Previous Session Recap

Trading volume at PSX floor increased by 47.66 million shares or 25.36% on DoD basis during last trading session, whereas the benchmark KSE100 Index opened at 45,100.61, posted a day high of 45,307.45 and a day low of 44,936.12 during last trading session. The session suspended at 45,004.19 with net change of -79.38 and net trading volume of 104.1 million shares. Daily trading volume of KSE100 listed companies increased by 47.17 million shares or 82.85% on DoD basis.

Foreign Investors remained in net selling position of 2.66 million shares and net value of Foreign Inflow dropped by 1.82 million US Dollars. Categorically, Foreign Individuals and Overseas Pakistanis remained in net buying positions of 0.03 and 3.91 million shares but Foreign Corporate Investors remained in net selling position of 6.6 million shares. While on the other side Local Individuals and Brokers remained in net buying positions of 8.96 and 6.69 million shares but Local Companies, Banks, NBFCs, Mutual Funds and Insurance Companies remained in net selling positions of 1.45, 5.95, 0.09, 0.11 and 5.53 million shares respectively.

Analytical Review

Asian shares buckle as tech firms come under more scrutiny

Asian shares pulled back on Wednesday as Wall Street was knocked hard on concerns about tighter regulations on the tech industry, denting a brief global equities recovery driven by hopes of easing fears of a trade war between China and the United States. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 0.4 percent, with tech-heavy Korean shares .KS11 falling 1.0 percent. Japan's Nikkei .N225 fell 2.1 percent. On Wall Street, the S&P 500 .SPX lost 1.73 percent and the Nasdaq Composite .IXIC dropped 2.93 percent, making their fourth decline in five sessions.

Wapda clears NHP dues of Punjab, KP

The Water and Power Development Authority has cleared the outstanding Net Hydel Profit (NHP) dues around Rs150 billion of Punjab and Khyber Pakhtunkhwa provinces. Out of the total Rs150 billion, Rs41.6 billion were raised by Wapda through loans from local banks, said the Ministry of Water Resource while briefing the Council of Common Interest. According to the minutes of the meeting, the Ministry of Water Resources informed that in compliance with the CCI's decision, Wapda raised a loan of Rs41.6 billion from local banks in January 2018 against the guarantee of Government of Pakistan. Accordingly, the NHP liabilities of Wapda were cleared. Earlier, the CCI decided that the Wapda should pay the outstanding dues of NHP to KP and Punjab by generating loan backed by the government guarantee in accordance with the MoU signed for the purpose.

FBR to miss annual tax target by Rs100b

Despite showing healthy growth of over 17 percent in tax collection during eight months, the Federal Board of Revenue (FBR) would miss its annual target by around Rs100 billion during current fiscal year. "Keeping in view the current pace of tax collection, we have estimated that tax collection will reach Rs3900 billion by the end of ongoing fiscal year," said an official of the FBR. He further said that recent rupee depreciation against US dollar would improve the tax collection at the import stage that includes custom duties, regulatory duties, sales tax and withholding tax. The Pak rupee-US dollar exchange rate in the interbank market closed at Rs115 per US dollar and witnessed an intraday high and low of Rs116.25 per US dollar and Rs110.60 per US dollar, respectively on last Tuesday.

Traders ask govt to abolish super tax

The Islamabad Chamber of Commerce and Industry on Tuesday has recommended the government to abolish the super tax imposed on the income of rich people and companies for the rehabilitations of Internally Displaced Persons (IDPs). “The government had imposed 3 percent super tax on income of 500 million and above as well as 4 percent super tax on income of banking companies in 2015 for rehabilitation of IDPs that was extended in 2016 and 2017. The government should abolish super tax as there was no further justification for it,” said Sheikh Amir Waheed, president ICCI while talking to MPA Raja Hanif advocate. He further said that the high tax rates in Pakistan were major cause of promoting tax evasion in the country and emphasized that in the forthcoming federal budget, government should cut tax rates that would help in expanding tax base, improving tax-to-GDP ratio and enhancing tax revenue of the country. He said 17 percent sales tax in Pakistan was almost highest in the region that has put extra burden on the common man and increased the cost of doing business in the country. He said in the next budget, government should reduce GST to single digit level that would provide significant relief to the common man, reduce cost of doing business and give boost to business activities.

