Previous Session Recap

Trading volume at PSX floor increased by 101.30 million shares or 68.47% on DoD basis, whereas the benchmark KSE100 index opened at 37,985.57, posted a day high of 38,242.12 and a day low of 36,918.22 points during last trading session while session suspended at 38,087.32 points with net change of -251.01 points and net trading volume of 186.77 million shares. Daily trading volume of KSE100 listed companies also increased by 68.38 million shares or 57.75% on DoD basis.

Foreign Investors remained in net selling positions of 28.54 million shares and value of Foreign Inflow dropped by 5.25 million US Dollars. Categorically, Foreign Individuals remained in net long positions of 0.0065 million shares but Foreign Corporate and Overseas Pakistani remained in net selling positions of 7.67 and 20.87 million shares respectively. While on the other side Banks, Mutual Fund and Brokers remained in net selling positions of 71.78, 6.38 and 4.49 million shares but Local Individuals, Companies, NBFCs and Insurance Companies remained in net long positions of 76.66, 4.94, 0.15 and 29.10 million shares respectively.

Analytical Review

World stocks set for worst week since 2008 as virus fears grip markets

Global share markets were headed for the worst week since the depths of the 2008 financial crisis as investors ditched risky assets on fears the coronavirus would become a pandemic and derail economic growth. Asian stocks tracked another overnight plunge in Wall Street’s benchmarks on Friday with the markets in China, Japan and South Korea all posting heavy losses. Hopes that the epidemic that started in China would be over in a few months and economic activity would return to normal have been shattered, as new infections reported around the world now surpass those in China. The worsening global threat from the virus prompted investors to rapidly step up bets the U.S. Federal Reserve would need to cut interest rates as soon as next month to support economic growth.

IMF, govt agree on steps for $450m release

The International Monetary Fund (IMF) on Thursday said it had reached a staff-level agreement with Pakistan authorities “on policies and reforms needed to complete the second review” of the $6bn Extended Fund Facility (EFF). The announcement was made by Ernesto Ramirez Rigo, Mission Chief for Pakistan, through a brief statement after a series of engagements with Adviser to the Prime Minister on Finance and Revenue Dr Hafeez Shaikh, Governor of the State Bank of Pakistan Dr Reza Baqir and Finance Secretary Naveed Kamran Baloch through video conference over the last two weeks. “IMF staff and the Pakistani authorities have reached a staff-level agreement on policies and reforms needed to complete the second review of the authorities’ reform programme supported under the EFF,” said the statement.

Experts for procurement of imported coal thru competitive pricing mechanism

Experts from coal industry Thursday underlined the need for the procurement of imported coal through competitive pricing mechanism to ensure cheap rates of the commodity for power generation which will help reduce the generation cost from this source. Addressing during fourth day of NEPRA Energy Week 2020, the international experts from United Kingdom and Singapore discussed the details about optimizing the procurement of imported coal through competitive pricing mechanism. During the session, the experts provided the global comparison of the international coal pricing, mechanism of price adjustment and its impact on electricity price.

SCCI flays raids on small industries under guise of levies collection

The Sarhad Chamber of Commerce and Industry (SCCI) has condemned the crackdown on the small industrial units situated on Kohat road Peshawar under guise of collecting sales tax and other levies by subordinate insinuations of the Federal Board of Revenue (FBR), and asked the government to stop harassment of small manufacturers and imposition of heavy fines on them. The issue was raised by owners of the small industries on Kohat road Peshawar in a meeting with the SCCI President Maqsood Anwar here at the chamber house on Thursday. The delegation comprised of Small Industrial Estate Association Kohat road president Wahid Awan, Dr Nasir, Haji Moalim, Dr Faisal, Abdullah, Noor Muhammad, Toor Khan, Mansoor Ahmad and others.

