Previous Session Recap

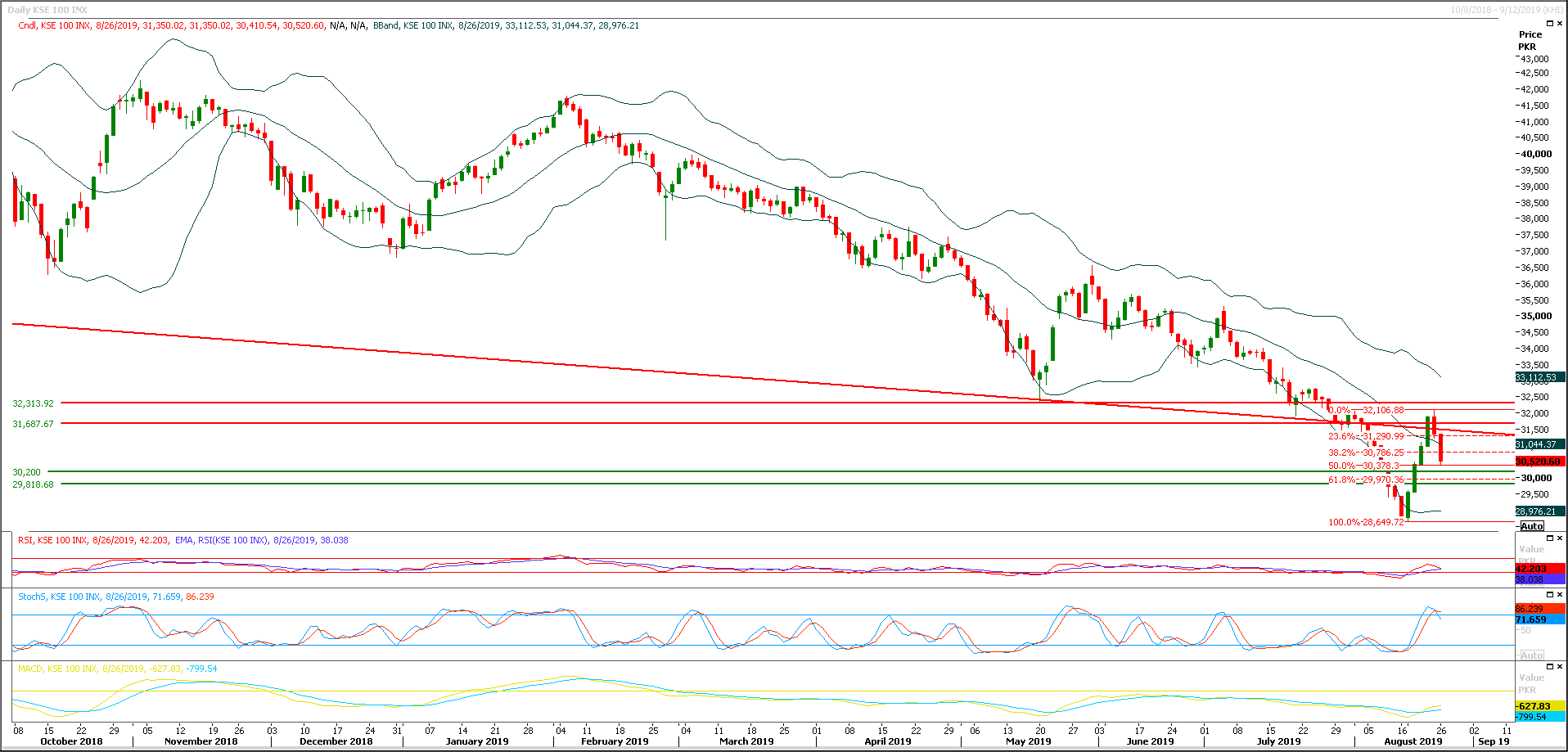

Trading volume at PSX floor dropped by 108.64 million shares or 47.09% on DoD basis, whereas the benchmark KSE100 index opened at 31,310.43, posted a day high of 31,350.02 and a day low of 30,410.54 points during last trading session while session suspended at 30,520.60 points with net change of -829.41 points and net trading volume of 92.66 million shares. Daily trading volume of KSE100 listed companies dropped by 81.71 million shares or 46.86% on DoD basis.

