Previous Session Recap

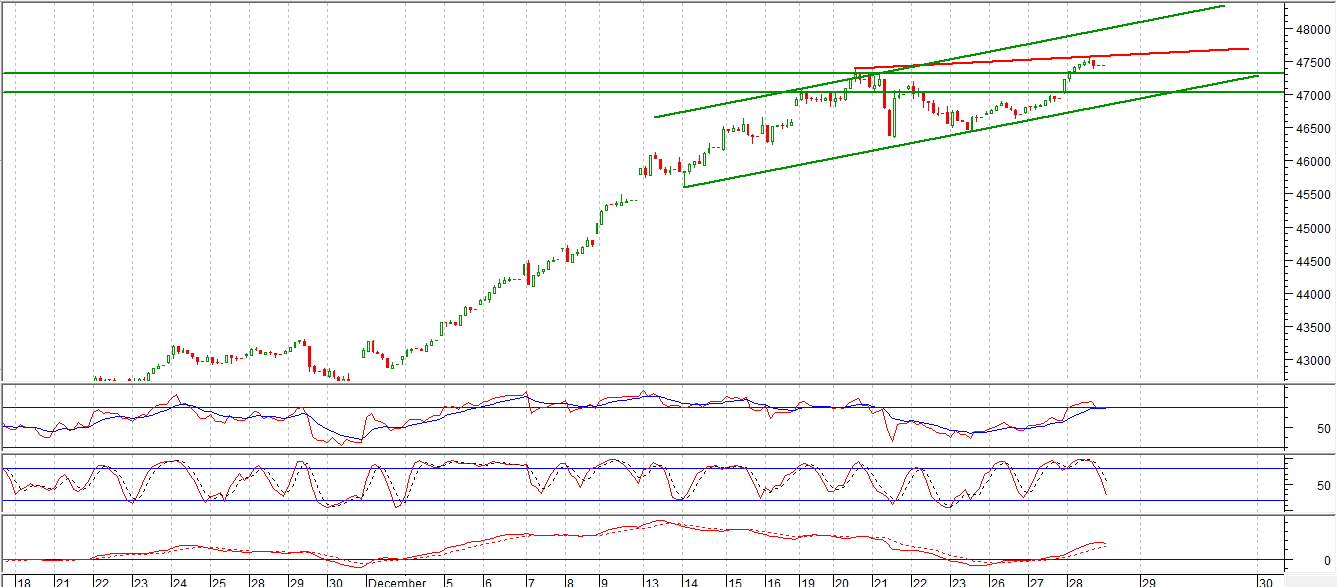

The Bench Mark KSE100 Index opened at 47029.33 with a gap of 108.86 points, posted day high of 47563.46 and day low of 47007.43 points during last trading session. The session suspended at 47424.63 points with net change of 504.16 points and net trading volume of 140.85 million shares. Daily trading volume of KSE100 listed companies increased by 50.41 million shares or 55.75% on DOD bases.

Foreign Investors remained in net selling position of 7.68 million shares and net value of Foreign Inflow dropped by 5.37 million US Dollars. Categorically Foreign Corporate and Overseas Pakistanis remained in net selling position of 5.0 and 2.84 million shares but Foreign Individuals remained in net buying position of 0.16 million shares. While on the other side, Local Individuals, Companies and NBFCs remained in net buying position of 1.23, 17.03 and 0.38 million shares respectively but Local Banks, Mutual Funds and Brokers remained in net selling position of 0.52, 2.87 and 4.42 million shares respectively.

Analytical Review

Asian shares slipped on Thursday after Wall Street suffered a mild setback after weeks of gains, while the dollar faded against the yen in typical year-end profit taking. Japanes Nikkei .N225 lost 1 percent as the yen firmed, edging away from its recent one-year top. Australian main index eased 0.1 percent, having touched a 17-month peak the previous day. Moves were modest across the region with MSCI broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS off just 0.05 percent. The pullback on Wall Street came amid light volumes and likely reflected caution about what the New Year might bring, given Wednesday was the first session when trades actually settle in January. The Dow .DJI fell 0.56 percent, while the S&P 500 .SPX lost 0.84 percent and the Nasdaq .IXIC 0.89 percent. Boeing (BA.N) fell 0.9 percent after Delta Air Lines (DAL.N) cancelled a $4-billion order for 18 Dreamliner aircraft.

Fourth nuclear power plant in Pakistan went online Wednesday, a joint collaboration with China that adds 340 megawatts to the national grid as part of the goverment efforts to end a growth-sapping energy deficit. Pakistan seeks to close an electricity shortfall that can stretch up to 7,000 MW in peak summer months, or around 32 percent of total demand.

Interior Minister Chaudhry Nisar Ali Khan Wednesday directed the Federal Investigation Agency (FIA) to investigate the embezzlement, worth billions of rupees, allegedly committed by oil marketing companies (OMCs) in collection of petroleum levy. An official of Ministry of Interior said the OMCs have collected billions of rupees from public under head of petroleum levy, but they did not deposit the amount in the national exchequer. The interior minister has directed director FIA Lahore to investigate the matter.

The Economic Coordination Committee (ECC) of the Cabinet on Wednesday allowed export of 225,000 tonnes of sugar, based on estimates that there would be a surplus of 1.23 million tonnes. However, only those mills will be allowed exports which have cleared all outstanding dues of farmers from the last season, and which have started crushing at full capacity.

Pakistan Cotton Ginners Association (PCGA) has strongly opposed the duty-free import of cotton from India describing it destructive to Pakistani economy. Addressing a press conference here on Tuesday PCGA Senior Vice Chairman Suhail Mehmood Haral, Chairman of Ginners Group Haji Muhammad Akram and former Chairman Shehzad Ali Khan said that more than 2 million bales of cotton are lying at ginneries as unsold stock and Textile miller are reluctant to purchase this stock.

ENGRO, SNGP, DCL and EFERT can lead market in positive direction.

Technical Analysis

The Bench Mark KSE100 Index penetrated its intraday triangle in bullish direction and now the resistant trend line of said channel is going to behave as support for it. Now it is in expansion mode of its triangle which can lead index towards 47964 but on intraday bases index can face a resistance around 47583 and breakout of that level will call for a further upside spike.

To Open picture in original resolution right click image and then click open image in a new tab

To Open picture in original resolution right click image and then click open image in a new tab

0 Comments

No comments yet. Be the first to comment!

Please log in to leave a comment.