Previous Session Recap

The Bench Mark KSE100 Index Opened at 49136.80 points, posted day high of 49273.94 and day low of 48941.69 points during last trading session while session suspended at 49007.99 points with net change of -54.27 points and net trading volume of 133.46 million shares. Daily trading volume of KSE100 listed companies increased by 19.67 million shares or 17.29% on DOD bases.

Foreign Investors remain in net buying of 2.19 million shares and net value of Foreign Inflow increased by 2956 US Dollars. Categorically Foreign Individuals and Overseas Pakistanis remain in net selling of 0.046 and 1.49 million shares but Foreign Corporate Investors remain in net buying of 3.73 million shares. While on the other side Local Individuals, Banks, NBFCs and Mutual Funds remain in net selling of 12.91, 3.33, 0.11 and 5.18 million shares respectively but Local Companies, and Brokers remain in net buying of 2.75 and 7.11 million shares respectively.

Analytical Review

Asian stocks erased early losses but stayed below 19-month highs on Monday as a renewed drop in sovereign bond yields on political concerns prompted some investors to move to the sidelines after a recent rally. Markets remained in recent broad trading ranges, and interest is focused on U.S. President Donald Trump speech to a joint session of Congress on Tuesday night, where he is expected to unveil some elements of his plans to cut taxes. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was flat after declining 0.3 percent in early trades. Japan .N225 was down 1.2 percent, and Australia off 0.2 percent. The broad Asia-Pacific index, which fell 0.7 percent on Friday, is still up more than 11 percent since end-December. Until we see some strong earnings, we are in for a correction phase, the head of equities at a U.S. fund in Hong Kong predicted.

Pending a strategic decision on its privatisation, Pakistan Steel Mills (PSM) continues to lose its land — this time to an industrial park to be set up under the China-Pakistan Economic Corridor. A government official told Dawn that Prime Minister Nawaz Sharif had approved allocation of 1,500 acres of PSM land for the industrial park. The prime minister has “desired that it (matter) may be taken up with the Privatisation Commission and Board of Directors of PSM,” said an order issued by the industries and production ministry. The ministry said the land was originally meant for investment as per PSM book of accounts and could be utilised for development of an industrial park under the CPEC. In order to finalise the modalities regarding establishment of the industrial park, the matter may please be placed before the (PSM) board, the order said. The Privatisation Commission was asked to work out to facilitate the earmarked piece of land for setting up the industrial park. Interestingly, the PSM board has been incomplete and without a chairman since the PML-N came to power in 2013.

Stored old dollar bills worth $500m surfaced in the first two months of 2017 as panic stricken savers and hoarders rushed to exchange them at any price. Market sources confirmed a sizeable amount was traded at sub-market rates. The fright syndrome contributed to the sudden surge in dollar flow which eased pressure on greenback supply in the open market, observed market watchers. The shrinking of the demand-supply gap helped bring relative stability in the value of a slipping rupee. The rupee recovered to 107 after crossing 109 to a dollar some time back.

ACCORDING to the weekly statement of position, deposits and other accounts of all scheduled banks for the week ended Feb 10, stood at Rs10,645.41bn after a 0.41pc decrease over the preceding week figure of Rs10,688.88bn. Compared with last year corresponding figure of Rs9,363.03bn, the current week’s figure was higher by 13.70pc. Deposits and other accounts of all commercial banks stood at Rs10,575.10bn against preceding week’s deposits of Rs10,619.73bn, showing a decline of 0.42pc. Deposits and other accounts of specialised banks stood at Rs70.30bn, lower by 1.68pc against previous week’s figure of Rs69.14bn. Total assets of all scheduled banks stood at Rs14,724.05bn, lower by 0.05pc over preceding week’s figure of Rs14,731.54bn. Current week’s figure is higher by10.20pc compared to last year’s corresponding figure of Rs13,361.39bn.

Today market is expected to remain volatile again, Traders are advised to exercise cautiously, Accumulate Banks on dips and take profit on higher levels.

Technical Analysis

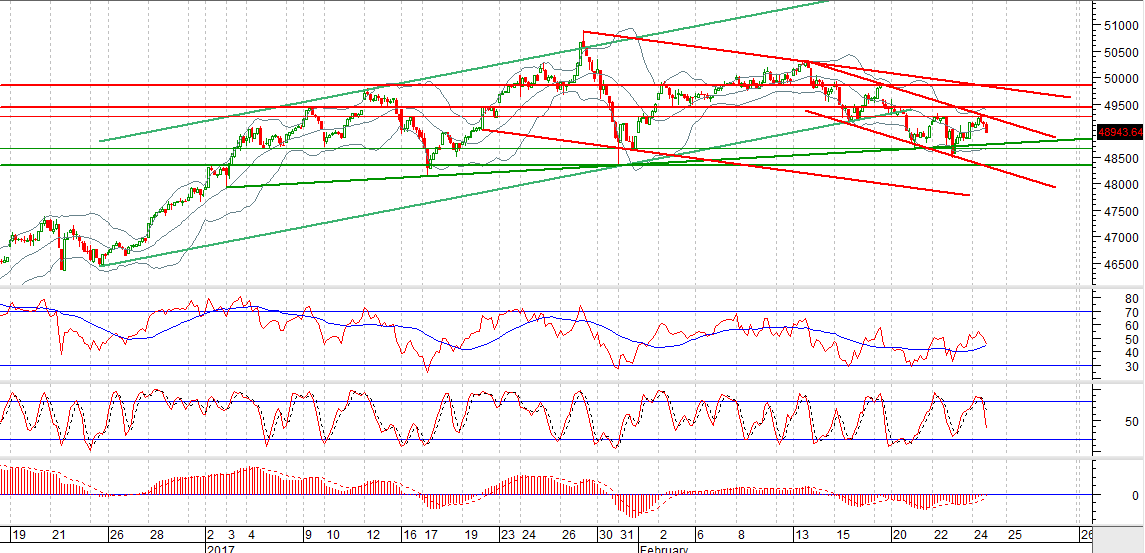

The Bench Mark KSE100 Index once again have been pushed back from its 50% intraday correction which is an alarming for bulls. Right now market is supported by a rising trend line around low of its second last trading session, breakout of that region will call for new bearish rally for expansion of current 50% correction. Index is not able to recover fom bearish corrections if index would not be able to close above 49440 then sentiments will remain bearish for current week. As Index has closed below 49105 during last trading session so that region is also becoming strong resistance. Market will remain volatile so swing trading with strict stop losses could be beneficial. Index have generated a new resistant region around 49275 point which will play a vital role in expiry of any new bullish wave before 49440 points. Daily closing below 48622 points will push index further downward till 47900 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.