Previous Session Recap

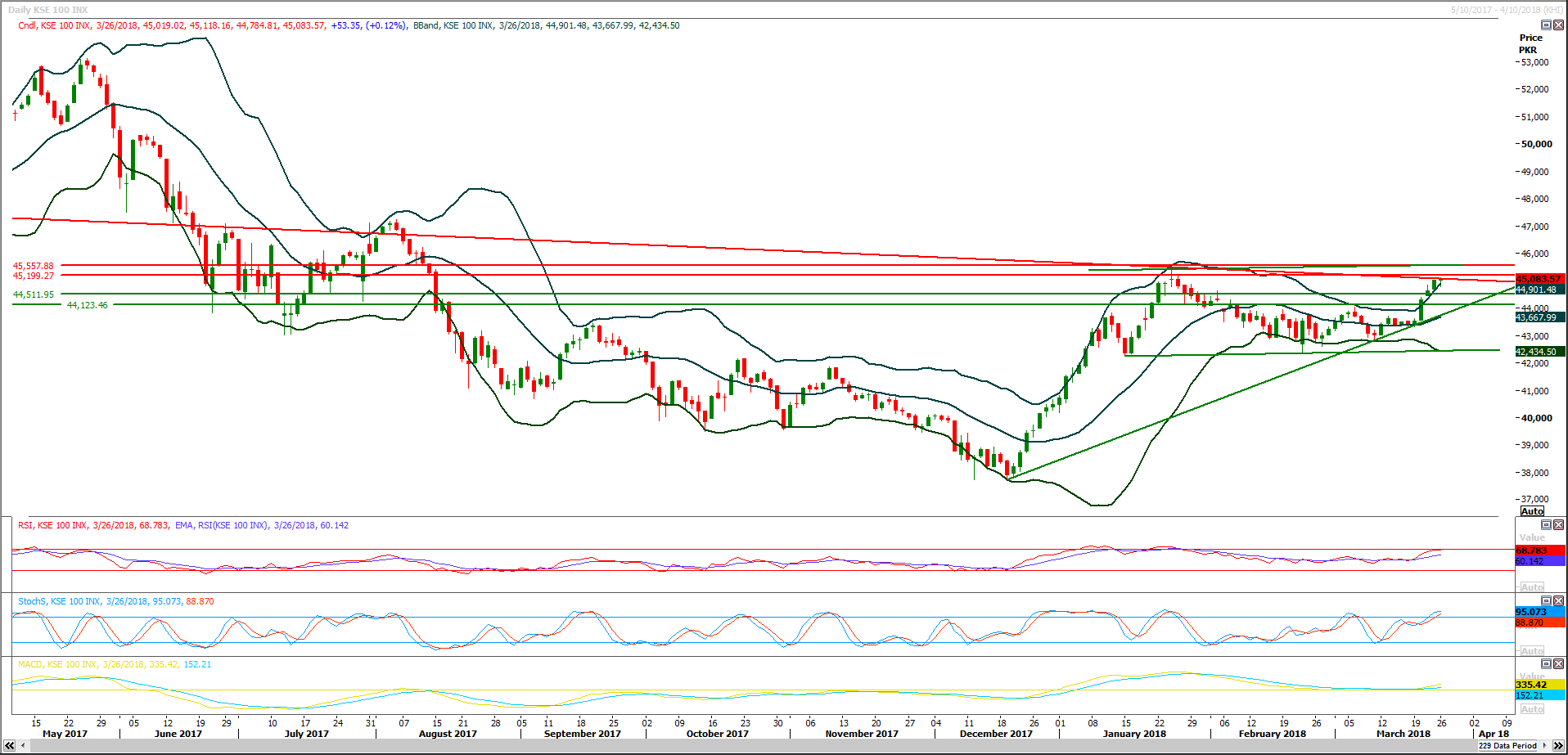

Trading volume at PSX floor dropped by 40.52 million shares or 17.74% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 45,019.02, posted a day high of 45,118.16 and a day low of 44,784.81 during last trading session. The session suspended at 45,083.57 with net change of 53.35 and net trading volume of 56.93 million shares. Daily trading volume of KSE100 listed companies dropped by 32.28 million shares or 36.18% on DoD basis.

Foreign Investors remained in net buying position of 0.59 million shares and net value of Foreign Inflow increased by 1.17 million US Dollars. Categorically, Foreign Individual and Corporate Investors remained in net selling positions of 0.03 and 2.83 million shares but Overseas Pakistanis remained in net buying position of 3.45 million shares. While on the other side Local Individuals and NBFCs remained in net buying positions of 4.11 and 0.45 million shares but Local Companies, Banks, Mutual Funds, Brokers and Insurance Companies remained in net selling positions of 1.18, 1.91, 0.76, 0.25 and 1.46 million shares respectively.

