Previous Session Recap

Trading Volume at PSX floor dropped by 5.83 million shares or 4.41%,DoD basis, whereas, the benchmark KSE100 Index opened at 42815.23, posted a day high of 43087.07 and a day low of 42628.37 during the last trading session. The session suspended at 42743.65 with a net change of -6.55 points and net trading volume of 67.65 million shares. Daily trading volume of KSE100 listed companies increased by 15.57 million shares or 28.89%,DoD basis.

Foreign Investors remained in a net buying position of 0.72 million shares and net value of Foreign Inflow increased by 4.68 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistani investors remained in net buying positions of 0.14 and 2.83 million shares but Foreign Corporate Investors remained in net selling position of 2.26 million shares. While on the other side Local Individuals, NBFCs and Brokers remained in net selling position of 3.47, 0.35 and 3.32 million shares respectively but Local Companies, Banks and Mutual Funds remained in net buying positions of 3.39, 1.28 and 2.52 million shares.

Analytical Review

Asian shares slumped on Tuesday while the dollar remained off recent highs against the yen against the backdrop of rising tensions on the Korean Peninsula. North Korea’s foreign minister said on Monday that a weekend tweet by President Donald Trump counted as a declaration of war on North Korea and that Pyongyang reserved the right to take countermeasures, including shooting down U.S. bombers even if they are not in its air space. MSCI’s broadest index of Asia-Pacific shares outside Japan was down 0.2 percent in early trade, following losses on Wall Street. Australian shares were up 0.1 percent, while South Korean shares were 0.3 percent down. Japan’s Nikkei stock index sagged 0.2 percent, pressured by a stronger yen.

Pakistan LNG Terminal Limited (PLTL) is presently under alleged government pressure to waive $50 million penalty it has imposed on the contractor for delaying the completion of the country’s second LNG terminal at Port Qasim. The PLTL—a public sector entity being run under control of the Ministry of Energy (Petroleum Division)—is supervising the LNG terminal project being client while the Pakistan GasPort Consortium Limited (PGPC) is executing this as contractor. The terminal, which was earlier scheduled to be completed by June, is now reportedly planned to be commissioned by November 28th after a delay of six months as per the contractors request sent to PLTL in August.

The government has asked China to expedite the second Free Trade Agreement (FTA) and conclude the process by December, a senior official of the commerce ministry told Dawn on Monday. Delegations from both countries met in Beijing on Sept 14 for the eighth round of negotiations on the FTA. Pakistan now hopes to have a final agreement to sign before the end of the year. “We have asked for 70 exportable items to be zero-rated immediately,” said the official, who did not wish to speak for attribution due to the sensitivity of the negotiations. The items include textiles, particularly cotton yarn and readymade garments, as well as leather, food and fisheries items.

A decision by the Supreme Court in favour of the pensioners of National Bank of Pakistan (NBP) on Monday will cost the bank approximately Rs47.7 billion. NBP said in a stock notice the Supreme Court dismissed its multiple civil appeals in pension-related cases filed by some of its retired employees and maintained the judgment of the Lahore High Court. Moreover, the court allowed another appeal by setting aside the judgment of the Peshawar High Court, which is also against NBP, it said. “The implementation of the decision... will have financial impact. The bank is considering exercising legal options available to safeguard its interests,” NBP said in the notice.

The country’s oil import bill rose nearly 35 per cent year-on-year to $2.03 billion in the first two months of this fiscal year. The share of oil in Pakistan’s total import bill in the July-Aug period was 21pc, which is putting more pressure on the country’s balance of payments. Official figures compiled by the Pakistan Bureau of Statistics (PBS) show that import of petroleum products went up 19pc in value. However, 58pc growth was recorded in terms of quantity of petroleum products. Import of petroleum crude posted a growth of 67pc in value and 63pc in terms of quantity during the period under review.

Today ENGRO, HTL , PAEL and PSO may lead the market in the positive direction.

