Previous Session Recap

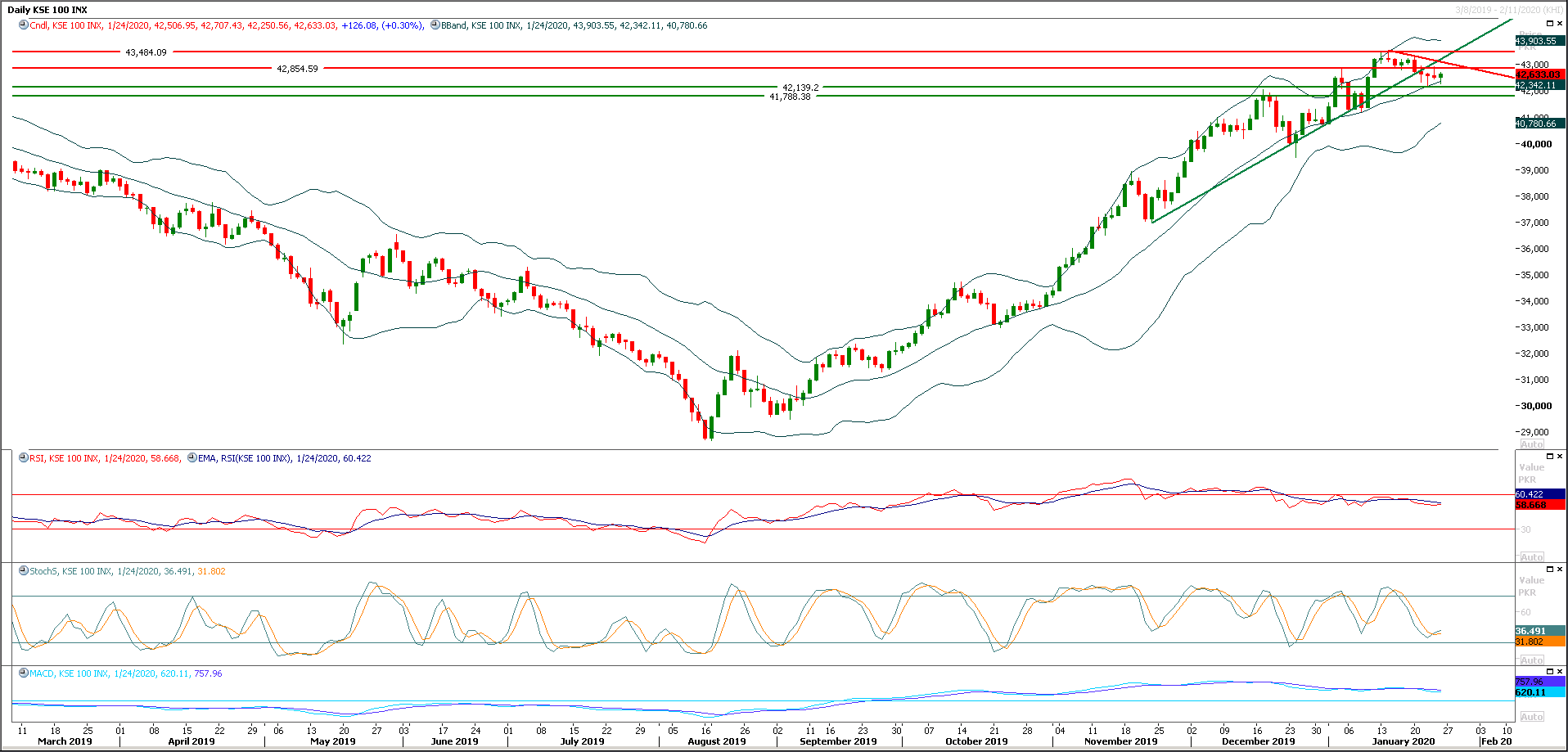

Trading volume at PSX floor dropped by 57.78 million shares or 25.03% on DoD basis, whereas the benchmark KSE100 index opened at 42,506.95, posted a day high of 42,707.43 and a day low of 42,250.56 points during last trading session while session suspended at 42,633.03 points with net change of -126.08 points and net trading volume of 113.68 million shares. Daily trading volume of KSE100 listed companies also dropped by 46.74 million shares or 29.14% on DoD basis.

