Previous Session Recap

Trading volume at PSX floor increased by 4.62 million shares or 4.35% on DoD basis, whereas, the benchmark KSE100 Index opened at 40152.72, posted a day high of 40152.72 and a day low of 39932.93 during last trading session. The session suspended at 40034.17 with net change of -216.24 and net trading volume of 74.32 million shares. Daily trading volume of KSE100 listed companies increased by 12.78 million shares or 20.77% on DoD basis.

Foreign Investors remained in net selling position of 0.13 million shares and net value of Foreign Inflow dropped by 3.18 million US Dollars. Categorically, Foreign Indiviual and Corporate Investors remained in net selling position of 0.34 and 2.25 million shares but Overseas Pakistanis remained in net buying of 2.46 million shares. While on the other side Local Individuals, Companies and Banks remained in net selling position of 2.85, 11.54 and 3.01 million shares respectively but Mutual Funds, Brokers and Insurance Companies remained in net buying of 11.5, 2.93 and 3.19 million shares respectively.

Analytical Review

Asian shares stepped back from decade highs on Tuesday as Chinese stocks stumbled for a second straight session, while the U.S. dollar trod water ahead of a crucial Senate vote on tax reform. MSCI’s broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS slipped 0.3 percent from last week’s high of 570.21 points. It was on track to end November in the black. The index has been on an uptrend most of this year, posting a monthly loss only once in 2017. Australian shares were flat while Japan's Nikkei .N225 rose 0.2 percent. Wall Street had been mixed on Monday, with the S&P 500 .SpX off a touch, the Nasdaq .IXIC losing 0.1 percent and the Dow .DJI up 0.1 percent.

The National Electric Power Regulatory Authority (Nepra) has imposed a fine of Rs5 million on Nation Transmission and Despatch Company (NTDC) under Nepra (Fines) Rules 2002 (Fine Rules) due to non-compliance of Performance Standards Transmission Rules 2005 (Performance Standards) particularly with respect to voltage and frequency fluctuations. The NTDC , being a transmission licensee, is required to submit Annual Performance Report to Nepra as per the Performance Standards and terms and conditions of its licence. Based on the Annual Performance Reports provided by NTDC , a comprehensive analysis report was prepared by Nepra which highlighted that the NTDC has prima facie violated the permissible voltage and frequency limits in the year 2013-14 as prescribed in the Performance Standards. Based on the findings of analysis report, the authority decided to initiate legal proceedings against NTDC .

National Accountability Bureau (NAB) Chairman Justice (R) Javed Iqbal has said that mobile phone companies were allegedly evading Rs400 billion in taxes to the Federal Board of Revenue (FBR) annually . According to a statement issued here on Monday, he called improving tax collection system of the FBR. “Pakistan is investors-friendly country and the best country for foreign investment and we should try utmost for collecting taxes for protecting our national interests as per the law,” the Nab chief said. He said that the potential tax was not being allegedly collected and deposited in the national exchequer by the mobile phone companies as per reports.

First shipment of Pakistani fresh meat successfully reached United Arab Emirates (UAE) on Monday. According to a private TV news channel, the shipment was sent as per agreement signed between Pakistan’s Foodex and UAE’s General Trading Company. Pakistan’s Additional Commercial Secretary Kamran Khan was also present on the occasion. Earlier, UAE and Pakistani businessmen had signed deals worth nearly $200 million (Dh734 million) during the Expo Pakistan 2017 which was held in Karachi on November 9-12. The UAE-based company Al-Tayeb International General Trading and Foodex Pakistan had reached an agreement on the import of Pakistani meat during the Expo Pakistan 2017. Pakistan is the fifth largest exporter of fresh meat and meat products to UAE with average annual exports of around $100 million.

Lahore Chamber of Commerce and Industry (LCCI) President Malik Tahir Javed has said trade imbalance and rising foreign debts are reversing the benefits of hard-earned gains and situation would be more critical if immediate controlling measures are not taken. In a statement, the LCCI president, Senior Vice president Khawaja Khawar Rasheed and Vice President Zeshan Khalil said that the country made a good economic progress in recent past but swelling trade deficit and debts put a reverse gear and are posing serious challenges to the economy . They said that according to a report, the trade deficit has widened by $12.13 billion in first four months of current fiscal year despite 10 percent growth in exports during the same period. The balance of trade widened by 31.24 percent to deficit of 12.13 during July-October 2017/2018 as compared with the deficit of $9.24 billion in the corresponding period of the last fiscal year.

