Previous Session Recap

Trading volume at PSX floor dropped by 46.64 million shares or 24.02% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 42,610.88, posted a day high of 42,701.54 and a day low of 42,309.05 during last trading session. The session suspended at 42,425.10 with net change of -21.52 and net trading volume of 71.27 million shares. Daily trading volume of KSE100 listed companies dropped by 40.51 million shares or 36.24% on DoD basis.

Foreign Investors remained in net selling positions of 11.46 million shares and net value of Foreign Inflow dropped by 1.44 million US Dollars. Categorically, Foreign Corporate Investors remained in net selling positions of 11.88 million shares but Overseas Pakistanis remained in net buying position of 0.42 million shares. While on the other side Local Individuals Mutual Funds and Brokers remained in net buying positions of 12.11, 3.64 and 4.85 million shares respectively but Local Companies, Banks, NBFCs and Insurance Companies remained in net selling positions of 3.95, 0.99, 4.12 and 0.33 million shares respectively.

Analytical Review

Asian shares rise after record highs on Wall Street

Asian shares rose early on Monday, taking support from Wall Street’s gains on Friday after U.S. Federal Reserve Chairman Jerome Powell said a gradual approach to raising rates was best to protect the U.S. economy and job growth. In early Asian trade on Monday, S&P500 E-mini futures ESc1 touched a record high of 2,885, and were last 0.2 percent higher at 2,882.5. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was up 0.1 percent, while Japan's Nikkei stock index .N225 gained 0.6 percent.

Traders for raising tax on imports

The Islamabad Chamber of Small Traders on Sunday said the country would need almost $9.25 in debt repayments during the current fiscal which would be a challenge. The amount needed to pay foreign debts and interest is almost equal to the forex reserves held by the central banks warranting foreign loan to keep the country afloat, it said. Serious efforts are needed to control imports otherwise the deficit can jump to $25 billion making it very difficult for the government to manage, said Patron Islamabad Chamber of Small Traders Shahid Rasheed Butt. Increasing interest rates will be a hard decision as it will start contraction in the economy at this critical juncture, he added. Shahid said that the tested recipe for controlling deficit has remained a cut in the developmental spending. However, the government can explore the option of jacking up the slab of 20 percent to 30 percent on imports.

Punjab promoting olive output to cut import bill

The Punjab government under its five-year (2015-2020) plan will provide some 473,500 olive saplings free of charge for plantation in the Olive Valley this year and the farmers can submit their application in this regard till August 31. The Olive Valley comprises Rawalpindi, Chakwal, Jhelum and Attock districts of Potohar region, besides Mianwali and Khushab districts. According to the Barani Agriculture Research Institute (BARI) Director, the Punjab Agriculture Department had so far managed to plant over one million olive saplings in the Potohar region. The programme was launched aimed at promoting local production of olive oil and curtailing import bill of edible oil sector, he said. He informed that the growers were offered subsidy in accordance with the set rules and procedure and they were bound to fully comply with the recommendations of the Provincial Agriculture Department. For the purpose the department had imported high quality saplings from the best recognized countries for the production of olive, he added.

Pak-China coop beneficial for giving boost to agri sector

China-Pakistan's growing socio-economic cooperation will be equally beneficial for giving boost to the agriculture sector, enhancing per acre yield of wheat crop. Farmers in Pakistan are expecting improved crop yields as field trials conducted by a Chinese State-owned enterprise involving hybrid wheat has yielded impressive results. Chinas' Sinochem Group Co, which has interests in chemicals and other agriculture-related services, has conducted field trials of hybrid wheat varieties and realized on average 24.4 percent increase in crop yields, according to company officials. It is also playing an important role in boosting trade ties under the country's innovative Belt and Road Initiative. "The tests on the hybrid varieties were implemented in 230 sites, spread over 2,000 hectares of land, mostly in experimental bases or local farms," said Chen Zhaobo, general manager of CNSGC Hybrid Wheat Seed (Beijing) Company.

