Previous Session Recap

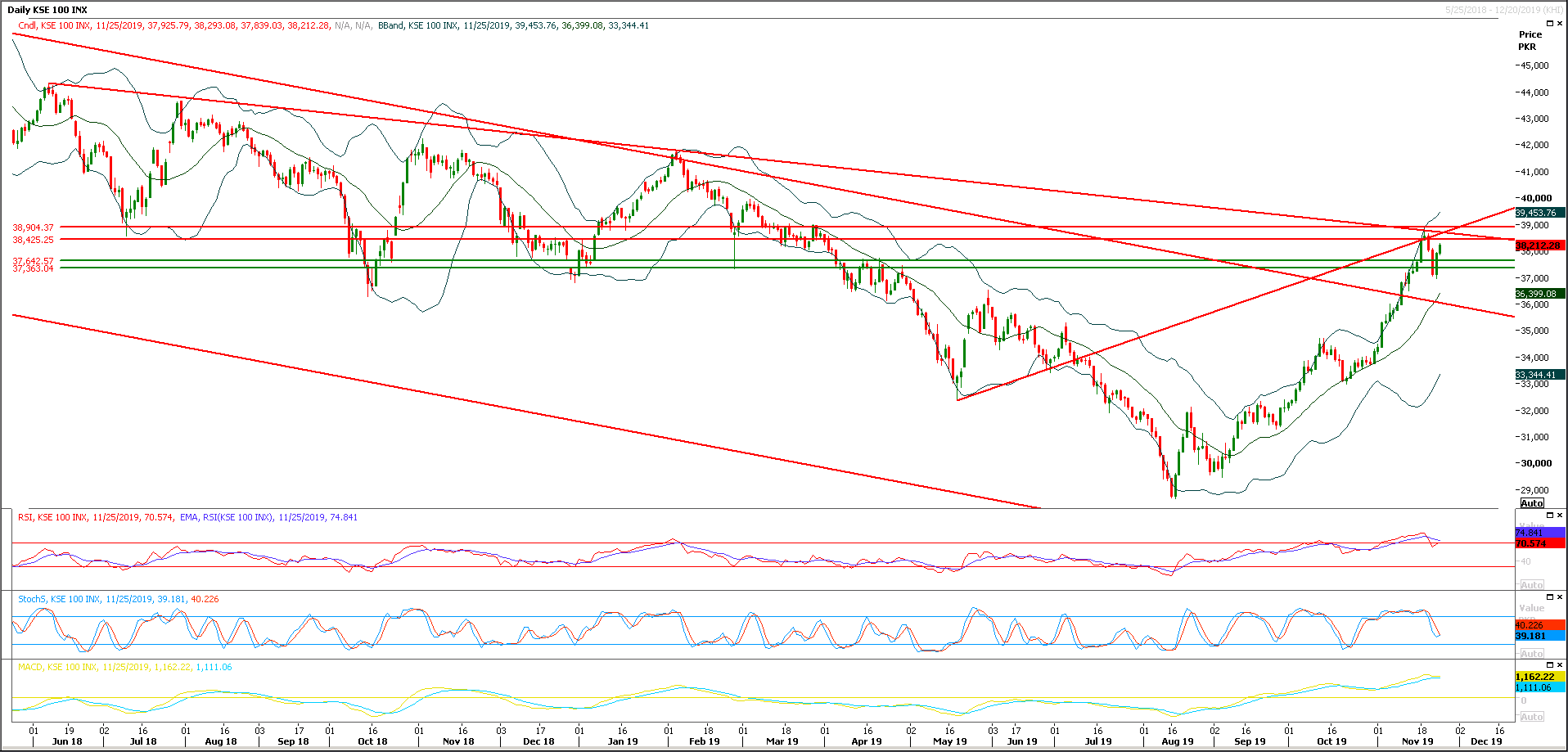

Trading volume at PSX floor dropped by 1.51 million shares or 0.62% on DoD basis, whereas the benchmark KSE100 index opened at 37,925.79, posted a day high of 38,293.08 and a day low of 37,839.03 points during last trading session while session suspended at 38,212.28 points with net change of 286.49 points and net trading volume of 167.02 million shares. Daily trading volume of KSE100 listed companies increased by 0.73 million shares or 0.44% on DoD basis.

