Previous Session Recap

Trading volume at PSX floor increased by 21.37 million shares or 10.32% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 44,705.94, posted a day high of 45,032.41 and a day low of 44,659.33 during last trading session. The session suspended at 45,030.22 with net change of 384.27 and net trading volume of 89.21 million shares. Daily trading volume of KSE100 listed companies increased by 6.56 million shares or 7.94% on DoD basis.

Foreign Investors remained in net buying position of 12.1 million shares and net value of Foreign Inflow increased by 9.77 million US Dollars. Categorically, Foreign Individual, Corporate and Overseas Pakistani Investors remained in net buying positions of 0.4, 9.09 and 2.61 million shares respectively. While on the other side Local Individuals, Banks, Mutual Funds, Brokers and Insurance Companies remained in net selling positions of 4.54, 0.21, 4.38, 6.62 and 2.28 million shares respectively but Local Companies and NBFCs remained in net buying positions of 3.08 and 2.56 million shares.

Analytical Review

Asian shares stumble as trade war fears roil global markets

Fears of a full-blown trade war between the United States and China battered Asian shares again on Monday, keeping the safe haven yen near a 16-month peak as investors fretted over the fate of global growth.But E-Mini futures for the S&P 500 .ESc1 leapt 0.6 percent, an unusual move during early Asian hours, after the Wall Street Journal reported the United States and China have quietly started negotiating to improve U.S. access to Chinese markets.The news was little consolation for Asian shares which were left nursing their wounds.Japan's Nikkei .N225 was down 0.6 percent after falling to a near six-month trough at open. Chinese shares declined about 1 percent in early trade. SSEC .CSI300

Traders for increasing Pak-Afghan economic ties

Traders stressed the need for enhancing bilateral economic relations between Pakistan and Afghanistan.This was stated by Council of OIC Federation of Pakistan Chamber of Commerce and Industry Haji Naseemur Rehman in a meeting with President Afghan Federation of Commerce and Industry Salahuddin Syed called him at Mardan on Sunday.He said that Pakistan and Afghanistan should adopt a global approach and focus on a wide range of activities like poverty alleviation, improvement of health, trade and commerce sectors in the region.He said that Organisation of Islamic Cooperation (OIC) needs to expand its vision with interactions among private and informal sectors being important.Pakistan and Afghanistan are brotherly nations and they are also largest trading partners. It is imperative that Pak-Afghan being the biggest economies must solve their bilateral issues through dialogues, he added. He said, Islamic countries are taking steps to boost investment in Pakistan and Afghanistan, which will help in eliminating problems facing both the countries.

Rising coal prices hit power plants

The rising coal prices in the world market, coupled with the recent devaluation of the rupee, has disturbed the viability of coal-fired power plants, especially captive power plants (CPPs) which are run by individual industrial units.According to industry sources, coal prices have increased up to $103 per tonne from $90 per tonne, reflecting a 14 per cent increase. The recent devaluation in the rupee price by over 10pc further made coal imports costlier, rendering power generation through coal costlier for coal-based CPPs.Talking to Dawn, Federation of Pakistan Chambers of Commerce and Industry (FPCCI) former President Mian Muhammad Adrees said that the government has to take urgent measures for restoring viability of coal-fired power plants. However, in case the government fails to do so, he warned, many industries that have CPPs will have no option but to shift to national grid which would result in unbearable load on the Wapda system.Another industrialist, Zubair Motiwala, said that presently around 500 megawatts of coal-based CPPs are operating in the country with their average production cost per unit at around Rs6. However, after the rise in coal prices in the world market and devaluation of the rupee the cost has gone high thereby challenging the viability of the industry.

Rupee slumps to new lows

THE local currency market witnessed volatile trade last week after the State Bank of Pakistan allowed market forces to determine the dollar exchange rate. The week was reduced to four trading sessions on account of Pakistan Day Holiday on March 23. On the interbank market, the rupee lost one paisa on Monday. The dollar drifted slightly higher at Rs110.57 and Rs110.58 against the prior weekend’s level of Rs110.56 and Rs110.57. On Tuesday, the rupee plunged over four per cent against the dollar, initially hitting an all-time low above Rs116, due to the central bank’s sudden move to allow rupee devaluation amid economic strains. Later in the session, the rupee recovered losses and settled at Rs114.80 and Rs115.20, still losing Rs4.23 on the buying counter and Rs4.62 on the selling counter. On Wednesday, the rupee lost 30 paisa on the buying counter, retaining overnight rate unchanged on the selling counter against the dollar at Rs115.10 and Rs115.20.

