Previous Session Recap

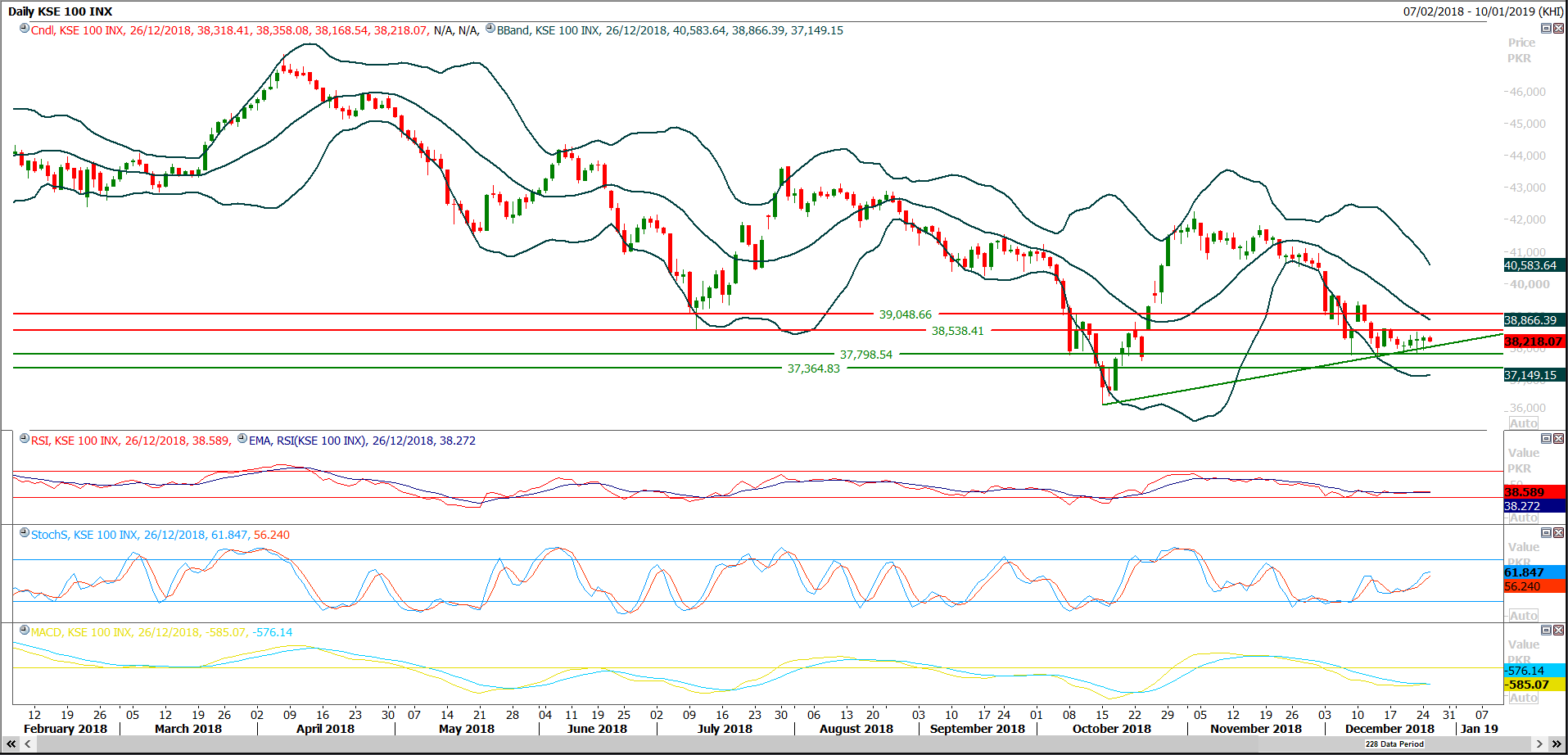

Trading volume at PSX floor Increased by 13.91 million shares or 18.64% on DOD basis whereas the Benchmark KSE100 index opened at 38,323.00, posted a day high of 38,358.08 and day low of 37.168.54 during last trading session while session suspended at 38,218.07 points with net change of -90.85 points and net trading volume of 61.08 million shares. Daily trading volume of KSE100 listed companies Increased by 3.39 million shares or 5.88% on DOD basis.

Foreign Investors remained in net selling positions of 1.41 million shares and net value of Foreign Inflow dropped by 0.34 million US Dollars. Categorically, Foreign Individuals remained in net buying positions of 0.06 million shares but Foreign Corporate and Overseas Pakistanis investors remained in net selling positions of 0.39 and 1.09 million shares. While on the other side Local Individuals, Local Companies, NBFCs and Brokers remained in net buying positions of 5.88, 0.08, 0.86 and 3.74 million shares respectively but Banks, Mutual Fund and Insurance Companies remained in net selling positions of 0.61, 2.78 and 4.73 million shares.