Foreign Investors remained in net selling positions of 39.54 million shares and net value of Foreign Inflow dropped by 0.38 million US Dollars. Categorically, Foreign Individual, Corporate and Overseas Pakistanis Investors remained in net selling positions of 0.13, 2.98 and 38.43 million shares. While on the other side Local Individuals, Companies, NBFCs, Mutual Fund and Brokers remained in net buying positions of 33.02, 0.22, 0.49, 2.72 and 8.55 million shares but Banks and Insurance Companies remained in net selling positions of 6.73 and 0.32 million shares respectively.

Analytical Review

Asian stocks cheered by fresh trade talk momentum

Asian stocks rose on Tuesday, bolstered by Wall Street’s record closing highs and signs of new momentum in Beijing’s and Washington’s efforts to end their long and acrimonious trade dispute. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.5% to a one-week high. Australian shares were up 0.9%, while Japan's Nikkei stock index .N225 rose 0.91%. Shares in the region extended gains on Tuesday after Beijing said Liu He, China’s Vice premier and chief trade negotiator, held a call with his U.S. counterparts and that both sides reached consensus on solving relevant problems. That followed positive headlines out of China and the United States on Monday, which had helped bolster confidence. The yen fell to a two-week low versus the dollar, while the Swiss franc traded near a six-week low against the greenback as the optimistic tone sapped demand for safe-haven currencies.

Rs52bn contract for Dasu power project signed

The Water and Power Development Authority (Wapda) has signed a Rs52.5 billion contract with a joint venture of General Electric Hydro China and Power China Zhongnan Engineering Corporation for electro-mechanical works of the Dasu hydropower project (stage-I). Dasu hydropower project’s general manager and project director Anwar ul Haque and GEHC deputy general manager Aijun Xu — the authorised representative of the joint venture — signed the contract on behalf of their respective sides at a ceremony here on Monday. French Ambassador Marc Barety, World Bank’s country director Illango Patchamuthu, Chinese and the US diplomats, Water Resources Secretary Mohammad Ashraf and Wapda chairman retired Lt Gen Muzammil Hussain also attended the ceremony. Water Resources Minister Faisal Vawda was conspicuous by his absence, though he was in the city.

Rs40 billion approved for Balochistan uplift projects

The Balochistan Planning and Development Department has approved around Rs40 billion for new and ongoing development projects for the second quarter of the current financial year. Official sources said on Monday that a meeting presided by Chief Minister Jam Kamal Khan Alyani was briefed on the development projects by Additional Chief Secretary Planning and Development Abdul Rehman Buzdar. The chief minister told the meeting that his government had started a new era in Balochistan by ensuring timely release of funds for development projects. “Previously, funds generally lapsed because they were issued at the end of the fiscal year. No delay will be tolerated in completion of development projects and there will be no compromise on quality of work,” he added.

EU close to addressing too-big-to-fail financial clearing house issue

European Union governments are close to agreeing new rules for handling failures of clearing houses, increasing the burden on these firms to limit losses that might rock the financial system, EU documents and sources said. The rules could set a global standard for regulators, which put clearing houses at the centre of trading in over-the-counter derivatives and interest rate swaps after the 2008 financial crisis but did not agree on how to wind them down safely. To lower risks in the multi-trillion-dollar derivatives trade, clearing houses stand between both sides of a transaction and ensure its completion even if one side goes bust. But the system is so reliant on them that they have become what analysts describe as “too big to fail”, meaning they are so large that a collapse would send shock waves around the global financial system that could force governments to step in.

LVMH puts a ring on jeweller Tiffany in $16.2bn union

LVMH and US jewellers Tiffany announced on Monday a $16.2 billion tie-up that is the French luxury group's biggest-ever acquisition and will bolster its presence in the United States. The deal comes after LVMH spent more than a month wooing Tiffany, the most iconic of US luxury brands known for its wedding rings and diamonds. The companies said in a statement they "have entered into a definitive agreement whereby LVMH will acquire Tiffany for $135 per share in cash, in a transaction with an equity value of approximately 14.7 billion euros or $16.2 billion". The deal adds Tiffany to LVMH's extensive stable of luxury brands that include Louis Vuitton, Dior and Moet & Chandon and will strengthen its position in the jewellery sector.