Budget deficit widens to 6.6pc in 2017-18

Pakistan’s budget deficit has widened to a whopping Rs2.26 trillion or 6.6 per cent of gross domestic product (GDP) in the outgoing fiscal year (2017-18), the highest in five year term of PML-N government. The PML-N government had revised the initial target of reducing the budget deficit from 4.1pc of GDP to 5.5pc for the outgoing fiscal year, but it failed to achieve both targets by a wide margin. Three provincial governments also failed to present surplus budgets during the period under review. After coming into power, PML-N government held out an assurance to the International Monetary Fund (IMF) to decrease fiscal deficit from 8pc in 2012-13 to 3.5pc within the next three years. In retrospect, the actual fiscal deficit ended up at 5.5pc in 2013-14, 5.3pc in 2014-15 and 4.6pc in 2015-16.

Asian shares rose early on Monday, taking support from Wall Street’s gains on Friday after U.S. Federal Reserve Chairman Jerome Powell said a gradual approach to raising rates was best to protect the U.S. economy and job growth. In early Asian trade on Monday, S&P500 E-mini futures ESc1 touched a record high of 2,885, and were last 0.2 percent higher at 2,882.5. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was up 0.1 percent, while Japan's Nikkei stock index .N225 gained 0.6 percent.

The Islamabad Chamber of Small Traders on Sunday said the country would need almost $9.25 in debt repayments during the current fiscal which would be a challenge. The amount needed to pay foreign debts and interest is almost equal to the forex reserves held by the central banks warranting foreign loan to keep the country afloat, it said. Serious efforts are needed to control imports otherwise the deficit can jump to $25 billion making it very difficult for the government to manage, said Patron Islamabad Chamber of Small Traders Shahid Rasheed Butt. Increasing interest rates will be a hard decision as it will start contraction in the economy at this critical juncture, he added. Shahid said that the tested recipe for controlling deficit has remained a cut in the developmental spending. However, the government can explore the option of jacking up the slab of 20 percent to 30 percent on imports.

The Punjab government under its five-year (2015-2020) plan will provide some 473,500 olive saplings free of charge for plantation in the Olive Valley this year and the farmers can submit their application in this regard till August 31. The Olive Valley comprises Rawalpindi, Chakwal, Jhelum and Attock districts of Potohar region, besides Mianwali and Khushab districts. According to the Barani Agriculture Research Institute (BARI) Director, the Punjab Agriculture Department had so far managed to plant over one million olive saplings in the Potohar region. The programme was launched aimed at promoting local production of olive oil and curtailing import bill of edible oil sector, he said. He informed that the growers were offered subsidy in accordance with the set rules and procedure and they were bound to fully comply with the recommendations of the Provincial Agriculture Department. For the purpose the department had imported high quality saplings from the best recognized countries for the production of olive, he added.

China-Pakistan's growing socio-economic cooperation will be equally beneficial for giving boost to the agriculture sector, enhancing per acre yield of wheat crop. Farmers in Pakistan are expecting improved crop yields as field trials conducted by a Chinese State-owned enterprise involving hybrid wheat has yielded impressive results. Chinas' Sinochem Group Co, which has interests in chemicals and other agriculture-related services, has conducted field trials of hybrid wheat varieties and realized on average 24.4 percent increase in crop yields, according to company officials. It is also playing an important role in boosting trade ties under the country's innovative Belt and Road Initiative. "The tests on the hybrid varieties were implemented in 230 sites, spread over 2,000 hectares of land, mostly in experimental bases or local farms," said Chen Zhaobo, general manager of CNSGC Hybrid Wheat Seed (Beijing) Company.

Pakistan’s budget deficit has widened to a whopping Rs2.26 trillion or 6.6 per cent of gross domestic product (GDP) in the outgoing fiscal year (2017-18), the highest in five year term of PML-N government. The PML-N government had revised the initial target of reducing the budget deficit from 4.1pc of GDP to 5.5pc for the outgoing fiscal year, but it failed to achieve both targets by a wide margin. Three provincial governments also failed to present surplus budgets during the period under review. After coming into power, PML-N government held out an assurance to the International Monetary Fund (IMF) to decrease fiscal deficit from 8pc in 2012-13 to 3.5pc within the next three years. In retrospect, the actual fiscal deficit ended up at 5.5pc in 2013-14, 5.3pc in 2014-15 and 4.6pc in 2015-16.

Market is expected to remain volatile therefore its recommended to stay cautious while trading during current trading session.

