Asian stocks fluctuated and U.S. equity futures fell as investors weighed the damage from Tropical Storm Harvey on U.S. oil refining centers. The greenback maintained losses after Federal Reserve Chair Janet Yellen failed to provide clues on monetary-policy tightening. Benchmarks in Tokyo swung between gains and losses, while they dropped in Seoul and Sydney with S&P 500 Index futures. Gasoline futures jumped as the wider impact of the storm that shut more than 10 percent of U.S. fuel-making capacity was becoming more evident.

Pakistan cannot allow the war in Afghanistan to spill into its own territory, Chief of Army Staff (COAS) Gen Qamar Javed Bajwa told his Afghan counterpart Gen Sharif Yaftali on Sunday. Gen Qamar met the Afghan army chief on the sidelines of a meeting of the Quadrilateral Counter-Terrorism Coordination Mechanism (QCCM) in Dushanbe, Tajikistan. In his meeting with Afghanistan’s Gen Yaftali, the COAS assured the neighbouring country of Pakistan’s support. However, he added that Pakistan could not let the Afghan war spill into its territory, according to an Inter-Services Public Relations (ISPR) statement.

Prime Minister Shahid Khaqan Abbasi inaugurated Liquefied Natural Gas (LNG) terminal at the Port Qasim, here on Sunday. It was Pakistan's first LNG terminal established by the Engro Terminal Limited within record 330 days and with a capacity to re-gasify up to 600 mmscfd. "Our government brought this inexpensive source of energy to the country in record time, Abbasi said speaking at the ceremony, adding that the previous three governments made several attempts to introduce LNG source of energy but failed.

He said that within eleven months since the contract was signed, the terminal began functioning which was an example of cooperation between the government and the private sector. The prime minister said other source of energy such as oil, hydel and nuclear were considered as expensive means as the country required an integrated and efficient source to overcome its crippling energy needs.

"The bids for the whole process were completely transparent and world acknowledged government's efforts in this regard," he said, adding that the world was thinking that the project would take several years but the government succeeded by introducing the LNG-based energy.

Puma Energy, a Singapore-based midstream and downstream oil firm, acquired a majority stake in oil marketing company Admore Gas Pvt Ltd to roll out its products in the country with growing gasoline consumption. Puma Energy, however, didn’t reveal the amount of acquiring 51 percent interests in Admore.

“The joint venture will bring Puma Energy branded retail sites, convenience stores and quality product range to the Pakistan market, and undertake a significant investment programme to develop best-in-class supply chain infrastructure in-country to ensure the future needs of our retail business partners and public customers can be met,” the company said in a statement. Oil sales in the country soared 11 percent at 10–year high of 26 million tonnes as the economy recorded a decade-high growth of 5.3 percent during the last fiscal year.

Banking sector’s spread fell nine basis points (bps) to 4.97 percent year-on-year in July as competition increased in the wake of soft interest rates, analysts said on Friday. Spread also registered a decline of five basis points month-on-month in July. Analyst Mustafa Mustansir at Taurus Securities Limited attributed the decline in spread to intensifying competition for low-cost funds. The State Bank of Pakistan’s (SBP) key policy rate stands at 42-decade low of 5.75 percent.

The fertilizer sector has witness a mixed trend for the seventh month of the current calendar year as almost all manufacturers have posted declining trends in urea off-take. As per numbers released by the National Fertilizer Development Centre, urea off-take for the month of July 2017 stood at 339,000 tons, down 68% month-on-month and 56% on a year-on-year basis. However, di-ammonium phosphate (DAP) off-take for the same month showed a positive trend and clocked in at 283,000 tons, posting an increase of 153% on monthly and 31% on year-on-year basis.

Today ATRL, GATM, ISL and NML may lead the market in positive direction.

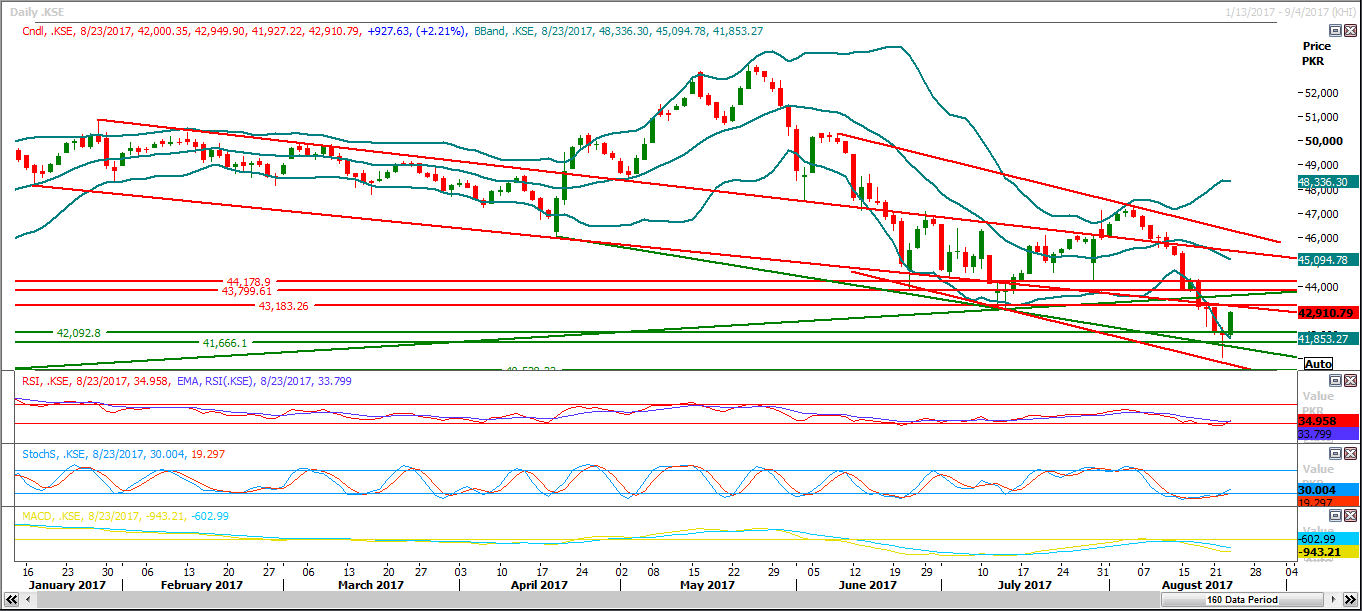

The Benchmark KSE-100 is range bound in a diagonal channel. The closing on Friday was near to the resistance at 42657, after the Index gave a false break from its support at 42008. With the technical Indicators in oversold zone, the KSE-100 awaits a trigger for a positive move. The resistant regions for today’s session stand at 42618, 42759 and 42950. Traders must keep an eye on the 9 Days moving average (currently at 42917) which may expose the Index to intraday profit taking. On the other hand, the levels to watch on the downside are 42112 and 42008. A closing below 42008 may result in a deeper correction towards 40700-40500 in the sessions to come. Traders are advised to practice a closing based Stop-loss at 42112, in case of a downside move in today’s session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.