Previous Session Recap

Trading volume at PSX floor increased by 11.75 million shares or 9.51% on DoD basis whereas the Benchmark KSE100 index opened at 40,882.10, posted a day high of 41,144.09 and day low of 40,664.17 during last trading session while session suspended at 40,771.55 with net change of -97.73 points and net trading volume of 68.88 million shares. Daily trading volume of KSE100 listed companies dropped by 0.86 million shares or 1.23% on DoD basis.

Foreign Investors remained in net buying position of 0.43 million shares but net value of Foreign Inflow dropped by 2.75 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistani remained in net selling position of 0.03 and 0.16 million shares but Foreign Corporate investors remained in net buying position of 0.62 million shares. While on the other side Local Companies, Banks, NBFCs, Mutual Funds and Insurances companies remained in net buying positions of 6.48, 0.06, 0.04, 5.08 and 4.78 million shares respectively, but Local Individuals and Brokers remained in net selling positions of 13.52 and 4.09 million shares respectively.

Analytical Review

Asia mood soured by Trump tariff threat, oil slips anew

Asian share markets struggled to extend a global rebound on Tuesday after U.S. President Donald Trump seemed to quash hopes of a trade truce with China, dampening risk appetite across the region. Japan's Nikkei .N225 managed to eke out a 0.1 percent gain, and Chinese blue-chips .CSI300 added 0.6 percent. Other bourses were mixed with MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS easing 0.1 percent. E-Mini futures for the S&P 500 ESc1 also retreated 0.4 percent, after rising sharply overnight.

Pakistan, China pledge to further boost ties

Pakistan and China Monday expressed the resolve to further strengthen cooperation and expand China Pakistan Economic Corridor (CPEC). Attack on the Chinese Consulate was a conspiracy to sabotage China-Pakistan Economic Corridor (CPEC), said Minister for Planning, Development & Reform, Makhdum Khusro Bakhtyar in a meeting with Chinese Ambassador Yao Jing.

LCCI stresses uniform gas tariff

The Lahore Chamber of Commerce and Industry (LCCI) on Monday urged authorities concerned to ensure implementation of uniform tariff of gas and availability of important raw material for industrial sector. LCCI Senior Vice President Khawaja Shahzad Nasir and Vice President Fahim-ur-Rehman Saigal said here in a media statement that government had announced to implement a uniform industrial gas tariff across the country and its indiscriminate supply but due to its delay, Punjab industry in general and export-oriented industry in particular was still facing a lot of problems.

Rs151.2b released for PSDP projects

The government has released Rs 151.17 billion under its Public Sector Development Programme (PSDP) 2018-19 for various ongoing and new schemes against the total allocation of Rs 675 billion. The released funds include Rs 68.74 billion for federal ministries and Rs 18.6 billion for special areas, according to a latest data released by Ministry of Planning, Development and Reform. Out of these allocations, the government released Rs 58.05 billion for National Highway Authority out of total allocation of Rs 185.2 billion out of which the major portion Rs 16.266 billion have been released for Lahore-Multan Motorway (M-3 section) of Karachi-Lahore Motorway. Whereas Rs 3.137 billion have been released for NTDC and PEPCO for which an amount of Rs 33.36 billion was allocated under PSDP 2018-19. Similarly Rs 2.78 billion have been released for Communication Division (other than National Highway Authority) for which the government has earmarked Rs 13.97 billion under PSDP 2018-19.

FPCCI lauds Kartarpura move

The FPCCI on Monday hailed the government decision to build the Kartarpura corridor and said that it would also help to resolve other issues with India. They said that business community fully support the decision to build Kartarpur corridor to facilitate Sikhs travel to the final resting place of Baba Guru Nanak, said a press release issued here. The decision will not only help Sikhs to visit Pakistan without a visa but it can also bring Pakistan and India together while improving the image of Islamabad, said Daroo Khan Achakzai, FPCCI’s presidential candidate.

Asian share markets struggled to extend a global rebound on Tuesday after U.S. President Donald Trump seemed to quash hopes of a trade truce with China, dampening risk appetite across the region. Japan's Nikkei .N225 managed to eke out a 0.1 percent gain, and Chinese blue-chips .CSI300 added 0.6 percent. Other bourses were mixed with MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS easing 0.1 percent. E-Mini futures for the S&P 500 ESc1 also retreated 0.4 percent, after rising sharply overnight.

