Previous Session Recap

Trading volume at PSX floor dropped by 197.81 million shares or 32.6%, DoD basis. Whereas, the KSE100 Index opened at 53045.15 with a positive gap of 168.69 points, posted a day high of 53127.24 and a day low of 52733.89 during the last trading session. The session suspended at 52869.01 with a net change of -7.45 points and a net trading volume of 142.45 million shares. Daily trading volume of KSE100 listed companies dropped by 4.7 million shares, 3.2% DoD basis.

Foreign Investors remained in a net selling position of 12.46 million shares and a net value of Foreign Inflow dropped by 11.71 million US Dollars. Categorically, Foreign Individual and Corporate investors remained in net selling positions of 0.027 and 13.25 million shares but Overseas Pakistanis remained in a net buying position of 0.81 million shares. While on the other side, Local Individuals, Companies and Mutual Funds remained in net buying positions of 7.95, 2.76 and 11.13 million shares, respectively. Local Banks, NBFCs and Brokers however remained in net selling positions of 5.48, 2.26 and 0.28 million shares respectively.

Analytical Review

Crude prices remained subdued early on Friday after an agreement by OPEC to extend existing supply curbs disappointed many who had hoped for larger cuts. Asian stocks dropped, turning away from Wall Street strong performance overnight. "This seems like a clear case of buy the rumor, sell the fact, which was touted to be the reaction," James Woods, global investment analyst at Rivkin Securities in Sydney, wrote in a note. U.S. crude CLc1 prices were flat at $48.88 early on Friday, after losing 4.8 percent overnight, set to end the week 2.8 percent lower. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS, which closed at a two-year high on Thursday, fell 0.2 percent, shrinking its weekly gain to 1.5 percent. Japanese Nikkei .N225 also slipped 0.2 percent, on track for a 1 percent increase for the week. Overnight on Wall Street, the S&P 500 .SPX and the Nasdaq .IXIC closed at record highs after strong earnings reports from retailers. The strong performance helped lift MSCI global stocks index to a record close overnight.

The power generation in the country has decreased by almost 16,764GWh to 85,206GWh during July-March FY2017 from the generation of 101,970 during July-March FY2016. Although the installed capacity of power generation has increased to 25,000MW from 22,900MW during corresponding period last year, however there was decline in generation as it remain 85,206GWh during FY2017 compared to 101,970 during July-March in FY2016, said Pakistan Economic Survey Report 2016-17. The reduction was mainly caused due to decline in hydro power generation and the closure of some expensive power generating units.

National Electric Power Regulatory Authority (NEPRA) Thursday approved Rs1.96 per unit reduction in power tariff under fuel price adjustment for April 2017. This decision was made during a public hearing chaired by chairman NEPRA Tariq Sadozai. In a petition, Central Power Purchasing Agency (CPPA) has sought adjustments of variation incurred in the fuel cost for power generation last month. Earlier, the CPPA, in its petition submitted with the regulator, sought Rs1.75 per unit reduction in power price on account of monthly fuel price adjustment. However, the regulator by approving Rs1.96 per unit decrease in power prices approved Rs15 billion worth relief for all power consumers. The reduction would not be applicable to the consumers using less than 300 units and K-Electric.

Pakistan has cut direct and indirect losses to its economy on account of terrorism by slightly above 40 per cent to $3.88 billion (Rs407.21bn) in the first nine months of this fiscal year. Economic Survey 2016-17 attributes this to an improving security condition in the wake of ongoing military-led counter terrorism operations in the tribal regions of the nation and elsewhere.

Finance Minister Ishaq Dar on Thursday announced that Gross Domestic Product (GDP) of Pakistan had grown 5.28pc in fiscal year 2016-17 (FY17), against the target of 5.7pc. "There has been visible growth in the national economy," the finance minister said at his annual press conference for the Pakistan Economic Survey. Dar said growth story of Pakistan was being celebrated all over the world, and called for a collaborative effort across party lines to help Pakistan maintain its economic momentum.

The Market is expected to remain volatile today. We advise Traders to exercise caution. Buying on dips and booking gains on strength is recommended.

Technical Analysis

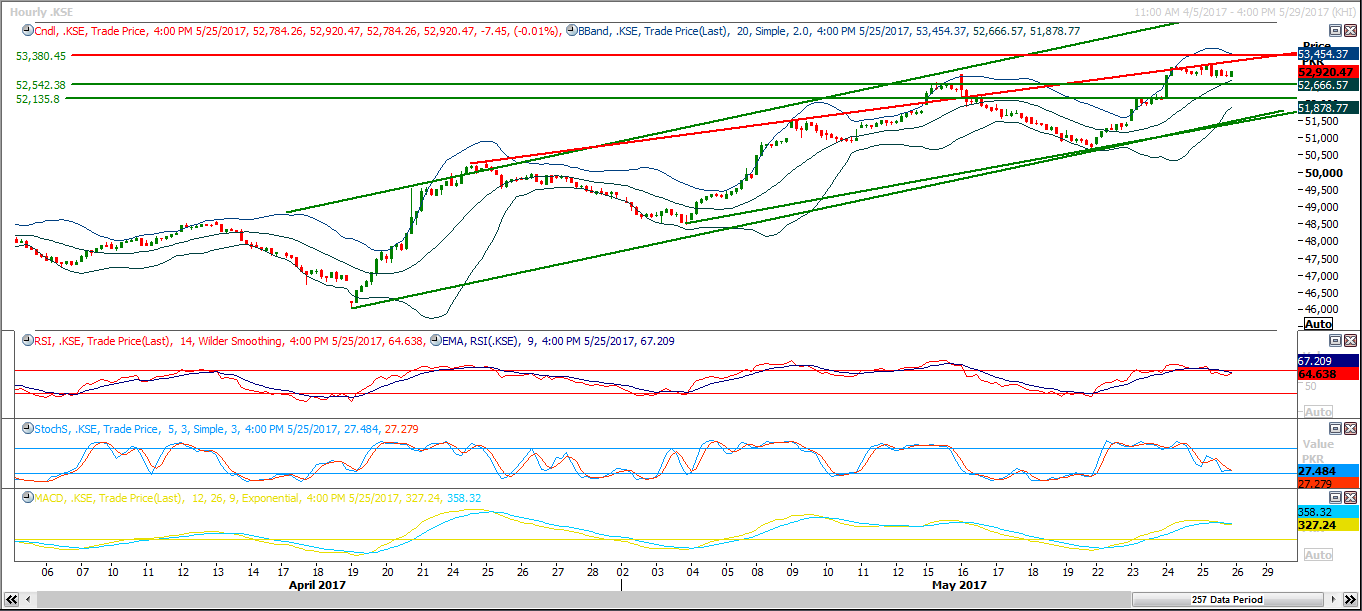

For the current trading session, the index is ready for a bullish spike on intraday basis but it may face resistances at 53080 and 53200 points from a resistant trend line and a horizontal resistant region. The Benchmark KSE100 Index is moving in an upward price channel and is heading for 61.8% expansion of its last 50% correction, which would complete at 53363. However, before the mentioned region, it is capped by a resistant trend line inside the said channel which would try to push it back towards 52560 on intraday basis. If it closes above the trend line at 53080, then the next target lies at 53360. Trading with strict stop loss of 52530 is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.