Previous Session Recap

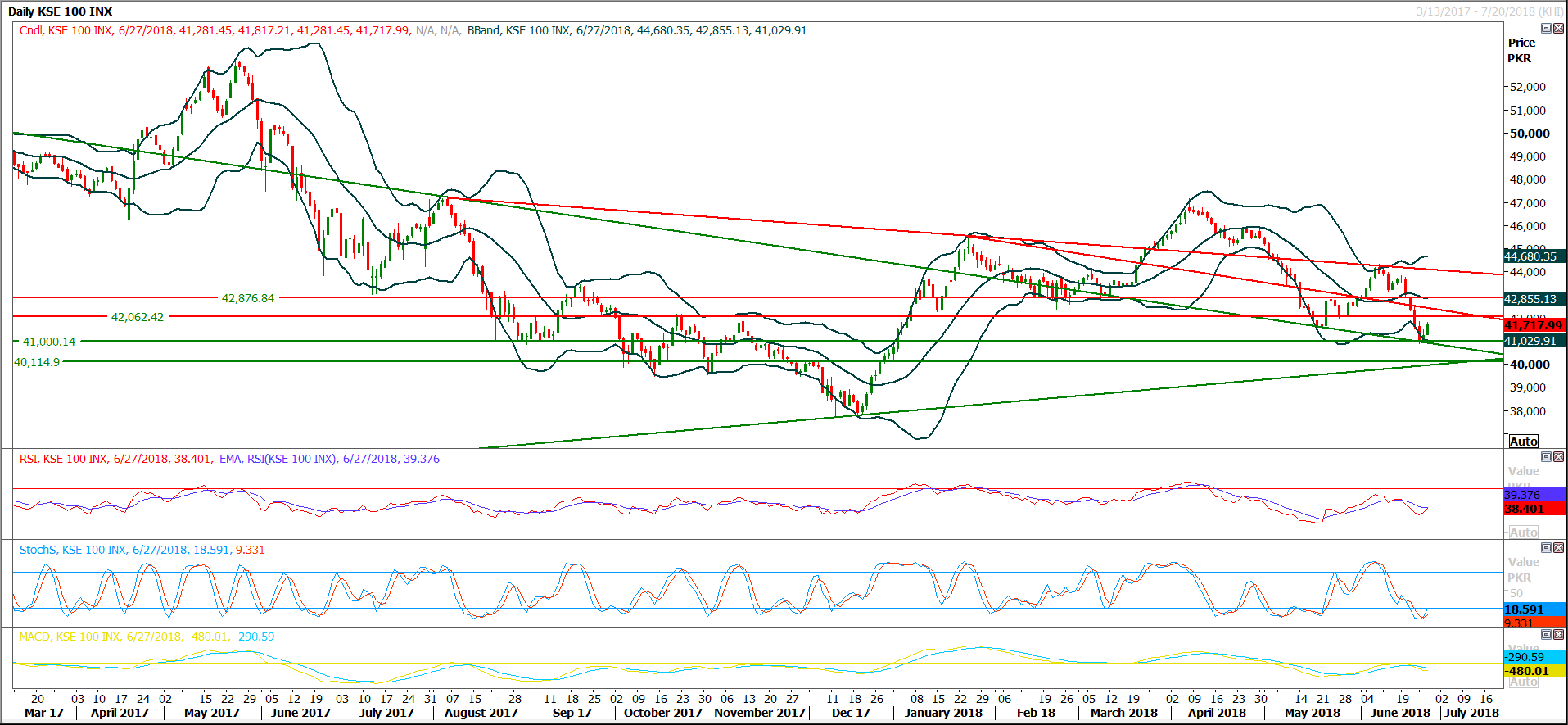

Trading volume at PSX floor increased by 55.72 million shares or 31.00% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 41,281.45, posted a day high of 41,817.21 and a day low of 41,281.45 during last trading session. The session suspended at 41,717.99 with net change of 471.90 and net trading volume of 104.01 million shares. Daily trading volume of KSE100 listed companies increased by 12.70 million shares or 13.91% on DoD basis.

