Previous Session Recap

The Benchmark KSE100 Index opened at 49785.17, posted a day high of 49954.04 and a day low of 49645.12 during last trading session. The session suspended at 49827.51 with a net change of 42.34 points and a net trading volume of 120.95 million shares. Daily trading volume of KSE100 listed companies dropped by 9.44 million shares or 7.24%,DoD basis.

Foreign Investors remained in a net selling position of 12.37 million shares and a net value of Foreign Inflow dropped by 1.71 million US Dollars during last trading session. Categorically, Foreign Individual, Corporate and Overseas Pakistani Investors remained in net selling positions of 0.10, 11.99 and 0.27 million shares respectively. On the other side Local Individuals, Companies and Banks remained in net buying positions of 16.27, 7.84 and 0.51 million shares but Mutual Funds and Brokers remained in net buying positions of 9.9 and 1.48 million shares respectively.

Analytical Review

Asian shares ticked down from a near two-year high on Thursday after a long-awaited U.S. tax plan failed to inspire investors, though sentiment remains supported by global growth prospects and receding worries about political risks in Europe. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 0.1 percent after hitting its highest level since June 2015 on Wednesday. Japanese Nikkei .N225 dipped 0.3 percent. U.S. President Donald Trump proposed slashing tax rates for businesses to 15 percent from the current 35 percent for public corporations and 39.6 percent for small businesses, and on overseas corporate profits returned to the country. But the one-page plan offered no specifics on how it would be paid for without increasing the deficit, which many analysts think would be difficult to achieve. "There were no specifics in terms of funding for the tax cuts. The announcement appeared many thins are still in flux," said Masahiro Ichikawa, senior strategist at Sumitomo Mitsui Asset Management.

As the power regulator ordered the refund of Rs4.35 per unit to consumers, ex-Wapda distribution companies on Wednesday made an extraordinary demand: let them utilize this money for up to six months to improve their cash flows. The unusual demand came at a public hearing conducted by the National Electric Power Regulatory Authority (NEPRA). It also carried an underlying warning of enhanced load shedding, particularly in Ramadan, if funds overcharged to consumers were returned immediately.

Cement companies are exploring new markets to sustain the plant expansion after losing market in South Africa, Kenya, Tanzania and Mozambique. South Africa imposed an anti-dumping duty on Pakistani cement one and a half years ago. Cement makers also used to export large quantities to Punjab state of India through the Wagah border and Mumbai via sea route. Currently they are exporting 250,000 to 300,000 tonnes of cement to the state of Tamil Nadu via sea. Annual cement exports to India is around one million tonnes. During the first nine months of the current year exports to the neighboring country have already hit 920,349 tonnes.

The Standing Committee of National Assembly on Finance on Wednesday supported the proposal by the textile sector to restructure bank loans of sick units to help their revival. Members of the textile sector informed the committee that the revival of sick units will earn $1 billion in foreign exchange and create five million jobs. Committee chairman Qaiser Ahmed Sheikh noted that exports have declined from $25bn to $20bn in the last four years and the decrease will continue if its basic causes are not addressed. The representatives of the textile sector identified a high cost of LNG, non-clearance of refunds and government borrowing by banks as major causes that led to the decline in exports.

Finance Minister Ishaq Dar has invited the Pakistani diaspora to invest in a development fund that the government is setting up to channel investment in major infrastructure development projects in the country. Briefing the Pakistani media on his five-day visit to Washington, the minister said that international financial institutions had also acknowledged “the impressive headway” the nation had made under the current government. Mr Dar was in Washington to attend spring meetings of the World Bank group but also held bilateral talks with US officials.

The Market is expected to remain volatile today. We advise Traders to exercise caution. Buying on dips and booking gains on strength is recommended.

Technical Analysis

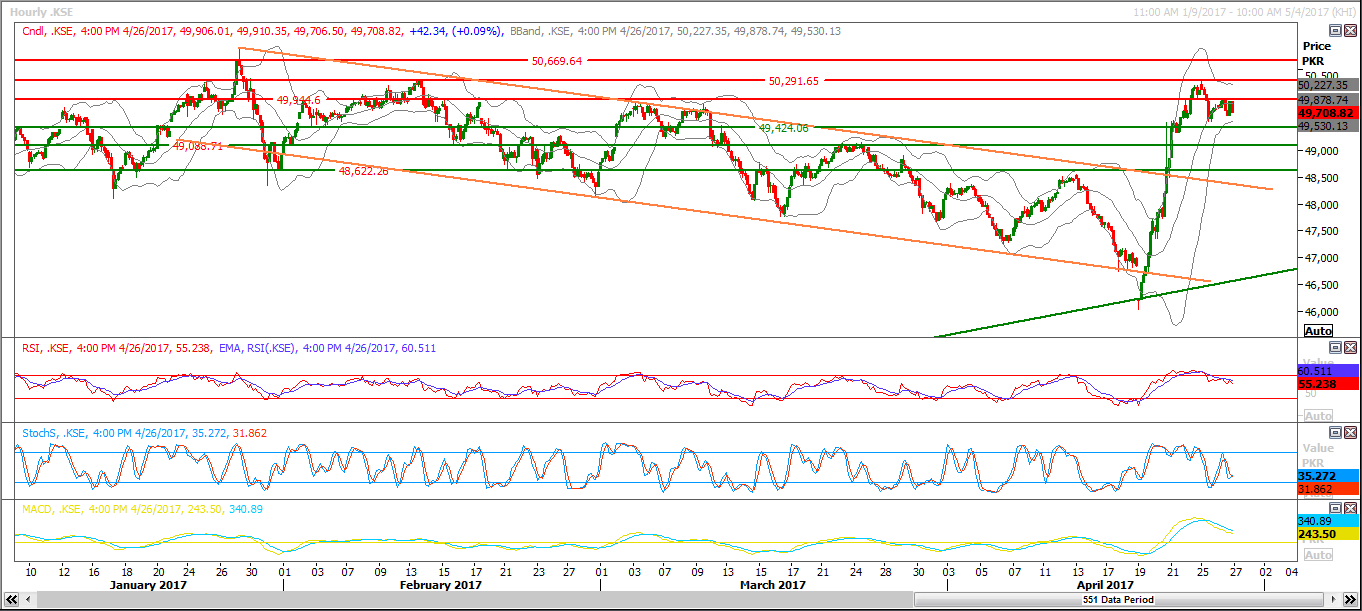

TThe Benchmark KSE100 Index is capped by a horizontal resistance at 49960 and has supportive regions around 49440. For current trading session index will remain under pressure until it closes above 49960 on hourly basis because correction of its last bullish rally is still pending. Daily Stochastic is trying to generate a bearish crossover which could push the index downwards due to which bearish momentum can take place. On daily chart Index is capped by a horizontal resistance or triple top at 50322 which would react as a major resistance in the coming trading sessions. For the current trading session trading with strict stop loss of 49440 is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.