Previous Session Recap

Trading volume at PSX floor Increased by 15.16 million shares or 17.12% on DOD basis whereas the Benchmark KSE100 index opened at 38,386.90, posted a day high of 38,460.10 and day low of 37.701.16 during last trading session while session suspended at 37,724.08 points with net change of -364.50 points and net trading volume of 69.74 million shares. Daily trading volume of KSE100 listed companies Increased by 8.65 million shares or 14.17% on DOD basis.

Foreign Investors remained in net buying positions of 1.68 million shares and net value of Foreign Inflow increased by 0.50 million US Dollars. Categorically, Foreign Individuals and Foreign Corporate remained in net selling positions of 0.05 and 0.26 million shares but and Overseas Pakistanis investors remained in net buying positions of 1.98 million shares. While on the other side Local Individuals, NBFCs, Mutual Fund, Brokers and Insurance Companies remained in net selling positions of 4.17, 0.51, 0.96, 3.28 and 0.95 million shares respectively but Local Companies and Banks remained in net buying positions of 3.86 and 4.16 million shares.

Analytical Review

Asia stocks edge up as Wall St. extends comeback rally

Asia stocks inched higher on Friday after Wall Street ended volatile trade in the green, adding to the massive gains of the previous session although lingering investor jitters helped support safe-haven currencies such as the yen. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.15 percent. It has fallen almost 4 percent so far in December. Australian stocks added 0.5 percent and South Korea’s KOSPI climbed 0.65 percent. Japan’s Nikkei bucked the trend and slipped 0.25 percent.

Power tariff scaled down by 31 paisas per unit

The National Electric Power Regulatory Authority (NEPRA) on Thursday allowed tariff decrease of Re 0.31 per unit for ex-WAPDA distribution companies on account of fuel price adjustment for the month of November. The decision was taken by NEPRA in a public hearing on the petition filed by the Central Power Purchasing Agency (CPPA). The decision will have a cumulative impact of around Rs 2 billion on the electricity consumers and the relief will be provided to the consumers in the January bills.

Pak-Qatar business conference to be held in Doha

A two-day Pak-Qatar business conference, organised by the Rawalpindi Chamber of Commerce and Industry (RCCI), will be held on January 28 at Doha, the capital city of Qatar state. Talking to APP, President RCCI said Malik Shahid Saleem said that RCCI being the oldest chamber of commerce in the country has geared up its efforts by arranging visits of delegations of Pakistani businessmen to various parts of world for exploring opportunities of enhancing trade and investments.

17pc staff of ex-Wapda Discos involved in power theft

Senate Standing Committee on Power was Thursday informed that around 17 percent employees of ex-WAPDA Discos have been found involved in electricity theft or other related activities and investigation is underway against them. The power distribution companies (DISCOs) have around 120,000 employees across the country out of which around 20,000 are found involved in theft or other related activities, said the special Secretary Power division, Hassan Nasir Jami while briefing the Senate Standing Committee on Power.

Govt to rationalise tariffs, duties for industry in mini-budget

Advisor to PM on Commerce, Textile, Industry & Production and Investment, Abdul Razak Dawood has said that the government is working to rationalize tariffs structure and customs duties in the next mini-budget that would be presented in January 2019 to facilitate the growth of industrialization as the current tariffs and customs duties were not favorable for the industry.

Asia stocks inched higher on Friday after Wall Street ended volatile trade in the green, adding to the massive gains of the previous session although lingering investor jitters helped support safe-haven currencies such as the yen. MSCI’s broadest index of Asia-Pacific shares outside Japan rose 0.15 percent. It has fallen almost 4 percent so far in December. Australian stocks added 0.5 percent and South Korea’s KOSPI climbed 0.65 percent. Japan’s Nikkei bucked the trend and slipped 0.25 percent.

The National Electric Power Regulatory Authority (NEPRA) on Thursday allowed tariff decrease of Re 0.31 per unit for ex-WAPDA distribution companies on account of fuel price adjustment for the month of November. The decision was taken by NEPRA in a public hearing on the petition filed by the Central Power Purchasing Agency (CPPA). The decision will have a cumulative impact of around Rs 2 billion on the electricity consumers and the relief will be provided to the consumers in the January bills.

A two-day Pak-Qatar business conference, organised by the Rawalpindi Chamber of Commerce and Industry (RCCI), will be held on January 28 at Doha, the capital city of Qatar state. Talking to APP, President RCCI said Malik Shahid Saleem said that RCCI being the oldest chamber of commerce in the country has geared up its efforts by arranging visits of delegations of Pakistani businessmen to various parts of world for exploring opportunities of enhancing trade and investments.

Senate Standing Committee on Power was Thursday informed that around 17 percent employees of ex-WAPDA Discos have been found involved in electricity theft or other related activities and investigation is underway against them. The power distribution companies (DISCOs) have around 120,000 employees across the country out of which around 20,000 are found involved in theft or other related activities, said the special Secretary Power division, Hassan Nasir Jami while briefing the Senate Standing Committee on Power.

