Previous Session Recap

Trading volume at PSX floor increased by 23.60 million shares or 18.97% on DoD basis, whereas the benchmark KSE100 index opened at 38,964.79, posted a day high of 38,976.83 and a day low of 38,074.16 points during last trading session while session suspended at 38,349.72 points with net change of -520.12 points and net trading volume of 118.39 million shares. Daily trading volume of KSE100 listed companies also increased by 23.92 million shares or 25.32% on DoD basis.

Foreign Investors remained in net selling positions of 4.81 million shares and value of Foreign Inflow dropped by 2.54 million US Dollars. Categorically, Foreign Individuals remained in net long positions of 0.025 million shares but Foreign Corporate and Overseas Pakistani remained in net selling positions of 4.05 and 0.78 million shares respectively. While on the other side Banks, NBFCs, Mutual Fund, Brokers Insurance Companies remained in net long positions of 1.32, 0.11, 1.44, 1.28 and 6.41 million shares but Local Individuals and Companies remained in net selling positions of 3.28 and 2.59 million shares. respectively.

Analytical Review

Oil falls for fifth day as coronavirus spreads outside of China

Oil prices fell for a fifth day on Thursday to their lowest since January 2019 as a growing number of new coronavirus cases outside of China deepened fears that the global economy will slow and lower crude demand. Brent crude LCOc1 was down 77 cents, or 1.4% at $52.66 a barrel at 0204 GMT. The contract earlier fell to its lowest since Jan. 4, 2019. West Texas Intermediate (WTI) futures CLc1 fell by 80 cents, or 1.6%, to $47.93 a barrel. The contract earlier fell to its lowest since Jan. 2, 2019. Brent prices have dropped 11% in the past five trading sessions through Thursday, the biggest five-day percentage loss since August 2019. WTI has declined 10.8% over the same period, also the biggest five-day percentage drop since August 2019.

Exporters’ key demands on energy tariff accepted

The government on Wednesday accepted major demands of the export sector, including the textile industry, particularly relating to energy sector tariff. Under an agreement, the zero-rated industries, including textiles, would be provided electricity at an all-inclusive rate of 7.5 cents per unit (kWh) and gas at $6.5 per unit (million British thermal unit or mmBtu) until June 30 this year. The government would also immediately withdraw electricity bills issued to the export sector with effect from January 2019 which had included a series of surcharges, quarterly adjustments and fuel price adjustments, All Pakistan Textile Mills Association (Aptma) chief executive officer Shahid Sattar told Dawn. The combined impact of these decisions was estimated at about Rs50 billion.

Pakistan settles decades-old trade dispute with Russia by paying off $93.5m

Pakistan paid 93.5 million US dollars to Russian companies in a bid to settle decades-old trade dispute between the two countries, the spokesperson of Pakistan's Commerce Ministry said on Wednesday. READ MORE: US sanctions head of Iraq’s Kataib Hezbollah Pakistan used to do import and export business with the Soviet Union, but the trade was suspended after the dissolution of the Soviet Union, leaving dues of some exporters uncleared by Pakistan, said the spokesperson Aisha Humera. On the other hand, some Pakistani exporters also did not get money in the course of time, and now money has been delivered to both Pakistani and Russian businessmen, she added.

PM Delivery Unit overrides Ogra law to stop further gas tariff hikes

Amid rising political pressure owing to prevailing price hike, the Prime Minister Office is seeking a drastic cut to revenue requirements of the two gas utilities for current fiscal year to minimise increase in gas rates. The move is likely to cast negatively on the ongoing talks with the International Monetary Fund (IMF), embarrass Oil and Gas Regulatory Authority (Ogra) that had determined the prescribed gas prices and affect the financial position of the Sui Northern Gas Pipelines Limited and Sui Southern Gas Company Limited. A senior government official told Dawn that the PM Delivery Unit (PMDU) has opposed repeated requests from the Petroleum Division to increase gas tariff by up to 15 per cent in line with requirements of the IMF programme and Ogra law. Prime Minister himself is seeking a freeze on gas and electricity rates for at least remaining period of the current fiscal year.

