Previous Session Recap

Trading volume at PSX floor increased by 37.14 million shares or 36.17% ,DoD basis, Whereas, the benchmark KSE100 Index opened at 41637.09, posted a day high of 41745.76 and a day low of 41355.45 during the last trading session. The session suspended at 41409.49 with a net change of -185.83 and net trading volume of 65.9 million shares. Daily trading volume of KSE100 listed companies increased by 17.79 million shares or 36.96%,DoD basis.

Foreign Investors remained in a net selling position of 3.14 million shares and net value of Foreign Inflow dropped by 0.33 million US Dollars. Categorically, Foreign Individual, Corporate and Overseas Pakistani Investors remained in net selling positions of 0.02, 2.82 and 0.3 million shares respectively. While on the other side Local Individuals, Mutual Funds and Insurance Companies remained in net buying positions of 9.92, 0.69 and 0.96 million shares respectively but Local Companies, Banks and Brokers remained in net selling positions of 2.48, 1.3 and 6.54 million shares respectively.

Analytical Review

Asian shares gained on Friday as technology shares were boosted by upbeat earnings from U.S. hi-tech giants while the euro hovered near three-month low against the dollar after the European Central Bank extended its stimulus. Japan's Nikkei .N225 gained 0.6 percent while South Korea's Kospi .KS11 rose 0.2 percent and Australian shares rose 0.2 percent. MSCI's broadest index of Asia-Pacific shares outside Japan was flat in dollar terms. .MIAPJ0000PUS Earnings from Alphabet (GOOG.O), Microsoft (MSFT.O) and Amazon.com (AMZN.O), the world’s second, third and fifth largest companies by market capitalization, were all upbeat, boosting their shares in after-hour trade. Shares in those companies rose 2.8 percent, 4.5 percent and 7.6 percent respectively.

Metallurgical Corporation of China (MCC) and state-owned Saindak Metals Ltd (SML) signed on Thursday an agreement under which the Chinese firm will continue operating the Saindak copper-gold project for another five years on existing terms. The two companies signed in 2002 a 10-year contract, which was extended for five years in 2012. The contract was to end on Oct 31. The government has always kept the terms of the contract confidential. The deal is believed to provide the provincial government with about 25 per cent of the net profit along with royalties and duties. The terms of contract are often criticised by nationalist leaders for being unfavourable to Balochistan. The lease extension will remain effective until Oct 30, 2022.

The Asian Development Bank (ADB) will provide financing for setting up of a benchmark model information technology park in Karachi as well as help in developing a strategy for national IT parks, it was learnt here. The government has requested the ADB to support its efforts to rejuvenate the Information and Communications Technology (ICT) sector. The Ministry of Information Technology and Telecom has initiated institutional arrangements such as the establishment of ‘Research and Development Fund’ for ICT.

Finance Minister Ishaq Dar has ordered the Federal Board of Revenue (FBR) to release by Oct 31 an amount of Rs13 billion involving more than 4,000 sales tax refund payment orders (RPOs) issued up to Aug 31. Chairing a meeting on Thursday, Mr Dar said the government is aware of liquidity problems being faced by the businessmen and traders community and keeping this fact in view he has given instructions to the FBR for making refund payments. He said the government had been able to contain the problem of refund pendency despite the increase in taxpayers number and increase in refund payments. “The FBR has been trying to facilitate the businessmen so that they are encouraged to pay their taxes,” he added.

A large number of US companies have plans to invest in Pakistan, with almost 95 per cent participants of American Business Council (ABC) ‘perception survey’ optimistic about long-term economic and operating environment in the country. These findings of the annual ABC survey were shared with the media on Thursday. Over 40pc of the respondents indicated that the perception of Pakistan improved in 2016-17, compared to 6pc from the year before. For 2016-17, 45pc rated the business climate as being better as compared to the year before when 17pc respondents had rated it good, highlighting market improvement.

The market is expected to remain volatile today, buying on dips and selling on strength is recommended.