Automakers lock horn over greenfield status

THE government has dismissed the perception that it is wavering on the implementation of the Automotive Development Policy 2016-21. However, it does not rule out the possibility of unintended missteps in the initial phase of policy enforcement. “The policy is paying rich dividends, so why would we vacillate? Millions of dollars have already been invested since the launch of the policy,” Engineering Development Board (EDB) CEO Mirza Nasim Baig tells Dawn over the phone from Islamabad. “We are both sincere and serious. The last policy (2008-13) fell flat on its objectives. But the current one is succeeding as it is aimed at addressing imperfections in the auto market by paving the way for new entrants in the sector which is expected to expand further with higher economic growth as CPEC gains materialise,” he says. In the first two years since the policy was launched in July 2016, six new investors have landed in the country, and the applications of nine companies, including some reputable global brands, are in the pipeline, he says.

Market is expected to remain volatile therfore its recommended to stay cautious while trading today.

Fears of a full-blown trade war between the United States and China battered Asian shares again on Monday, keeping the safe haven yen near a 16-month peak as investors fretted over the fate of global growth.But E-Mini futures for the S&P 500 .ESc1 leapt 0.6 percent, an unusual move during early Asian hours, after the Wall Street Journal reported the United States and China have quietly started negotiating to improve U.S. access to Chinese markets.The news was little consolation for Asian shares which were left nursing their wounds.Japan's Nikkei .N225 was down 0.6 percent after falling to a near six-month trough at open. Chinese shares declined about 1 percent in early trade. SSEC .CSI300

Traders stressed the need for enhancing bilateral economic relations between Pakistan and Afghanistan.This was stated by Council of OIC Federation of Pakistan Chamber of Commerce and Industry Haji Naseemur Rehman in a meeting with President Afghan Federation of Commerce and Industry Salahuddin Syed called him at Mardan on Sunday.He said that Pakistan and Afghanistan should adopt a global approach and focus on a wide range of activities like poverty alleviation, improvement of health, trade and commerce sectors in the region.He said that Organisation of Islamic Cooperation (OIC) needs to expand its vision with interactions among private and informal sectors being important.Pakistan and Afghanistan are brotherly nations and they are also largest trading partners. It is imperative that Pak-Afghan being the biggest economies must solve their bilateral issues through dialogues, he added. He said, Islamic countries are taking steps to boost investment in Pakistan and Afghanistan, which will help in eliminating problems facing both the countries.

The rising coal prices in the world market, coupled with the recent devaluation of the rupee, has disturbed the viability of coal-fired power plants, especially captive power plants (CPPs) which are run by individual industrial units.According to industry sources, coal prices have increased up to $103 per tonne from $90 per tonne, reflecting a 14 per cent increase. The recent devaluation in the rupee price by over 10pc further made coal imports costlier, rendering power generation through coal costlier for coal-based CPPs.Talking to Dawn, Federation of Pakistan Chambers of Commerce and Industry (FPCCI) former President Mian Muhammad Adrees said that the government has to take urgent measures for restoring viability of coal-fired power plants. However, in case the government fails to do so, he warned, many industries that have CPPs will have no option but to shift to national grid which would result in unbearable load on the Wapda system.Another industrialist, Zubair Motiwala, said that presently around 500 megawatts of coal-based CPPs are operating in the country with their average production cost per unit at around Rs6. However, after the rise in coal prices in the world market and devaluation of the rupee the cost has gone high thereby challenging the viability of the industry.

THE local currency market witnessed volatile trade last week after the State Bank of Pakistan allowed market forces to determine the dollar exchange rate. The week was reduced to four trading sessions on account of Pakistan Day Holiday on March 23. On the interbank market, the rupee lost one paisa on Monday. The dollar drifted slightly higher at Rs110.57 and Rs110.58 against the prior weekend’s level of Rs110.56 and Rs110.57. On Tuesday, the rupee plunged over four per cent against the dollar, initially hitting an all-time low above Rs116, due to the central bank’s sudden move to allow rupee devaluation amid economic strains. Later in the session, the rupee recovered losses and settled at Rs114.80 and Rs115.20, still losing Rs4.23 on the buying counter and Rs4.62 on the selling counter. On Wednesday, the rupee lost 30 paisa on the buying counter, retaining overnight rate unchanged on the selling counter against the dollar at Rs115.10 and Rs115.20.

THE government has dismissed the perception that it is wavering on the implementation of the Automotive Development Policy 2016-21. However, it does not rule out the possibility of unintended missteps in the initial phase of policy enforcement. “The policy is paying rich dividends, so why would we vacillate? Millions of dollars have already been invested since the launch of the policy,” Engineering Development Board (EDB) CEO Mirza Nasim Baig tells Dawn over the phone from Islamabad. “We are both sincere and serious. The last policy (2008-13) fell flat on its objectives. But the current one is succeeding as it is aimed at addressing imperfections in the auto market by paving the way for new entrants in the sector which is expected to expand further with higher economic growth as CPEC gains materialise,” he says. In the first two years since the policy was launched in July 2016, six new investors have landed in the country, and the applications of nine companies, including some reputable global brands, are in the pipeline, he says.