Foreign Investors remained in net buying positions of 115.56 million shares and net value of Foreign Inflow increased by 6.59 million US Dollars. Categorically, Foreign Individuals and Foreign Corporate remained in net buying positions of 0.27 and 118.14 million shares but Overseas Pakistani investors remained in net buying positions of 2.85 million shares. While on the other side Local Companies and Mutual Fund remained in net buying positions of 20.50 and 10.79 million shares but Local Individuals, Banks, NBFCs, Brokers and Insurance Companies remained in net selling positions of 145.14, 0.07, 0.36, 1.02 and 1.46 million shares respectively.

Analytical Review

Shares, oil slide as China virus fears intensify; yen, Treasuries in demand

Stocks tumbled on Monday as investors grew increasingly anxious about the economic impact of China’s spreading virus outbreak, with demand spiking for safe-haven assets such as the Japanese yen and Treasury notes. Japan's Nikkei average .N225 suffered a steep 1.8% loss, on track for the biggest one-day fall in three weeks. U.S. S&P 500 mini futures ESc1 was last down 0.9%, having fallen 1.3% in early Asian trade. “All you see is headlines about the coronavirus, giving investors a reason to sell the markets,” said Takeo Kamai, head of executions services at CLSA in Tokyo. The ability of the coronavirus to spread is getting stronger and infections could continue to rise, China’s National Health Commission said on Sunday, with more than 2,700 people globally infected and 80 in China killed by the disease.

Pak Customs expands model CMAA, MoUs with numerous countries

An event was held to celebrate International Customs Day in Customs House, Islamabad which was chaired and addressed by FBR Chairman Mr. Syed Shabbar Zaidi, FBR Member (Customs Policy) Mr. Muhammad Javed Ghani also addressed the Customs officers and officials. International Customs Day is celebrated by 183 Customs Administrations of the World on 26th January of every year under the auspices of the World Customs Organization (WCO) that has chosen the theme “Customs fostering sustainability for People, Prosperity, and the Planet” for this year (i.e. 2020). The purpose being to urge upon the customs administrations world over to attach requisite priority to this theme and make practical arrangements to ensure tangible achievements in this regard.

Govt inaction on warnings about shortage caused wheat flour crisis

Unreliable estimation of the size of the wheat crop and delays in taking appropriate decisions are being blamed for a wheat flour crisis that has been in the making for some time, Dawn has learnt from knowledgeable sources. A crisis had already begun to brew as far back as May last year when the authorities were alerted to the possibility of a wheat shortage, but the government took cosmetic measures like imposing a ban on export of the commodity. Even that decision by the Economic Coordination Committee (ECC) of the cabinet about the ban came late in the day after the food security ministry had sent several reminders to it.

Kerb market sees dip in inflows as dollars head to banks

Inflow of dollars in the domestic market has dropped by 40-50 per cent during the month but the currency dealers were not able to identify its exact cause. With the exchange rate largely stable of late, the attraction of dollar business in the country has drastically fallen as currency dealers said they were depositing over 90pc of surplus with the banks. “The inflow of dollars in the open currency market across the country was about $300 million a month earlier, but is now in the range of $150-200m,” said Forex Association of Pakistan President Malik Bostan.