Govt links Rs4.88/unit hike in K-Electric tariff to ECC’s approval

The government will seek the approval of Economic Coordination Committee (ECC) of the cabinet for the approval of Rs4.88 increase in power tariff for K-Electric consumers under 11 quarterly adjustments, it is learnt reliably here. The government has decided that instead of transferring the burden of 11 quarterly adjustments to the power consumers of K-Electric in a single go and will seek ECC approval for the phase wise hike in power tariff, official sources said. The matter of tariff increase for K-electric on the agenda of ECC meeting, scheduled for today (Wednesday), sources told The Nation.

Oil prices fell for a fifth day on Thursday to their lowest since January 2019 as a growing number of new coronavirus cases outside of China deepened fears that the global economy will slow and lower crude demand. Brent crude LCOc1 was down 77 cents, or 1.4% at $52.66 a barrel at 0204 GMT. The contract earlier fell to its lowest since Jan. 4, 2019. West Texas Intermediate (WTI) futures CLc1 fell by 80 cents, or 1.6%, to $47.93 a barrel. The contract earlier fell to its lowest since Jan. 2, 2019. Brent prices have dropped 11% in the past five trading sessions through Thursday, the biggest five-day percentage loss since August 2019. WTI has declined 10.8% over the same period, also the biggest five-day percentage drop since August 2019.

The government on Wednesday accepted major demands of the export sector, including the textile industry, particularly relating to energy sector tariff. Under an agreement, the zero-rated industries, including textiles, would be provided electricity at an all-inclusive rate of 7.5 cents per unit (kWh) and gas at $6.5 per unit (million British thermal unit or mmBtu) until June 30 this year. The government would also immediately withdraw electricity bills issued to the export sector with effect from January 2019 which had included a series of surcharges, quarterly adjustments and fuel price adjustments, All Pakistan Textile Mills Association (Aptma) chief executive officer Shahid Sattar told Dawn. The combined impact of these decisions was estimated at about Rs50 billion.

Pakistan paid 93.5 million US dollars to Russian companies in a bid to settle decades-old trade dispute between the two countries, the spokesperson of Pakistan's Commerce Ministry said on Wednesday. READ MORE: US sanctions head of Iraq’s Kataib Hezbollah Pakistan used to do import and export business with the Soviet Union, but the trade was suspended after the dissolution of the Soviet Union, leaving dues of some exporters uncleared by Pakistan, said the spokesperson Aisha Humera. On the other hand, some Pakistani exporters also did not get money in the course of time, and now money has been delivered to both Pakistani and Russian businessmen, she added.

Amid rising political pressure owing to prevailing price hike, the Prime Minister Office is seeking a drastic cut to revenue requirements of the two gas utilities for current fiscal year to minimise increase in gas rates. The move is likely to cast negatively on the ongoing talks with the International Monetary Fund (IMF), embarrass Oil and Gas Regulatory Authority (Ogra) that had determined the prescribed gas prices and affect the financial position of the Sui Northern Gas Pipelines Limited and Sui Southern Gas Company Limited. A senior government official told Dawn that the PM Delivery Unit (PMDU) has opposed repeated requests from the Petroleum Division to increase gas tariff by up to 15 per cent in line with requirements of the IMF programme and Ogra law. Prime Minister himself is seeking a freeze on gas and electricity rates for at least remaining period of the current fiscal year.

The government will seek the approval of Economic Coordination Committee (ECC) of the cabinet for the approval of Rs4.88 increase in power tariff for K-Electric consumers under 11 quarterly adjustments, it is learnt reliably here. The government has decided that instead of transferring the burden of 11 quarterly adjustments to the power consumers of K-Electric in a single go and will seek ECC approval for the phase wise hike in power tariff, official sources said. The matter of tariff increase for K-electric on the agenda of ECC meeting, scheduled for today (Wednesday), sources told The Nation.

Market is expected to remain volatile during current trading session.

