Previous Session Recap

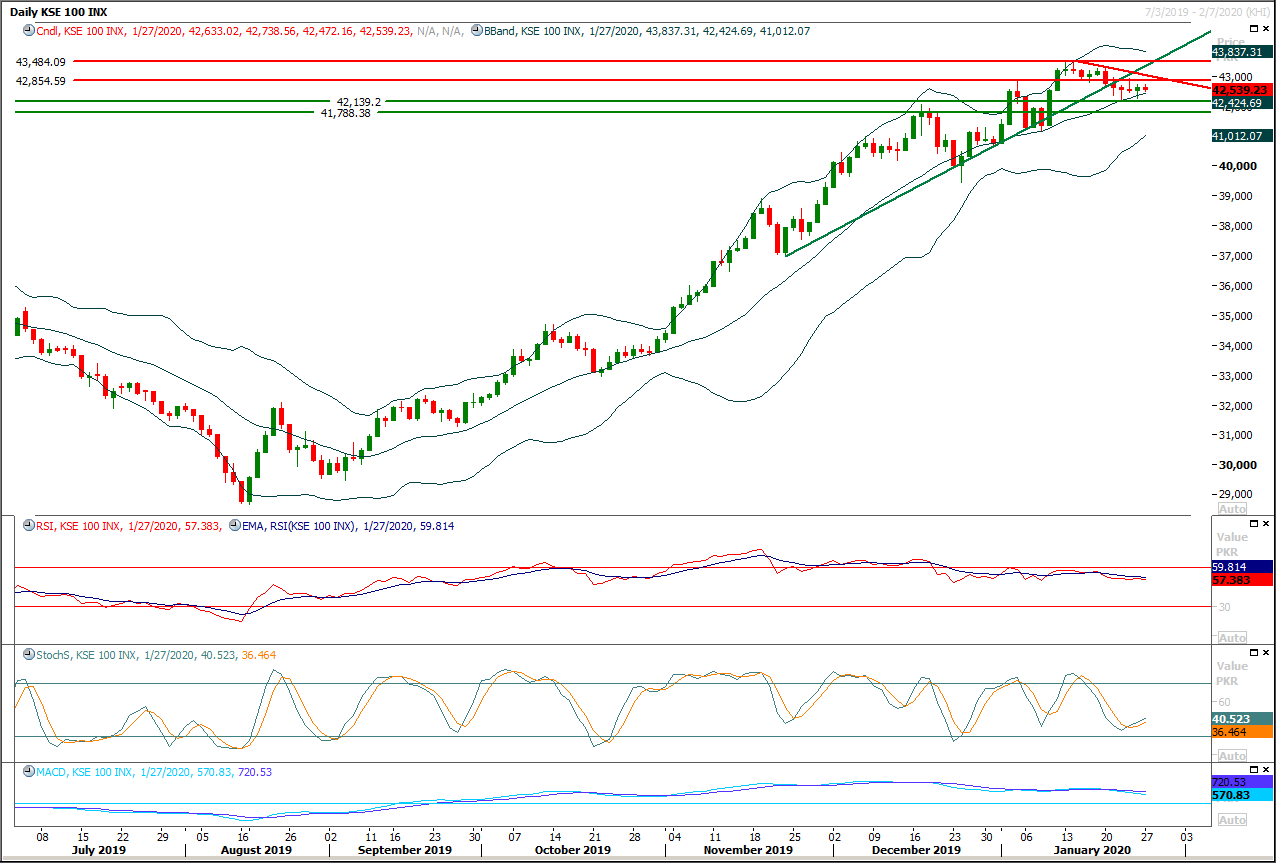

Trading volume at PSX floor increased by 25.44 million shares or 14.70% on DoD basis, whereas the benchmark KSE100 index opened at 42,633.02, posted a day high of 42,738.56 and a day low of 42,472.16 points during last trading session while session suspended at 42,539.23 points with net change of -93.79 points and net trading volume of 126.38 million shares. Daily trading volume of KSE100 listed companies also increased by 12.70 million shares or 11.17% on DoD basis.

