Previous Session Recap

Trading volume at PSX floor increased by 19.18 million shares or 15.2% on DoD basis, whereas, the benchmark KSE100 Index opened at 42844.80, posted a day high of 42957.71 and day low of 42599.64 points during last trading session while session suspended at 42666.23 points with net change of -77.42 points and net trading volume of 145.41 million shares. Daily trading volume of KSE100 listed companies increased by 26.27 million shares or 38.84% on DoD basis.

Foreign Investors remain in net selling of 18.23 million shares and net value of Foreign Inflow dropped by 6.66 million US Dollars. Categorically, Foreign Individual and Corporate investors remain in net selling of 0.089 and 19.22 million shares but Overseas Pakistanis remain in net buying of 1.08 million shares. While on the other side Local Individuals, Banks, NBFCs and Insurance companies remain in net selling of 12.17, 0.28, 0.14 and 0.76 million shares but Local companies, Mutual Funds and brokers remain in net buying of 18.76, 8.5 and 2.76 million shares respectively.

Analytical Review

The dollar climbed to a one-month high and bond yields rose on Wednesday as risks grew for a U.S. interest rate hike in December, while Asian stocks hovered near multi-week lows as tensions in the Korean peninsula remain elevated. Markets were put on notice by Federal Reserve Chair Janet Yellen who used a Tuesday speech to warn it would be “imprudent” to keep policy on hold until inflation is back to 2 percent. She said the U.S. central bank “should also be wary of moving too gradually” on rates. The mood was less upbeat elsewhere, with MSCI’s broadest index of Asia-Pacific shares outside Japan off 0.1 percent at three-week lows following bellicose statements by Trump and North Korean leader Kim Jong Un. Trump warned North Korea on Tuesday that any U.S. military option would be “devastating” for Pyongyang, but said the use of force was not Washington’s first option to deal with the country’s ballistic and nuclear weapons program.

The National Electric Power Regulatory Authority (Nepra) on Tuesday ordered ex-Wapda distribution companies (Discos) to refund Rs1.82 per unit to electricity consumers for overcharging them in August with a total financial impact of about Rs23 billion. At a public hearing presided over by Nepra’s Member Tariff Himayatullah Khan, the regulator also expressed displeasure at the utilisation of four gas-based efficient power plants on the most expensive fuel – high-speed diesel (HSD) – with an average additional cost to consumers of Rs2bn per month and observed that around Rs24bn worth of relief might have been denied to consumers in a year.

Ambassador Delegation of the European Union (EU) to Pakistan Jean-Francois Cautain has said that the EU-Pakistan Five Year Engagement Plan is proof of a confident relationship between the EU and Pakistan. Speaking at the programme arranged by the English Speaking Union of Pakistan at the Beach Luxury Hotel on Tuesday, he also said that the Generalised System of Preferences (GSP) Plus granted to Pakistan by the EU in 2014 had been very successful in building ties.

The Asian Development Bank (ADB) on Tuesday noted that Pakistan’s fiscal and external sector vulnerabilities have reappeared with the wider current account deficit, falling foreign exchange reserves, rising debt obligations and consequently greater external financing needs. “Political uncertainty heightened following the Supreme Court decision in August to disqualify the prime minister elected in 2013. Calm has returned, and his party will continue to lead the government until new parliamentary elections due by the third quarter of 2018. Still, possible loss of momentum for making policy decisions may hamper growth prospects,” the ADB stated in its report titled as “Asian Development Outlook (ADO) 2017, update”.

Punjab Finance Minister Dr Ayesha Ghaus Pasha has said that the macroeconomic policy tools are still in the realm of the federal government, while the provincial government is undertaking multiple reforms to boost the economy, saying a lot of assistance is still required from the center. The Provincial Finance Minister stated this while addressing an extension lecture session on National Macroeconomic Management & Role of Provinces, organized by Punjab Economic Research Institute (PERI), Planning & Development Department at local hotel, Lahore.

Today ENGRO, HTL , PAEL and PSO may lead the market in the positive direction.

