Previous Session Recap

The Bench Mark KSE100 Index Opened at 46693.18 with a gap of 59.19 points, posted day high of 46898.59 and day low of 46622.42 during last trading session. The session suspended at 46689.73, with net change of 55.74 points and net trading volume of 83.5 million shares. Daily trading volume of KSE100 listed companies dropped by 21.92 million shares or 20.79% on DOD bases.

Foreign Investors remained in net selling position of 2.01 million shares and net value of Foreign Inflow dropped by 5.5 million US Dollars. Categorically Foreign Individuals and Corporate Investors remained in net selling position of 14983 shares and 3.4 million shares respectively. Overseas Pakistanis remained in net buying position of 1.4 million shares. While on the other side, Local Individuals and Banks remained in net buying position of 14.46 and 17.43 million shares but Local Companies, NBFCs, Mutual Funds and Brokers remained in net selling position of 9.13, 0.67, 5.84 and 15.17 million shares respectively.

Analytical Review

Asian stocks were mixed on Tuesday, in thin trade and with little to guide them as most major markets were closed on Monday for Christmas holidays, while the dollar reclaimed its losses from Monday. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was flat, with Australia and New Zealand closed for a holiday in lieu of Christmas. Japanese Nikkei .N225 rose 0.3 percent, buoyed by a weaker yen. Chinese CSI 300 index .CSI300 was little changed while the Shanghai Composite .SSEC slipped 0.2 percent, despite positive data. U.S. oil prices extended gains on Tuesday in post-Christmas trading, as OPEC and non-OPEC members are set to start curbing output in less than a week to support oil prices. NYMEX crude for February delivery CLc1 was up 16 cents at $53.18 a barrel by 0002 GMT, after closing up 7 cents at a 17-month high on Friday. London Brent crude for February delivery LCOc1 was yet to trade after settling up 11 cents at $55.16 a barrel on Friday. Oil markets were closed on Monday after Christmas holiday.

Sui Northern Gas Pipelines Limited (SNGPL) is facing a gas shortfall of 400 million cubic feet per day (mmcfd) and as a result domestic consumers of Punjab are facing low pressure and severe loadshedding. According to official figures of the SNGPL, the company is supplying 1.93 billion cubic feet per day (BCFD) of gas including 400 MMCFD of imported liquefied natural gas (LNG), while total demand is over 2.3 BCFD.

Beijing has pledged to finance three more road projects under the China-Pakistan Economic Corridor (CPEC), making its total contribution to the corridor-related road projects to Rs1.025 trillion so far. China will provide Rs107.76 billion as soft loan for the three new projects, National Highway Authority (NHA) spokesman Kashif Zaman told Dawn on Monday. It is already providing Rs917bn for another three road projects. The three new projects to be financed by China fall on the western route of the corridor. They include a 280-kilomtre road from Raikot to Thakot at a cost of Rs8bn, 210km dual carriageway from Yarik to Zhob (Rs80bn), and a 110km road from Basima to Khuzdar (Rs19.76bn).

The government has maintained the customs duty on cotton yarn at the lowest level of 5 percent in order to support the textile industry. Sources said that this was informed to the Senate Standing Committee on Finance in writing by Federal Board of Revenue (FBR) while briefing on the implementation of the committee recommendations to the Finance Bill 2016.

Chinese Ministry of Finance (MOF) will adjust tariffs downward on a number of exports and imports from various countries, including Pakistan. The new plan comes into force from next year, according to the MOF website, reports Xinhua news. To meet domestic demand, tax rates will be lowered on some imported commodities next year, it said.

SEARL, MTL, ASTL, SMBL and LOTCHEM can lead market in positive direction.

Technical Analysis

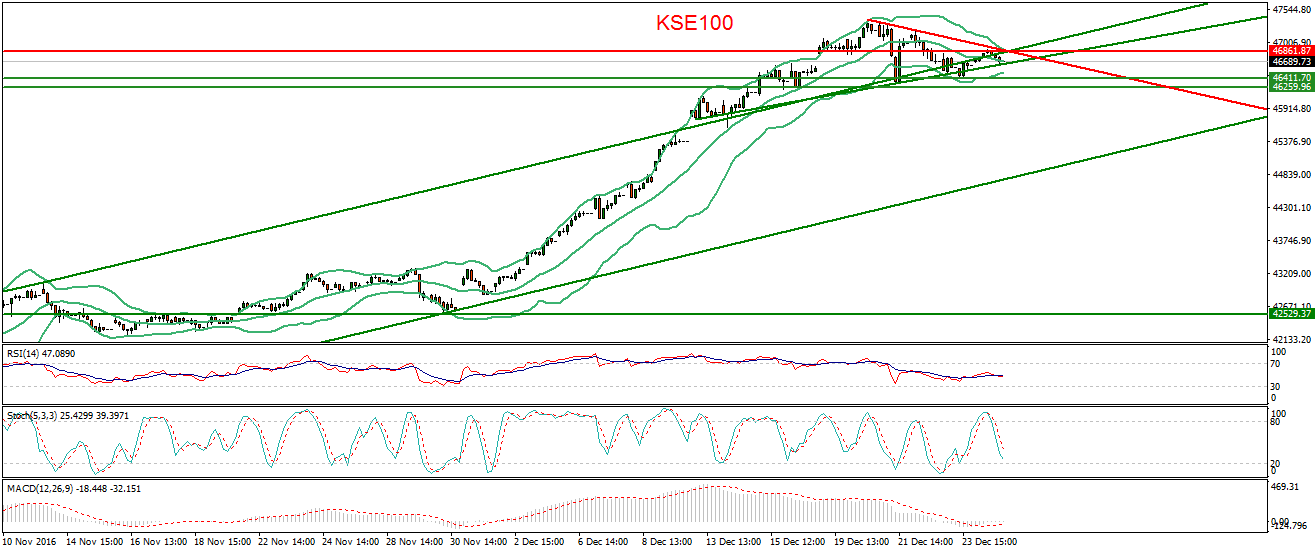

The Bench Mark KSE100 Index is caged in triangle on hourly chart and breakout of either side of this triangle will call for a new trend. It is also not being able to close below 61.8% intra-day correction which it already has fulfilled on 21st Dec. 2016. On hourly chart, it is being supported by a rising trend line but thin volumes are creating an alarming situation on PSX. Therefore, right now trading with strict stop loss could be beneficial. During current trading session, market will try to break its two major resistances at 46865 and 46959 as it already has tried to break its supportive region during last two trading sessions but could not succeed.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.