Foreign Investors remained in net selling positions of 3.01 million shares and net value of Foreign Inflow dropped by 0.35 million US Dollars. Categorically, Foreign Individuals and Foreign Corporate remained in net buying positions of 0.02 and 2.05 million shares but Overseas Pakistani investors remained in net buying positions of 5.08 million shares. While on the other side Local Individuals and Mutual Fund remained in net buying positions of 9.16 and 0.87 million shares but Local Companies, Banks, NBFCs, Brokers and Insurance Companies remained in net selling positions of 3.68, 1.63, 0.006, 0.96 and 0.49 million shares respectively.

Analytical Review

Stocks crumble as China virus toll mounts, safe havens in demand

Asian stocks extended a global selloff on Tuesday as China took more drastic steps to combat a deadly new coronavirus, while bonds shone on expectations central banks would need to keep stimulus flowing to offset the likely economic drag. As the death toll reached 106 in China, some health experts questioned whether Beijing can contain the virus which has spread to more than 10 countries, including France, Japan and the United States. No deaths have been reported outside of China so far. China has already extended the Lunar New Year holiday to Feb. 2 nationally, and to Feb. 9 for Shanghai. On Tuesday, the country’s largest steelmaking city in northern Hebei province, Tangshan, suspended all public transit in an effort to prevent the spread of the virus. With Chinese markets shut investors were selling the offshore yuan CNH= and the Australian dollar AUD=D3 as a proxy for risk. Oil was also under pressure as fears about the wider fallout from the virus mounted.

Pakistan needs $234.5bn to achieve key SDGs

Pakistan needs at least $234.5 billion investment by 2030 to deliver on three sustainable development goals (SDGs) — power, digital access, transport and clean water and sanitation. The findings were released by Standard Chartered bank in a report titled “Opportunity 2030: The Standard Chartered SDG Investment Map” to help companies, institutional investors, and other stakeholders ascertain the impact of their investments in achieving United Nation’s SDGs. The map identifies $10 trillion opportunity for private-sector investors across all emerging markets. In Pakistan, the power sector needs $99.3bn, digital access $56.6bn, transport $38.5bn and clean water and sanitation $4bn.

Stocks, oil tumble as China virus rattles markets

Global stocks and oil plunged on Monday as panicked investors fled risky assets for safer bets gold, bonds, the dollar and the yen, after China warned that a deadly new coronavirus was spreading fast. On equity markets luxury goods makers and airlines suffered particularly as Chinese tourist spending is a key factor for them. China extended its traditional Lunar New Year holidays to buy time in the fight against the epidemic and fears of a repeat of the 2003 SARS outbreak, which also began in China, spooked investors. Recent record highs on stock markets gave them plenty of room for a reverse.

Discos start filing petitions for increase in tariff

The power distribution companies (Discos) of Wapda have started filing fresh petitions for increase in tariff under the newly introduced two-part tariff mechanism to pass on full electricity costs to consumers in a timely manner. Under the amended Nepra act (Regulation of Generation, Transmission and Distribution of Electric Power Act), the power companies are required to file separate tariff petitions for power supply and distribution. Section 23E of the Nepra act now requires that “power supply” licences would perform the function of the sale of electric power and “distribution” licencees under Section 20 would be limited to ownership, operation, management and control of distributing facilities for the movement of delivery to consumers.

Malaysians invited to participate in auction of oil and gas blocks

Ikram Muhammad Ibrahim, High Commissioner of Malaysia, called on Federal Minister for Energy Omar Ayub Khan and Nadeem Babar, Special Assistant to Prime Minister on Petroleum, at the Petroleum Division Monday morning. The high commissioner apprised the minister and Special Assistant to the Prime Minister about preparations being undertaken for the upcoming visit of Prime Minister Imran Khan to Malaysia. Federal Minister for Energy, Omar Ayub Khan and Nadeem Babar shared the structural reforms being carried out in the energy sector of the country including with a special focus on the ease of doing business in the energy sector of Pakistan. Federal Minister Omar Ayub Khan invited Malaysian investors to fully participate in the auction of oil and gas blocks that will be offered to foreign investors shortly with 18 initial blocks in the first phase. The SAPM also shared the possibility of Petronas acquiring divested shares from OGDCL, PPL and Mari Petroleum that will be divested to shared partners. Babar also invited Petronas to favorably look at LNG infrastructure development opportunities in Pakistan.