Nepra approves Rs2.28 per unit cut in tariff

The National Electric Power Regulatory Authority (Nepra) Tuesday approved Rs2.28 per unit reduction in power tariff for ex-Wapda distribution companies (Discos) for the month of February under a monthly fuel adjustment formula. The decision was taken by Nepra in a public hearing on the petition filed by Central Power Purchasing Agency (CPPA). In its petition CPPA had sought tariff reduction by Rs 2.1928 per unit to make some previous adjustment. However, the Nepra decided to reduce power tariff by Rs 2.28 per unit. Following reduction in power tariff, the consumers will enjoy a relief of over Rs 10 billion which will be provided in the bills of April. This adjustment/relief adjustment will be available to domestic consumers in the entire Pakistan except for K-Electric and the lifeline consumers. The reason for not providing relief to the consumers of K-Electric was that it was a privatized company and distributing its own generated electricity to the consumers in Karachi and is not covered under this determination. The relief will also not be available to the lifeline consumers consuming up to 300 units per month, as they were already being provided subsidized electricity. The relief will also not be passed on to the industrial consumers who were already getting cheaper electricity. According to the petition, total energy generated in February 2018 was 6979.16 GWh at a total price of Rs 34.25 billion.

Market is expected to remain volatile therfore its recommended to stay cautious while trading today.

Asian shares pulled back on Wednesday as Wall Street was knocked hard on concerns about tighter regulations on the tech industry, denting a brief global equities recovery driven by hopes of easing fears of a trade war between China and the United States. MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 0.4 percent, with tech-heavy Korean shares .KS11 falling 1.0 percent. Japan's Nikkei .N225 fell 2.1 percent. On Wall Street, the S&P 500 .SPX lost 1.73 percent and the Nasdaq Composite .IXIC dropped 2.93 percent, making their fourth decline in five sessions.

The Water and Power Development Authority has cleared the outstanding Net Hydel Profit (NHP) dues around Rs150 billion of Punjab and Khyber Pakhtunkhwa provinces. Out of the total Rs150 billion, Rs41.6 billion were raised by Wapda through loans from local banks, said the Ministry of Water Resource while briefing the Council of Common Interest. According to the minutes of the meeting, the Ministry of Water Resources informed that in compliance with the CCI's decision, Wapda raised a loan of Rs41.6 billion from local banks in January 2018 against the guarantee of Government of Pakistan. Accordingly, the NHP liabilities of Wapda were cleared. Earlier, the CCI decided that the Wapda should pay the outstanding dues of NHP to KP and Punjab by generating loan backed by the government guarantee in accordance with the MoU signed for the purpose.

Despite showing healthy growth of over 17 percent in tax collection during eight months, the Federal Board of Revenue (FBR) would miss its annual target by around Rs100 billion during current fiscal year. "Keeping in view the current pace of tax collection, we have estimated that tax collection will reach Rs3900 billion by the end of ongoing fiscal year," said an official of the FBR. He further said that recent rupee depreciation against US dollar would improve the tax collection at the import stage that includes custom duties, regulatory duties, sales tax and withholding tax. The Pak rupee-US dollar exchange rate in the interbank market closed at Rs115 per US dollar and witnessed an intraday high and low of Rs116.25 per US dollar and Rs110.60 per US dollar, respectively on last Tuesday.

The Islamabad Chamber of Commerce and Industry on Tuesday has recommended the government to abolish the super tax imposed on the income of rich people and companies for the rehabilitations of Internally Displaced Persons (IDPs). “The government had imposed 3 percent super tax on income of 500 million and above as well as 4 percent super tax on income of banking companies in 2015 for rehabilitation of IDPs that was extended in 2016 and 2017. The government should abolish super tax as there was no further justification for it,” said Sheikh Amir Waheed, president ICCI while talking to MPA Raja Hanif advocate. He further said that the high tax rates in Pakistan were major cause of promoting tax evasion in the country and emphasized that in the forthcoming federal budget, government should cut tax rates that would help in expanding tax base, improving tax-to-GDP ratio and enhancing tax revenue of the country. He said 17 percent sales tax in Pakistan was almost highest in the region that has put extra burden on the common man and increased the cost of doing business in the country. He said in the next budget, government should reduce GST to single digit level that would provide significant relief to the common man, reduce cost of doing business and give boost to business activities.

The National Electric Power Regulatory Authority (Nepra) Tuesday approved Rs2.28 per unit reduction in power tariff for ex-Wapda distribution companies (Discos) for the month of February under a monthly fuel adjustment formula. The decision was taken by Nepra in a public hearing on the petition filed by Central Power Purchasing Agency (CPPA). In its petition CPPA had sought tariff reduction by Rs 2.1928 per unit to make some previous adjustment. However, the Nepra decided to reduce power tariff by Rs 2.28 per unit. Following reduction in power tariff, the consumers will enjoy a relief of over Rs 10 billion which will be provided in the bills of April. This adjustment/relief adjustment will be available to domestic consumers in the entire Pakistan except for K-Electric and the lifeline consumers. The reason for not providing relief to the consumers of K-Electric was that it was a privatized company and distributing its own generated electricity to the consumers in Karachi and is not covered under this determination. The relief will also not be available to the lifeline consumers consuming up to 300 units per month, as they were already being provided subsidized electricity. The relief will also not be passed on to the industrial consumers who were already getting cheaper electricity. According to the petition, total energy generated in February 2018 was 6979.16 GWh at a total price of Rs 34.25 billion.