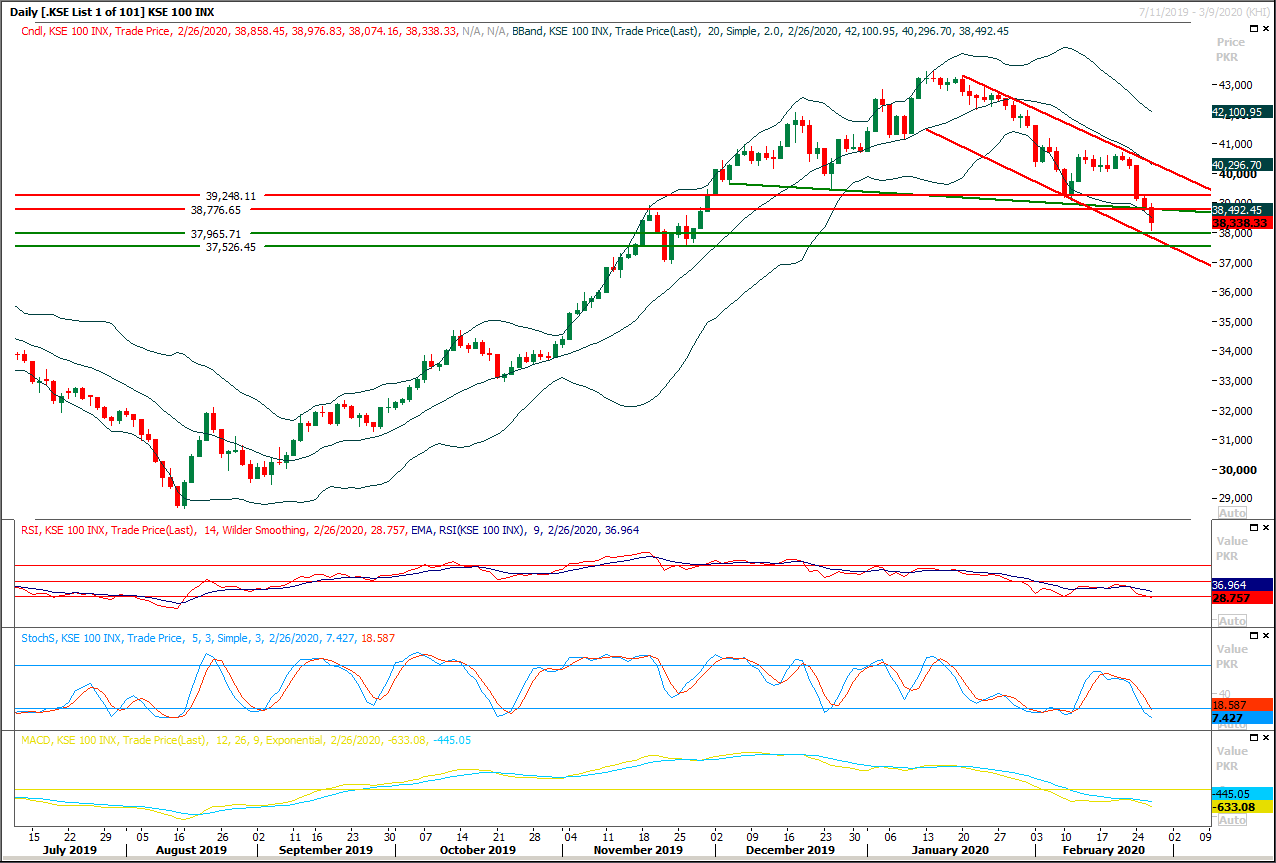

Technical Analysis

The Benchmark KSE100 index have give a clear breakout of its descending wedge in downward direction and now it would try to retest supportive trend line of that wedge as a resistant region therefore an intraday pull back could be witnessed and during this pull back index would face major resistance at 38,770 points where crossover of a horizontal line with a descending trend line would try to push index downward again. It's recommended to stay on selling side and start selling on strength with strict stop loss of 39,250 points because momentum is strongly bearish on weekly and monthly charts and it's expected that a monthly evening shooting star formation would took place which would add more pressure on index in coming days. Meanwhile index have supportive regions ahead at 37,960 points and breakout below that region would call for 37,500 points. This weekly closing below 37,500 points would push index into bearish zone on short to mid-term basis while to recover from current bearish sentiment index need to close above 39,760 points in next two trading sessions.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.