Previous Session Recap

The Benchmark KSE100 Index opened at 49827.51, posted a day high of 49909.33 and a day low of 49445.69 during last trading session. Whereas the session suspended at 49481.70 with a net change of -345.81 points and net trading volume of 110.81 million shares. Daily trading volume of KSE100 listed companies dropped by 10.14 million shares or 8.38%, DoD basis.

Foreign Investors remained in net selling position of 8.98 million shares and net value of Foreign inflow dropped by 3.41 million US Dollars. Categorically, Foreign Individual, Corporate and Overseas Pakistani Investors remained in net selling position of 0.29, 7.84 and 0.86 million shares respectively. On the other side Local Individuals, Mutual Funds and brokers have added 4.97, 7.05 and 8.53 million shares to their positions but Local Companies, Banks, NBFCs have offloaded 6.24, 1.75 and 5.18 million shares from their holdings respectively during last trading session.

Analytical Review

Asian stocks inched higher on Friday and looked set to close a strong week on a positive note, while the euro slipped after the European Central Bank showed no signs of paring its stimulus program. MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS was up 0.1 percent, putting it on pace to end the week up 1.9 percent, which would be its best week in six. Earlier in the week, it hit an almost two-year high. Japanese Nikkei .N225 fell 0.1 percent as March industrial output and household spending fell more than expected and consumer inflation remained tepid. But the index was poised for a 3.3 percent weekly gain, its strongest since November. The yen JPY was steady at 111.23 yen to the dollar, but looked set to end the week weaker, with the dollar posting a 2 percent gain. The dollar index .DXY, which tracks the greenback against a basket of global peers, gained 0.1 percent to 99.198, but is headed for a 0.8 percent weekly loss, thanks to a surge in the euro.

Pakistan has refused part financing from the Asian Development Bank (ADB) for the $8 billion Karachi-Peshawar Railway Line (ML-1) after China said it wanted to fund the project single-handedly. “China strongly argued that two-sourced financing would create problems and the project would suffer,” Minister for Planning and Development Ahsan Iqbal told a news conference on Thursday. The minister said he would not comment whether the Ministry of Railways has resisted the Chinese request for fears of monopoly, but said the entire financing would now come from China. The project was originally planned to be partly funded by the Manila-based ADB.

Foreign exchange reserves have been dropping by a monthly average of half a billion dollars, making it difficult for the government to strike a balance between the outflow and inflow of greenbacks. Market sources said public-sector companies are not buying dollars from the interbank market. Instead, they are taking loans so that foreign exchange reserves of commercial banks remain intact. The State Bank of Pakistan (SBP) reported on Thursday reserves fell to $21.15bn, which shows a drop of about $3bn in the last six months. The SBP report said reserves of the central bank decreased $366 million to $16.05bn due to external debt servicing and other official payments during the week ending on April 21.

Builders are agitating against high prices of steel, cement and ceramics, and have asked the government to protect interests of the general public instead of the industry. In a statement issued on Thursday, Association of Builders and Developers (ABAD) Chairman Mohsin Sheikhani said manufacturers were seeking a permanent anti-dumping duty on the import of steel meant for construction. The government imposed the duty to protect the steel industry when the commodity’s prices dipped to $220 a tonne on the international market. However, as global steel prices have now reached $480 a tonne, the government has not lifted the duty, and steel makers were capitalising on the opportunity. Local steel is selling for Rs85,000 a tonne against the imported steel available at Rs55,000.

The Directorate of Customs Valuation has increased the customs valuation rate on import of 1,800cc and above vehicles ahead of federal budget 2017-18. All Pakistan Motor Dealers Association (APMDA) Chairman H.M. Shehzad said the decision would raise the duty of such vehicles by Rs200,000 to Rs1.5 million depending on around 400 models as the mechanism of customs valuation for imported vehicles had been changed without taking stakeholders into confidence. He said the association members had suspended the clearance of around 200 vehicles at the port due to an increase in valuation rate. However, the government would not get Rs3 billion revenue due to non clearance of vehicles.

The Market is expected to remain volatile today. We advise Traders to exercise caution. Buying on dips and booking gains on strength is recommended.

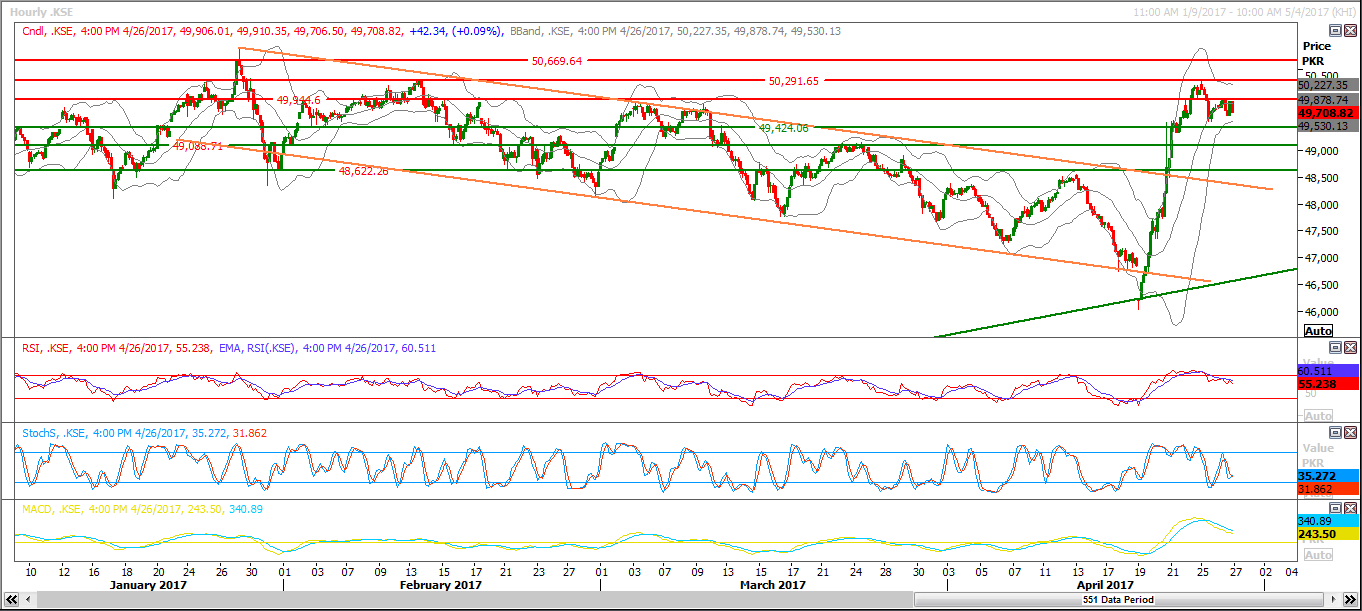

Technical Analysis

The Bench Mark KSE100 Index is getting support from a horizontal support at 49440 and breakout of this region will call for 49240 and then 49088. Breakout of 49440 will call for an expansion of its last 50% correction on hourly chart. Daily stochastic has already generated a bearish crossover and now MAORSI is trying to strengthen its bearish momentum by generating its bearish crossover. If index closes below 49440, next target would be 49088 on daily chart. Buying with strict stop loss of 49440 is recommended but on breakout of 49440 it is recommended to sell on strength with targets at 49240 and 49088.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.