Technical Analysis

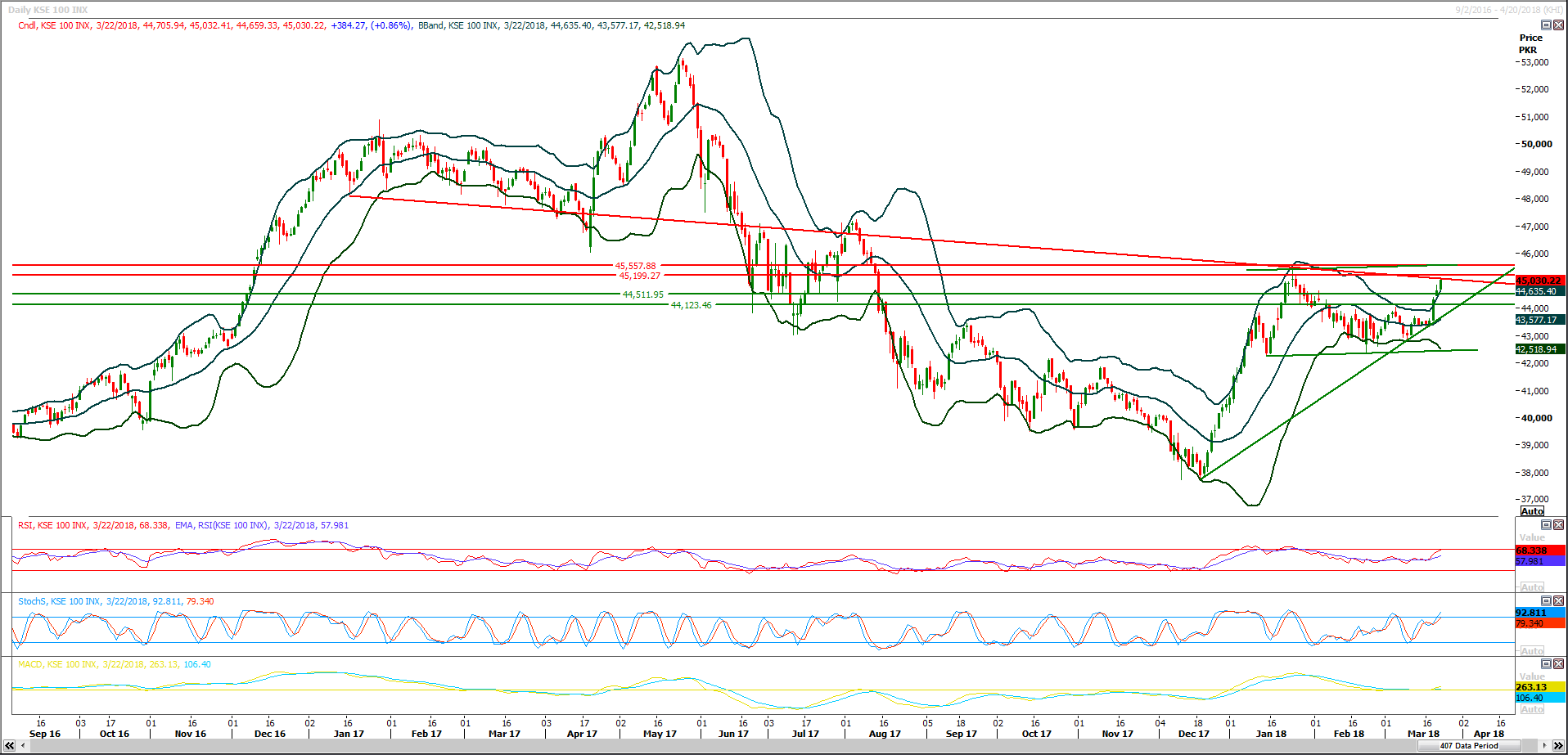

The Benchmark KSE100 Index is capped by a resistant trend line along with a horizontal resistant region on its way towards expansion of a triangle on daily chart. Daily Stochastic along with MACD is showing a positive momentum and these both would lead index towards 45,200 and 45,550 points where index would found resistances from two horizontal resistances. While supportive regions are standing at 44,511 and 44,130 points and these both regions fall on two strong horizontal supportive regions. For Current trading session index seems to hit 45211 points on intraday basis and closing above that region would call for 45,500 points but its recommended to adopt swing trading strategy.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.