Previous Session Recap

The Bench Mark KSE100 Index Opened at 49018.74, posted day high of 49081.28 and day low of 48489.74 during last trading session while session suspended at 48520.75 with net change of -487.24 points and net trading volume of 95 million shares. Daily trading volume of KSE100 listed companies dropped by 38.46 million shares or 28.82% on DOD bases.

Foreign Investors remain in net selling position of 4.28 million shares and net value of Foreign Inflow dropped by 11.91 million US Dollars. Categorically Foreign Individuals, Corporate and Overseas Pakistani Investors remain in net selling position of 0.027, 1.96 and 2.29 million shares respectively while on the other hand Local Companies, Banks, NBFCs and Brokers remain in net buying position of 14.71, 3.50, 2.79 and 0.73 million shares respectively, but Local Individuals and Mutual Funds remain in net selling position of 7.70 and 11.75 million shares respectively.

Analytical Review

U.S. stocks ended slightly higher on Monday and the Dow closed at a record high for a 12th straight session, as President Donald Trump said he would make a big infrastructure statement on Tuesday. The Dow streak of record-high closes matches a 12-day run in 1987, with Boeing (BA.N) and UnitedHealth (UNH.N) among the biggest boosts for the Dow on Monday. The S&P 500 also closed at a record high. Energy gave the biggest boost to the S&P 500, with the energy index .SPNY up 0.9 percent. Trump, who met with state governors at the White House, also said he is seeking what he called a historic increase in military spending of more than 9 percent, while he said his administration would be moving quickly on regulatory reforms. The comments came ahead of Trump first address to a joint session of Congress Tuesday evening. Investors are looking for more specifics on Trump plans, given the hefty gains in the market since the Nov. 8 election.

Oil and Gas Regulatory Authority (Ogra) has recommended an increase of up to 40.57 percent in the prices of POL products for the first fortnight of March 2017. Under its fortnightly price adjustment, Ogra has recommended an increase of 4.15 percent or Rs2.96 per litre in the prices of Motor Spirit (petrol), increase of 2.7 percent or Rs2.18 per litre in the price of high speed diesel (HSD), it is learnt reliably here on Monday. According to the summary sent to the Ministry of Petroleum and Natural Resources and the Ministry of Finance, the Ogra has proposed double digit increase in the price of kerosene and light diesel oil (LDO). As per the Ogra’s summary, it is proposed to the government to increase 40.57 percent or Rs17.55 per litre in the price of kerosene oil and 25.24 percent or Rs10.94/litre increase in the price of light diesel oil (LDO).

The cement exports to Afghanistan decreased to 0.166 million tons during the month of January 2017 from 0.174 million tons of corresponding period, showing a decline of 4.5 percent. However, exports to India registered a healthy increase from 0.049 million tons in January last year to 0.861 million tons during the same month this year, showing growth of 77 percent. Exports to India are mainly through Wahga border and southern coast of India. Industry stakeholders expressed concerns over falling exports to Afghanistan that have declined in the first seven months of this fiscal by 10.88 percent. They said cement exports to India have registered an increase of 79.34 percent during July 2016 to January 2017. Export by sea also declined by 19.23 percent during first seven months of current fiscal.

State Bank of Pakistan (SBP) has directed that all imports into Pakistan should be made compulsorily through Electronic Import Form (EIF) to curb illegal and duplicate payments of imports by unscrupulous elements. In this regard, it was observed that due to peculiar nature of trade with Afghanistan through land routes, especially via Torkham and Chaman borders, Pakistani importers were facing difficulties to carry out import transactions through ElF. In order to address these difficulties and to facilitate traders of the above regions, the procedure for registration of contracts and payments has been simplified. Now, the requirement for routing of shipping documents against registered contract through banks shall not be mandatory for imports from Afghanistan through land routes.

ATRL,ASCandOverAll Oil and Marketing Companies(PSO and SHEL)can lead the market in the positive direction.

Technical Analysis

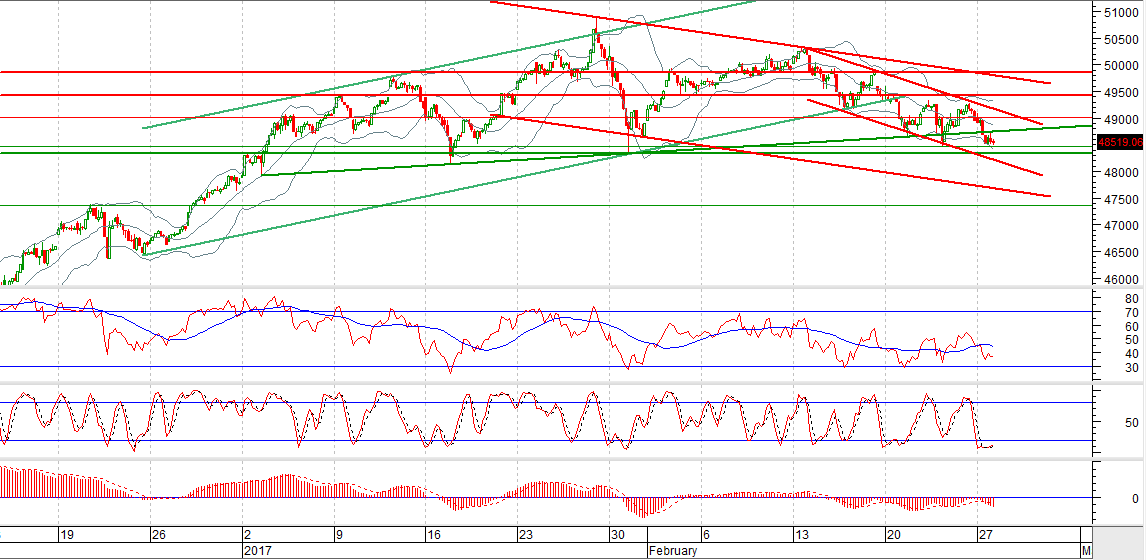

The Bench Mark KSE100 Index has penetrated its supportive trend lines in bearish direction and now it has supportive region ahead at its double bottom from where it can bounce back on intraday basis but trend is still bearish as its capped by two major resistant trend lines at 49105 and 49723, trend will remain bearish until and unless it closes above 49960 . For current trading session it may bounce back from 48474 or 48300 towards 48747 or 49049 where it will face a strong resistance. Daily closing below 48300 will call for 47900 and 47400 in coming days. KSE100 Index has failed to recover from its bearish trend as its in expansion mode of its bearish corrections. Trading with strict stop loss is recommended.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.