Technical Analysis

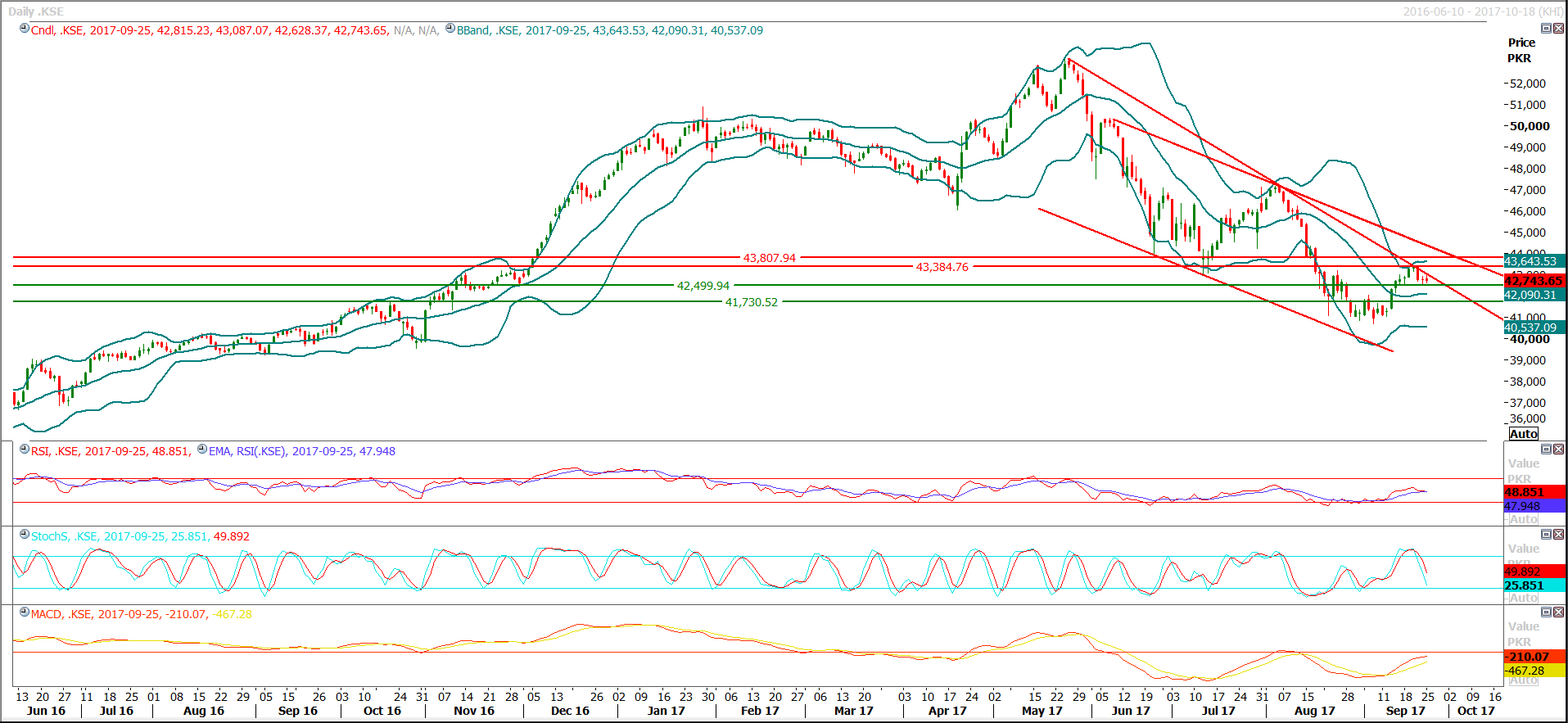

The Benchmark KSE100 Index is capped by a resistant trend line on the daily chart which is trying to push the index in a negative zone, while on supportive side it is being supported by a horizontal support at 42500, breakout of 42450 on bearish side will call for 42000 and 41700. For the current trading session buying with strict stop loss of 42450 could be initiated but on breakout of this level cut and reverse would be suggested.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.