Advisor to PM on Commerce, Textile, Industry & Production and Investment, Abdul Razak Dawood has said that the government is working to rationalize tariffs structure and customs duties in the next mini-budget that would be presented in January 2019 to facilitate the growth of industrialization as the current tariffs and customs duties were not favorable for the industry.

Market is expected to remain volatile during current trading session therefore it's recommended to stay cautious while trading

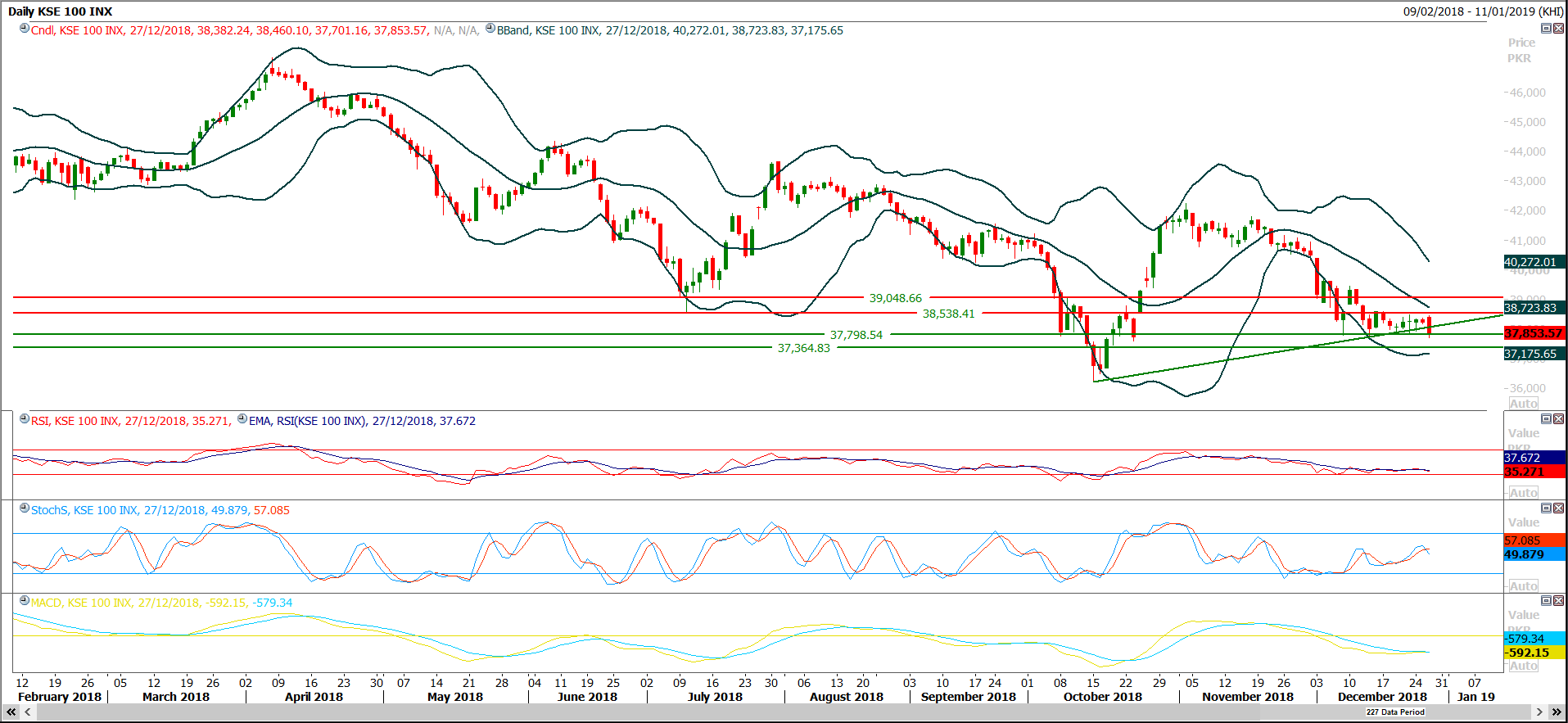

Technical Analysis

The Benchmark KSE100 Index have penetrated below its supportive trend line which was supporting index since last week but still closed above major supportive region of 37,700 points during last trading session. As of now it’s expected that index would remain under pressure if it would succeed in opening with a negative gap below 37,700 points and would find some ground between 37,415-37,37,370 points. Daily momentum indicators have generated bearish crossovers and these would try to lead index in negative direction if hourly momentum indicators would not succeed in generating reversal patterns. Today’s whole trading session depends on closing of first hourly chart’s closing level because if index would succeed in maintaining above 37,700 points then a cheat pattern would be witnessed which would create volatile situation in market. It’s recommended to either stay side line or trade with strict stop loss on both sides because index is standing on fourth bottom on weekly chart and now its supportive side authenticity is being voided with pressure from selling side.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.