Profit of Pakistan banks soars despite tough economic reforms: CEN

The banking sector topped among businesses which thrived during the present times of economic crisis in Pakistan, reports China Economic Net (CEN). Banks have continued to earn higher profits during these tough times as reflected by increasing spread of every bank – the difference between the interest rate which banks charge from borrowers and the interest rate they pay to the depositors. Higher spreads ensure higher profits to the banks. They are on a rise since the benchmark interest rate resumed its upward trajectory in January 2018. The spreads increased 2.13 percentage points to 5.13% in December 2019 compared to 3% in December 2018, said Arif Habib Limited (AHL) while citing latest data from the central bank. “

Stocks tumbled on Monday as investors grew increasingly anxious about the economic impact of China’s spreading virus outbreak, with demand spiking for safe-haven assets such as the Japanese yen and Treasury notes. Japan's Nikkei average .N225 suffered a steep 1.8% loss, on track for the biggest one-day fall in three weeks. U.S. S&P 500 mini futures ESc1 was last down 0.9%, having fallen 1.3% in early Asian trade. “All you see is headlines about the coronavirus, giving investors a reason to sell the markets,” said Takeo Kamai, head of executions services at CLSA in Tokyo. The ability of the coronavirus to spread is getting stronger and infections could continue to rise, China’s National Health Commission said on Sunday, with more than 2,700 people globally infected and 80 in China killed by the disease.

An event was held to celebrate International Customs Day in Customs House, Islamabad which was chaired and addressed by FBR Chairman Mr. Syed Shabbar Zaidi, FBR Member (Customs Policy) Mr. Muhammad Javed Ghani also addressed the Customs officers and officials. International Customs Day is celebrated by 183 Customs Administrations of the World on 26th January of every year under the auspices of the World Customs Organization (WCO) that has chosen the theme “Customs fostering sustainability for People, Prosperity, and the Planet” for this year (i.e. 2020). The purpose being to urge upon the customs administrations world over to attach requisite priority to this theme and make practical arrangements to ensure tangible achievements in this regard.

Unreliable estimation of the size of the wheat crop and delays in taking appropriate decisions are being blamed for a wheat flour crisis that has been in the making for some time, Dawn has learnt from knowledgeable sources. A crisis had already begun to brew as far back as May last year when the authorities were alerted to the possibility of a wheat shortage, but the government took cosmetic measures like imposing a ban on export of the commodity. Even that decision by the Economic Coordination Committee (ECC) of the cabinet about the ban came late in the day after the food security ministry had sent several reminders to it.

Inflow of dollars in the domestic market has dropped by 40-50 per cent during the month but the currency dealers were not able to identify its exact cause. With the exchange rate largely stable of late, the attraction of dollar business in the country has drastically fallen as currency dealers said they were depositing over 90pc of surplus with the banks. “The inflow of dollars in the open currency market across the country was about $300 million a month earlier, but is now in the range of $150-200m,” said Forex Association of Pakistan President Malik Bostan.

The banking sector topped among businesses which thrived during the present times of economic crisis in Pakistan, reports China Economic Net (CEN). Banks have continued to earn higher profits during these tough times as reflected by increasing spread of every bank – the difference between the interest rate which banks charge from borrowers and the interest rate they pay to the depositors. Higher spreads ensure higher profits to the banks. They are on a rise since the benchmark interest rate resumed its upward trajectory in January 2018. The spreads increased 2.13 percentage points to 5.13% in December 2019 compared to 3% in December 2018, said Arif Habib Limited (AHL) while citing latest data from the central bank. “

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 index is trying to find some ground above supportive region of 42,100 points since last week and now daily momentum indicators have started changing direction towards bullish side and it's expected that index would try to cheat a widely spread concept of evening shooting star during current trading session by moving into positive zone. Overall behavior of index seems bearish or range bound but an intraday spike could be witnessed if index would open with a positive gap. Initially 42,860 points would react as a resistance but breakout above this region would call for 43,000 points where index would need some fresh volumes to move on. Mean while index is also being capped by a descending trend line on daily chart and that line would also resist against bulls around 43,000-43,050 points. It's recommended to post trailing stop loss on both sides because either breakout above 43,000 points or below 42,000 points will call for a rally of 1000 points on either side.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.