Previous Session Recap

Trading volume at PSX floor dropped by 44.68 million shares or 20.05% on DoD basis, whereas, the benchmark KSE100 Index opened at 39524.24, posted a day high of 39719.13 and a day low of 339293.37 during last trading session. The session suspended at 39525.75 with net change of 54.86 and net trading volume of 89.19 million shares. Daily trading volume of KSE100 listed companies dropped by 9.3 million shares or 9.45% on DoD basis.

Foreign Investors remained in net buying position of 3.69 million shares and net value of Foreign Inflow increased by 1.18 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistanis remained in net selling positions of 0.15 and 0.53 million shares but Foreign Corporate Investors remained in net buying position of 4.38 million shares. While on the other side Local Individuals, Companies, Banks and NBFCs remained in net selling positions of 5.84, 2.9, 3.58 and 0.22 million shares respectively but Mutual Funds, Brokers and Insurance Companies remained in net buying positions of 3.29, 2.38 and 1.98 million shares respectively.

Analytical Review

Oil prices were supported around a 2-1/2 year top on Wednesday after an explosion of a Libyan crude pipeline sparked supply fears while gold and copper hovered near multi-week highs, boosting commodity- and energy-linked shares around Asia. Trading was generally thin across the board in a holiday-shortened week. MSCI’s broadest index of Asia-Pacific shares outside Japan edged up 0.1 percent to the highest since late November. For the year so far, the index has added 31.6 percent. The rally in oil and metals prices helped Asian stocks overcome overnight losses on Wall Street led by a tumble in Apple Inc. Australian shares advanced 0.3 percent on Wednesday to a near decade high of 6,092.8 points, with materials and energy sectors leading gains.

With a continuously shrinking demand-supply gap, the government launched on Tuesday a mobile phone application to let consumers know real-time electricity billing and supply situation of any public-sector distribution company (Disco). Speaking at the launch of Roshan Pakistan, an Android-based mobile app, Minister for Power Awais Ahmad Khan Leghari said the government focused on building generation capacity during its first four years and would now move towards consumer-oriented services and transparency.

Senate Chairman Mian Raza Rabbani said on Tuesday foreign loans come with strings as lenders’ conditions infringe upon national sovereignty. If a nation has a choice, then it should opt for increasing exports by promoting the indigenous industry and making it competitive, he said while addressing the 41st Export Awards ceremony of the Federation of Pakistan Chambers of Commerce and Industry (FPCCI). “I’d suggest that if we have a choice between exports and foreign loans, then we should go for the former in order to safeguard our sovereignty,” he maintained.

Logjam in economic progress and serious economic challenges have made the role of Ministry of Finance most important. State Minister for Finance Rana Afzal Khan will have to put in his best efforts to put economy back on the rails and to tackle the economic threats like unimpressive exports, rising imports, huge trade deficit, rupee devaluation and mammoth debts. While congratulating Rana Afzal Khan for his elevation as state minister for finance , LCCI President Malik Tahir Javaid called for immediate measures to improve the economic signals and socio-economic structure of the country. “We don’t want to be critics, we want economic progress and prosperity of the country and for this purpose, just right directions are needed to be set in consultation with the stakeholders”, he said. While giving some proposals to the MoF, LCCI President Malik Tahir Javaid said that consultation in policy making will bring economy out of mire therefore stakeholders must be taken on board on economic matters. He said that private sector should be facilitated and plan should be evolved to improve declining exports.

The Lahore Electric Supply Company has failed to ensure zero loadshedding despite having surplus power supply from national grid, as forced electricity shutdowns continued in various parts of provincial capital. According to Lesco officials, power allocation from the national grid for the company is around 2000MW while demand is up to 1700MW but power breakdowns of at least two to three hours have been reported in a number of areas. Consumers refuted the claims of the federal government that over 65 per cent population of the country would be free of loadshedding, stating that more than 42pc of the feeders across the country were facing loadshedding.