Analytical Review

Asia shares cheered by trade hopes, dollar downcast

Asian share markets rose sharply on Tuesday as reports of behind-the-scenes talks between the United States and China rekindled hopes a damaging trade war could be averted, in turn sapping the strength of the dollar and yen. Taking their cue from a surge on Wall Street, Japan’s Nikkei climbed 1.7 percent and China blue chips added 1.2 percent. MSCI’s broadest index of Asia-Pacific shares outside Japan rose almost 1 percent. South Korea’s KOSPI climbed 0.7 percent, adding to gains made after the U.S. exempted the country’s steel from import tariffs. The abrupt mood swing came amid reports Chinese and U.S. officials were busy negotiating to avert an all-out trade war. White House officials are asking China to cut tariffs on imported cars, allow foreign majority ownership of financial services firms and buy more U.S.-made semiconductors, said a person familiar with the discussions. Chinese Premier Li Keqiang on Monday pledged to maintain trade negotiations and ease access to American businesses.

Shaukat Tarin returns to lead new Economic Advisory Council

Prime Minister Shahid Khaqan Abbasi has reconstituted a 13-member Economic Advisory Council (EAC) led by former finance minister Shaukat Tarin to advise the government on economic policies. The trimmed down committee from 19 to 13 has only two members – Mr Abid Hassan and Dr Abdul Qayyum Sulehri – from the previous EAC, which was headed by Ishaq Dar. Those inducted into the reconstituted council were still unclear if the government really required productive policy input for the economic direction of the country amid political transition or wanted to have a routine consultative forum meeting once or twice a year. The prominent among those excluded from new EAC include former governor State Bank of Pakistan Dr Ishrat Husain, Dr Ashfaq Hassan Khan, former economic adviser and Dean Nust Business School, and former principal economic adviser Sakib Sherani.

Shanghai Power committed to buy K-Electric

The Shanghai Electric Power Ltd (SEPL) has sought the government’s support in accelerating the process of regulatory approvals to facilitate the completion of Sale-Purchase Agreement (SPA) of majority shares in K-Electric Ltd (KEL). A delegation of SEPL led by Wang Yundan, the company chairman, called on the Prime Minister Shahid Khaqan Abbasi in Islamabad on Monday and apprised him of the current status of acquisition process of majority stake in KEL. The premier assured the delegation that the government remains committed to supporting SEPL with a view to further liberalising the power generation and distribution sector. “To this extent, the government is committed to enabling the process [of KEL sale] to move forward subject to completion of all regulatory frameworks,” Abbasi told the delegation.

Transportation price of RLNG to Punjab set at Rs81/mmBtu

The Oil and Gas Regulatory Authority (Ogra) has determined charges for transportation of regasified liquefied natural gas (RLNG) to Punjab at Rs81 per mmBtu (million British Thermal Unit) for the current year. This will yield about Rs25 billion to the Sui Northern Gas Pipeline Limited (SNGPL) during the current year. The regulator has, however, decided to consider increasing transportation charges to about Rs94 per mmBtu to adjust increase in unit cost because of lower than committed supplies. SNGPL had demanded that the earlier working of transportation charges or cost of service at the time of determined estimated revenue requirement (DERR) was based on the assumption that RLNG supply into SNGPL system will increase from 600 million cubic feet per day (mmcfd) to 1200mmcfd with effect from July 1, 2017. However, due to delay in commissioning of the second terminal, RLNG supply could not reach 1200mmcdf until December 2017.

Tractor makers seek cut in input tax rate

Pakistan Automotive Manufacturers Association (Pama) has urged the government to reduce the rate of input tax on tractors which is resulting in liquidity crunch. The rate of sales tax charged on tractor sales is five per cent, as against the components, purchased locally as well as imported, required to manufacture tractors are subjected to 17pc sales tax. Pama Director General Abdul Waheed Khan said this has resulted in accumulation of legitimate refunds with Federal Board of Revenue (FBR), which currently stands at Rs2.4 billion approximately for the industry. Due to this, the entire tractor industry is facing a liquidity crunch affecting the trust of foreign investors/shareholders, he added.

Market is expected to remain volatile therfore its recommended to stay cautious while trading today.