EPay Punjab fetches Rs1b revenue in less than 5 months

EPay Punjab, the first ever government payment aggregator for citizen facilitation and ease of business, has collected over Rs1 billion revenue from multiple levies since its launch five months back. This was informed in a progress review meeting of Punjab Information Technology Board presided over by Chairman PITB Azfar Manzoor on Thursday. Director General IT Operations Faisal Yousaf and other senior officials participated in the meeting. EPay Punjab was launched on October 4 last year as a collaborative endeavor of Finance Department and PITB. The system provides general public a stress-free and efficient method of paying all taxes through contemporary banking channels; without going through the existing cumbersome process.

Global share markets were headed for the worst week since the depths of the 2008 financial crisis as investors ditched risky assets on fears the coronavirus would become a pandemic and derail economic growth. Asian stocks tracked another overnight plunge in Wall Street’s benchmarks on Friday with the markets in China, Japan and South Korea all posting heavy losses. Hopes that the epidemic that started in China would be over in a few months and economic activity would return to normal have been shattered, as new infections reported around the world now surpass those in China. The worsening global threat from the virus prompted investors to rapidly step up bets the U.S. Federal Reserve would need to cut interest rates as soon as next month to support economic growth.

The International Monetary Fund (IMF) on Thursday said it had reached a staff-level agreement with Pakistan authorities “on policies and reforms needed to complete the second review” of the $6bn Extended Fund Facility (EFF). The announcement was made by Ernesto Ramirez Rigo, Mission Chief for Pakistan, through a brief statement after a series of engagements with Adviser to the Prime Minister on Finance and Revenue Dr Hafeez Shaikh, Governor of the State Bank of Pakistan Dr Reza Baqir and Finance Secretary Naveed Kamran Baloch through video conference over the last two weeks. “IMF staff and the Pakistani authorities have reached a staff-level agreement on policies and reforms needed to complete the second review of the authorities’ reform programme supported under the EFF,” said the statement.

Experts from coal industry Thursday underlined the need for the procurement of imported coal through competitive pricing mechanism to ensure cheap rates of the commodity for power generation which will help reduce the generation cost from this source. Addressing during fourth day of NEPRA Energy Week 2020, the international experts from United Kingdom and Singapore discussed the details about optimizing the procurement of imported coal through competitive pricing mechanism. During the session, the experts provided the global comparison of the international coal pricing, mechanism of price adjustment and its impact on electricity price.

The Sarhad Chamber of Commerce and Industry (SCCI) has condemned the crackdown on the small industrial units situated on Kohat road Peshawar under guise of collecting sales tax and other levies by subordinate insinuations of the Federal Board of Revenue (FBR), and asked the government to stop harassment of small manufacturers and imposition of heavy fines on them. The issue was raised by owners of the small industries on Kohat road Peshawar in a meeting with the SCCI President Maqsood Anwar here at the chamber house on Thursday. The delegation comprised of Small Industrial Estate Association Kohat road president Wahid Awan, Dr Nasir, Haji Moalim, Dr Faisal, Abdullah, Noor Muhammad, Toor Khan, Mansoor Ahmad and others.

EPay Punjab, the first ever government payment aggregator for citizen facilitation and ease of business, has collected over Rs1 billion revenue from multiple levies since its launch five months back. This was informed in a progress review meeting of Punjab Information Technology Board presided over by Chairman PITB Azfar Manzoor on Thursday. Director General IT Operations Faisal Yousaf and other senior officials participated in the meeting. EPay Punjab was launched on October 4 last year as a collaborative endeavor of Finance Department and PITB. The system provides general public a stress-free and efficient method of paying all taxes through contemporary banking channels; without going through the existing cumbersome process.

Market is expected to remain volatile during current trading session.

