Previous Session Recap

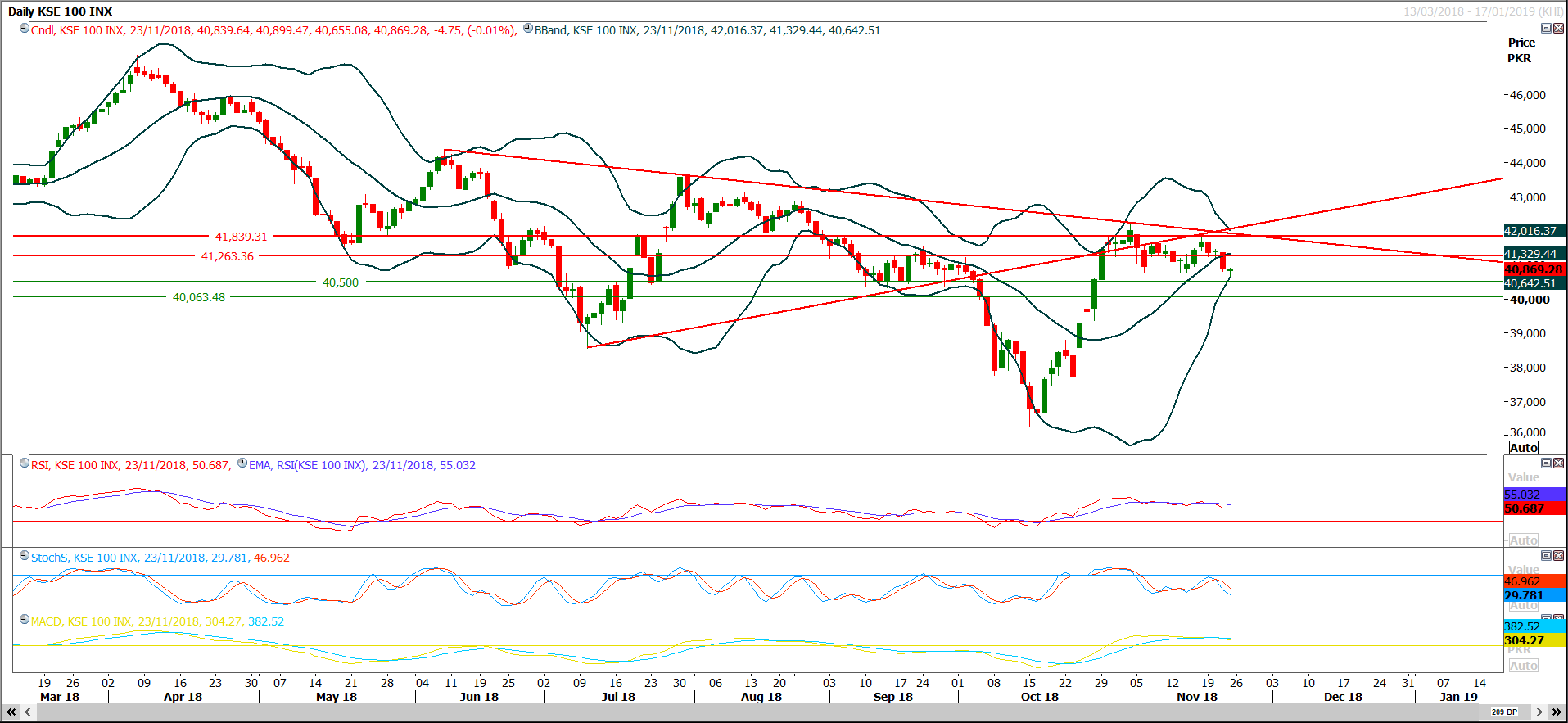

Trading volume at PSX floor dropped by 36.63 million shares or 22.86% on DoD basis whereas the Benchmark KSE100 index opened at 40,839.64, posted a day high of 40,899.47 and day low of 40,655.08 during last trading session while session suspended at 40,869.28 with net change of -4.75 points and net trading volume of 69.74 million shares. Daily trading volume of KSE100 listed companies dropped by 19.18 million shares or 21.57% on DoD basis.

