Previous Session Recap

Trading volume at PSX floor Increased by 0.61 million shares or 0.26% on DoD basis, whereas the benchmark KSE100 index opened at 40,328.32, posted a day high of 41,148.72 and a day low of 40,328.32 points during last trading session while session suspended at 41,127.79 points with net change of 799.47 points and net trading volume of 132.02 million shares. Daily trading volume of KSE100 listed companies dropped by 3.28 million shares or 2.43% on DoD basis.

Foreign Investors remained in net selling positions of 1.85 million shares and value of Foreign Inflow dropped by 1.57 million US Dollars. Categorically, Foreign Individuals, Corporate and Overseas Pakistanis remained in net selling positions of 0.34, 0.77 and 0.74 million shares. While on the other side Local Companies, Banks, NBFCs and Brokers and remained in net selling positions of 15.53, 11.51, 0.72 and 22.04 million shares but Local Individuals, Mutual Fund and Insurance Companies remained in net buying positions of 41.33, 10.08 and 0.22 million shares respectively.

Analytical Review

Asian shares hit 18-month top in festive cheer; oil, gold hold gains

Asian shares jumped to an 18-month high on Friday while gold and oil prices stayed buoyant in a holiday-shortened week, as investor optimism was boosted by hopes a U.S.-China trade deal would soon be signed. Traders returned from their Christmas and Boxing Day break to digest comments from Beijing that it was in close contact with Washington about an initial trade agreement, shortly after U.S. President Donald Trump talked up a signing ceremony for the recently struck Phase 1 trade deal. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS jumped 0.55% to 555.25, a level not seen since mid-2018. It is up about 16% so far this year. Japan's Nikkei .N225 was flat, but on track for a near 20% rise this year, biggest annual increase since 2013. The country’s industrial output slipped for a second straight month in November in another sign the economy is cooling. Japan has approved a record budget for the coming fiscal year, in a bid to shore up growth.

Karachi industrialists lambaste gas shortages

Leaders representing Karachi Industrial Forum and members of different textile bodies have criticised the utility company over its failure to supply gas to industrial units and warned of protests in case the Sui Southern Gas Company (SSGC) failed to restore gas at normal pressure. Addressing a press conference at the Karachi Press Club on Thursday, they said that by curtailing gas supply to Karachi industry, around 57 per cent of country’s industries have been affected in addition to hindering 54pc of the total exports. The gas crisis is bound to hurt country’s exports because in the forthcoming Heimtextil, Frankfurt — the world’s biggest textile exhibition — exporters would be unable to enter into contracts due to gas shortages. Moreover, they said that on one hand the government is not providing gas to the industrial whereas on the other, it is hinting at increasing gas and power tariffs further.

Nepra approves Rs1.56 per unit hike in power tariff

The National Electric Power Regulatory Authority (Nepra) on Thursday approved an increase of Rs1.56 per unit in power tariff on account of fuel adjustment cost of electricity consumed in October. The Central Power Purchasing Agency (CPPA) had sought an increase of Rs1.73 per unit. The raise will put an additional burden of Rs14.50 billion on electricity consumers. The government has again put on operation furnace oil plants owing to lesser availability of gas to produce electricity. On Thursday, Nepra chairman Tausif H. Farooq presided over a public hearing on a request for increase in power tariff in the wake of CPPA’s monthly fuel adjustments. Nepra does monthly and quarterly adjustments in power tariff.

PMA claims govt misleading nation about drug price cut

The Pakistan Medical Association (PMA) has accused the Ministry of National Health Services (NHS) of misleading the nation by claiming that the federal cabinet has reduced prices of 89 medicines at its meeting held on Dec 24. The representative body of doctors said it was a six-month-old decision which had been announced again after the recent cabinet meeting. It also shared a notification of the Ministry of NHS, dated June 19, in which pharmaceutical companies were directed to reduce prices of 89 medicines. However, the Ministry of NHS has denied the allegation and claimed that six months ago just an advisory had been issued regarding reduction in prices of drugs and now finally the government had taken the decision to reduce prices.

