Previous Session Recap

The Bench Mark KSE100 Index Opened with a gap of 35.21 points in positive direction at 46724.94, posted day high of 46985.65 and day low of 46707.31 during last trading session. The session suspended at 46920.47 with net change of 230.74 points and net trading volume of 90.44 million shares. Daily trading volume of KSE100 listed companies increased by 6.94 million shares on DOD bases.

Analytical Review

Asia stocks followed Wall Street higher early on Wednesday, while the dollar firmed against major peers such as the yen following the release of upbeat U.S. economic data overnight. Crude oil prices held large gains on expectations of supply tightening once oil-producing nations implement a scheduled output cut. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS rose 0.2 percent. Australian stocks were up 0.9 percent. Japanes Nikkei .N225 was little changed. U.S. stocks rose slightly on Tuesday, supported by upbeat consumer and housing data, with gains in technology shares lifting the Nasdaq Composite to a record close.

National Electric Power Regulatory Authority (Nepra) on Tuesday approved a refund of Rs 3.60 per KWh in tariff of power Distribution Companies (Discos) and 60-paisa increase in tariff for K-E consumers for November 2016 under monthly fuel price adjustment mechanism. These decisions were taken at two public hearings presided over by Chairman Nepra, Brigadier Tariq Saddozai (Retd). Members from Sindh and Balochistan were also present in the hearing. The officials of Central Power Purchasing Agency (CPPA) and KE pleaded their case.

The Sindh government has asked the federal government to stop collection of royalty on crude oil and allow provinces to collect the same under their own laws as a constitutional residual subject, it emerged on Tuesday. Officials said the provincial government raised the issue at a recent meeting of the Council of Common Interests (CCI) in which Sindh Chief Minister Murad Ali Shah said the ‘ownership right’ of the provinces over mineral oil and natural gas had never been an issue.

Electricity rates have been lowered by Rs3.60 per unit by the National Electric Power Regulatory Authority (Nepra) as power producers managed to generate cheaper electricity in November. However, K-Electric consumers will be charged an additional amount of Rs0.60 on each unit consumed as the power utility had to use furnace oil for producing power amid short supply of gas. The decision was made on Tuesday at a public hearing by Nepra regarding monthly fuel-price adjustment.

Pakistan Textile Exporters Association (PTEA) has stressed for immediate announcement of textile package promised by the Premier to arrest the widening trade deficit as substantial capacity to produce exportable surplus is either fully or partially closed due to high energy cost and other factors concerning cost of doing business.

Overall Oil and Gas Sector, Overall Cement Sector, and Overall Banking Sector can lead market in positive direction.

Technical Analysis

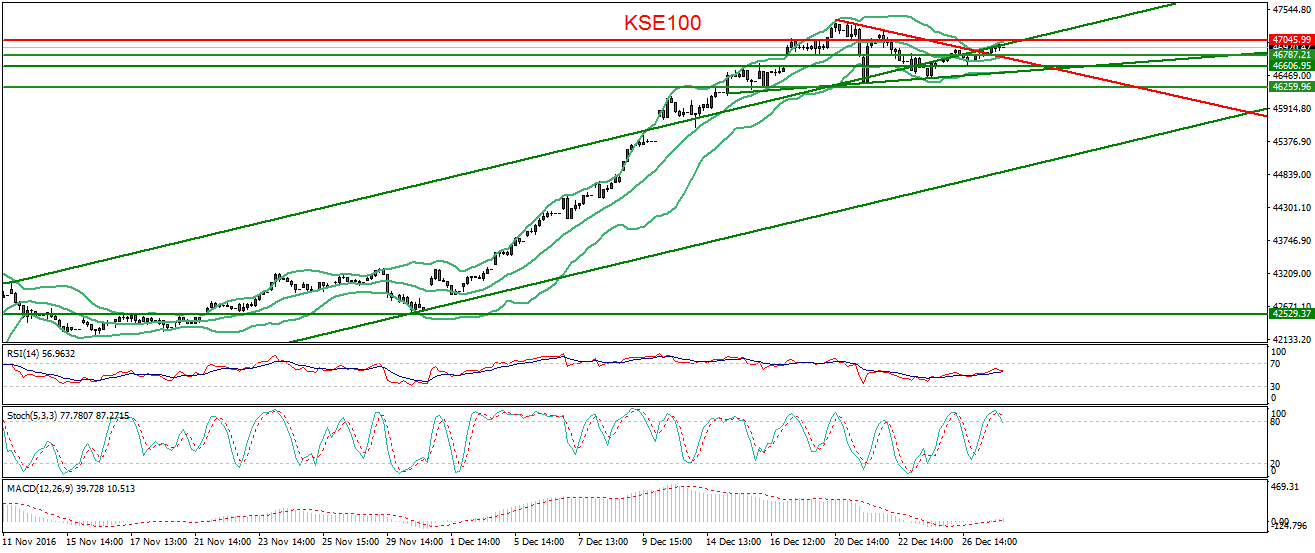

The Bench Mark KSE100 Index penetrated its intraday triangle in bullish direction and now the resistant trendline of said channel is going to behave as support for it. During current trading session, market will try to break its major resistance at 46959 as it already has tried to break its supportive region during last three trading sessions but could not succeed. Though, it has given a clear breakout of its resistant region so its expected that Index would be bullish for current trading session and some new volume would be pumped if it is able to close above 46960 on hourly bases. Oil Sector would try to generate bullish momentum in KSE100 Index.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.