Foreign Investors remained in net buying position of 0.87 million shares but net value of Foreign Inflow dropped by 1.34 million US Dollars. Categorically, Foreign Corporate investors remained in net selling position of 1.18 million shares but Overseas Pakistani investors remained in net buying position of 2.01 million shares. While on the other side local individuals, NBFCs, Mutual Funds and Insurances companies remained in net selling positions of 3.93, 1.79, 1.11 and 0.35 million shares respectively, but Local Companies, Banks and Brokers remained in net buying positions of 0.17, 1.94 and 3.75 million shares respectively.

Analytical Review

Asian shares tick up but oil rout dampens sentiment

Asian shares edged higher on Monday, though investors were cautious as plunging oil prices fanned worries about a dimming outlook for the global economy. Markets are also bracing for a crucial meeting between U.S. and Chinese leaders at the end of the week as trade tensions between the economic superpowers showed no signs of easing. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS edged up 0.4 percent, led by gains in Taiwan shares following local elections, while Japan's Nikkei .N225 advanced 0.6 percent. In China, the Shanghai composite index .SSEC ticked up 0.3 percent. On Wall Street, U.S. stocks lost ground on Friday, with the benchmark S&P 500 .SPX hitting its lowest close in more than six months as the energy sector was sold off in the wake of the oil slump.

Nepra loses legal authority in two members’ absence

Amid question marks over countrywide uniform electricity tariff and more than Rs65 billion annual extra payments to independent power producers (IPPs), the National Electric Power Regulatory Authority (Nepra) has become legally dysfunctional in the absence of majority of its members. On Friday (Nov 23), the term-in-office of Nepra Chairman Tariq Saddozai expired when the regulator was already short of two members from Sindh and Khyber Pakhtunkhwa. Thus, Nepra lost its mandatory three-member quorum required to take decisions. Currently, it has only two members — from Punjab and Balochistan — in the five-member authority.

Rupee’s search for solid backing

Many hearts and minds moved with fluctuations in the rupee value before and after the July 25 elections because much was at stake, including the push and the pull of political pride. Although sentiments can’t rule the exchange rates, they can sway them in a certain direction briefly. Former finance minister Ishaq Dar’s policy of keeping the rupee overvalued had started backfiring long before the elections. When Imran Khan took over as prime minister on August 18, the rupee had already lost enough ground to the dollar.

UK business council keen to invest $250m in healthcare

Pak Britain Business Council (PBBC) has expressed willingness to invest $250million in different development projects including healthcare, pharmaceutical and financial services. Chairman PBBC Julian Barns stated this during his visit to the Rawalpindi Chamber of Commerce and Industry (RCCI) yesterday. While providing details, Chairman Julian Barns said that the council desired to invest around $250 million in Pakistan in Health sectors. "We are looking forward for joint ventures in construction of 25 state of the art hospitals in different cities of Pakistan. We are working with Government of Pakistan in identifying areas located near big cities and probably these facilities will be constructed around the big cities with all civic facilities so that people from the rural areas can get these facilities with affordable price," he added.

Govt urged to help carpet industry in boosting exports

The Pakistan Carpet Manufacturers and Exporters Association on Sunday urged the government to prepare necessary changes for country’s export policy as per changing international scenario. The association has said that due to failed policies of the previous political governments, country has plunged into trouble in the fields of economy including exports. This was stated by Association Group Leader Latif Malik while chairing a meeting in Lahore. Carpet Institute Chairman Saeed Khan, Member Executive and Coordinator Riaz Ahmed, Senior Member Malik Akbar, Qamar Zia among other were present on the occasion. Senior member Riaz Ahmed and Qamar Zia briefed the meeting about their recent visit to China and details of meeting with Secretary Trade Development Authority.

Asian shares edged higher on Monday, though investors were cautious as plunging oil prices fanned worries about a dimming outlook for the global economy. Markets are also bracing for a crucial meeting between U.S. and Chinese leaders at the end of the week as trade tensions between the economic superpowers showed no signs of easing. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS edged up 0.4 percent, led by gains in Taiwan shares following local elections, while Japan's Nikkei .N225 advanced 0.6 percent. In China, the Shanghai composite index .SSEC ticked up 0.3 percent. On Wall Street, U.S. stocks lost ground on Friday, with the benchmark S&P 500 .SPX hitting its lowest close in more than six months as the energy sector was sold off in the wake of the oil slump.