Pakistan and China Monday expressed the resolve to further strengthen cooperation and expand China Pakistan Economic Corridor (CPEC). Attack on the Chinese Consulate was a conspiracy to sabotage China-Pakistan Economic Corridor (CPEC), said Minister for Planning, Development & Reform, Makhdum Khusro Bakhtyar in a meeting with Chinese Ambassador Yao Jing.

The Lahore Chamber of Commerce and Industry (LCCI) on Monday urged authorities concerned to ensure implementation of uniform tariff of gas and availability of important raw material for industrial sector. LCCI Senior Vice President Khawaja Shahzad Nasir and Vice President Fahim-ur-Rehman Saigal said here in a media statement that government had announced to implement a uniform industrial gas tariff across the country and its indiscriminate supply but due to its delay, Punjab industry in general and export-oriented industry in particular was still facing a lot of problems.

The government has released Rs 151.17 billion under its Public Sector Development Programme (PSDP) 2018-19 for various ongoing and new schemes against the total allocation of Rs 675 billion. The released funds include Rs 68.74 billion for federal ministries and Rs 18.6 billion for special areas, according to a latest data released by Ministry of Planning, Development and Reform. Out of these allocations, the government released Rs 58.05 billion for National Highway Authority out of total allocation of Rs 185.2 billion out of which the major portion Rs 16.266 billion have been released for Lahore-Multan Motorway (M-3 section) of Karachi-Lahore Motorway. Whereas Rs 3.137 billion have been released for NTDC and PEPCO for which an amount of Rs 33.36 billion was allocated under PSDP 2018-19. Similarly Rs 2.78 billion have been released for Communication Division (other than National Highway Authority) for which the government has earmarked Rs 13.97 billion under PSDP 2018-19.

The FPCCI on Monday hailed the government decision to build the Kartarpura corridor and said that it would also help to resolve other issues with India. They said that business community fully support the decision to build Kartarpur corridor to facilitate Sikhs travel to the final resting place of Baba Guru Nanak, said a press release issued here. The decision will not only help Sikhs to visit Pakistan without a visa but it can also bring Pakistan and India together while improving the image of Islamabad, said Daroo Khan Achakzai, FPCCI’s presidential candidate.

Market is expected to remain volatile during current trading session therefore it's recommended to stay cautious while trading

