Previous Session Recap

Trading volume at PSX floor increased by 10.21 million shares or 3.06% on DoD basis, whereas the Benchmark KSE100 index opened at 39,697.20 posted a day high of 40,069.40 and day low of 39,271.10 points while the session suspended at 39,631.91 with net change of 360.79 points and net trading volume of 200.46 million shares. Daily trading volume of KSE100 listed companies increased by 32.77 million shares or 19.54% on DoD basis.

Foreign Investors remained in net buying position of 2.30 million shares and net value of Foreign Inflow increased by 0.35 million US Dollars. Categorically, Foreign Corporate remained in net buying positions of 5.55 million shares but Foreign Individuals and Overseas Pakistanis investors remained in net selling positions of 0.28 and 2.97 million shares. While on the other side Local Individuals, Banks and Insurance Companies remained in net selling positions of 20.58, 9.42 and 5.58 million shares but Local Companies, NBFCs, Mutual Fund and Brokers remained in net buying positions of 9.19, 0.05, 18.73 and 3.88 million shares respectively.

Analytical Review

Asian shares struggle to shake off rout despite Wall St. bounce

Asian shares wobbled in early Friday trade, struggling to shake off the previous day’s global markets rout, after weak results from tech giants Alphabet Inc and Amazon.com heightened concerns over world trade and economic growth. he shaky start for regional bourses came despite a bounce on Wall Street overnight, which was helped by bargain-hunting and positive earnings from Microsoft Corp. Those gains were put into perspective, however, as shares of both Amazon.com Inc and Alphabet Inc fell sharply after the closing bell on disappointing earnings.

ADB assures KP CM of continued assistance for development

A delegation of Asian Development Bank led by Country Director for Pakistan Xiaohong Yang on Thursday called on Chief Minister Khyber-Pakhtunkhwa Mahmood Khan in Islamabad. Finance Minister KP Taimur Jhagrla and Secretary Agriculture Israr were also present. The delegation discussed a host of issues related to sustainable development of the province and welfare of its people.

No violation of PPRA rules in award of contract

Senate Standing Committee on Communications was informed Thursday that Multan-Sukkur Motorway contract was signed under government-to-government framework. The meeting held under the chairmanship of Senator Hidayatullah was informed by Secretray Communications that PPRA rules did not apply on projects being executed under grants or soft loans. Chairman NHA said that all miniseries were part of the joint working group and JCC, and no rules were violated in award of Multan- Sukkur Motorway contract.

MoF waiting for PM’s approval to issue bonds

The ministry of finance is waiting for Prime Minister Imran Khan’s approval for issuing Sukuk and Euro bonds in the international market to generate $2-3 billion to build the foreign exchange reserves of the country. “We are only waiting for Prime Minister’s approval for issuing the bonds,” said a top official of the ministry of finance. He further said that volume of these bonds depends on the market situation, whether the interest is high or low. We have roughly projected to receive at least two billion dollars, he added.

Bank of China vows to help promote bilateral trade

Bank of China has announced to play its active role in establishing and promoting mutual trade links between the Pakistani and Chinese trade companies so as to boost bilateral trade ties. Bank of China Head (Business Development) Ms Sun Hui stated this while addressing a meeting of Sialkot exporters held at Pakistan Sports Goods Manufacturers and Exporters Association (PSGMEA). Chairman PSGMEA Ch. Muhammad Arshad presided over the meeting.

Asian shares wobbled in early Friday trade, struggling to shake off the previous day’s global markets rout, after weak results from tech giants Alphabet Inc and Amazon.com heightened concerns over world trade and economic growth. he shaky start for regional bourses came despite a bounce on Wall Street overnight, which was helped by bargain-hunting and positive earnings from Microsoft Corp. Those gains were put into perspective, however, as shares of both Amazon.com Inc and Alphabet Inc fell sharply after the closing bell on disappointing earnings.

A delegation of Asian Development Bank led by Country Director for Pakistan Xiaohong Yang on Thursday called on Chief Minister Khyber-Pakhtunkhwa Mahmood Khan in Islamabad. Finance Minister KP Taimur Jhagrla and Secretary Agriculture Israr were also present. The delegation discussed a host of issues related to sustainable development of the province and welfare of its people.

Senate Standing Committee on Communications was informed Thursday that Multan-Sukkur Motorway contract was signed under government-to-government framework. The meeting held under the chairmanship of Senator Hidayatullah was informed by Secretray Communications that PPRA rules did not apply on projects being executed under grants or soft loans. Chairman NHA said that all miniseries were part of the joint working group and JCC, and no rules were violated in award of Multan- Sukkur Motorway contract.

The ministry of finance is waiting for Prime Minister Imran Khan’s approval for issuing Sukuk and Euro bonds in the international market to generate $2-3 billion to build the foreign exchange reserves of the country. “We are only waiting for Prime Minister’s approval for issuing the bonds,” said a top official of the ministry of finance. He further said that volume of these bonds depends on the market situation, whether the interest is high or low. We have roughly projected to receive at least two billion dollars, he added.

Bank of China has announced to play its active role in establishing and promoting mutual trade links between the Pakistani and Chinese trade companies so as to boost bilateral trade ties. Bank of China Head (Business Development) Ms Sun Hui stated this while addressing a meeting of Sialkot exporters held at Pakistan Sports Goods Manufacturers and Exporters Association (PSGMEA). Chairman PSGMEA Ch. Muhammad Arshad presided over the meeting.

DGKC, PSO, ISL, PAEL and TRG would try to lead negative momentum with volatile price moves during current trading session.