Amid question marks over countrywide uniform electricity tariff and more than Rs65 billion annual extra payments to independent power producers (IPPs), the National Electric Power Regulatory Authority (Nepra) has become legally dysfunctional in the absence of majority of its members. On Friday (Nov 23), the term-in-office of Nepra Chairman Tariq Saddozai expired when the regulator was already short of two members from Sindh and Khyber Pakhtunkhwa. Thus, Nepra lost its mandatory three-member quorum required to take decisions. Currently, it has only two members — from Punjab and Balochistan — in the five-member authority.

Many hearts and minds moved with fluctuations in the rupee value before and after the July 25 elections because much was at stake, including the push and the pull of political pride. Although sentiments can’t rule the exchange rates, they can sway them in a certain direction briefly. Former finance minister Ishaq Dar’s policy of keeping the rupee overvalued had started backfiring long before the elections. When Imran Khan took over as prime minister on August 18, the rupee had already lost enough ground to the dollar.

Pak Britain Business Council (PBBC) has expressed willingness to invest $250million in different development projects including healthcare, pharmaceutical and financial services. Chairman PBBC Julian Barns stated this during his visit to the Rawalpindi Chamber of Commerce and Industry (RCCI) yesterday. While providing details, Chairman Julian Barns said that the council desired to invest around $250 million in Pakistan in Health sectors. "We are looking forward for joint ventures in construction of 25 state of the art hospitals in different cities of Pakistan. We are working with Government of Pakistan in identifying areas located near big cities and probably these facilities will be constructed around the big cities with all civic facilities so that people from the rural areas can get these facilities with affordable price," he added.

The Pakistan Carpet Manufacturers and Exporters Association on Sunday urged the government to prepare necessary changes for country’s export policy as per changing international scenario. The association has said that due to failed policies of the previous political governments, country has plunged into trouble in the fields of economy including exports. This was stated by Association Group Leader Latif Malik while chairing a meeting in Lahore. Carpet Institute Chairman Saeed Khan, Member Executive and Coordinator Riaz Ahmed, Senior Member Malik Akbar, Qamar Zia among other were present on the occasion. Senior member Riaz Ahmed and Qamar Zia briefed the meeting about their recent visit to China and details of meeting with Secretary Trade Development Authority.

PSO, DGKC, ATRL and TRG may lead the index in negative direction.

Technical Analysis

The Benchmark KSE100 Index have slide below its major primary supportive region of 41,000 points after three weeks during last trading session and it have penetrated its secondary supportive region 40,760 points before its weekly closing but closed above that region at 40,869 points which indicates that index is losing its strength on bullish side. During last three weeks index have traded range bound between 41,840 and 40760 and its daily stochastic have squeezed which is indicating that now a breakout would have to happen in coming week and it’s recommended to stay prepared for that breakout. Index have last hope for bulls at 40,500 points because if that region would be maintained then index could spike towards 41,260 and 41,860 points but if it would succeed in sliding below that region on daily closing basis then it can target 38,000 points on short term basis. Daily & weekly momentum indicators are ready for a bearish rally but hourly indicators would try to take a spike on intraday basis which may last towards 41,260 points. It’s recommended to stay on short side and avoid initiating long positions until index close above 41,260 points.

PSO have started its bearish journey after getting resistance from 282 Rs and now it would try to find some ground at 268 and 266 Rs but closing below 266 would for a further dropdown towards 257. TRG have succeeded in avoiding closing below 29.97 Rs during last trading session but it’s still in danger zone because trading below 32.50 and near to 29.97 means that TRG could lose momentum anytime which may lead it towards a serious dip therefore long position must be kept with strict stop loss of 29.60 Rs otherwise avoiding long positions is recommended at current price. ATRL have succeeded in avoiding a weekly evening shooting star by getting support from its major supportive region of 200 Rs but it have lost its momentum therefore right now its recommended to swing it between 212-200 Rs with strict stop loss on either side.

PSO have started its bearish journey after getting resistance from 282 Rs and now it would try to find some ground at 268 and 266 Rs but closing below 266 would for a further dropdown towards 257. TRG have succeeded in avoiding closing below 29.97 Rs during last trading session but it’s still in danger zone because trading below 32.50 and near to 29.97 means that TRG could lose momentum anytime which may lead it towards a serious dip therefore long position must be kept with strict stop loss of 29.60 Rs otherwise avoiding long positions is recommended at current price. ATRL have succeeded in avoiding a weekly evening shooting star by getting support from its major supportive region of 200 Rs but it have lost its momentum therefore right now its recommended to swing it between 212-200 Rs with strict stop loss on either side.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.