Asian stocks rose on Tuesday, bolstered by Wall Street’s record closing highs and signs of new momentum in Beijing’s and Washington’s efforts to end their long and acrimonious trade dispute. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.5% to a one-week high. Australian shares were up 0.9%, while Japan's Nikkei stock index .N225 rose 0.91%. Shares in the region extended gains on Tuesday after Beijing said Liu He, China’s Vice premier and chief trade negotiator, held a call with his U.S. counterparts and that both sides reached consensus on solving relevant problems. That followed positive headlines out of China and the United States on Monday, which had helped bolster confidence. The yen fell to a two-week low versus the dollar, while the Swiss franc traded near a six-week low against the greenback as the optimistic tone sapped demand for safe-haven currencies.

The Water and Power Development Authority (Wapda) has signed a Rs52.5 billion contract with a joint venture of General Electric Hydro China and Power China Zhongnan Engineering Corporation for electro-mechanical works of the Dasu hydropower project (stage-I). Dasu hydropower project’s general manager and project director Anwar ul Haque and GEHC deputy general manager Aijun Xu — the authorised representative of the joint venture — signed the contract on behalf of their respective sides at a ceremony here on Monday. French Ambassador Marc Barety, World Bank’s country director Illango Patchamuthu, Chinese and the US diplomats, Water Resources Secretary Mohammad Ashraf and Wapda chairman retired Lt Gen Muzammil Hussain also attended the ceremony. Water Resources Minister Faisal Vawda was conspicuous by his absence, though he was in the city.

The Balochistan Planning and Development Department has approved around Rs40 billion for new and ongoing development projects for the second quarter of the current financial year. Official sources said on Monday that a meeting presided by Chief Minister Jam Kamal Khan Alyani was briefed on the development projects by Additional Chief Secretary Planning and Development Abdul Rehman Buzdar. The chief minister told the meeting that his government had started a new era in Balochistan by ensuring timely release of funds for development projects. “Previously, funds generally lapsed because they were issued at the end of the fiscal year. No delay will be tolerated in completion of development projects and there will be no compromise on quality of work,” he added.

European Union governments are close to agreeing new rules for handling failures of clearing houses, increasing the burden on these firms to limit losses that might rock the financial system, EU documents and sources said. The rules could set a global standard for regulators, which put clearing houses at the centre of trading in over-the-counter derivatives and interest rate swaps after the 2008 financial crisis but did not agree on how to wind them down safely. To lower risks in the multi-trillion-dollar derivatives trade, clearing houses stand between both sides of a transaction and ensure its completion even if one side goes bust. But the system is so reliant on them that they have become what analysts describe as “too big to fail”, meaning they are so large that a collapse would send shock waves around the global financial system that could force governments to step in.

LVMH and US jewellers Tiffany announced on Monday a $16.2 billion tie-up that is the French luxury group's biggest-ever acquisition and will bolster its presence in the United States. The deal comes after LVMH spent more than a month wooing Tiffany, the most iconic of US luxury brands known for its wedding rings and diamonds. The companies said in a statement they "have entered into a definitive agreement whereby LVMH will acquire Tiffany for $135 per share in cash, in a transaction with an equity value of approximately 14.7 billion euros or $16.2 billion". The deal adds Tiffany to LVMH's extensive stable of luxury brands that include Louis Vuitton, Dior and Moet & Chandon and will strengthen its position in the jewellery sector.

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 index have bounced back after getting support at 37,000 points during second last trading session and right now it's in correction phase and it would considered bearish until it would not succeed in closing above 38,500 or 38,900 points on daily closing basis. Daily momentum indicators are still in bearish mode but now they are trying to start a pullback but it's expected that if index would not succeed in closing above 39,200 points then chance of a weekly evening star would increase. As of now hourly momentum is ready to convert its direction towards bearish side and in this case index would only need to slide below 37,700 points and pressure would start increasing which would try to push index in bearish zone towards 36,900 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.