IMF releases second tranche of $454m

The government on Thursday received second tranche of $454 million from the International Monetary Fund (IMF). The transfer will be added to the State Bank’s foreign exchange reserves next week. However, during the week ending Dec 20, the SBP’s reserves increased by $14m to $10.907 billion. On the other hand, reserves held by the commercial banks decreased by $74.7m bringing the country’s total reserves down to $17.595bn.

Asian shares jumped to an 18-month high on Friday while gold and oil prices stayed buoyant in a holiday-shortened week, as investor optimism was boosted by hopes a U.S.-China trade deal would soon be signed. Traders returned from their Christmas and Boxing Day break to digest comments from Beijing that it was in close contact with Washington about an initial trade agreement, shortly after U.S. President Donald Trump talked up a signing ceremony for the recently struck Phase 1 trade deal. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS jumped 0.55% to 555.25, a level not seen since mid-2018. It is up about 16% so far this year. Japan's Nikkei .N225 was flat, but on track for a near 20% rise this year, biggest annual increase since 2013. The country’s industrial output slipped for a second straight month in November in another sign the economy is cooling. Japan has approved a record budget for the coming fiscal year, in a bid to shore up growth.

Leaders representing Karachi Industrial Forum and members of different textile bodies have criticised the utility company over its failure to supply gas to industrial units and warned of protests in case the Sui Southern Gas Company (SSGC) failed to restore gas at normal pressure. Addressing a press conference at the Karachi Press Club on Thursday, they said that by curtailing gas supply to Karachi industry, around 57 per cent of country’s industries have been affected in addition to hindering 54pc of the total exports. The gas crisis is bound to hurt country’s exports because in the forthcoming Heimtextil, Frankfurt — the world’s biggest textile exhibition — exporters would be unable to enter into contracts due to gas shortages. Moreover, they said that on one hand the government is not providing gas to the industrial whereas on the other, it is hinting at increasing gas and power tariffs further.

The National Electric Power Regulatory Authority (Nepra) on Thursday approved an increase of Rs1.56 per unit in power tariff on account of fuel adjustment cost of electricity consumed in October. The Central Power Purchasing Agency (CPPA) had sought an increase of Rs1.73 per unit. The raise will put an additional burden of Rs14.50 billion on electricity consumers. The government has again put on operation furnace oil plants owing to lesser availability of gas to produce electricity. On Thursday, Nepra chairman Tausif H. Farooq presided over a public hearing on a request for increase in power tariff in the wake of CPPA’s monthly fuel adjustments. Nepra does monthly and quarterly adjustments in power tariff.

The Pakistan Medical Association (PMA) has accused the Ministry of National Health Services (NHS) of misleading the nation by claiming that the federal cabinet has reduced prices of 89 medicines at its meeting held on Dec 24. The representative body of doctors said it was a six-month-old decision which had been announced again after the recent cabinet meeting. It also shared a notification of the Ministry of NHS, dated June 19, in which pharmaceutical companies were directed to reduce prices of 89 medicines. However, the Ministry of NHS has denied the allegation and claimed that six months ago just an advisory had been issued regarding reduction in prices of drugs and now finally the government had taken the decision to reduce prices.

The government on Thursday received second tranche of $454 million from the International Monetary Fund (IMF). The transfer will be added to the State Bank’s foreign exchange reserves next week. However, during the week ending Dec 20, the SBP’s reserves increased by $14m to $10.907 billion. On the other hand, reserves held by the commercial banks decreased by $74.7m bringing the country’s total reserves down to $17.595bn.

Market is expected to remain volatile during current trading session.