Foreign Investors remained in net buying positions of 2.05 million shares and net value of Foreign Inflow increased by 1.36 million US Dollars. Categorically, Foreign Individual and Foreign Corporate remained in net selling positions of 0.06 and 1.29 million shares but Overseas Pakistani investors remained in net buying positions of 3.39 million shares respectively. While on the other side Local Individuals and NBFCs remained in net long positions of 6.73 and 0.005 million shares but Local Companies, Banks, Mutual Funds, Brokers and Insurance Companies remained in net selling positions of 3.35, 0.50, 3.40, 1.14 and 0.38 million shares respectively.

Analytical Review

Asia stocks, bond yields climb as trade war fears ebb

Asian stocks rose in step with their global peers while safe-haven bonds retreated on Tuesday, as signs Sino-U.S. trade hostilities might be easing for now helped restore investor confidence after the previous session’s rout. Supporting the market mood, U.S. President Donald Trump on Monday flagged the possibility of a trade deal with China and said he believed Beijing was sincere in its desire to reach an agreement. Global markets had been roiled at the start of the week by new tariffs from the world’s two largest economies. MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.3% after dropping 1.3% the previous day. The Shanghai Composite Index advanced 1%. South Korea’s KOSPI added 0.8% and Japan’s Nikkei rose 1.1%. Equity markets may have found traction for now but the longer-term outlook for risk assets, buffeted repeatedly by trade concerns, remained shaky. “There is still a large element of uncertainty regarding the U.S.-China trade dispute. It remains difficult to foresee a resolution, and this will continue to weigh on equity market sentiment,” said Shusuke Yamada, chief Japan FX and equity strategist at Bank Of America Merrill Lynch.

PM sets up body to help meet FATF targets

Prime Minister Imran Khan has set up a high-powered 12-member National Financial Action Task Force (FATF) Coordination Committee to ensure execution of all FATF-related tasks till Dec 1. Led by Minister for Economic Affairs Division Hammad Azhar, the committee comprises federal secretaries of finance, foreign affairs and interior besides heads of all the institutions and regulators concerned with money laundering and terror financing. They include the governor of the State Bank of Pakistan (SBP), chairman of Securities and Exchange Commission of Pakistan (SECP), director general of the Federal Investigation Agency (FIA), member (customs) of the Federal Board of Revenue (FBR) and DG of the Financial Monitoring Unit (FMU). The committee also has three senior officials from the military’s General Headquarters (GHQ).

7th Pak-China Business Forum-Industrial Expo from Sept 2

President Dr Arif Alvi is likely to inaugurate three-day ‘7th Pak-China Business Forum-Industrial Expo 2019’ being held at the Lahore Expo Centre from September 02 to 04, 2019. China Chamber of Commerce for Import and Export of Machinery and Electronic Product (CCCME), Qingdao Overseas Investment Services Centre (QOISC), COMSATS University and Federation of Pakistan Chambers of Commerce & Industry (FPCCI) are jointly hosting the event with theme ‘Building Knowledge-driven Worldwide Business Cooperation platform for Pakistan.’ Chief Minister Punjab Usman Buzdar is scheduled to host a gala dinner in honour of participants of this mega exhibition. Governor Punjab Chaudhry Muhammad Sarwar, Punjab Industries Minister Malik Aslam Iqbal and other dignitaries will be chairing different technical sessions.

LCCI launches Classified Directory of Trade & Industry

Lahore Chamber of Commerce & Industry on Monday launched “LCCI Classified Directory of Trade & Industry – 2019”. LCCI President Almas Hyder launched the document which has vast range of business data along with Senior Vice President Khawaja Shahzad Nasir and Vice President Faheem-ur-Rehman Saigal. Executive Committee members were also present on the occasion. The directory has the data of 4017 manufacturers, 4119 exporters, 7383 importers, 3693 traders, 44 indenting agents and 5827 from services sector. The directory will prove an essential reference for every firm having business interests.

China lets yuan sink, Trump says serious talks to start

China allowed its yuan to sink on Monday while US President Donald Trump said the two sides will talk “very seriously” about their war over trade and technology following tit-for-tat tariff hikes and Trump’s threat to order American companies to stop doing business with China. The escalations prompted warnings that the chances of a settlement of the fight that threatens to tip the global economy into recession were disappearing. But Trump, speaking at the Group of Seven (G7) meeting of major economies in France, said serious negotiations would begin. “We are going to start talking very seriously,” Trump said. He said the Chinese “mean business”. Trump gave no details. Negotiators already were scheduled to meet next month in Washington following talks in Shanghai in July that ended with no signs of progress.