Today PSO, ATRL and PAEL may lead the market in the positive direction.

Technical Analysis

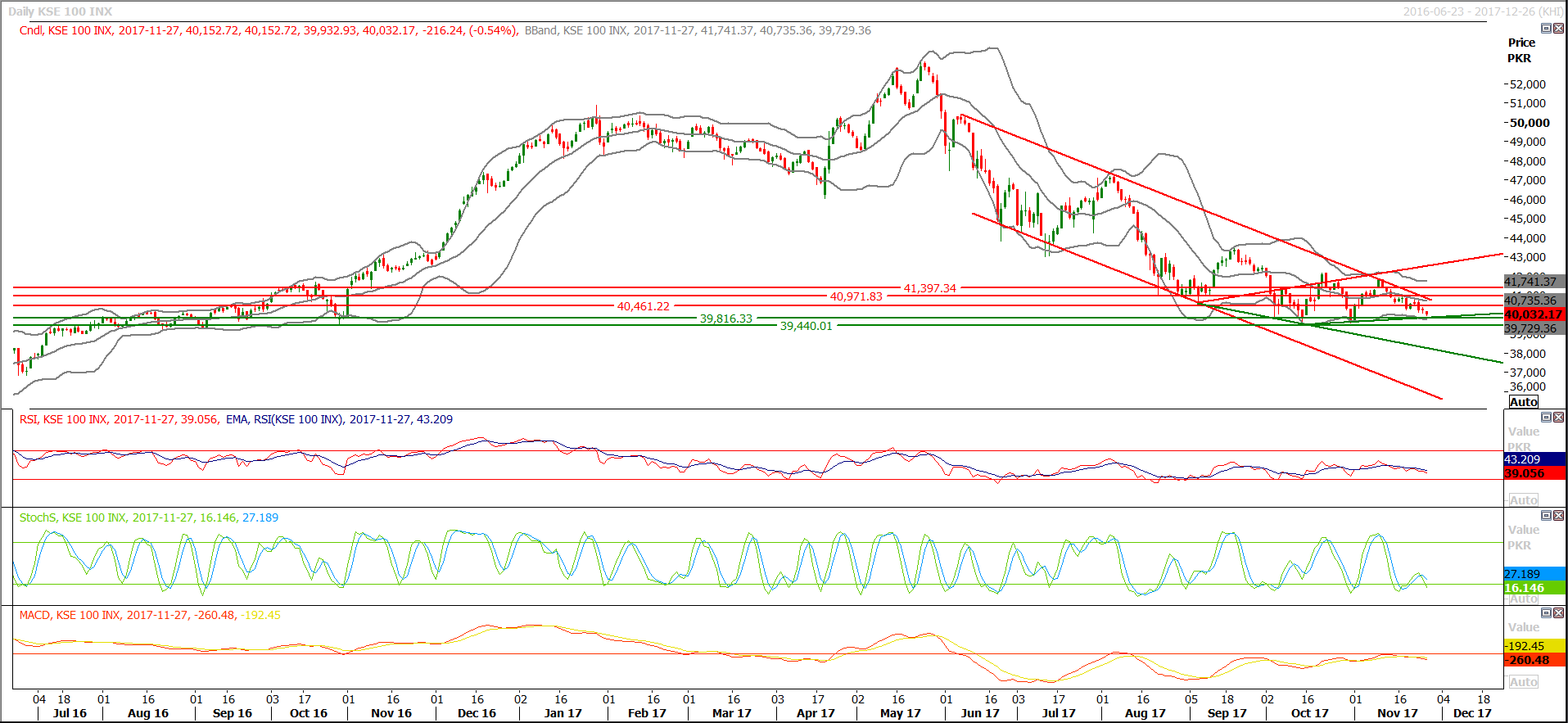

The Benchmark KSE100 Index have a supportive region at 39860 where a horizontal supportive region is generating a crossover with a supportive trend line and this crossover would result as a strong supportive region against current bearish trend. While resistant regions are standing at 40431 and 40860 which fall on horizontal resistances. Breakout of 39860 in bearish direction would call for 39400 in coming days and it would also clearly indicate for a new yearly low of index for current year but if this level would be maintained then index would try to bounce back towards 40860 and closing above 40860 would call for 42800 and 43400. As of right now index is standing at a very curicial stage therefore its recommended to trade very cautiously with strict stop loss.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.