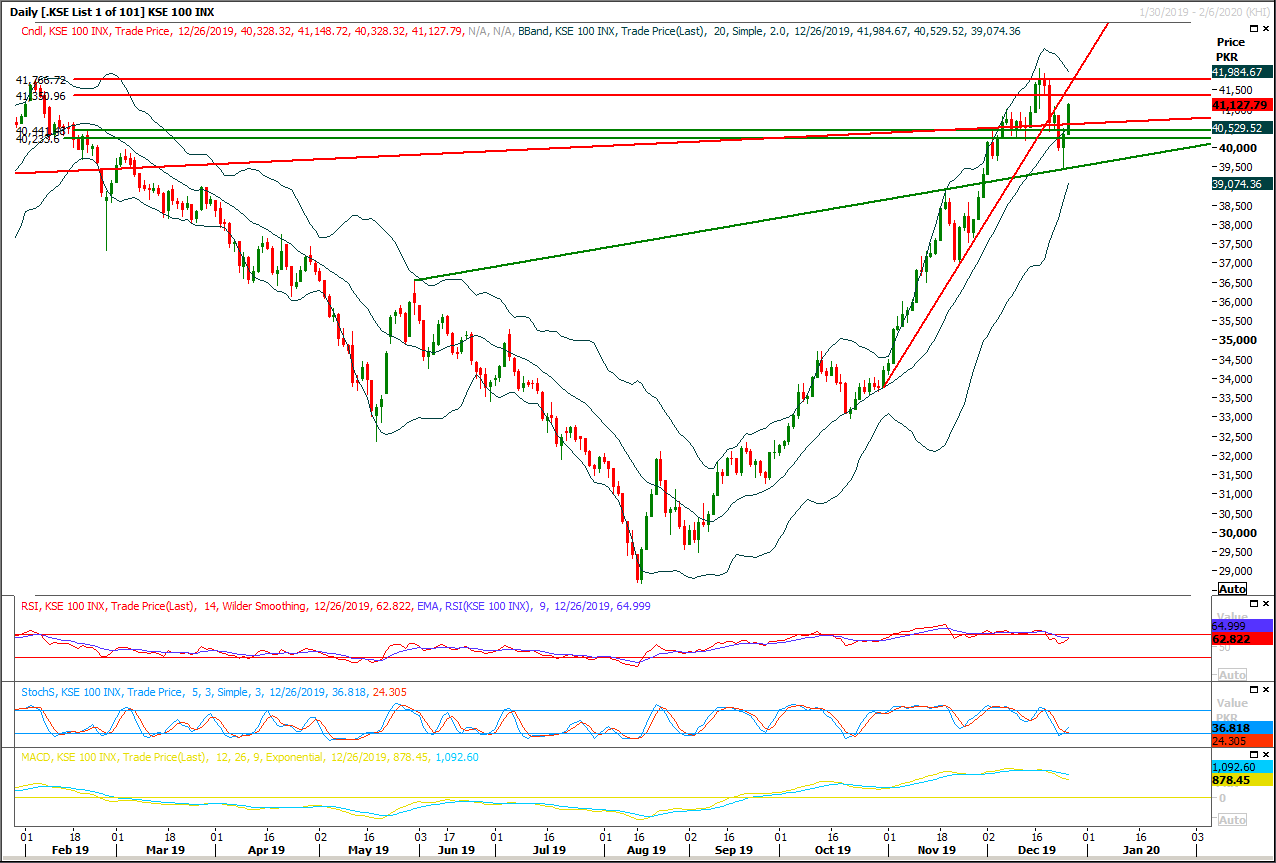

Technical Analysis

The Benchmark KSE100 index have came back to retest breakout of its previous bullish wedge on daily chart and now its reaching correction levels of its bearish run as well. A daily morning star is taking place on chart but it needs confirmation by closing above 41,350 points. While Index would also face strong resistances between 41,350 and 41,760 points where it would face double top at a horizontal resistance. It's recommended to stay cautious and start profit taking on existing long positions but it's recommended to wait for a confirmation before initiating short positions because if index would not succeed in closing above 41,760 points then it would got a harder push in downward direction.

While on flip side breakout above 41,760 points would call for further advance rally towards 42,200 and 42,800 points but it would need some fresh volume because index is going to create a third hammer in this region and it indicates that a serious fight is taking place between bulls and bears in this region.

While on flip side breakout above 41,760 points would call for further advance rally towards 42,200 and 42,800 points but it would need some fresh volume because index is going to create a third hammer in this region and it indicates that a serious fight is taking place between bulls and bears in this region.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.