Previous Session Recap

Trading volume at PSX floor dropped by 40.7 million shares or 28.38%,DoD basis, whereas, the benchmark KSE100 Index opened at 41305.30, posted a day high of 41626.86 and a day low of 41294.95 during the last trading session. The session suspended at 41564.71 with a net change of 273.03 and net trading volume of 48.11 million shares. Daily trading volume of KSE100 listed companies dropped by 16.82 million shares or 25.91%,DoD basis.

Foreign Investors remained in a net selling position of 0.95 million shares but net value of Foreign Inflow dropped by 0.67 million shares. Categorically, Foreign Individual and Corporate investors remained in net selling positions of 0.053 and 0.073 million shares but Overseas Pakistanis remained in a net buying position of 1.08 million shares. While on the other side Local Individuals, Companies, Banks and Insurance Companies remained in net buying positions of 5.21, 1.1, 0.6 and 1.58 million shares respectively but Mutual Funds and Brokers remained in net selling positions of 2.7 and 7.67 million shares.

Analytical Review

Asian stocks barely changed on Thursday, capped as Wall Street shares pulled back from record highs, while the euro stretched gains ahead of a European Central Bank meeting that could take a major step away from its accommodative policy. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was flat. Australian stocks and South Korea's KOSPI .KS11 both inched down 0.1 percent. Japan's Nikkei .N225, which had its 16-day winning run snapped the previous day, shrugged off Wall Street weakness and rose 0.2 percent, lifted by shares backed by strong earnings. Shanghai stocks .SSEC were up 0.4 percent. Taiwan .TWOII was flat.

The US State Department has said that Pakistan’s refusal to acknowledge the existence of terrorist safe havens on its soil would not automatically lead to sanctions against the country. At a Tuesday afternoon news briefing, the department’s spokesperson Heather Nauert also refused to assess the impact of Secretary of State Rex Tillerson’s visit to Islamabad on US-Pakistan relations.The US media, however, noted that Mr Tillerson was greeted by a mid-level Foreign Office official and US Ambassador David Hale at the military airport in Rawalpindi. This was “a welcome without the pomp that usually accompanies high-level visits”, a US government-funded broadcasting organization, Radio Liberty, reported.

Pakistan Petroleum Limited (PPL) executed a gas sales agreement with Central Power Generation Company Limited (CPGCL) also known as GENCO II for sale of up to 200 MMscfd gas with 72.5 percent 'take or pay' commitment, from its solely-owned and operated Kandhkot Gas Field (KGF) to GENCO II’s Guddu Thermal Power Station (GTPS), District Kashmore, Sindh.MD & CEO,PPL Syed Wamiq Bokhari and CEO, CPGCL Muhammad Ayub Ansari signed the agreement in Islamabad.

The Economic Co-ordination Committee (ECC) of the Cabinet has rejected a proposal of Petroleum Division to raise the OMCs'' storage capacity from 20 days to 30 days after Finance Minister opposed it saying any such decision will widen current account deficit, well informed sources told Business Recorder. Finance Minister Senator Ishaq Dar argued against the proposal saying that he did not agree with the proposed enhancement of storage capacity of OMCs from 20 days to 30 days as usually as 20-day stock was being maintained in many countries of the world and such stock is sufficient to cater to the needs of the country. He further argued that the proposed enhancement of the storage capacity would cause unnecessary pressure on foreign exchange reserves of the country and will ultimately widen current account deficit. He suggested that enforcement of the condition to maintain 20 days'' stock of petroleum products should be ensured rather than increasing storage capacity.

Minister for Petroleum Division Sardar Awais Ahmed Khan Leghari said on Wednesday that the government is preparing a plan to fix power sector issues in its entirety. He made these remarks while presiding over the 111th meeting of Private Power and Infrastructure Board (PPIB). He said that the Power Division is assessing and analyzing the demand and supply scenarios and evaluating the ground situation to prepare future course of action for power sector. The Board was briefed that in order to further ensure the elimination of load-shedding and have some backup for unforeseen outages, CCE has approved 1250MW RLNG-based power generation project near Trimmu Barrage in District Jhang, Punjab. This project having estimated cost of US $802 million was approved in today's meeting for further processing. The project is targeted to start generating power in simple cycle mode by December 2018.

Today ATRL, PAEL and PPL may lead the market in the positive direction.