NML, ENGRO, POL and PSO may lead the index in positive direction

Technical Analysis

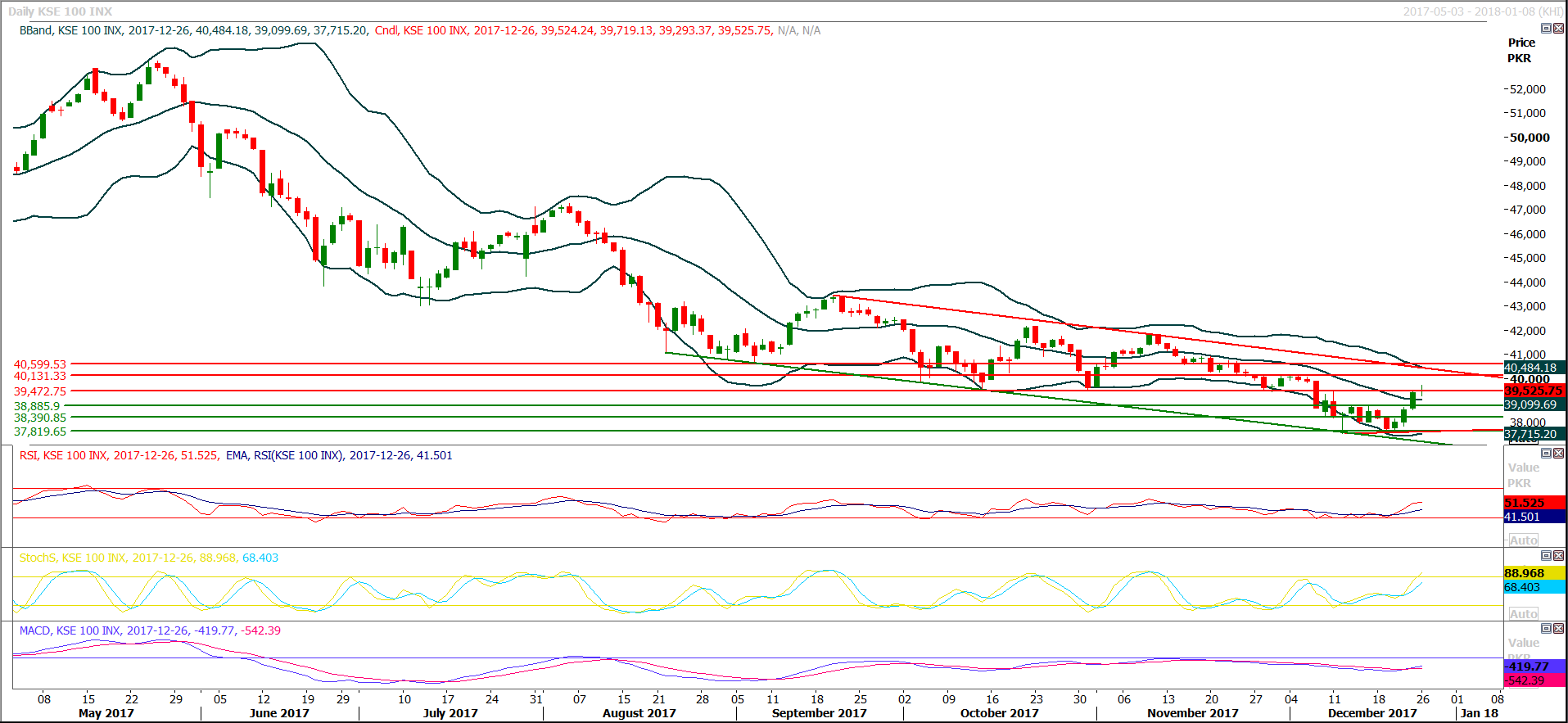

The Benchmark KSE100 Index have bounced back after posting a double botton on weekly chart during last trading week and have closed above its first resistance of 39100 points while the second and third major resistant regions are ahead at 39900 and 40150 points. Its expected that index would open with a positive gap and would try to move towards 40150 during this week where inidex would face a major resistance. Index have created a weekly bullish engulfing pattern and weekly stochastic and MAORSI have generated bullish crossover which would push index in bullish direction. Its recommended to buy on dip and sell on strength during current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.