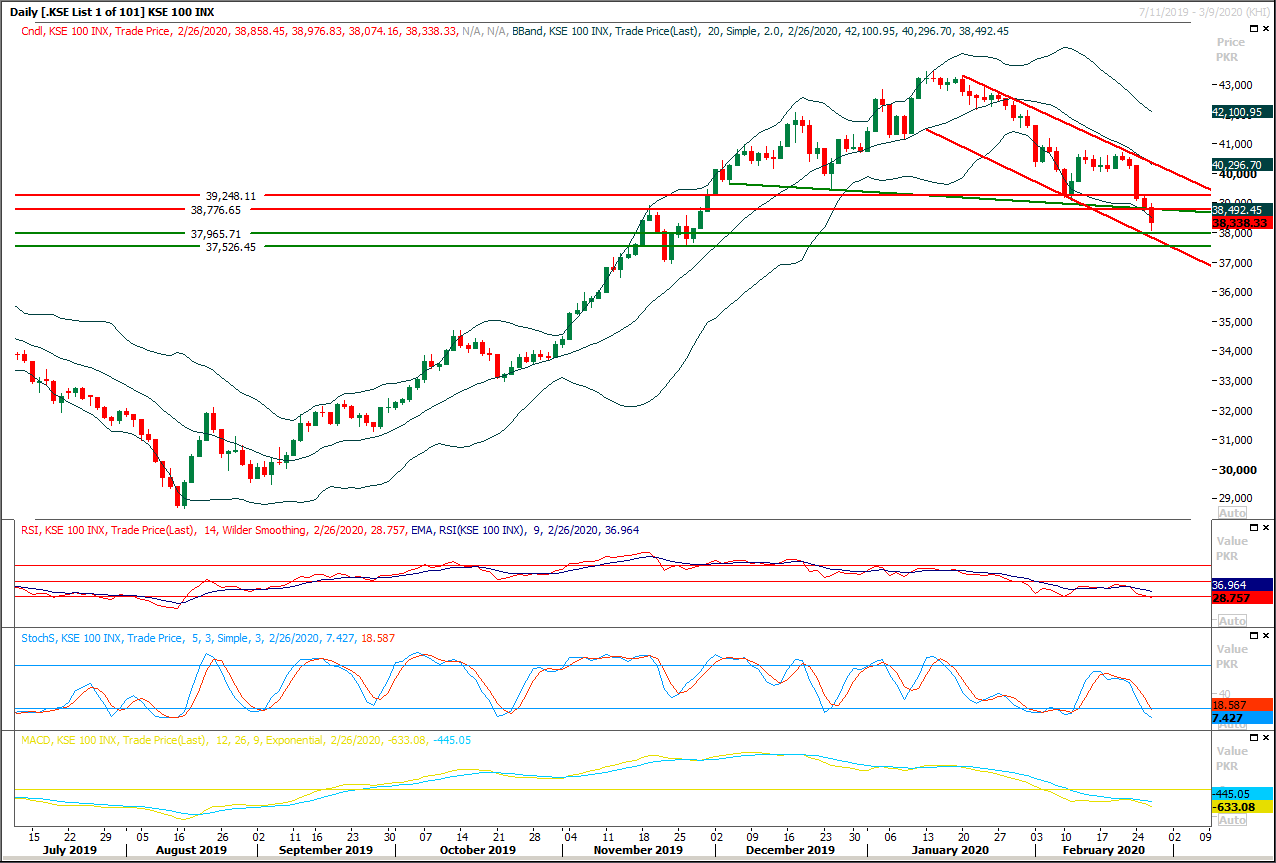

Technical Analysis

The Benchmark KSE100 index have give a clear breakout of its descending wedge in downward direction and now it would remain bearish towards 37,000 and 36,500 points index would face major resistance at 38,350 points and 38,770 where crossover of a horizontal line with a descending trend line would try to push index downward again. It's recommended to stay on selling side and start selling on strength with strict stop loss of 39,250 points because momentum is strongly bearish on weekly and monthly charts and it's expected that a monthly evening shooting star formation would took place which would add more pressure on index in coming days. Meanwhile index have supportive regions ahead at 37,960 points and breakout below that region would call for 37,500 points. This weekly closing below 37,500 points would push index into bearish zone on short to mid-term basis while to recover from current bearish sentiment index need to close above 39,760 points in next two trading sessions.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.