Previous Session Recap

Trading volume at PSX floor increased by 63.48 million shares or 33.26% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 42,106.57, posted a day high of 42,123.57 and a day low of 41,696.26 during last trading session. The session suspended at 42,089.16 with net change of 749.94 and net trading volume of 129.86 million shares. Daily trading volume of KSE100 listed companies increased by 22.28 million shares or 20.71% on DoD basis.

Foreign Investors remained in net selling position of 1.44 million shares but net value of Foreign Inflow increased by 0.13 million US Dollars. Categorically, Foreign Corporate remained in net selling positions of 2.22 million shares but Overseas Pakistanis investors remained in net buying positions of 0.78 million shares. While on the other side Local Individuals, Local Companies, Banks, NBFCs and Insurance Companies remained in net buying positions of 5.22, 2.04, 1.18, 0.09 and 0.09 million shares but Mutual Fund and Brokers remained in net selling positions of 2.60 and 4.44 million shares respectively.

Analytical Review

Asian shares post modest gains as trade fears keep investors cautious

Asian stocks struggled to gain traction on Friday, following a mixed Wall Street finish and as the worsening Sino-U.S. trade dispute kept investors in the region cautious, despite signs of rapprochement between the United States and Europe. MSCI’s broadest index of Asia-Pacific shares outside Japan dipped 0.1 percent. The CSI300 of Chinese shares fell 0.5 percent. Japan’s Nikkei eked out a 0.1 percent gain though it was capped by worries that the Bank of Japan could scale down its asset purchase at its upcoming policy review next week. MSCI’s gauge of stocks across the globe, ACWI, hit four-month highs on Thursday, with European car maker shares gaining 2.6 percent after the European Union and the United States agreed to negotiate on trade, easing fears of a Transatlantic trade war.

Forex figures $ 15.729 billion

Total liquid foreign reserves of the country stand at dollars 15.729 billion, said State Bank of Pakistan (SBP) on Thursday. According to a SBP weekly statement here, the foreign reserves held by the State Bank on July 20 amounted to $ 9,010.7 million. The net foreign reserves held by commercial banks were $6,718.1 million. During the week ending July 20, SBP's reserves decreased by $53 million to $9,011 million due to payments on account of external debt servicing.

Unido, Nust sign MoU

United Nations Industrial Development (UNIDO) signed MoU with National University of Sciences and Technology (NUST) and the ceremony was held at the main campus of the NUST. UNIDO Country Representative Nadia Aftab and Rector NUST Naweed Zaman were present at the occasion, along with UNIDO team comprising of all coordinators of projects and NUST team including Pro-rectors, senior department heads and associates. Rector NUST Naweed Zaman said that NUST always endeavours to do projects with industry and to offer the expertise of NUST to the industry for enhancing the productivity and international acceptance of Pakistani products. UNIDO Country Representative Nadia Aftab asserted that by virtue of this particular MoU, the cooperation between these two organizations will be reiterated and new areas of cooperation will be identified which will benefit the industry, society, academia as well as country.

Farmers asked to remove weeds from fields

It has been observed that cotton crop is susceptible to attack of Cotton Leaf Curl Virus (CLCV) this year due to climatic change. A spokesman for the agriculture department said on Thursday that farmers must eliminate weeds from the cotton fields to mitigate the impact of this disease. Cotton Leaf Curl Virus (CLCV) mainly spreads due to attack of Whitefly which serves as mediator of this disease. He said in case of attack of Cotton Leaf Curl Virus (CLCV), farmers should start application of fertilizer particularly Magnesium could mitigate impact of the disease. The spokesman advised that judicious use of fertilizers during hot humid weather could enhance the output.

BRICS pledges unity against trade threats

Five of the biggest emerging economies on Thursday stood by the multilateral system and vowed to strengthen economic cooperation in the face of US tariff threats and unilateralism. The heads of the BRICS group -- Brazil, Russia, India, China and South Africa -- met in Johannesburg for an annual summit dominated by the risk of a US-led trade war, although leaders did not publicly mention President Donald Trump by name. "We express concern at the spill-over effects of macro-economic policy measures in some major advanced economies," they said in joint statement. "We recognise that the multilateral trading system is facing unprecedented challenges. We underscore the importance of an open world economy." Trump has said he is ready to impose tariffs on all $500 billion (428 billion euros) of Chinese imports, complaining that China's trade surplus with the US is due to unfair currency manipulation.