Analytical Review

Asian shares ride Wall Street surge, oil rally

Asian shares on Thursday latched on to a dramatic surge on Wall Street as markets, battered by a recent drum roll of deepening political and economic gloom, cheered upbeat U.S. data and the Trump administration’s effort to shore up investor confidence. In a buying frenzy that was as spectacular as the recent rout, U.S. stocks soared with the Dow Jones Industrial Average rocketing more than 1,000 points for the first time on Wednesday.

CCoP approves sell-off of NPPMCL, MPCL

The Cabinet Committee on Privatization (CCoP) has approved the privatisation of National Power Parks Management Company (NPPMCL) and Mari Petroleum Company Ltd. The CCoP meeting, which was chaired by Finance Minister Asad Umar, discussed the privatization programme. Secretary Privatization Division gave the meeting an update on privatisation process of public sector entities on the active privatization list including RLNG Power Plants (Balloki and Haveli Bahadurshah) under National Power Parks Management Company (NPPMCL), Lakhra Coal Mines and Services International Hotel. Matters relating to divestment of Govt’s residual shares in Mari Petroleum Company also came under discussion.

Trade Agreement-II with China likely in June

Advisor to the Prime Minister on Commerce Abdul Razzaq Dawood Wednesday said Trade Agreement-II was expected with China by June next year while efforts were also on to get access to Korean markets. China would hopefully open its markets for Pakistani products while efforts were also being made to ensure greater access to other international markets, he was quoted by Radio Pakistan while talking to media persons.

Urea, DAP sales fall on high prices

Urea and di-ammonium phosphate (DAP) sales have dropped in November mainly because of high rates but the situation is expected to change in the current month due to Rabi crop demand. The figures released by National Fertiliser Development Centre (NFDC) shows total urea offtake was recorded at 497,000 tonnes in November, showing a decline of 17.4 per cent year-on-year.

Govt to ensure uninterrupted gas supply

The government on Wednesday decided to ensure “uninterrupted” supply of gas to domestic consumers, commercial units and zero-rated industries this winter and impose a ban on import of furnace oil. The decisions were taken at a meeting of the Cabinet Committee on Energy (CCoE) presided over by Prime Minister Imran Khan at the Prime Minister Office.

Asian shares on Thursday latched on to a dramatic surge on Wall Street as markets, battered by a recent drum roll of deepening political and economic gloom, cheered upbeat U.S. data and the Trump administration’s effort to shore up investor confidence. In a buying frenzy that was as spectacular as the recent rout, U.S. stocks soared with the Dow Jones Industrial Average rocketing more than 1,000 points for the first time on Wednesday.

The Cabinet Committee on Privatization (CCoP) has approved the privatisation of National Power Parks Management Company (NPPMCL) and Mari Petroleum Company Ltd. The CCoP meeting, which was chaired by Finance Minister Asad Umar, discussed the privatization programme. Secretary Privatization Division gave the meeting an update on privatisation process of public sector entities on the active privatization list including RLNG Power Plants (Balloki and Haveli Bahadurshah) under National Power Parks Management Company (NPPMCL), Lakhra Coal Mines and Services International Hotel. Matters relating to divestment of Govt’s residual shares in Mari Petroleum Company also came under discussion.

Advisor to the Prime Minister on Commerce Abdul Razzaq Dawood Wednesday said Trade Agreement-II was expected with China by June next year while efforts were also on to get access to Korean markets. China would hopefully open its markets for Pakistani products while efforts were also being made to ensure greater access to other international markets, he was quoted by Radio Pakistan while talking to media persons.

Urea and di-ammonium phosphate (DAP) sales have dropped in November mainly because of high rates but the situation is expected to change in the current month due to Rabi crop demand. The figures released by National Fertiliser Development Centre (NFDC) shows total urea offtake was recorded at 497,000 tonnes in November, showing a decline of 17.4 per cent year-on-year.

The government on Wednesday decided to ensure “uninterrupted” supply of gas to domestic consumers, commercial units and zero-rated industries this winter and impose a ban on import of furnace oil. The decisions were taken at a meeting of the Cabinet Committee on Energy (CCoE) presided over by Prime Minister Imran Khan at the Prime Minister Office.

Market is expected to remain volatile during current trading session therefore it's recommended to stay cautious while trading

Technical Analysis

The Benchmark KSE100 Index is getting support from a rising trend line since last week and has succeeded in maintaining its major supportive region of 37,700 points during last and current week as well. Daily and hourly momentum indicators are still bearish which could add pressure on index if it would not succeed in penetration of 38,500 points in upward direction. Index would face strong resistances at 38,500 and 38,860 points during current trading session. It’s recommended to stay cautious during trading session because market is expected to remain volatile.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.