Asian share markets rose sharply on Tuesday as reports of behind-the-scenes talks between the United States and China rekindled hopes a damaging trade war could be averted, in turn sapping the strength of the dollar and yen. Taking their cue from a surge on Wall Street, Japan’s Nikkei climbed 1.7 percent and China blue chips added 1.2 percent. MSCI’s broadest index of Asia-Pacific shares outside Japan rose almost 1 percent. South Korea’s KOSPI climbed 0.7 percent, adding to gains made after the U.S. exempted the country’s steel from import tariffs. The abrupt mood swing came amid reports Chinese and U.S. officials were busy negotiating to avert an all-out trade war. White House officials are asking China to cut tariffs on imported cars, allow foreign majority ownership of financial services firms and buy more U.S.-made semiconductors, said a person familiar with the discussions. Chinese Premier Li Keqiang on Monday pledged to maintain trade negotiations and ease access to American businesses.

Prime Minister Shahid Khaqan Abbasi has reconstituted a 13-member Economic Advisory Council (EAC) led by former finance minister Shaukat Tarin to advise the government on economic policies. The trimmed down committee from 19 to 13 has only two members – Mr Abid Hassan and Dr Abdul Qayyum Sulehri – from the previous EAC, which was headed by Ishaq Dar. Those inducted into the reconstituted council were still unclear if the government really required productive policy input for the economic direction of the country amid political transition or wanted to have a routine consultative forum meeting once or twice a year. The prominent among those excluded from new EAC include former governor State Bank of Pakistan Dr Ishrat Husain, Dr Ashfaq Hassan Khan, former economic adviser and Dean Nust Business School, and former principal economic adviser Sakib Sherani.

The Shanghai Electric Power Ltd (SEPL) has sought the government’s support in accelerating the process of regulatory approvals to facilitate the completion of Sale-Purchase Agreement (SPA) of majority shares in K-Electric Ltd (KEL). A delegation of SEPL led by Wang Yundan, the company chairman, called on the Prime Minister Shahid Khaqan Abbasi in Islamabad on Monday and apprised him of the current status of acquisition process of majority stake in KEL. The premier assured the delegation that the government remains committed to supporting SEPL with a view to further liberalising the power generation and distribution sector. “To this extent, the government is committed to enabling the process [of KEL sale] to move forward subject to completion of all regulatory frameworks,” Abbasi told the delegation.

The Oil and Gas Regulatory Authority (Ogra) has determined charges for transportation of regasified liquefied natural gas (RLNG) to Punjab at Rs81 per mmBtu (million British Thermal Unit) for the current year. This will yield about Rs25 billion to the Sui Northern Gas Pipeline Limited (SNGPL) during the current year. The regulator has, however, decided to consider increasing transportation charges to about Rs94 per mmBtu to adjust increase in unit cost because of lower than committed supplies. SNGPL had demanded that the earlier working of transportation charges or cost of service at the time of determined estimated revenue requirement (DERR) was based on the assumption that RLNG supply into SNGPL system will increase from 600 million cubic feet per day (mmcfd) to 1200mmcfd with effect from July 1, 2017. However, due to delay in commissioning of the second terminal, RLNG supply could not reach 1200mmcdf until December 2017.

Pakistan Automotive Manufacturers Association (Pama) has urged the government to reduce the rate of input tax on tractors which is resulting in liquidity crunch. The rate of sales tax charged on tractor sales is five per cent, as against the components, purchased locally as well as imported, required to manufacture tractors are subjected to 17pc sales tax. Pama Director General Abdul Waheed Khan said this has resulted in accumulation of legitimate refunds with Federal Board of Revenue (FBR), which currently stands at Rs2.4 billion approximately for the industry. Due to this, the entire tractor industry is facing a liquidity crunch affecting the trust of foreign investors/shareholders, he added.

Technical Analysis

The Benchmark KSE100 Index is capped by a descending trend line along with a horizontal resistant region on its way towards expansion of breakout of a triangle on daily chart and these both resistant regions have reacted very strong against current bullish rally during last trading session and index formatted a hammer on daily chart, now current trading session have become a key point for future move because this session can play a vital role in creating an evening shooting star on daily chart which would be indication of start of a correction. Momentum indicators on daily chart started a slight move towards negative zone because Stochastic and MAORSI have started moving towards a bearish crossover which would be confirmed today, but MACD is still in bullish mode and it is not leaving its bullish move. MACD could push index towards an upset if it would slide towards negative zone. For current trading session it’s recommended to wait for clear breakout of either side and then initiate new entries because breakout of 45,211 would call for a spike of further 300-1000 points while on bearish side breakout of 44,550 would call for a dip towards 43800.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.