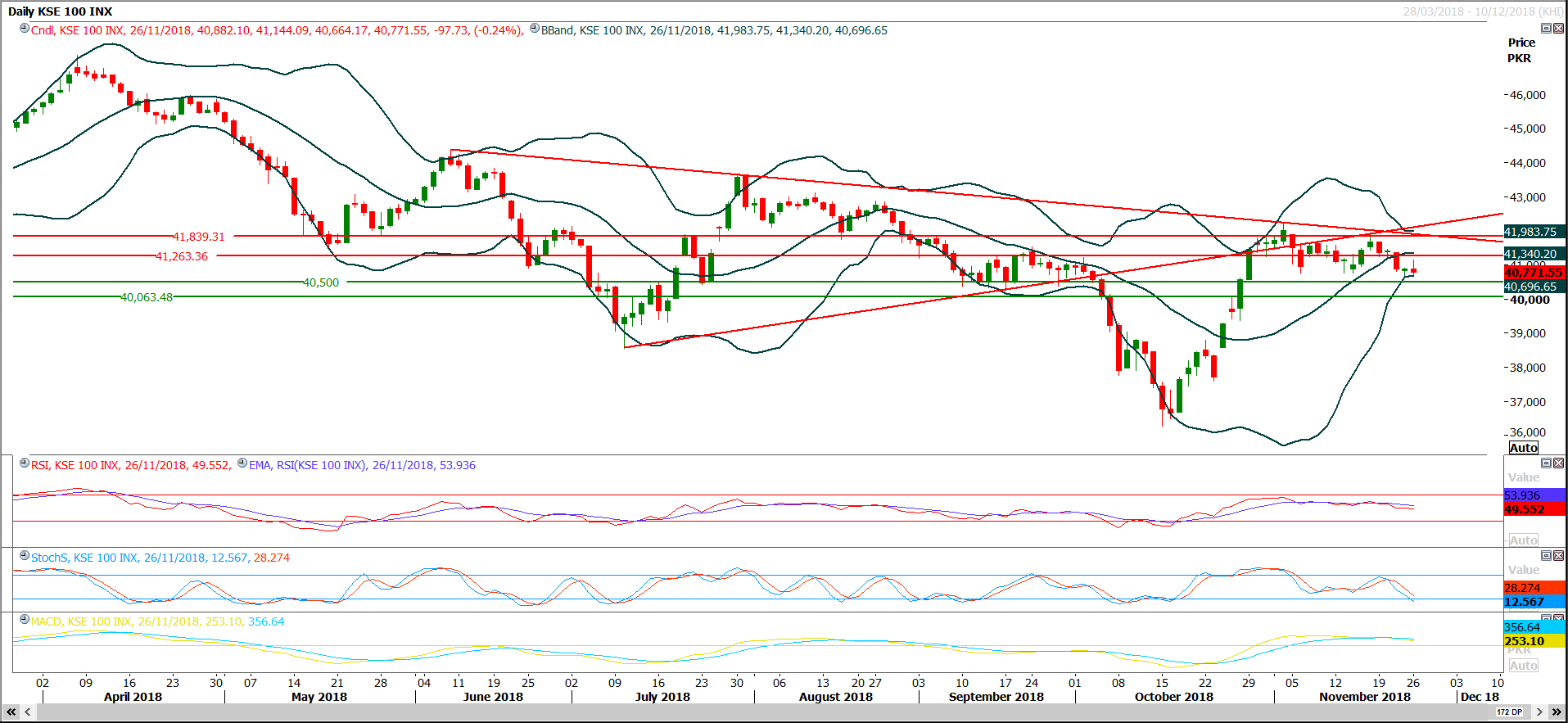

Technical Analysis

The Benchmark KSE100 Index have stayed below its major primary supportive region of 41,000 points after three weeks during last trading session and it have penetrated its secondary supportive region 40,760 points before yesterday’s closing but closed above that region at 40,771.55 points which indicates that index is losing its strength on bullish side. During last three weeks index have traded range bound between 41,840 and 40760 and its daily Bollinger band have squeezed which is indicating that now a breakout would have to happen in coming week and it’s recommended to stay prepared for that breakout. Index have last hope for bulls at 40,500 points because if that region would be maintained then index could spike towards 41,260 and 41,860 points but if it would succeed in sliding below that region on daily closing basis then it can target 38,000 points on short term basis. Daily & weekly momentum indicators are ready for a bearish rally but hourly indicators would try to take a spike on intraday basis which may last before 41,100 or 41,260 points. It’s recommended to stay on short side at spikes and avoid initiating long positions until index close above 41,260 points.

MLCF have bounced back after retesting its resistant region which falls on a horizontal resistance and right now it’s heading towards a strong supportive region which falls on 48 Rs and a bearish harami formation on daily chart which would try to add pressure on index therefore it’s recommended to trade it very cautiously. PAEL have slide below its major supportive region of 31.50 after a week time and right now it have supportive region ahead at 30.20 where it will find a strong support but if it would succeed in sliding below that region then its short term trend would once again changed to bearish zone. DOL have its initial supportive region ahead at 32.30 where its 50% correction would be completed but if bearish momentum would continue below that region then it can target 30.60 to fulfill its daily gap.

MLCF have bounced back after retesting its resistant region which falls on a horizontal resistance and right now it’s heading towards a strong supportive region which falls on 48 Rs and a bearish harami formation on daily chart which would try to add pressure on index therefore it’s recommended to trade it very cautiously. PAEL have slide below its major supportive region of 31.50 after a week time and right now it have supportive region ahead at 30.20 where it will find a strong support but if it would succeed in sliding below that region then its short term trend would once again changed to bearish zone. DOL have its initial supportive region ahead at 32.30 where its 50% correction would be completed but if bearish momentum would continue below that region then it can target 30.60 to fulfill its daily gap.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.