Technical Analysis

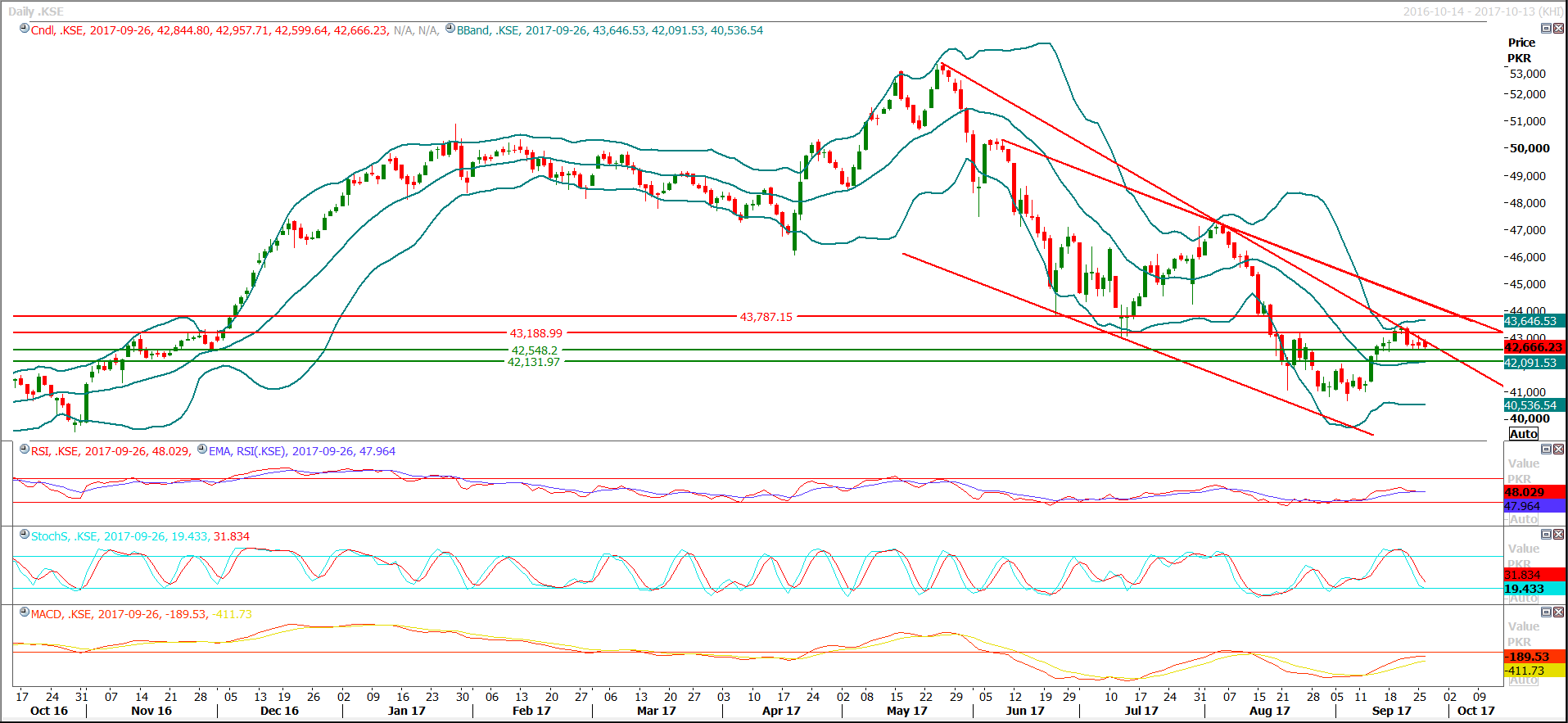

The Bench Mark KSE100 Index have formatted a tripple bottom at a horizontal support while its capped by a resistant trend line which is capping bullish momentum and keeping its cagged between 43200 and 42500 points. Breakout of either 42450 or 43200 points would push index for further 500 points in either side therefore a cuatious trading strategy is recommended for current trading session. Hourly stochastic is trying to generate a bullish crossover which would try to pump some fresh air in index but its recommended to wait for breakout of 43200 points for new buying while for selling breakout of 42450 points is an attractive region.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.