Asian stocks extended a global selloff on Tuesday as China took more drastic steps to combat a deadly new coronavirus, while bonds shone on expectations central banks would need to keep stimulus flowing to offset the likely economic drag. As the death toll reached 106 in China, some health experts questioned whether Beijing can contain the virus which has spread to more than 10 countries, including France, Japan and the United States. No deaths have been reported outside of China so far. China has already extended the Lunar New Year holiday to Feb. 2 nationally, and to Feb. 9 for Shanghai. On Tuesday, the country’s largest steelmaking city in northern Hebei province, Tangshan, suspended all public transit in an effort to prevent the spread of the virus. With Chinese markets shut investors were selling the offshore yuan CNH= and the Australian dollar AUD=D3 as a proxy for risk. Oil was also under pressure as fears about the wider fallout from the virus mounted.

Pakistan needs at least $234.5 billion investment by 2030 to deliver on three sustainable development goals (SDGs) — power, digital access, transport and clean water and sanitation. The findings were released by Standard Chartered bank in a report titled “Opportunity 2030: The Standard Chartered SDG Investment Map” to help companies, institutional investors, and other stakeholders ascertain the impact of their investments in achieving United Nation’s SDGs. The map identifies $10 trillion opportunity for private-sector investors across all emerging markets. In Pakistan, the power sector needs $99.3bn, digital access $56.6bn, transport $38.5bn and clean water and sanitation $4bn.

Global stocks and oil plunged on Monday as panicked investors fled risky assets for safer bets gold, bonds, the dollar and the yen, after China warned that a deadly new coronavirus was spreading fast. On equity markets luxury goods makers and airlines suffered particularly as Chinese tourist spending is a key factor for them. China extended its traditional Lunar New Year holidays to buy time in the fight against the epidemic and fears of a repeat of the 2003 SARS outbreak, which also began in China, spooked investors. Recent record highs on stock markets gave them plenty of room for a reverse.

The power distribution companies (Discos) of Wapda have started filing fresh petitions for increase in tariff under the newly introduced two-part tariff mechanism to pass on full electricity costs to consumers in a timely manner. Under the amended Nepra act (Regulation of Generation, Transmission and Distribution of Electric Power Act), the power companies are required to file separate tariff petitions for power supply and distribution. Section 23E of the Nepra act now requires that “power supply” licences would perform the function of the sale of electric power and “distribution” licencees under Section 20 would be limited to ownership, operation, management and control of distributing facilities for the movement of delivery to consumers.

Ikram Muhammad Ibrahim, High Commissioner of Malaysia, called on Federal Minister for Energy Omar Ayub Khan and Nadeem Babar, Special Assistant to Prime Minister on Petroleum, at the Petroleum Division Monday morning. The high commissioner apprised the minister and Special Assistant to the Prime Minister about preparations being undertaken for the upcoming visit of Prime Minister Imran Khan to Malaysia. Federal Minister for Energy, Omar Ayub Khan and Nadeem Babar shared the structural reforms being carried out in the energy sector of the country including with a special focus on the ease of doing business in the energy sector of Pakistan. Federal Minister Omar Ayub Khan invited Malaysian investors to fully participate in the auction of oil and gas blocks that will be offered to foreign investors shortly with 18 initial blocks in the first phase. The SAPM also shared the possibility of Petronas acquiring divested shares from OGDCL, PPL and Mari Petroleum that will be divested to shared partners. Babar also invited Petronas to favorably look at LNG infrastructure development opportunities in Pakistan.

Market is expected to remain volatile during current trading session.

Technical Analysis

The Benchmark KSE100 index is trying to find some ground above supportive region of 42,100 points since last week and now daily momentum indicators have started changing direction towards bullish side and it's expected that index would try to cheat a widely spread concept of evening shooting star during current trading session by moving into positive zone. Overall behavior of index seems bearish or range bound but an intraday spike could be witnessed if index would open with a positive gap. Initially 42,860 points would react as a resistance but breakout above this region would call for 43,000 points where index would need some fresh volumes to move on. Mean while index is also being capped by a descending trend line on daily chart and that line would also resist against bulls around 43,000-43,050 points. It's recommended to post trailing stop loss on both sides because either breakout above 43,000 points or below 42,000 points will call for a rally of 1000 points on either side.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.