Previous Session Recap

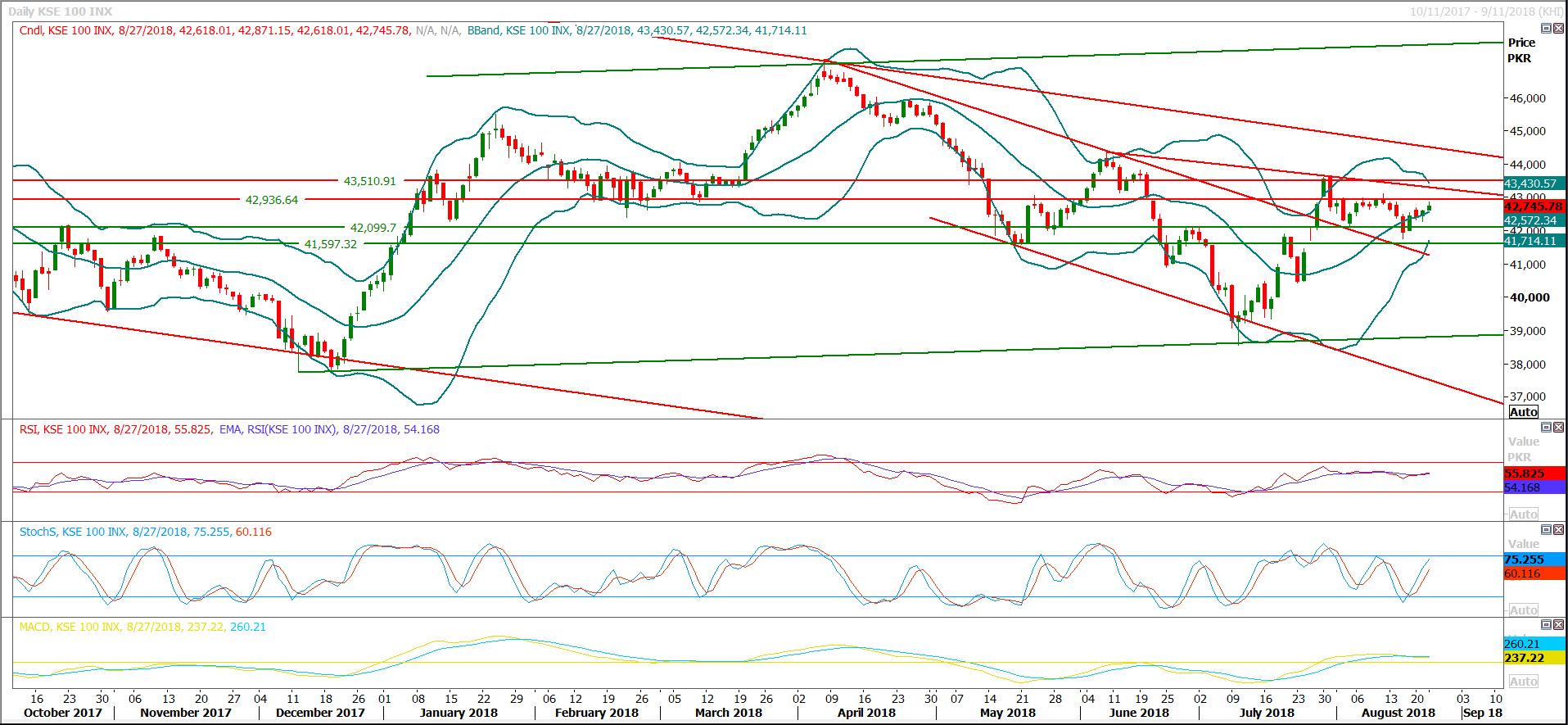

Trading volume at PSX floor increased by 101.69 million shares or 87.75% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 42,618.01, posted a day high of 42,871.15 and a day low of 42,618.01 during last trading session. The session suspended at 42,745.78 with net change of 157.49 and net trading volume of 106.93 million shares. Daily trading volume of KSE100 listed companies increased by 57.75 million shares or 117.46% on DoD basis.

Foreign Investors remain in net selling positions of 4.22 million shares but net value of Foreign Inflow dropped by 0.67 million US Dollars. Categorically Foreign Corporate and Overseas Pakistanis remained in net buying positions of 0.57 and 3.62 million shares. While on the other side Local Individuals Companies, Banks, NBFCs and Insurance Companies remained in net selling positions of 4.88, 0.52, 1.78, 6.52 and 2.0 million shares respectively but Mutual Funds and Brokers remained in net buying positions of 4.7 and 5.67 million shares.

Analytical Review

Asian markets cheer U.S.-Mexico trade dea

Asian shares advanced on Tuesday and the U.S. dollar hovered near one-month lows as a U.S.-Mexico deal to overhaul the North American Free Trade Agreement boosted risk appetite. MSCI’s broadest index of Asia-Pacific shares outside Japan climbed 0.6 percent for a second straight day of gains. Australian shares and Japan’s Nikkei both rose 0.7 percent. New York’s S&P 500 and Nasdaq indexes hit record highs led by gains in technology stocks.