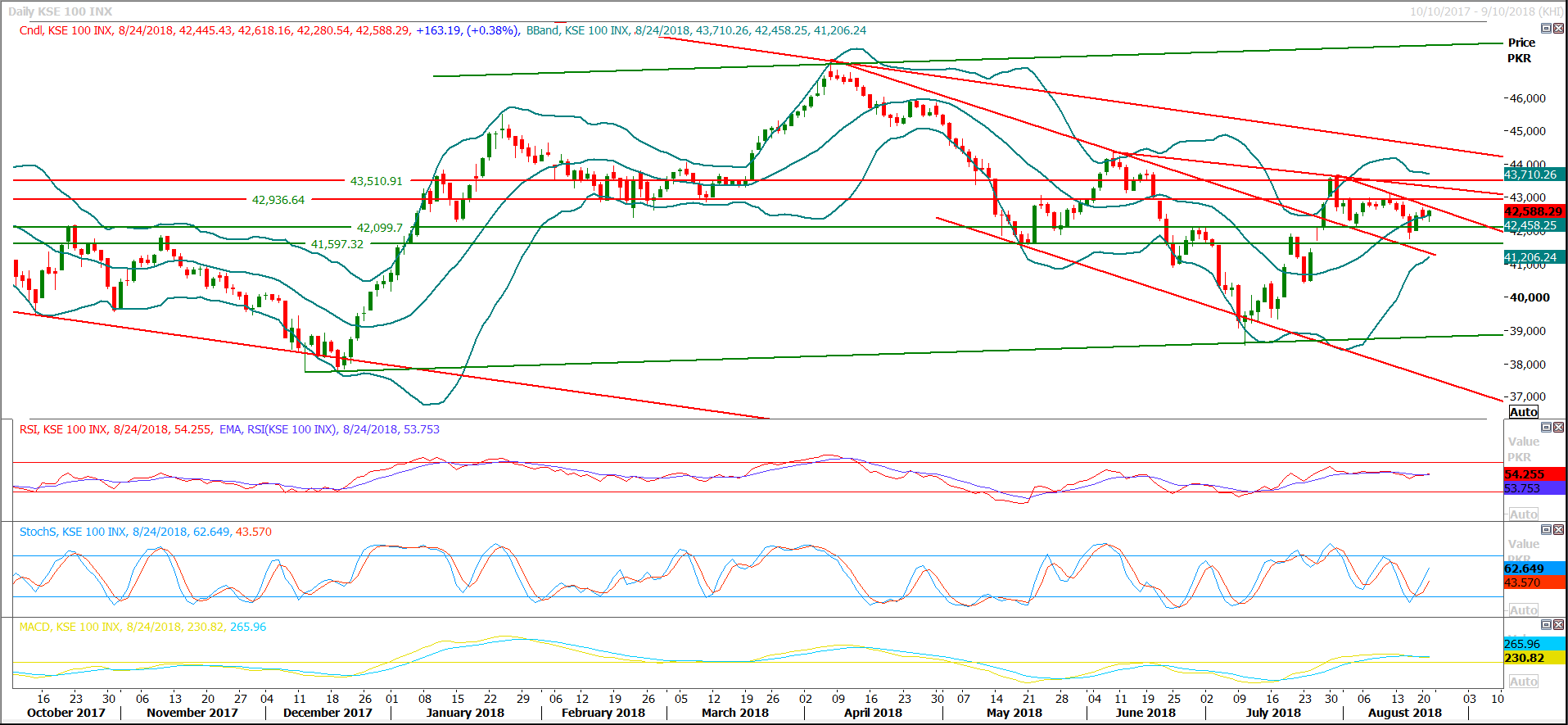

Technical Analysis

The Benchmark KSE100 Index is being capped by a descending trend line on daily chart which falls on 61.8% correction of its latest bearish rally, to close with a positive node index needs to open with a positive gap above said trend line otherwise it’s going to face strong resistance at 42, 660 and 42,940 points on intraday basis. While on the other side supportive regions are standing at 42,089 and 41,800 points. It’s expected that market would remain volatile and an intraday spike could be witnessed which may lead index towards 42,940 points after a positive gap opening therefore its recommended to buy on dip with strict stop loss until index slide below 42,089 points.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.