Technical Analysis

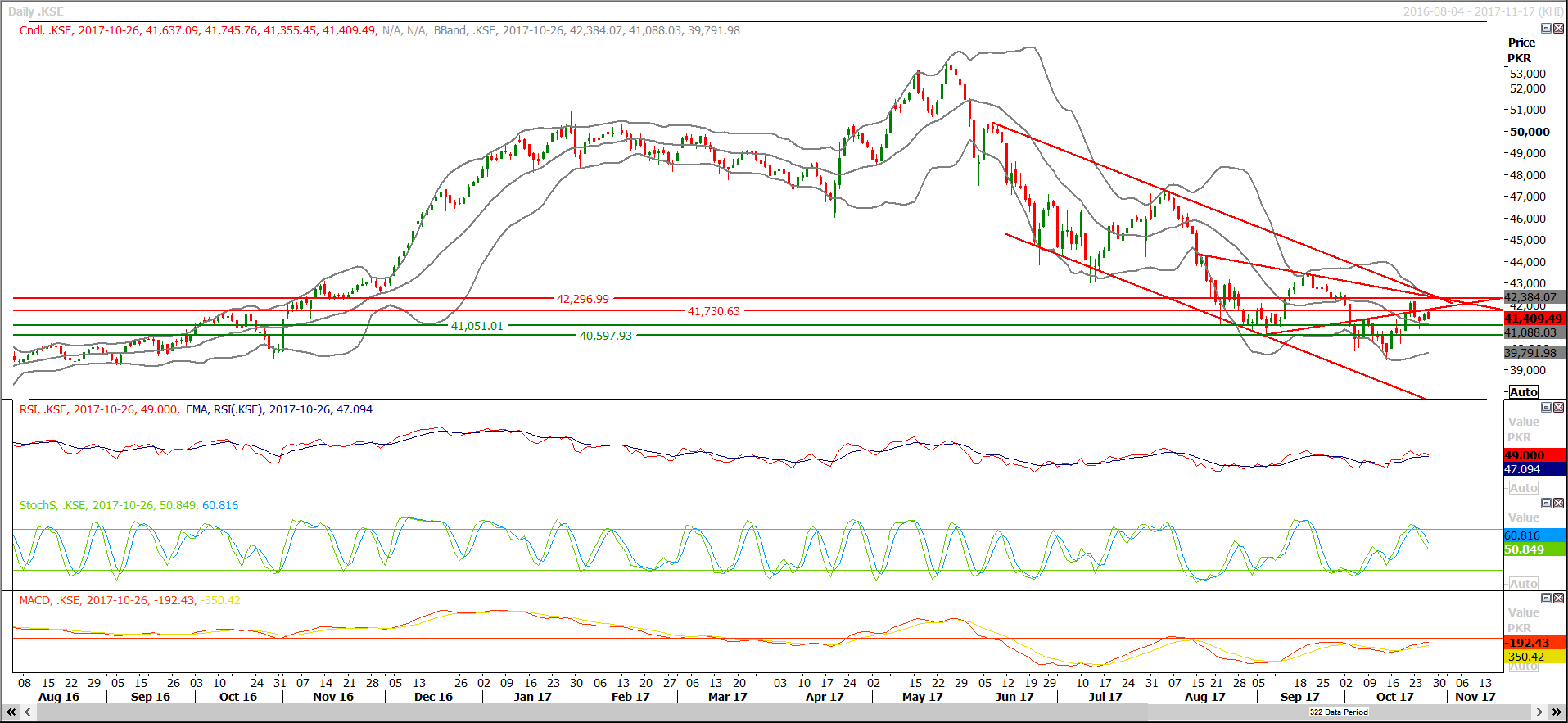

The Benchmark KSE100 Index is trying to recover after posting 61.8% correction of its last bullish rally but on its way towards expansion of said correction it is capped by the two major resistant regions at 41700 and 42300. As of right now it is capped by crossover of a resistant trend line with a horizontal resistant region and daily stochastic is also in bearish direction which might also add pressure on index if index fails to close above 41700. Breakout of 41700 will call for 42200-42300 region but if index penetrate its supportive region of 41050 then free fall might happen towards 40850 and 40500, therefore a cautious trading strategy is recommended for the current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.