Asian stocks struggled to gain traction on Friday, following a mixed Wall Street finish and as the worsening Sino-U.S. trade dispute kept investors in the region cautious, despite signs of rapprochement between the United States and Europe. MSCI’s broadest index of Asia-Pacific shares outside Japan dipped 0.1 percent. The CSI300 of Chinese shares fell 0.5 percent. Japan’s Nikkei eked out a 0.1 percent gain though it was capped by worries that the Bank of Japan could scale down its asset purchase at its upcoming policy review next week. MSCI’s gauge of stocks across the globe, ACWI, hit four-month highs on Thursday, with European car maker shares gaining 2.6 percent after the European Union and the United States agreed to negotiate on trade, easing fears of a Transatlantic trade war.

Total liquid foreign reserves of the country stand at dollars 15.729 billion, said State Bank of Pakistan (SBP) on Thursday. According to a SBP weekly statement here, the foreign reserves held by the State Bank on July 20 amounted to $ 9,010.7 million. The net foreign reserves held by commercial banks were $6,718.1 million. During the week ending July 20, SBP's reserves decreased by $53 million to $9,011 million due to payments on account of external debt servicing.

United Nations Industrial Development (UNIDO) signed MoU with National University of Sciences and Technology (NUST) and the ceremony was held at the main campus of the NUST. UNIDO Country Representative Nadia Aftab and Rector NUST Naweed Zaman were present at the occasion, along with UNIDO team comprising of all coordinators of projects and NUST team including Pro-rectors, senior department heads and associates. Rector NUST Naweed Zaman said that NUST always endeavours to do projects with industry and to offer the expertise of NUST to the industry for enhancing the productivity and international acceptance of Pakistani products. UNIDO Country Representative Nadia Aftab asserted that by virtue of this particular MoU, the cooperation between these two organizations will be reiterated and new areas of cooperation will be identified which will benefit the industry, society, academia as well as country.

It has been observed that cotton crop is susceptible to attack of Cotton Leaf Curl Virus (CLCV) this year due to climatic change. A spokesman for the agriculture department said on Thursday that farmers must eliminate weeds from the cotton fields to mitigate the impact of this disease. Cotton Leaf Curl Virus (CLCV) mainly spreads due to attack of Whitefly which serves as mediator of this disease. He said in case of attack of Cotton Leaf Curl Virus (CLCV), farmers should start application of fertilizer particularly Magnesium could mitigate impact of the disease. The spokesman advised that judicious use of fertilizers during hot humid weather could enhance the output.

Five of the biggest emerging economies on Thursday stood by the multilateral system and vowed to strengthen economic cooperation in the face of US tariff threats and unilateralism. The heads of the BRICS group -- Brazil, Russia, India, China and South Africa -- met in Johannesburg for an annual summit dominated by the risk of a US-led trade war, although leaders did not publicly mention President Donald Trump by name. "We express concern at the spill-over effects of macro-economic policy measures in some major advanced economies," they said in joint statement. "We recognise that the multilateral trading system is facing unprecedented challenges. We underscore the importance of an open world economy." Trump has said he is ready to impose tariffs on all $500 billion (428 billion euros) of Chinese imports, complaining that China's trade surplus with the US is due to unfair currency manipulation.

SNGP, DGKC, PPL and PSO may lead the trend in case of reversal after a spike.