Foreign Investors remained in net selling position of 3.19 million shares and net value of Foreign Inflow dropped by 4.95 million US Dollars. Categorically, Foreign Corporate remained in net selling positions of 3.70 million shares but Overseas Pakistanis investors remained in net buying positions of 0.51 million shares. While on the other side Local Individuals, Local Companies, Banks, Mutual Fund and Insurance Companies remained in net buying positions of 9.95, 39.97, 3.70, 0.86 and 4.04 million shares but NBFCs and Brokers remained in net selling positions of 0.33 and 55.19 million shares respectively.

Analytical Review

Asian shares flirt with nine-month low on mounting trade war fears

Asian stocks slumped to nine-month lows on Thursday on growing worries the U.S. administration’s approach to trade is harming global economic growth even as it appeared to be modifying its approach to curb Chinese investments in U.S. technology firms. U.S. oil prices hit a 3-1/2-year high as plunging U.S. crude stockpiles compounded supply worries in a market already uncertain about Libyan exports, a production disruption in Canada and Washington’s demands that importers stop buying Iranian crude. MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.25 percent to a nine-month low in early trade while Japan’s Nikkei shed 0.30 percent. The U.S. S&P 500 lost 0.60 percent on Wednesday to one-month closing low.

Banks refuse to pay in foreign currency

Commercial banks have refused to pay foreign currency account holders in international currency while State Bank of Pakistan insists that government has not frozen foreign currency accounts. The account holders who receive their salaries from foreign companies have been denied payments in international currencies. "I went to bank to get money from my dollars account but the bank refused to pay me and said I can only get my payments in local currency at interbank rates," said Zulfiqar Ahmed an account holder of a commercial bank. The interbank rates of foreign currency are lower than open market rates.

Nepra okays Rs1.25/unit hike in May power tariff

The National Electric Power Regulatory Authority (NEPRA) on Wednesday allowed the Ex-Wapda power distribution companies (Discos) to increase the power tariff by Rs1.25 per unit for the month of May. The decision was taken by Nepra in a public hearing on the petition filed by the Central Power Purchasing Agency (CPPA) and will have a cumulative burden of around Rs15.7 billion on consumers. The hearing was chaired by Nepra’s Member Punjab Saif Ullah Chatta Member KP Nepra, Himayat Ullah Khan also accompanied him. The hearing was also attended by Senate’s Standing Committee on Power Chairman Fida Muhammad. Member Nepra Himayat Ullah Khan said that due to the system’s technical and administrative losses, circular debt is ballooning and consumers have to bear maximum burden of system inefficiencies, technical and administrative losses.

KPRA crosses Rs11b revenue target

The Khyber Pakhtunkhwa Revenue Authority (KPRA) has crossed its revenue collection target of Rs11billion for the financial year-2018 and collected Rs04 billion for Khyber Pakhtunkhwa government during four months (April-July) for the outgoing FY year. The authority collected Rs01 billion continuously every month from April to June. It is pertinent to mention here that, the current Director General Nasir Khan assumed his charge from April 2018, and KPRA on his directives collected Rs01 billion every month continuously (April-June) from small, medium and large service providers/business in terms of Sales Tax on services, while keeping his (KPRA) conventional record on track in achieving revenue targets. KPRA crossed its revenue target and is fully hopeful for next year target

China wants to expand FTA with Pakistan

China wants to expand and promote Free Trade Agreement (FTA) with Pakistan, Chinese Deputy Head of Mission Lijian Zhao said on Wednesday. Addressing at the Regional Conference on 'Connectivity and Geo-Economics in South Asia' here, Lijian Zhao said China was interested in exploring more trade opportunities with Pakistan. The Chinese diplomat expressed confidence that China Pakistan Economic Corridor (CPEC) would result into regional connectivity for the benefit of not only Pakistan and China but all neighbouring states. However, he stressed the need for further improvement in matters related to the CPEC for its effective implementation. Lijian Zhao called for settling the cross-border issues between the two countries and mentioned that Korakoram Highway and construction of Karachi motorway were significant. He said China was providing educational scholarships to Pakistan at a large scale and the number of Pakistani students studying in China was greater as compared to those in the United States and Europe. Director Pakistan Institute for Peace Studies (PIPS) Amir Rana said CPEC would prove as a confidence-building measure among the regional countries. He said cooperation among the regional States was important in ensuring peace.