Technical Analysis

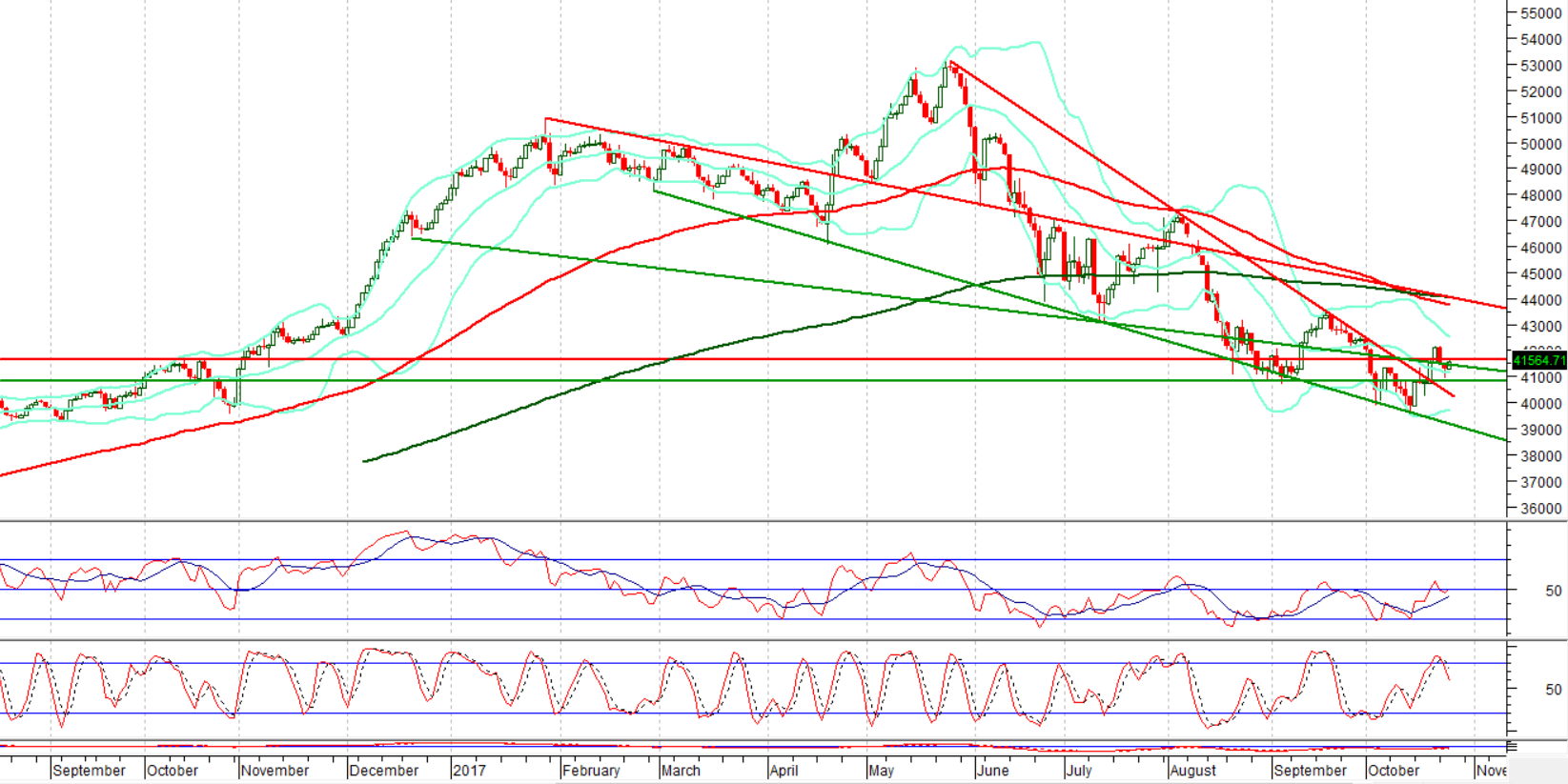

TThe Benchmark KSE100 Index has bounced back after completing 61.8% correction on the daily chart of its last bullish rally which was expired two days ago after posting a double top on the daily chart. Daily Stochastic has generated a bearish crossover which might add pressure on index but if index closes above 41700 on intraday basis then it might create a hope for bullish on short term basis. For the current trading session index might try to post a spike towards 41700 while supportive regions are standing at 40850 and 40500. Swing trading is recommended for the current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.