Technical Analysis

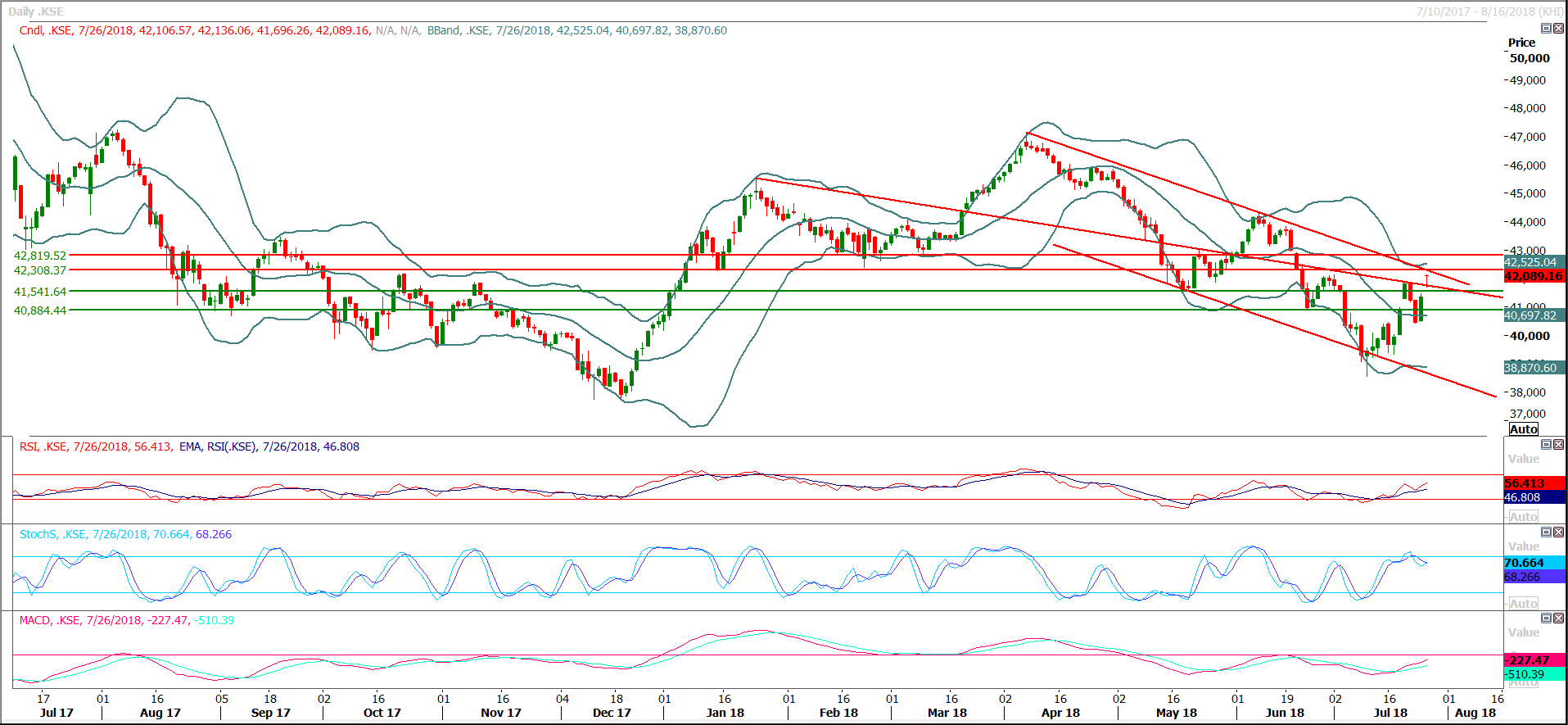

The Benchmark KSE100 Index is moving in a downward price channel and right now it’s going to face a strong resistance from resistant trend line of said channel along with a horizontal resistant region. Index have left a gap during last trading session which still have to be filled in coming days and if index would not become able to close above 42,380 points during current trading session then there are chances for a bearish pull back which would lead index towards 41,720 and 41,500 points. Breakout of 42,380 points on daily chart in bullish direction would call for 42,800 and 43,100 points. It’s recommended to stay cautious or practice swing trading until index close above 43,100 points on daily and weekly charts.

Index has chances of completion of double top on weekly chart if it would not close above 42,300 points today and closing below that region would increase pressure of selling and that may convert into panic selling in blue chips. SNGP, PPL, DGKC and PSO are heading toward resistant regions from where they can start a reversal if a breakout would not happen. Current SNGP have resistant region ahead at 98, PPL at 216 and DGKC may lead towards 112 and 116 but from those regions a correction or dip could be witnessed in this script, while PSO have strong resistant region ahead at 322 Rs. It’s recommended to start profit taking before these regions in these shares and be ready for a swing in case of reversal with strict stop loss.

Index has chances of completion of double top on weekly chart if it would not close above 42,300 points today and closing below that region would increase pressure of selling and that may convert into panic selling in blue chips. SNGP, PPL, DGKC and PSO are heading toward resistant regions from where they can start a reversal if a breakout would not happen. Current SNGP have resistant region ahead at 98, PPL at 216 and DGKC may lead towards 112 and 116 but from those regions a correction or dip could be witnessed in this script, while PSO have strong resistant region ahead at 322 Rs. It’s recommended to start profit taking before these regions in these shares and be ready for a swing in case of reversal with strict stop loss.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.