SNGPL, SSGC seek gas price hike to cut losses

The two state-owned natural gas companies SNGPL and SSGC Monday said that they are losing money due to huge difference in the gas purchase and sale prices which is increasing the circular debt, demanding the government to increase the gas prices to resolve the issue. Sui Northern Gas Pipeline Limited (SNGPL) is purchasing natural gas from gas producers at an average rate of Rs 629 per million British Thermal Unit (MMBTU) and selling at Rs399 per unit, with a net loss of about Rs230 per unit which is making business operations difficult and weakening company’s financial health, said Managing Director SNGPL Amjad Latif while briefing the Senate Special Committee on Circular Debt here.

Urea stocks hit lowest level ahead of winter sowing

Urea stocks hit the lowest level of half a million tons in August, around 12 percent less than the monthly demand, fanning fear of the nutrient shortage for key winter crops in the agriculture country. This poses a major challenge to the new government that took office a couple of days ago, they said. National Fertiliser Development Centre’s (NFDC) data revealed that the opening inventory of urea in August stood at 0.087 million tons, the lowest level in summer 2018. With the local production of 0.46 million tons the total urea availability in August comes in at 0.547 million tons against the off-take of 0.620 million tons, showing a shortfall of 0.073 million tons.

Pakistan borrows $439.17m in July to maintain foreign reserves

Pakistan has borrowed $439.17 million in the first month of the current fiscal year to keep its foreign reserves above the two months import bill. Sources informed that overall, the country received $468.31 million in grants and loans in July 2018 from donors, commercial banks and multilateral institutions. Pakistan has to make a repayment of Rs601 billion in foreign loans during the current fiscal year 2018-9.

FBR reforms to be discussed in next cabinet meeting

The government is gearing up to launch a drastic reform plan for the Federal Board of Revenue (FBR) with the objectives of enhancing revenue collection and promoting equity and transparency in the tax machinery. Dawn has learnt that the plan is in advanced stages, but nobody at the FBR is aware of it. “We have moved a summary to the cabinet for introducing reforms in the FBR” Finance Minister Asad Umar told Dawn on Monday. The cabinet is expected to take up the summary in its next meeting, he said. “I would describe this as the beginning of FBR reforms” he said. He added that the government intends to build on the work on the tax reform committee of the previous government, which had also been endorsed by a committee of the national assembly but never moved into implementation stage.

Asian shares advanced on Tuesday and the U.S. dollar hovered near one-month lows as a U.S.-Mexico deal to overhaul the North American Free Trade Agreement boosted risk appetite. MSCI’s broadest index of Asia-Pacific shares outside Japan climbed 0.6 percent for a second straight day of gains. Australian shares and Japan’s Nikkei both rose 0.7 percent. New York’s S&P 500 and Nasdaq indexes hit record highs led by gains in technology stocks.

The two state-owned natural gas companies SNGPL and SSGC Monday said that they are losing money due to huge difference in the gas purchase and sale prices which is increasing the circular debt, demanding the government to increase the gas prices to resolve the issue. Sui Northern Gas Pipeline Limited (SNGPL) is purchasing natural gas from gas producers at an average rate of Rs 629 per million British Thermal Unit (MMBTU) and selling at Rs399 per unit, with a net loss of about Rs230 per unit which is making business operations difficult and weakening company’s financial health, said Managing Director SNGPL Amjad Latif while briefing the Senate Special Committee on Circular Debt here.

Urea stocks hit the lowest level of half a million tons in August, around 12 percent less than the monthly demand, fanning fear of the nutrient shortage for key winter crops in the agriculture country. This poses a major challenge to the new government that took office a couple of days ago, they said. National Fertiliser Development Centre’s (NFDC) data revealed that the opening inventory of urea in August stood at 0.087 million tons, the lowest level in summer 2018. With the local production of 0.46 million tons the total urea availability in August comes in at 0.547 million tons against the off-take of 0.620 million tons, showing a shortfall of 0.073 million tons.

Pakistan has borrowed $439.17 million in the first month of the current fiscal year to keep its foreign reserves above the two months import bill. Sources informed that overall, the country received $468.31 million in grants and loans in July 2018 from donors, commercial banks and multilateral institutions. Pakistan has to make a repayment of Rs601 billion in foreign loans during the current fiscal year 2018-9.

The government is gearing up to launch a drastic reform plan for the Federal Board of Revenue (FBR) with the objectives of enhancing revenue collection and promoting equity and transparency in the tax machinery. Dawn has learnt that the plan is in advanced stages, but nobody at the FBR is aware of it. “We have moved a summary to the cabinet for introducing reforms in the FBR” Finance Minister Asad Umar told Dawn on Monday. The cabinet is expected to take up the summary in its next meeting, he said. “I would describe this as the beginning of FBR reforms” he said. He added that the government intends to build on the work on the tax reform committee of the previous government, which had also been endorsed by a committee of the national assembly but never moved into implementation stage.

Market is expected to remain volatile therefore its recommended to stay cautious while trading during current trading session.

Technical Analysis

The KSE100 index faces its first strong horizontal resistance level at 42,940pts while the second resistance stands at 43,031pts. We believe these levels will likely keep the index’s rally contained and may even push the KSE100 into negative territory. On the flipside, the index’s first support level stands at 42,460pts while falling through this level may cause the index to find support at 42,089pts. Although daily momentum indicators suggest a bullish run, hourly and weekly momentum indicators predict a bearish spell. We recommend a “sell on strength” stance with stop losses during the current trading session and suggest booking profits at mentioned resistance levels.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.