Asian stocks slumped to nine-month lows on Thursday on growing worries the U.S. administration’s approach to trade is harming global economic growth even as it appeared to be modifying its approach to curb Chinese investments in U.S. technology firms. U.S. oil prices hit a 3-1/2-year high as plunging U.S. crude stockpiles compounded supply worries in a market already uncertain about Libyan exports, a production disruption in Canada and Washington’s demands that importers stop buying Iranian crude. MSCI’s broadest index of Asia-Pacific shares outside Japan fell 0.25 percent to a nine-month low in early trade while Japan’s Nikkei shed 0.30 percent. The U.S. S&P 500 lost 0.60 percent on Wednesday to one-month closing low.

Commercial banks have refused to pay foreign currency account holders in international currency while State Bank of Pakistan insists that government has not frozen foreign currency accounts. The account holders who receive their salaries from foreign companies have been denied payments in international currencies. "I went to bank to get money from my dollars account but the bank refused to pay me and said I can only get my payments in local currency at interbank rates," said Zulfiqar Ahmed an account holder of a commercial bank. The interbank rates of foreign currency are lower than open market rates.

The National Electric Power Regulatory Authority (NEPRA) on Wednesday allowed the Ex-Wapda power distribution companies (Discos) to increase the power tariff by Rs1.25 per unit for the month of May. The decision was taken by Nepra in a public hearing on the petition filed by the Central Power Purchasing Agency (CPPA) and will have a cumulative burden of around Rs15.7 billion on consumers. The hearing was chaired by Nepra’s Member Punjab Saif Ullah Chatta Member KP Nepra, Himayat Ullah Khan also accompanied him. The hearing was also attended by Senate’s Standing Committee on Power Chairman Fida Muhammad. Member Nepra Himayat Ullah Khan said that due to the system’s technical and administrative losses, circular debt is ballooning and consumers have to bear maximum burden of system inefficiencies, technical and administrative losses.

The Khyber Pakhtunkhwa Revenue Authority (KPRA) has crossed its revenue collection target of Rs11billion for the financial year-2018 and collected Rs04 billion for Khyber Pakhtunkhwa government during four months (April-July) for the outgoing FY year. The authority collected Rs01 billion continuously every month from April to June. It is pertinent to mention here that, the current Director General Nasir Khan assumed his charge from April 2018, and KPRA on his directives collected Rs01 billion every month continuously (April-June) from small, medium and large service providers/business in terms of Sales Tax on services, while keeping his (KPRA) conventional record on track in achieving revenue targets. KPRA crossed its revenue target and is fully hopeful for next year target

China wants to expand and promote Free Trade Agreement (FTA) with Pakistan, Chinese Deputy Head of Mission Lijian Zhao said on Wednesday. Addressing at the Regional Conference on 'Connectivity and Geo-Economics in South Asia' here, Lijian Zhao said China was interested in exploring more trade opportunities with Pakistan. The Chinese diplomat expressed confidence that China Pakistan Economic Corridor (CPEC) would result into regional connectivity for the benefit of not only Pakistan and China but all neighbouring states. However, he stressed the need for further improvement in matters related to the CPEC for its effective implementation. Lijian Zhao called for settling the cross-border issues between the two countries and mentioned that Korakoram Highway and construction of Karachi motorway were significant. He said China was providing educational scholarships to Pakistan at a large scale and the number of Pakistani students studying in China was greater as compared to those in the United States and Europe. Director Pakistan Institute for Peace Studies (PIPS) Amir Rana said CPEC would prove as a confidence-building measure among the regional countries. He said cooperation among the regional States was important in ensuring peace.

Market is expected to remain volatile therefore it's recommended to stay cautious while trading today.

Technical Analysis

The Benchmark KSE100 Index is trying to bounce back after finding support on a descending trend line on daily chart since last two trading sessions but weekly momentum indicators have just started bearish move this week. As of now index is capped by a horizontal resistance at 42,062 along with a descending trend line at 42,400 points and at those points 38% and 50% correction of last bearish rally are also completing therefore it needs a very cautious approach while trading around these regions. On the supportive side index have supportive regions around 41,000 and 40,500 points. Index seems to dive again after these regions therefore its recommended to initiate selling on strength with strict stop loss during current trading session.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.