Technical Analysis

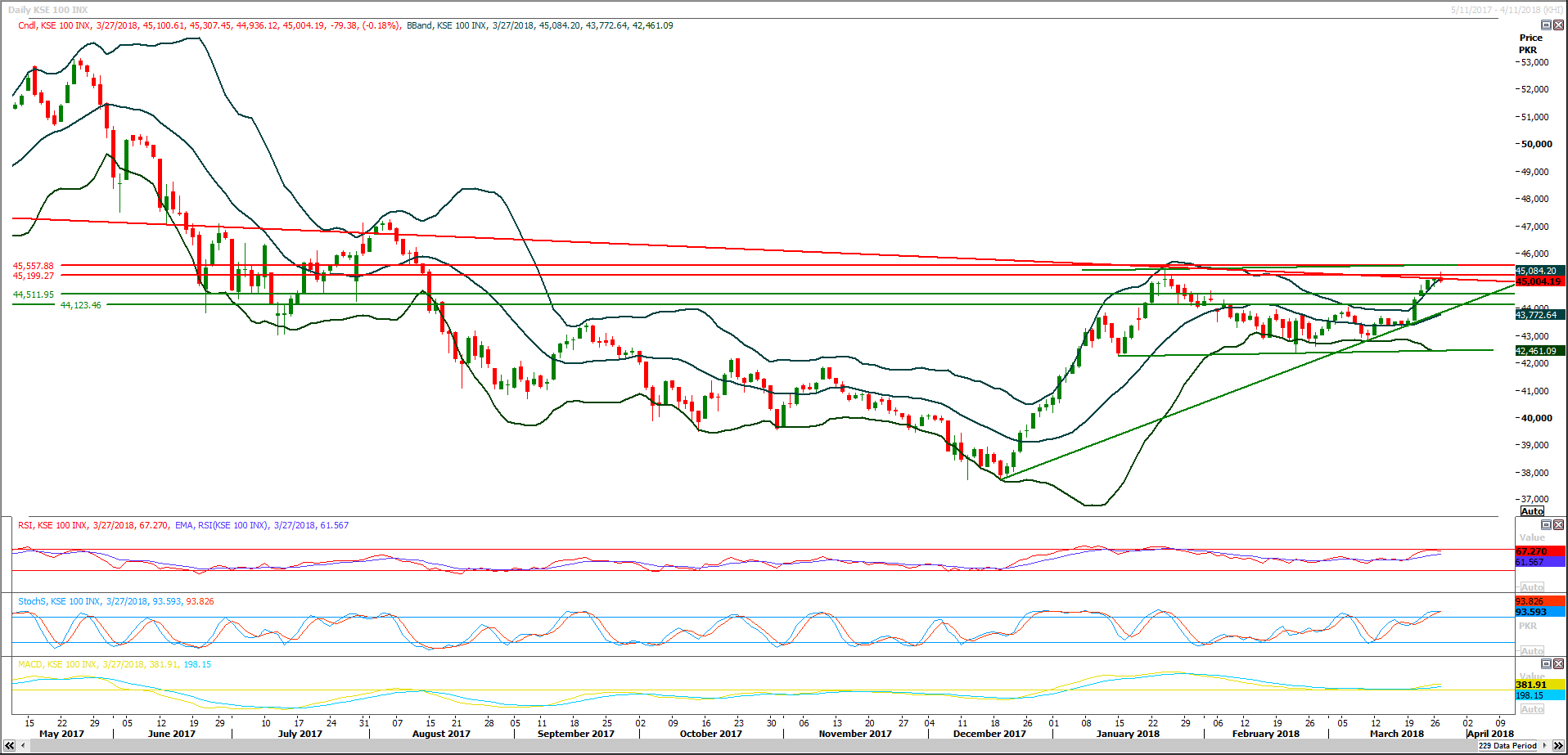

The Benchmark KSE100 Index is capped by a descending trend line along with a horizontal resistant region on its way towards expansion of breakout of a triangle on daily chart and these both resistant regions have reacted very strong against current bullish rally during last trading session and index formatted a hammer on daily chart, now current trading session have become a key point for future move because this session can play a vital role in creating an evening shooting star on daily chart which would be indication of start of a correction. Momentum indicators on daily chart started a slight move towards negative zone because Stochastic and MAORSI have started moving towards a bearish crossover which would be confirmed today, but MACD is still in bullish mode and it is not leaving its bullish move. MACD could push index towards an upset if it would slide towards negative zone. For current trading session it’s recommended to wait for clear breakout of either side and then initiate new entries because breakout of 45,211 would call for a spike of further 300-1000 points while on bearish side breakout of 44,550 would call for a dip towards 43800.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.