Asian stocks rose in step with their global peers while safe-haven bonds retreated on Tuesday, as signs Sino-U.S. trade hostilities might be easing for now helped restore investor confidence after the previous session’s rout. Supporting the market mood, U.S. President Donald Trump on Monday flagged the possibility of a trade deal with China and said he believed Beijing was sincere in its desire to reach an agreement. Global markets had been roiled at the start of the week by new tariffs from the world’s two largest economies. MSCI’s broadest index of Asia-Pacific shares outside Japan was up 0.3% after dropping 1.3% the previous day. The Shanghai Composite Index advanced 1%. South Korea’s KOSPI added 0.8% and Japan’s Nikkei rose 1.1%. Equity markets may have found traction for now but the longer-term outlook for risk assets, buffeted repeatedly by trade concerns, remained shaky. “There is still a large element of uncertainty regarding the U.S.-China trade dispute. It remains difficult to foresee a resolution, and this will continue to weigh on equity market sentiment,” said Shusuke Yamada, chief Japan FX and equity strategist at Bank Of America Merrill Lynch.

Prime Minister Imran Khan has set up a high-powered 12-member National Financial Action Task Force (FATF) Coordination Committee to ensure execution of all FATF-related tasks till Dec 1. Led by Minister for Economic Affairs Division Hammad Azhar, the committee comprises federal secretaries of finance, foreign affairs and interior besides heads of all the institutions and regulators concerned with money laundering and terror financing. They include the governor of the State Bank of Pakistan (SBP), chairman of Securities and Exchange Commission of Pakistan (SECP), director general of the Federal Investigation Agency (FIA), member (customs) of the Federal Board of Revenue (FBR) and DG of the Financial Monitoring Unit (FMU). The committee also has three senior officials from the military’s General Headquarters (GHQ).

President Dr Arif Alvi is likely to inaugurate three-day ‘7th Pak-China Business Forum-Industrial Expo 2019’ being held at the Lahore Expo Centre from September 02 to 04, 2019. China Chamber of Commerce for Import and Export of Machinery and Electronic Product (CCCME), Qingdao Overseas Investment Services Centre (QOISC), COMSATS University and Federation of Pakistan Chambers of Commerce & Industry (FPCCI) are jointly hosting the event with theme ‘Building Knowledge-driven Worldwide Business Cooperation platform for Pakistan.’ Chief Minister Punjab Usman Buzdar is scheduled to host a gala dinner in honour of participants of this mega exhibition. Governor Punjab Chaudhry Muhammad Sarwar, Punjab Industries Minister Malik Aslam Iqbal and other dignitaries will be chairing different technical sessions.

Lahore Chamber of Commerce & Industry on Monday launched “LCCI Classified Directory of Trade & Industry – 2019”. LCCI President Almas Hyder launched the document which has vast range of business data along with Senior Vice President Khawaja Shahzad Nasir and Vice President Faheem-ur-Rehman Saigal. Executive Committee members were also present on the occasion. The directory has the data of 4017 manufacturers, 4119 exporters, 7383 importers, 3693 traders, 44 indenting agents and 5827 from services sector. The directory will prove an essential reference for every firm having business interests.

China allowed its yuan to sink on Monday while US President Donald Trump said the two sides will talk “very seriously” about their war over trade and technology following tit-for-tat tariff hikes and Trump’s threat to order American companies to stop doing business with China. The escalations prompted warnings that the chances of a settlement of the fight that threatens to tip the global economy into recession were disappearing. But Trump, speaking at the Group of Seven (G7) meeting of major economies in France, said serious negotiations would begin. “We are going to start talking very seriously,” Trump said. He said the Chinese “mean business”. Trump gave no details. Negotiators already were scheduled to meet next month in Washington following talks in Shanghai in July that ended with no signs of progress.

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 index have continued its bearish momentum below its initial supportive region of 31,200 points during last trading session have fall around 50% of its previous bullish rally in just two days. As of now index would try to find ground between 30.200 to 29,700 points but closing below 29,700 points would push index further downward and may lead it towards a new low of 27,400 points. While on flipside it would face resistances at 30,800 and 31,200 in case of any reversal. It's recommended to stay cautious because some volatile could be witnessed in index and if it would not succeed in penetration below 30,000 points then a sharp pull back would be witnessed.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.