Technical Analysis

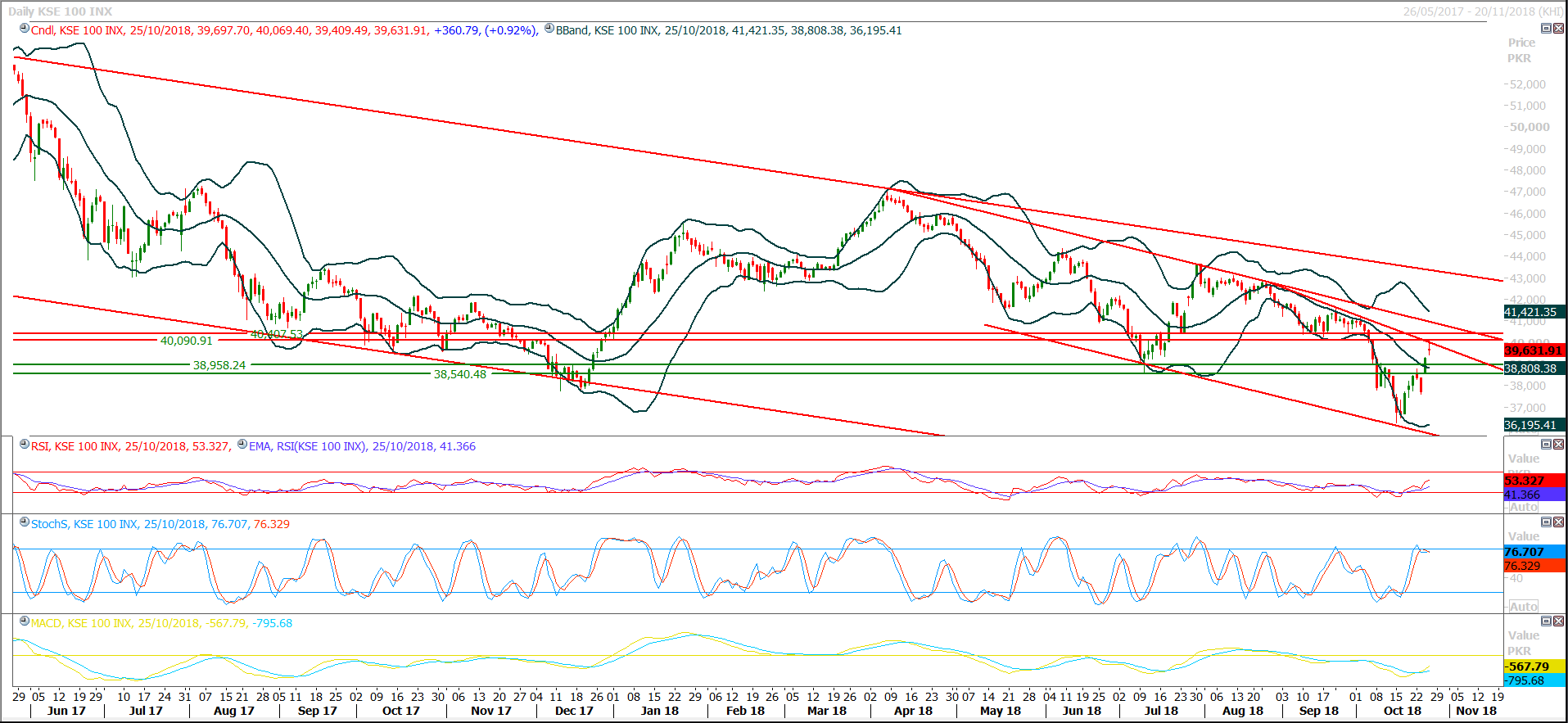

The Benchmark KSE100 Index have bounced back after getting resistance from crossover of a horizontal resistance with a descending trend line and have formatted a doji on daily chart which have opened chances of an evening shooting stat if index would close in negative zone during current trading session. As of now index have resistant regions ahead at 40,010 and 40,089 points while supportive regions are standing at 39,200 and 38,860 points. Daily momentum indicators are trying to lean back and with today’s negative closing they would succeed in doing so which would push index towards 38,860 points and further for coverage of gap which happened two days ago. It’s recommended start selling on strength with strict stop loss of 40,400.

PAEL have strong resistant region ahead at 31.60 which would try to cap its current bullish momentum and push it back towards a new low because in case of reversal expansion of current correction would lead PAEL in negative zone therefore it’s recommended to start profit taking from previous buying and initiate selling on strength. DGKC is capped by strong horizontal resistance at 92.80 and it would need some fresh blood to close above 92.80 and 93.60 therefore selling on strength during current trading session would be beneficial. MLCF is capped at 41.70 and breakout of that region would call for 44.10 therefore its recommended to initiate selling on strength with strict stop loss. ISL have a strong resistant region ahead between 85.30 till 86 Rs and its recommended to initiate selling on strength in it as it would bounce back towards 70 and 67 Rs in case of reversal.

PAEL have strong resistant region ahead at 31.60 which would try to cap its current bullish momentum and push it back towards a new low because in case of reversal expansion of current correction would lead PAEL in negative zone therefore it’s recommended to start profit taking from previous buying and initiate selling on strength. DGKC is capped by strong horizontal resistance at 92.80 and it would need some fresh blood to close above 92.80 and 93.60 therefore selling on strength during current trading session would be beneficial. MLCF is capped at 41.70 and breakout of that region would call for 44.10 therefore its recommended to initiate selling on strength with strict stop loss. ISL have a strong resistant region ahead between 85.30 till 86 Rs and its recommended to initiate selling on strength in it as it would bounce back towards 70 and 67 Rs in case of reversal.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.