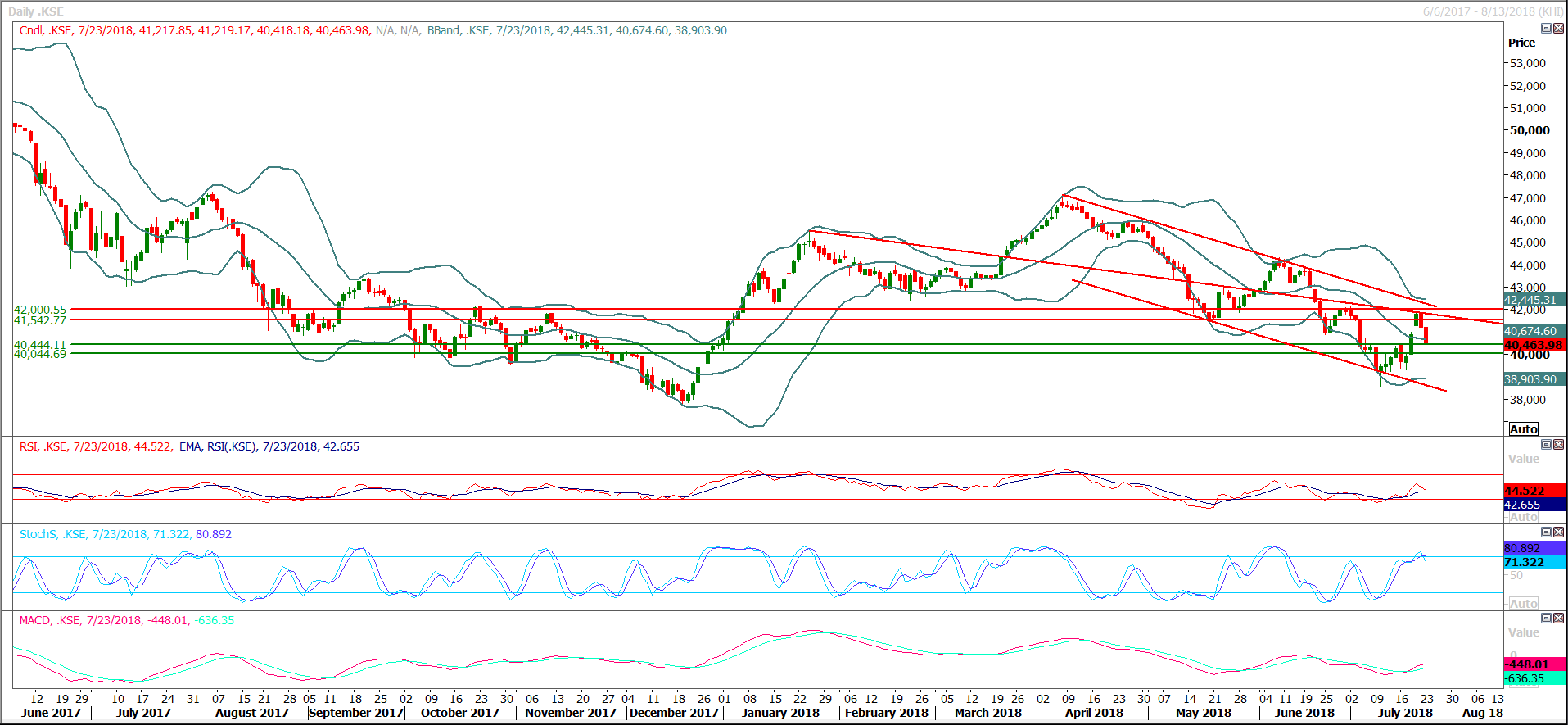

The Benchmark KSE100 Index had once again bounced back after completing 61.8% bullish correction and had generated a bullish engulfing pattern on daily chart. As of now it seems that index would try to target 41,860 and then 42,130 points in response to expansion of this correction, therefore a positive spike could be witnessed during current trading session which would be capped by two consecutive descending trend lines on daily chart. Profit taking is recommended on strength during current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.